The crypto market has recently experienced a notable downturn, with Bitcoin (BTC) falling below the $90,000 mark for the first time since November 2024. This decline has raised concerns among investors and market participants. However, Binance CEO Richard Teng offers a perspective that frames this market movement as a “tactical retreat” rather than a structural reversal.

Macroeconomic Factors Influencing the Market

This recent dip in the market can be related to a few different macroeconomic occurrences. So, global markets were uncertain, primarily because U.S. President Donald Trump announced that he would proceed with a 25 percent tariff on imports from Canada and Mexico. Geopolitical events like these usually lead to aftershocks in other asset classes, with crypto being no exception.

According to Teng, the response of the crypto market to these incidents resembles that of traditional financial markets, but it also includes a special strength that typically brings a strong recovery.

Market Sentiment and the Indicators

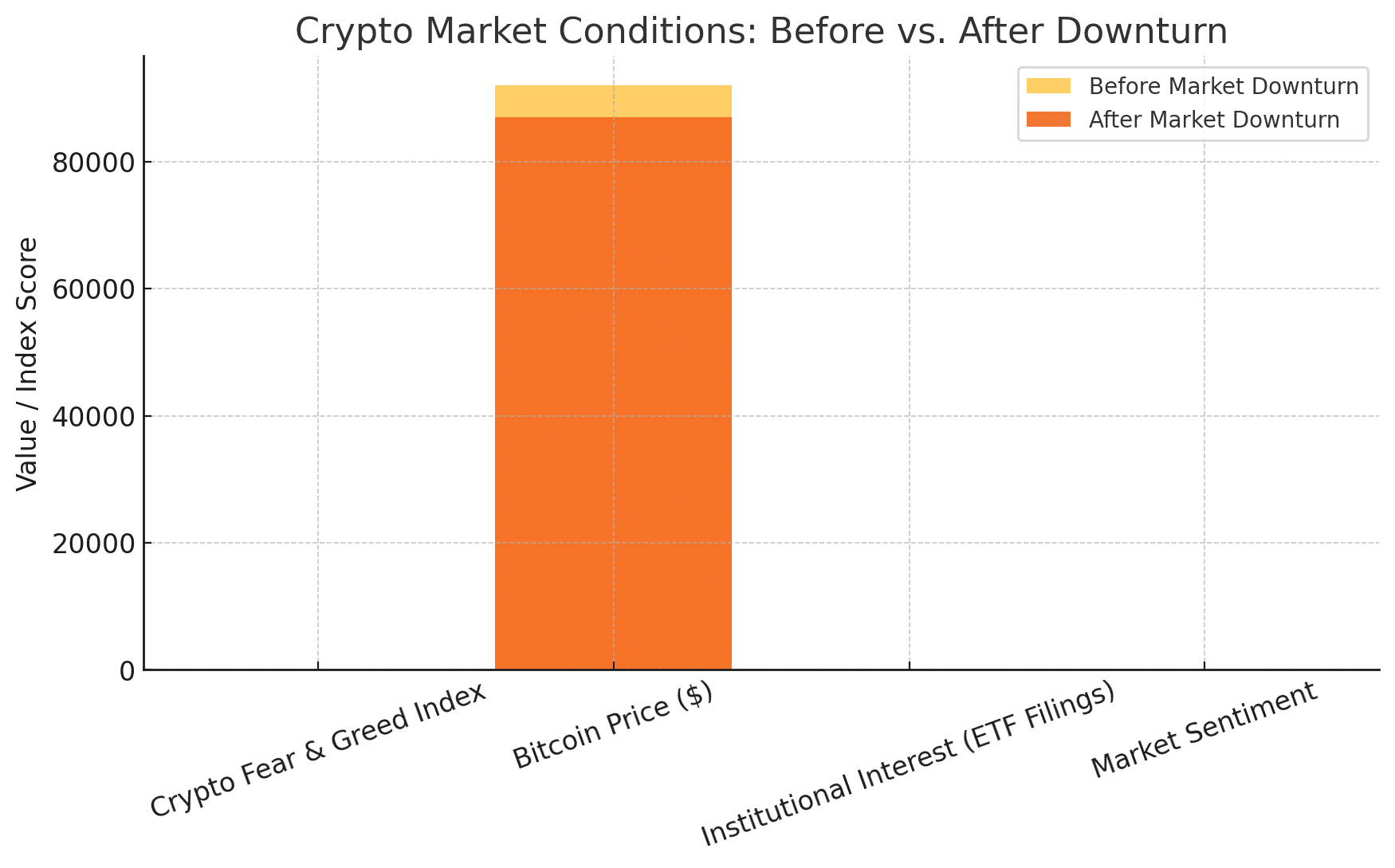

Sentiment indicators at the moment are consistent with increased caution among investors. The Crypto Fear & Greed Index has nose-dived to a score of 21/100, classifying general market sentiment as “Extreme Fear.” Such a drastic decline in the span of a few months indicates that traders are growing anxious as they digest recent news.

Likewise, Nansen’s Risk Barometer has now turned “Risk-off,” suggesting that this trend away from riskier assets is more pervasive. These shifts in sentiment, while terrible, have been seen as precursors of market corrections and their recoveries in the past.

