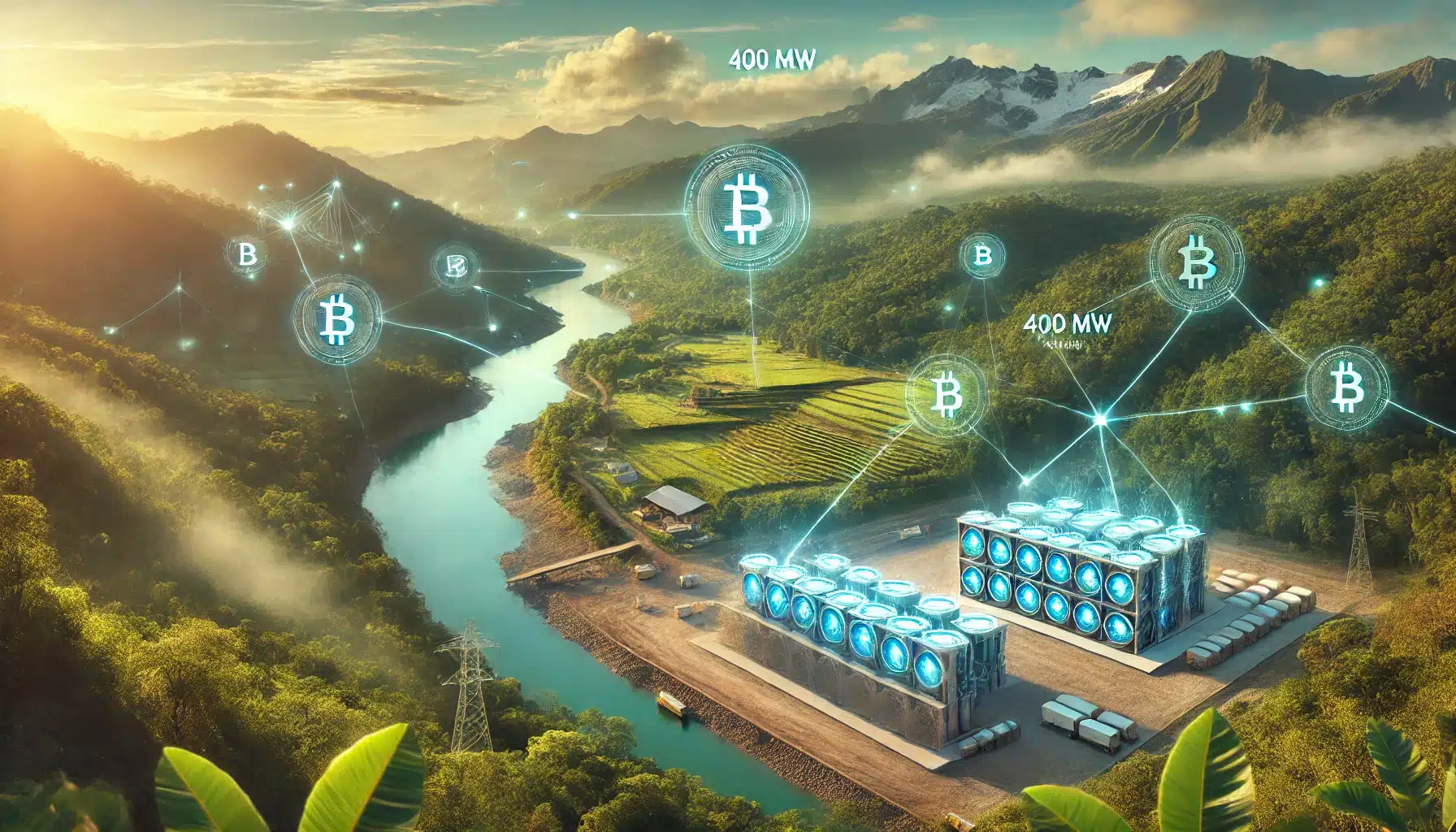

Crypto mining in Paraguay is on the cusp of significant expansion, with over 400 MW in projects still awaiting approval. Felix Sosa, the president of the National Power Administration of Paraguay (ANDE), has dismissed claims suggesting that recent power hikes might have caused a mass exit of cryptocurrency mining companies. According to Sosa, no cryptocurrency mining companies have left Paraguay, and over 400 MW in projects are still waiting for approval. Sosa’s reassurances come amid concerns that the increase in power rates might drive crypto mining firms away from the country.

