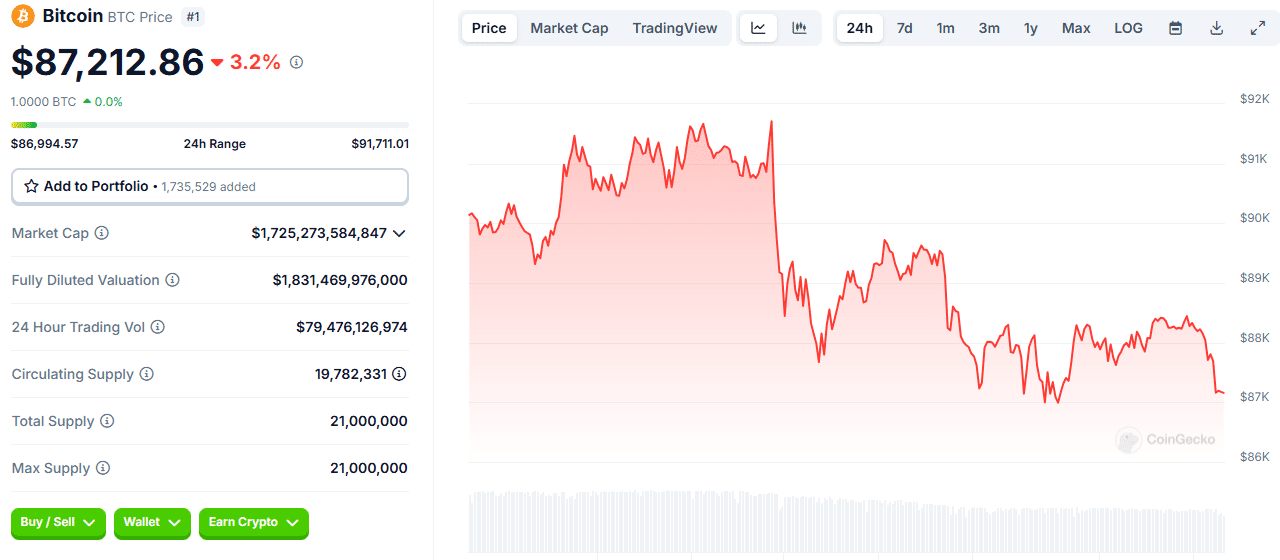

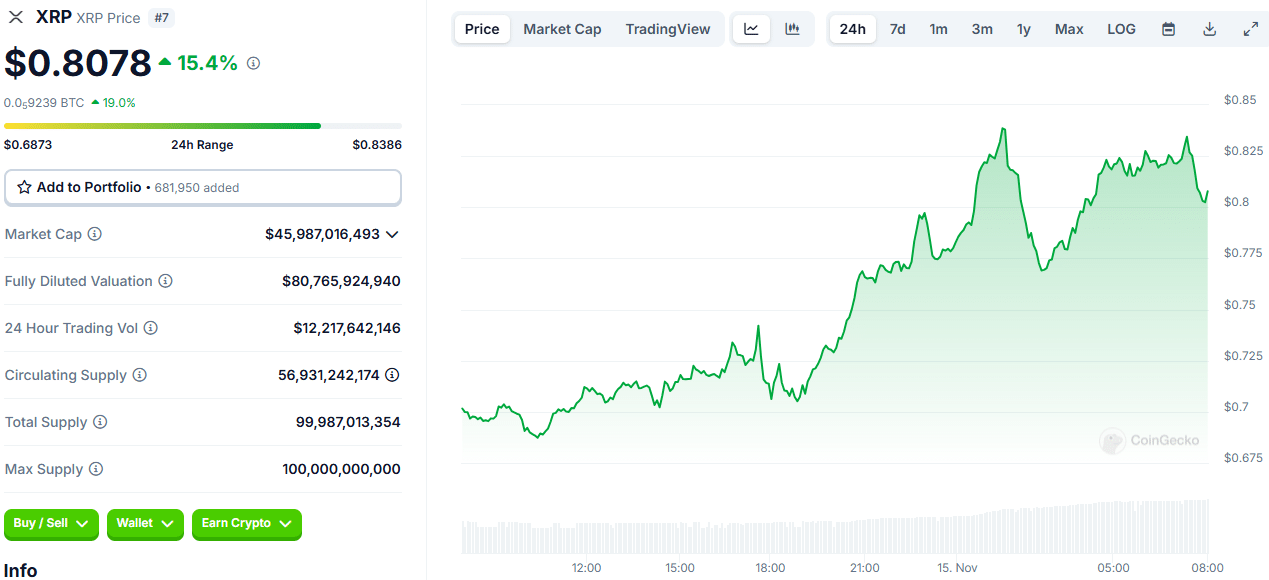

The crypto market is experiencing a whirlwind of activity, blending opportunities with uncertainty. After weeks of climbing to new heights, Bitcoin has slipped back to $88,000, creating waves across the industry. Major players like Ethereum and Solana have also faced downward pressure. Yet, not all news is gloomy—Ripple’s XRP and Hedera’s HBAR have emerged as the shining stars, with XRP delivering an impressive 18% gain. These movements have sparked debates about the market’s trajectory, fueling both hope and caution among investors.

Can Bitcoin and Ethereum Regain Their Momentum?

After nearly breaching $90,000, Bitcoin’s drop to $88,000 disappointed many investors. However, such corrections are common in volatile markets. Recent ETF launches and increased sales from large mining wallets have added to the downward pressure. In fact, miners moved 25,000 BTC to exchanges in recent days, amplifying short-term sell-offs. Despite this, market corrections often pave the way for new growth cycles, suggesting brighter prospects for long-term holders.

Ethereum also dipped below the $3,000 mark, unsettling some traders. The decline was largely attributed to profit-taking by large investors and outflows from ETFs. Although institutional interest has slightly waned, Ethereum’s potential remains strong. With ongoing technological advancements and rising network adoption, ETH could unlock significant value in the near future.

Winners and Losers: A Snapshot of Today’s Crypto Market

Ripple’s XRP stole the spotlight following favorable developments in its legal battle with the SEC. Speculation surrounding SEC Chair Gary Gensler’s potential departure has further boosted investor confidence. Similarly, HBAR joined the rally, securing its position as one of the top gainers of the day.

On the flip side, Dogecoin (DOGE) fell by 4%, dropping to $0.37, while PeanutThe Squirrel (PNUT) suffered a staggering 19% loss, leaving investors frustrated. The broader market remains in flux, with major cryptocurrencies like Bitcoin and Ethereum struggling with short-term declines. Meanwhile, altcoins are charting unique paths driven by distinct dynamics.

Key Takeaways for Investors

The crypto market’s notorious volatility underscores the importance of a strategic approach. While Bitcoin and Ethereum face temporary setbacks, altcoins like XRP and HBAR present lucrative opportunities. Investors should stay informed and navigate these waves with caution. As always, The Bit Journal recommends keeping a long-term perspective while embracing short-term corrections as potential entry points for future gains.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!