The latest crypto forecast, as of today, indicates a noticeable shift in sentiment as digital assets enter a consolidation phase. After a rapid rally that pushed Bitcoin and Ethereum to multi-month highs, the momentum is cooling, prompting cautious optimism.

Investors are now digesting gains, and many are rebalancing their portfolios. Analysts suggest this breather may not be a negative development but rather a sign of strength before the next bullish wave begins.

With inflation concerns, regulatory headlines, and ETF dynamics in play, the coming days will test traders’ convictions. As the market recalibrates, crypto forecast emerges as a guiding beacon for navigating uncertain waters, as traders are shifting attention to altcoins, seeking undervalued assets in anticipation of the next leg up.

Bitcoin Holds Above $108K, Eyes Key Support Levels

Bitcoin (BTC) is trading at $108,816, showing resilience despite failing to break the $109,588 resistance. This level has now become a pivot point in Bitcoin’s price journey. Bitfinex analysts note that such post-rally consolidation is not uncommon and usually precedes renewed momentum. The current support sits at the 20-day EMA of $105,453, a crucial line that will determine if bulls remain in control. If Bitcoin successfully bounces off this support, a retest of the $111,980 resistance becomes likely.

However, a drop below the EMA might lead to a decline toward $100,000, a psychological support that has historically drawn strong buyer interest. As this scenario unfolds, Bitcoin continues to anchor the crypto forecast. Analysts following the crypto forecast emphasize that Bitcoin’s direction will strongly influence altcoin behavior.

Ethereum Struggles at Resistance but Maintains Bullish Structure

Ethereum (ETH), trading at $2,727, is showing strength but faces stiff resistance at $2,775. The crypto forecast for ETH remains bullish, largely due to the ascending triangle pattern forming on the daily chart. This is typically a continuation signal, suggesting a potential breakout toward $3,153 if buyers push through resistance.

Analysts caution, however, that a breakdown below the 20-day EMA at $2,467 could invalidate this setup. If that happens, ETH might see short-term weakness, with downside targets at $2,323 and $2,111. Still, Ethereum’s solid fundamentals and strong developer activity lend credibility to the bullish case within the broader crypto forecast. Traders relying on the crypto forecast should monitor ETH closely, as it often leads altcoin trends.

XRP Finds Balance Amid ETF Hopes

XRP is holding steady at $2.30, sandwiched between its 20-day EMA ($2.33) and 50-day SMA ($2.24). This tight range suggests traders are waiting for a catalyst, and the crypto forecast hinges on whether XRP can break higher or lower. A move above the 20-day EMA could open the door to $2.65 and potentially $3.00. On the other hand, a fall below $2.24 might invite selling pressure down to $2.00, with further downside risk to $1.61.

Market participants are also closely watching the ETF approval landscape, as developments there could significantly influence XRP’s trajectory in the crypto forecast. The presence of institutional interest and futures trading adds complexity to the crypto forecast for XRP.

BNB Flirts With Breakout as Triangle Pattern Forms

BNB (Binance Coin), currently priced at $685.76, is forming an ascending triangle pattern—a bullish technical formation that signals accumulation. A successful breakout above $693 could fuel a rally toward $752, affirming bullish sentiment in the crypto forecast. The volume profile also indicates renewed interest among buyers.

However, failure to hold above the 20-day EMA at $658 could prompt a move toward the 50-day SMA at $622. BNB’s price behaviour this week will be a litmus test for the strength of broader altcoin momentum. Market watchers following the crypto forecast will be looking for confirmation through volume spikes and candle closes in the days ahead.

Solana Consolidates, Awaits Breakout Signal

Solana (SOL) is trading at $173 and remains range-bound between $169 and $180. This phase of consolidation is often seen before explosive moves, and SOL is poised to play a central role in the upcoming crypto forecast. If SOL breaks above $180, it could target the $210–$220 resistance area. Conversely, a fall below $169 might drag it to $159 and possibly $153.

This technical behaviour suggests a tug-of-war between bulls and bears. Traders are advised to wait for a decisive candle close before initiating major positions, as the outcome could shape the next leg of the market. The crypto forecast continues to identify SOL as a bellwether for high-performance layer-1s.

