The recent consolidation phase in Bitcoin (BTC) has raised concerns among investors, with the leading cryptocurrency now signaling potential downward movement. This shift has led to a change in market sentiment, leaving traders and analysts questioning whether BTC will regain its upward momentum or face further declines. Let’s explore the latest expert opinions and analysis on Bitcoin’s price trajectory.

Bitcoin Technical Analysis: Key Levels to Watch

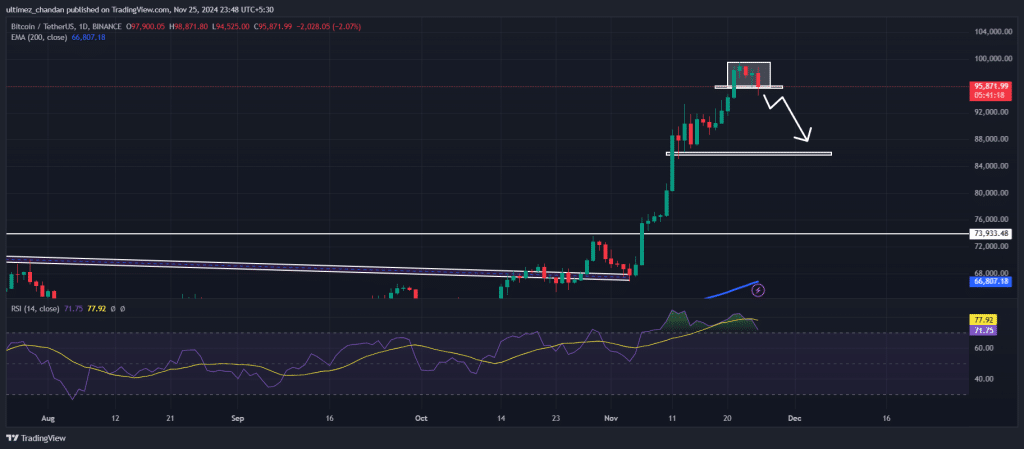

Technical indicators suggest that BTC has broken below its consolidation zone’s lower boundary, initiating a bearish move. Analysts predict that Bitcoin could experience a 10% drop, potentially reaching levels as low as $86,300.

Despite this, Bitcoin is still trading above the 200-day Exponential Moving Average (EMA) on the daily chart, which is a signal of a strong longer-term bullish trend. However, the Relative Strength Index (RSI) exceeding the 70 level indicates that upward momentum might be limited. The RSI is a vital technical tool used to identify whether an asset is overbought or oversold, and its current position hints at caution for bulls.

Factors Driving the Bearish Sentiment

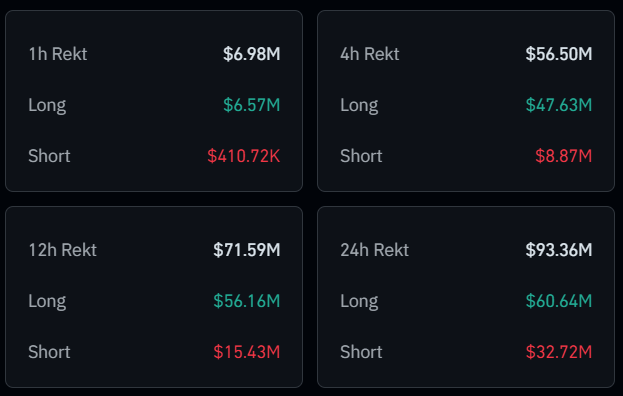

One of the major triggers behind Bitcoin’s decline is the large-scale liquidation of long positions, as revealed by on-chain data from Coinglass. Over the last four hours, $47.65 million worth of long positions were liquidated compared to just $8.87 million in short positions. In the past hour alone, $6.65 million in long positions and $410,000 in short positions were liquidated, signaling that bearish pressure is dominating the market.

This wave of liquidations underscores a shift in control back to bearish forces, suggesting that Bitcoin’s price may continue its downward trajectory in the days to come.

Major Purchases Fail to Stem the Decline

Interestingly, this downturn occurred shortly after MicroStrategy completed its massive acquisition of 55,000 BTC, valued at $5.4 billion. Similarly, Semler Scientific, a healthcare firm, recently purchased $30 million worth of Bitcoin. Despite these significant investments, the selling pressure in the market has overshadowed the impact of these acquisitions.

Market Participation Remains Strong

Amidst the volatility, Bitcoin’s trading volume has surged by 38%, reflecting robust market participation from investors and traders. This heightened activity suggests that the market is closely monitoring Bitcoin’s price action and remains engaged, even as prices fall.

What’s Next for Bitcoin?

With bearish indicators dominating the charts, investors are advised to adopt cautious strategies. While key support levels will be critical in determining Bitcoin’s next move, the current market climate demands a careful approach.

For the latest insights and updates, The Bit Journal continues to monitor Bitcoin’s performance closely, offering actionable analysis for its readers.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Folgen Sie uns auf Twitter und LinkedIn und treten Sie unserem Telegram-Kanal bei, um sofort über aktuelle Nachrichten informiert zu werden!