Based on current market data, the crypto market tanked in the early hours of Friday with major digital assets and a big liquidation event. Bitcoin (BTC) went below $105,000 and the global crypto market cap shrank by 3%, erasing $150 billion in value. Currently, investors and analysts are trying to figure out what happened and what’s next.

Massive Liquidations Hit the Market

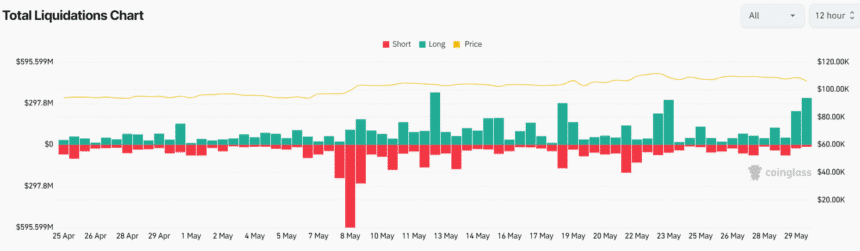

According to Coinglass, $750 million in crypto positions were liquidated in 24 hours with $380 million in 4 hours. 196,000 traders were reportedly affected with the largest single liquidation being a BTC/USDT position worth $12.74 million on OKX.

Longs took the biggest hit with $660 million while shorts were $90 million. Major cryptos like BTC, ETH, SOL, XRP, DOGE and SUI were among those affected and contributed to the market crash. Dropping sharply from the recent highs seen across board, the current market prices of these major coins as at the time of these writing are as follows:

BTC: $105,273, experiencing a 2.68%, ETH: $2,618 with 4.01% drop , SOL: $163.28 with 5.70% drop, XRP: $2.18 with 4.66% drop, DOGE: $0.20 with 9.05% drop, SUI: $3.45 with 5.67% drop, all within 24hrs.

Options Expiry: A Volatility Trigger

A big factor behind the crypto market’s instability is the expiry of Bitcoin and Ethereum options on Deribit worth $11.6 billion. 93,000 BTC options worth $10 billion and 624,000 ETH options worth $1.62 billion are expiring.

The put-call ratio for BTC options is 0.88 with a max pain at $100,000. This means more downside pressure on Bitcoin’s price. ETH options have a put-call ratio of 0.81 and a max pain at $2,300 which is below the current price of Ethereum.

Analysts from Greeks.live say Ethereum is experiencing an upward shock that’s slowing down and the market is recalibrating both price and volatility. They note that deliveries are less than 8% of total positions and are declining. This means institutions are not reacting to new highs and the market might be entering a phase of steady moderate growth.

Inflation Data Adds to Uncertainty

To top it all off, the US Personal Consumption Expenditures (PCE) inflation data is coming out. The annual PCE is expected to be 2.2% down from 2.3% last month and the month-over-month inflation is expected to rise 0.1%. The core PCE which excludes food and energy is expected to be 2.2%.

This is watched by investors as it influences the Fed’s monetary policy decisions. A higher than expected inflation rate could mean interest rate hikes which are bearish for risk assets like cryptocurrencies.

ETF Outflows Reflect Investor Sentiment

In the midst of the crypto market crash, spot Bitcoin ETFs have seen a net outflow of $346.8 million, the first outflow in nearly 10 trading days. BlackRock’s IBIT spot Bitcoin ETF saw a net inflow of $125.1 million, so some investors are still confident. Fidelity’s FBTC had a net outflow of $166.3 million, Grayscale’s GBTC had a net outflow of $107.5 million and ARK 21Shares Bitcoin ETF had a net outflow of $89.2 million.

Investors are being cautious, because of the market volatility and macrofactors. Despite the big drop, the market is expected to bounce back. This is because of investors buying the dip and the US SEC ending a long running lawsuit against Binance which gave the market a temporary boost.

Conclusion

The recent crypto market crash shows how volatile and macro sensitive the space is. The combination of massive liquidations, big options expiries and inflation data coming up has created a perfect storm and we are seeing big corrections. Short term bounces are possible but investors should be cautious and watch economic indicators that can move the market.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What caused the recent crypto market crash?

$750 million in liquidations, $11.6 billion in Bitcoin and Ethereum options expiring and investor concerns over US inflation data.

How do options expiries affect the crypto market?

Options expiries cause volatility as traders adjust their positions and can move the underlying assets big time.

Why is PCE inflation data important for crypto investors?

PCE inflation data affects the Fed’s interest rate decisions. Higher inflation means rate hikes which can hurt risk assets like crypto.

What does the net outflow from Bitcoin ETFs mean?

Net outflows means investors are pulling out, possibly due to market uncertainty or a change of heart.

Will the crypto market recover soon?

There’s been a small bounce but recovery will depend on inflation data, regulatory news and overall sentiment.

Glossary

Liquidation: When a trader has to close their position because they don’t have enough funds to hold the position, often triggered by big price movements.

Options Expiry: The date options contracts expire and often cause market volatility as traders adjust their positions.

Put-Call Ratio: A metric that compares the number of put options to call options to gauge market sentiment.

Max Pain Point: The price at which the most options contracts expire worthless and option holders lose the most money.

PCE Inflation: Personal Consumption Expenditures Price Index, a measure of inflation that reflects changes in the prices of goods and services consumed by individuals.