Financial Fundamentals and Institutions Interest

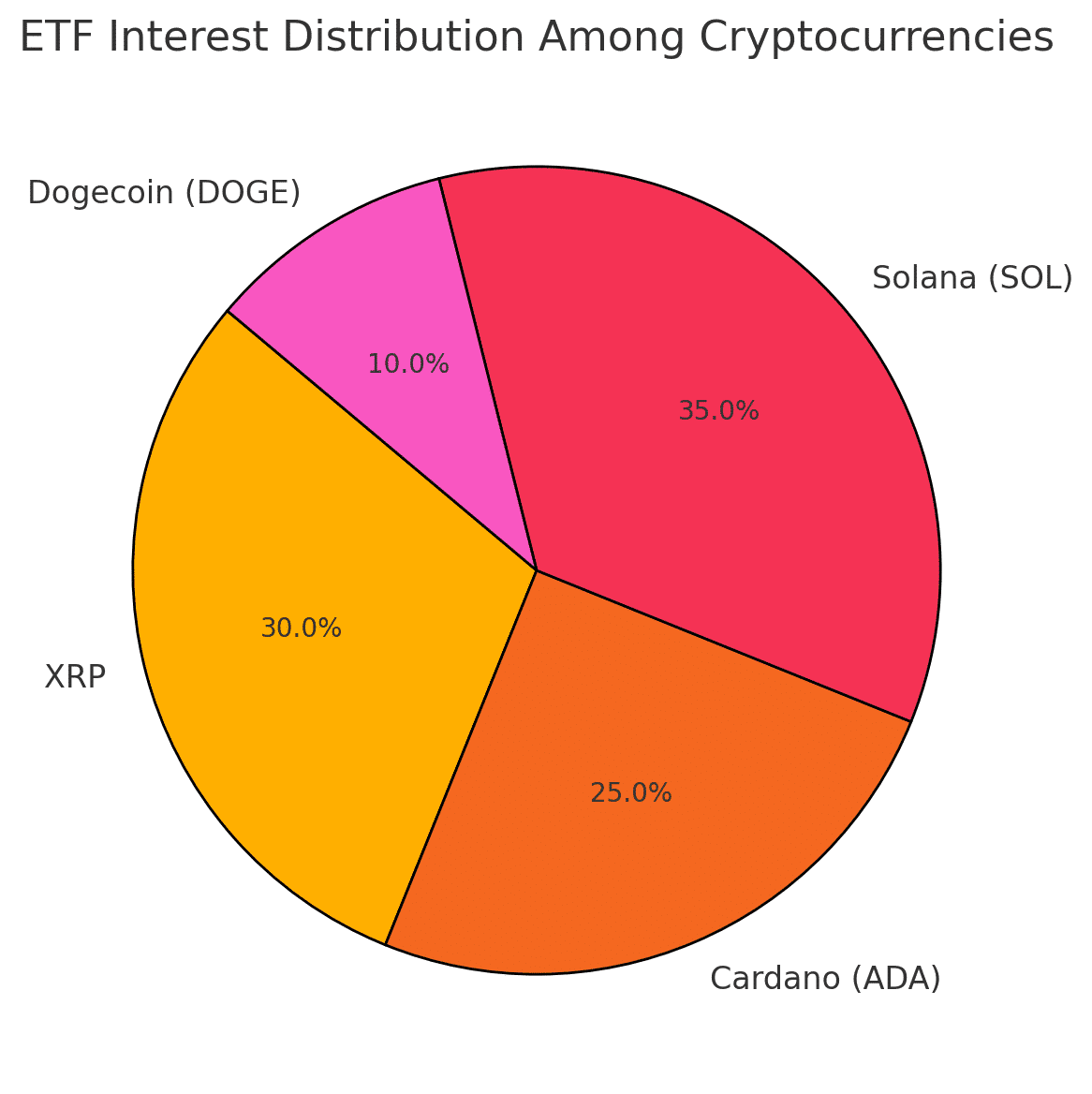

Though volatile now, the underlying market fundamentals look solid. Cryptocurrency-based financial products are in huge demand, as seen by the growing number of crypto ETF applications.

This includes applications submitted from asset managers for ETFs rooted in XRP, Cardano (ADA), Solana (SOL) and Dogecoin (DOGE) since the resignation of SEC Chair Gary Gensler on Jan. 20, 2025. Such uptrend represents a long-term institutional interest in the crypto market, and can be a stabilizing factor in the market.

Historical Resilience of the Crypto Market

The crypto market has a history of recovering from its lows. Such as in the 2022 market correction, following the collapse of exchange FTX, when the value of Bitcoin fell below $20,000. But when market conditions stabilized, it not only bounced back but also entered into new all-time highs in the coming years. This trend highlights the ability of the market to evolve and thrive, despite catalyst opportunities.

Strategic Considerations

Due to what is happening in the markets, Teng recommends investors keep the long game in mind. Instead, he asks that we consider this most recent downturn as a tactical retreat driven by macroeconomic headwinds, not by internal deficiencies in the crypto ecosystem. Conversely, for more experienced investors, such spell’s of volatility may be seen as potential tactical opportunities to evaluate and widen their portfolios, at reduced market prices, with the hope of future growth.

Conclusion

Investors have shifted eyes since the recent drop in cryptocurrency valuations of historic proportions, where it is important to put this movement in the context of how markets and historical trends behave. The recent focus on macro-level events, investor sentiment, and solid exchange fundamentals also indicates that the current slide is a temporary correction rather than a permanent downturn. However, as these key external factors rest for the market to digest, the intrinsic strength of cryptos will likely prevail allowing recovery and continued growth.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What was behind this week’s drop in cryptocurrency prices?

