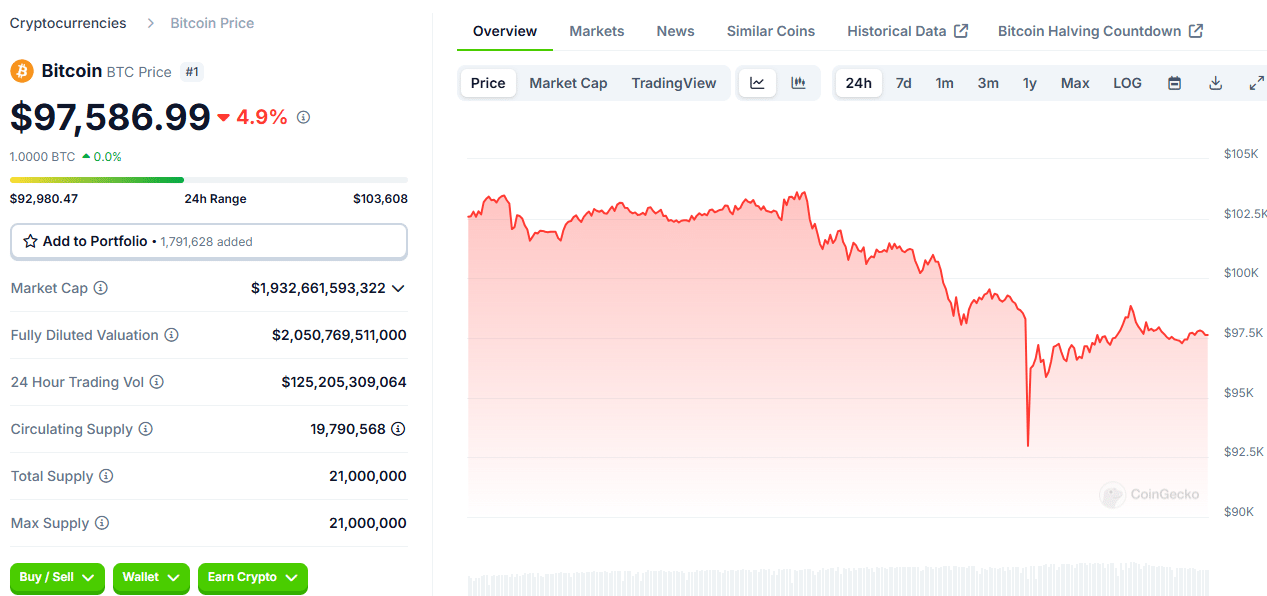

In a dramatic turn, Bitcoin (BTC) plunged to $91,998 within the last 24 hours, before a modest recovery to $97,541. This sharp decline sent ripples across the broader crypto market, sparking mixed performance among major altcoins. Despite the turbulence, Bitcoin’s monthly growth trajectory remains intact, underscoring the shifting sentiment within the crypto ecosystem.

Institutional Moves Amplify Market Dynamics

The dip below the critical $100,000 threshold triggered liquidations totaling $649 million, affecting both long and short positions. Over the past 24 hours, Bitcoin’s value dropped by 4%, leaving its market capitalization at $1.93 trillion and daily trading volume at $146 billion. This decline caused Bitcoin’s dominance to slightly recede to 53.84%.

Institutional players played a key role in shaping the market trend. SoSo Value reported $3.85 million in outflows from BTC ETFs on Thursday, while Fidelity made a bullish move by acquiring $47 million worth of Bitcoin. Grayscale sold $148 million in GBTC shares while adding $95 million in BTC ETFs through its Bitcoin Mini Trust. Market participants are now keenly awaiting BlackRock’s next update on Bitcoin-related activity.