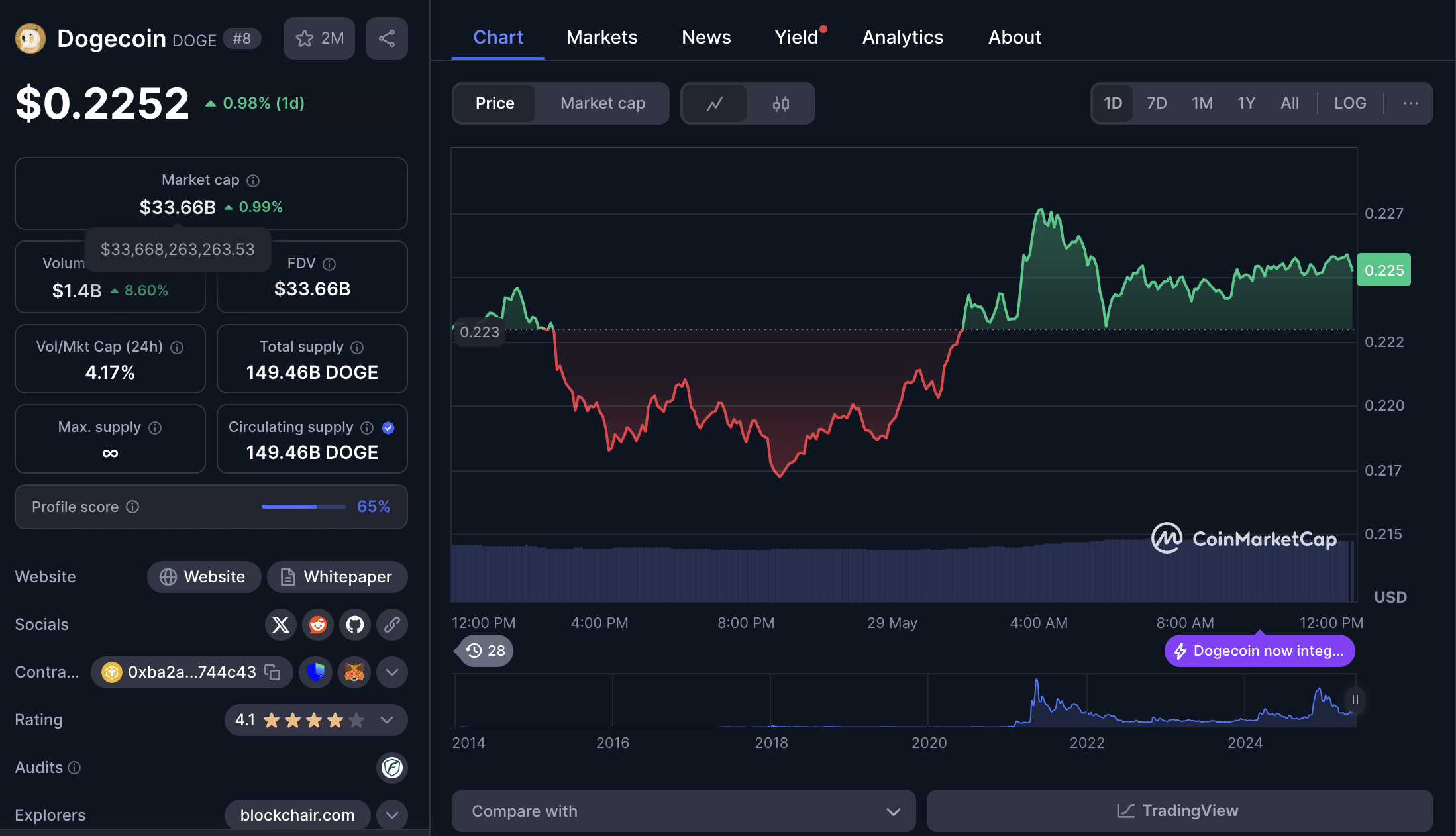

Dogecoin Holds $0.22 Support

Dogecoin (DOGE), trading around $0.225, continues to respect its 20-day EMA support at $0.22. This level has become a battle zone, with bulls attempting to defend it from short-term sellers. A break below could push DOGE to $0.21 or even $0.19, testing the 50-day SMA. The broader crypto forecast for DOGE suggests that it remains in a consolidation phase between $0.14 and $0.26.

