The Bitcoin market is in a strong bullish phase, with prices flirting with the $100,000 milestone. Since November 5, Bitcoin has surged by 45.65%, while the altcoin market has climbed an impressive 46.57%. Despite the optimism surrounding crypto, prominent analyst Michael van de Poppe has issued a stark warning about the possibility of sudden market crashes. His advice? Investors should avoid overconfidence and prepare for potential volatility.

What Are Sudden Market Crashes?

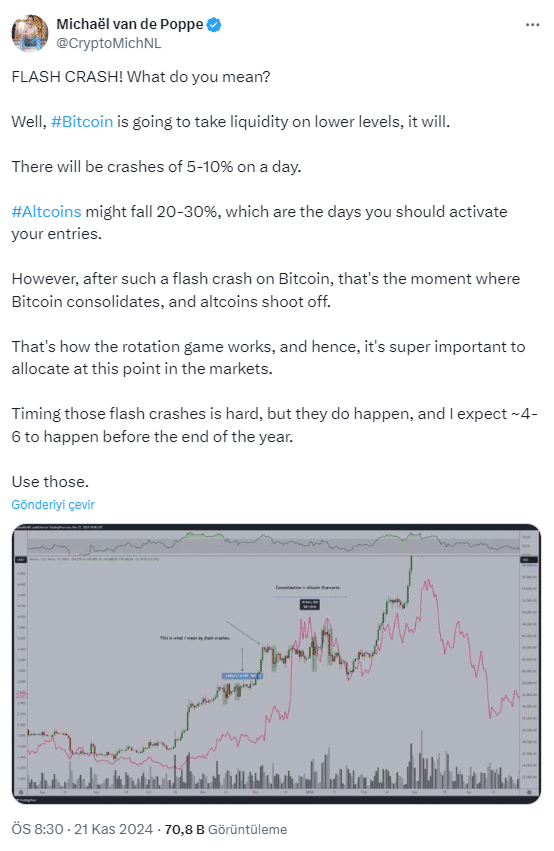

Sudden crashes, defined as sharp price drops of 5-10% or more within a single day, can wreak havoc due to their unpredictability. Michael van de Poppe predicts that Bitcoin could experience 4 to 6 such crashes before the year ends. While pinpointing the exact timing is nearly impossible, he stresses that these events are inevitable.

Van de Poppe also forecasts that during these Bitcoin crashes, the altcoin market could decline by as much as 20-30%. With the total altcoin market capitalization currently at $1.28 trillion, this represents a significant potential drawdown.

Altcoin Market Reaction to Bitcoin Crashes

Following these sudden drops, Bitcoin is expected to enter a period of consolidation or stabilization. Meanwhile, the altcoin market could present new investment opportunities, potentially leading to a bull market. Van de Poppe suggests that well-prepared investors could capitalize on these dips, turning them into lucrative buying opportunities.

For traders, timing and allocation are critical during these periods of heightened volatility. The aftermath of a sudden crash may look grim, but for those ready to act, it could pave the way for substantial gains as the market rebounds.

Market Performance Highlights

Since November 5, Bitcoin has climbed from $67,848.59 to a recent high of $99,000. Key milestones include an $88,634.15 peak on November 11 following the U.S. elections and a subsequent consolidation phase between $91,079.51 and $87,339.55 from November 12-18. Altcoins like XRP, ETH, SOL, and ADA are also making waves, with XRP surging 24% in a single day to $1.40 following news of SEC Chairman Gary Gensler’s resignation.

What Does This Mean for Investors?

As sudden crashes become more likely, it’s essential for investors to stay vigilant. According to The Bit Journal, the next few months could bring both risks and opportunities in equal measure. While these events may seem alarming, strategic investors can leverage the dips to build positions in promising assets.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!