Sosa highlighted that ANDE had just signed a new contract for 6 MW with an undisclosed cryptocurrency mining firm, which will start operations in Coronel Belbrano, Itapua. This addition brings the total number of legal cryptocurrency mining firms in Paraguay to 72. With more projects pending approval, the landscape of crypto mining in Paraguay remains dynamic and promising.

No Cryptocurrency Mining Companies Have Cancelled Contracts

Despite the recent power hikes, Felix Sosa has made it clear that no cryptocurrency mining companies have rescinded their contracts with ANDE. He stressed that the institution continues to support the crypto mining sector, which remains a crucial part of Paraguay’s economic strategy. According to Sosa, ANDE has been methodically evaluating sites to ensure they have adequate power availability for new installations.

This stance aligns with statements from Paraguayan President Santiago Pena, who believes that the 15% increase in power rates for the cryptocurrency mining sector will not deter companies from setting up operations in Paraguay. However, some firms, like Penguin Group, have already decided to move their operations to Brazil, citing what they view as ANDE’s “excessive greed.” Despite this, Sosa projects that the Paraguayan government will generate around $100 million in revenue from crypto mining operations this year.

Proposed Temporary Bitcoin Mining Ban Faces Stalled Progress

Paraguay’s lawmakers are now re-evaluating a proposed blanket ban on Bitcoin mining. Initially introduced last week, this controversial measure aimed to temporarily outlaw Bitcoin mining for 180 days, citing concerns about illegal cryptocurrency mines disrupting the country’s power supply. However, progress on the ban has stalled as officials consider alternative strategies.

Senator Lilian Samaniego has confirmed that a public hearing will be held on April 23 to discuss the implications of Bitcoin mining in Paraguay. In the meantime, legislators are weighing the benefits of selling surplus energy from the Itaipu hydropower plant to cryptocurrency miners instead of exporting it to Brazil and Argentina. This alternative approach could offer a new revenue stream for the country while supporting the growing crypto mining industry.

Financial Benefits of Crypto Mining in Paraguay: A New Economic Perspective

The Paraguayan government is exploring the economic potential of crypto mining, with recent declarations aiming to boost local and foreign investment in infrastructure. Senator Salyn Buzarquis has highlighted that 45 licensed cryptocurrency miners are expected to generate $48 million for ANDE by 2024, with projections reaching $125 million by 2025 as more equipment is installed.

Given the cost of electricity production at the Itaipu hydropower plant is around $22 per megawatt-hour (MWh), ANDE could see a 45% net profit margin by selling excess energy to local crypto miners at $40/MWh. This would translate to an annual revenue of $73 million and contribute approximately $17 million in value-added tax to the treasury. Buzarquis believes that Bitcoin mining operations could even save ANDE from bankruptcy, allowing for further investment in infrastructure and preventing rate hikes for Paraguayan citizens.

However, there are ongoing concerns about illegal mining operations, which have reportedly caused 50 instances of power disruptions since February. If the proposed ban passes, it could significantly impact major industry players like Marathon Digital Holdings, which set up operations in Paraguay last November.

Industry experts, including Hashlabs Mining co-founder Jaran Mellerud, argue that Paraguay should focus on cracking down on illegal mining rather than imposing a blanket ban on the entire sector. With 45 licensed miners and another 20 applicants seeking approval, representing a total of approximately 2000 MW, the crypto mining industry in Paraguay is poised for significant growth.

Concluding

In conclusion, while there are challenges facing the crypto mining sector in Paraguay, including power rate increases and regulatory uncertainties, the industry continues to demonstrate robust growth potential. As officials debate the future of crypto mining in Paraguay, the outcome will likely shape the sector’s trajectory in the coming years. Stay tuned for more updates on this evolving story on The Bit Journal