A successful bounce off the current support would keep DOGE in its established range, with upside momentum building only above $0.26. Traders are encouraged to watch volume closely for signs of trend continuation or reversal. The crypto forecast implies DOGE’s meme appeal may be amplified if broader risk appetite returns.

Cardano Holds Neckline, Faces Resistance at $0.86

Cardano (ADA) is trading at $0.752 and is showing signs of holding above the neckline of a bullish inverse head-and-shoulders pattern. This is encouraging in the context of the crypto forecast, but weak follow-through buying suggests caution. If ADA falls below the 50-day SMA at $0.70, it could slide to a solid support base at $0.60. A move above $0.86 would trigger renewed bullish interest, setting up a possible run toward $1.01.

For now, ADA is in a wait-and-see mode as investors look for a confirmed breakout or breakdown to guide their strategies. The crypto forecast emphasizes ADA’s performance as a gauge for smart contract ecosystems.

Sui Looks for Direction Below Resistance

Sui (SUI) is trading arounf $3.70 and has failed to clear the 20-day EMA ($3.66) decisively, highlighting bearish pressure on rallies. The crypto forecast points to a test of the 50-day SMA at $3.24, a level that must hold to maintain medium-term bullish structure. A rebound here could reignite a push toward the $4.25 resistance zone.

If sellers dominate, SUI may plunge to $2.86. As newer assets often face heightened volatility, risk management is key for traders watching this token. SUI’s performance will be pivotal in gauging appetite for recently launched altcoins and gauging trends highlighted in the crypto forecast.

Hyperliquid Dips Below Support Level

Hyperliquid (HYPE) has dropped to $33.60, breaching support at $35.73. This breakdown signals potential near-term weakness in the token’s structure. The crypto forecast suggests a possible drop to the 20-day EMA at $30 if $32 support fails. For HYPE to reclaim bullish momentum, it must close above $35.73 and ideally make a strong move toward $42.25.

The coming sessions are critical, as traders assess whether this is a standard retracement or a deeper correction. Within the crypto forecast, HYPE remains a speculative play with a high reward-risk ratio.

Chainlink Awaits Breakout Confirmation

Chainlink (LINK), now at $15.87, is hovering around neckline support with indicators showing a neutral stance. The 20-day EMA ($15.66) is flattening, while RSI is balanced, suggesting indecision. For LINK to reclaim bullish momentum in the ongoing crypto forecast, a breakout above $18 is essential.

This move would signify renewed buying interest and could lead to a rally toward $19.80. Conversely, if LINK breaks below the 50-day SMA at $14.68, the pair could revisit $13.20. Chainlink’s growing relevance in oracle infrastructure keeps it on many investors’ radar, especially within the crypto forecast.

Conclusion: Consolidation Sets the Stage for Next Crypto Surge

The current crypto forecast points to a market pause after a strong bullish cycle. With Bitcoin above $108,000 and Ethereum near $2,730, the structural trend remains intact.

Many altcoins are forming bullish setups but need confirmation via breakouts. Traders should remain vigilant and patient, watching volume and macro indicators for guidance.

With ETF developments, institutional inflows, and regulatory clarity evolving, the stage is set for the next major crypto move, be it higher or lower. The crypto forecast continues to serve as a valuable tool for navigating volatile market conditions.

FAQs

What is the current price of Bitcoin?

As of May 29, 2025, Bitcoin is trading at $108,816.

Is Ethereum still bullish?

Yes, Ethereum remains bullish in the crypto forecast, especially if it breaks the $2,738 resistance.

What’s supporting the XRP price?

XRP’s resilience is backed by ETF optimism and strong market fundamentals.

Will Altcoins rally soon?

Altcoins are in consolidation, but the crypto forecast suggests potential breakouts in the near term.

Glossary

Crypto Forecast – A predictive analysis of cryptocurrency price trends and market behavior.

EMA (Exponential Moving Average) – A technical indicator used to smooth price data and identify trends.

SMA (Simple Moving Average) – A widely used indicator that averages prices over a specific period.

Resistance Level – A price point that an asset struggles to break above.

Support Level – A price point where an asset tends to find buying interest.