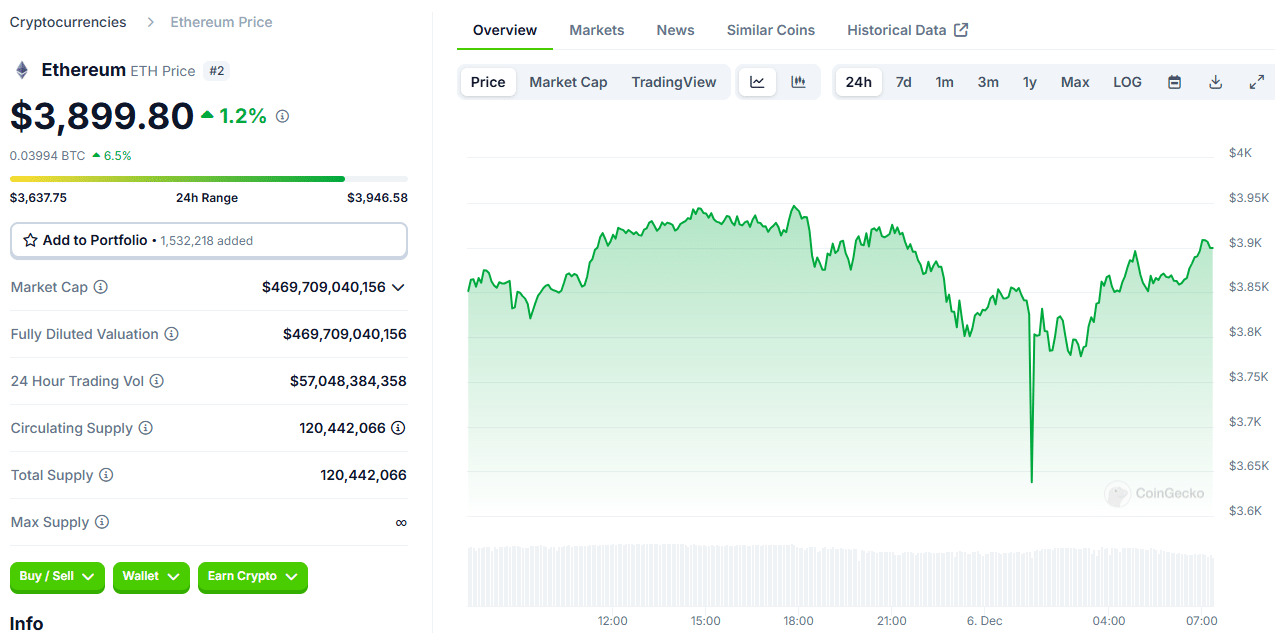

Ethereum and Altcoins: Mixed Performances Across the Board

Ethereum (ETH) managed a 1% increase over the last day, trading at $3,859. The second-largest cryptocurrency hit lows of $3,683 and highs of $3,956 during this period. Ethereum’s market cap stands at $465 billion, with a trading volume of $57 billion, holding steady with a 13% market dominance.

Other altcoins showed varied results: XRP slipped 2% to $2.30, with a market cap of $131 billion and trading volume at $17 billion. Meanwhile, Solana (SOL) surged by 6% to $241, bolstering its market cap to $228 billion.

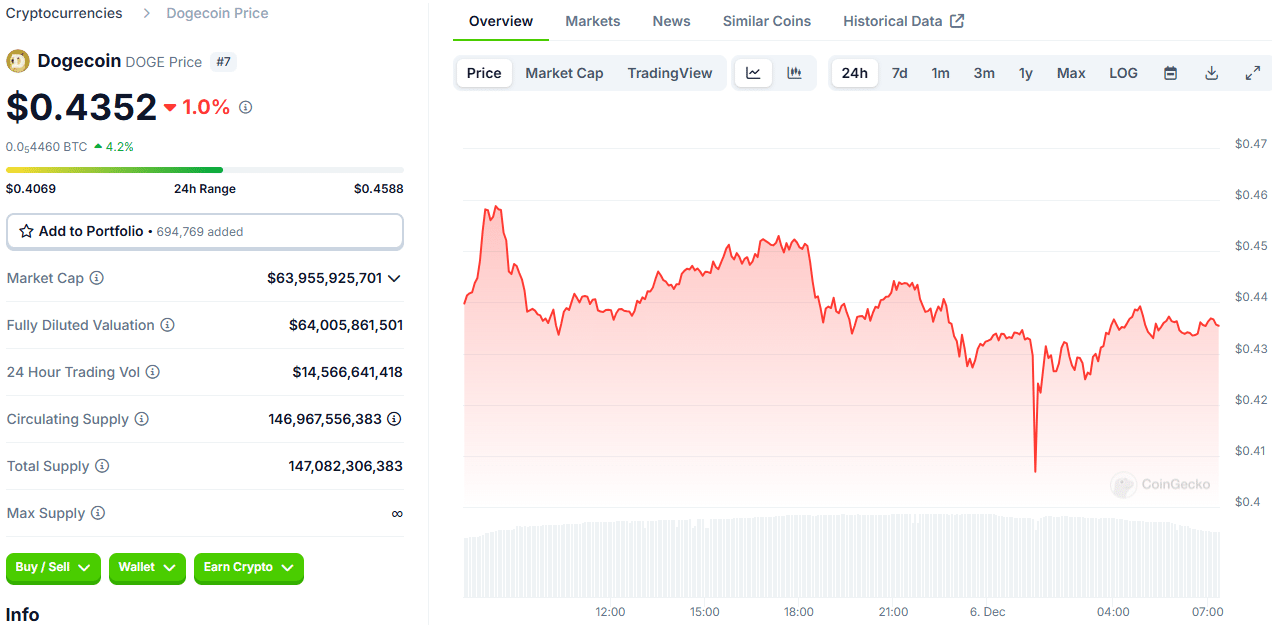

Meme Coins and Market Winners/Losers

The meme coin segment experienced turbulence as Dogecoin (DOGE) dropped 2% to $0.43, and Shiba Inu (SHIB) followed suit with a 2% decline, trading at $0.00003079. However, lesser-known meme coins like PEPE and WIF rallied, showing gains between 1% and 4%.

Among the biggest movers, JasmyCoin (JASMY) soared by 36% to $0.05225, taking the top spot as the day’s biggest gainer. On the other hand, IOTA fell by 9%, landing at $0.4434. These fluctuations highlight the importance of thorough research and vigilance in navigating the volatile crypto market.

As always, The Bit Journal encourages readers to stay informed and exercise caution when participating in the ever-evolving world of digital assets.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!