This decline is mainly due to macroeconomics and geopolitical events, such as the announcement by the United States government of new tariff taxes.

What impact does the current market sentiment have on cryptocurrency investments?

And measures such as the Crypto Fear & Greed Index demonstrate mounting fright among traders—typically a precursor to a quick panic sell but also a buying opportunity for those in it for the long haul.

Are institutional investors still buying cryptocurrencies in this downturn?

Yes, institutional interest is still existent with the influx of crypto ETF applications and consistent asset manager involvement.

How have cryptocurrencies performed historically after similar downturns?

In history, cryptocurrencies have shown resilience, eventually recovering from downturns to hit new highs as market conditions get better.

Glossary

Crypto ETF: An exchange-traded fund that tracks the performance of a specific cryptocurrency or a group of cryptocurrencies, providing investors with exposure without the need to buy the assets directly.

Crypto Fear & Greed Index: The emotional sentiment of the crypto market ranges from extreme fear to extreme greed.

Nansen’s Risk Barometer: A measure of crypto investors’ risk appetite, warning when money is flowing back into risk-on assets or retreating into risk-off commodity

Macroeconomic factors: The economic conditions and events that affect the overall economy and financial markets, including government policy, geopolitical events, and global economic trends.

Tactical Retreat: A temporary pullback in market prices, viewed as a strategic pause rather than a long-term decline.

Source