In a recent tweet, Kraken Chief Security Officer (CSO) Nick Percoco emphasized the critical importance of crypto self custody. This statement has caused a stir among traders and market participants, who are now expressing concerns about the security of their digital assets on exchange platforms.

Percoco’s Crypto Warning Sparks Industry Debate

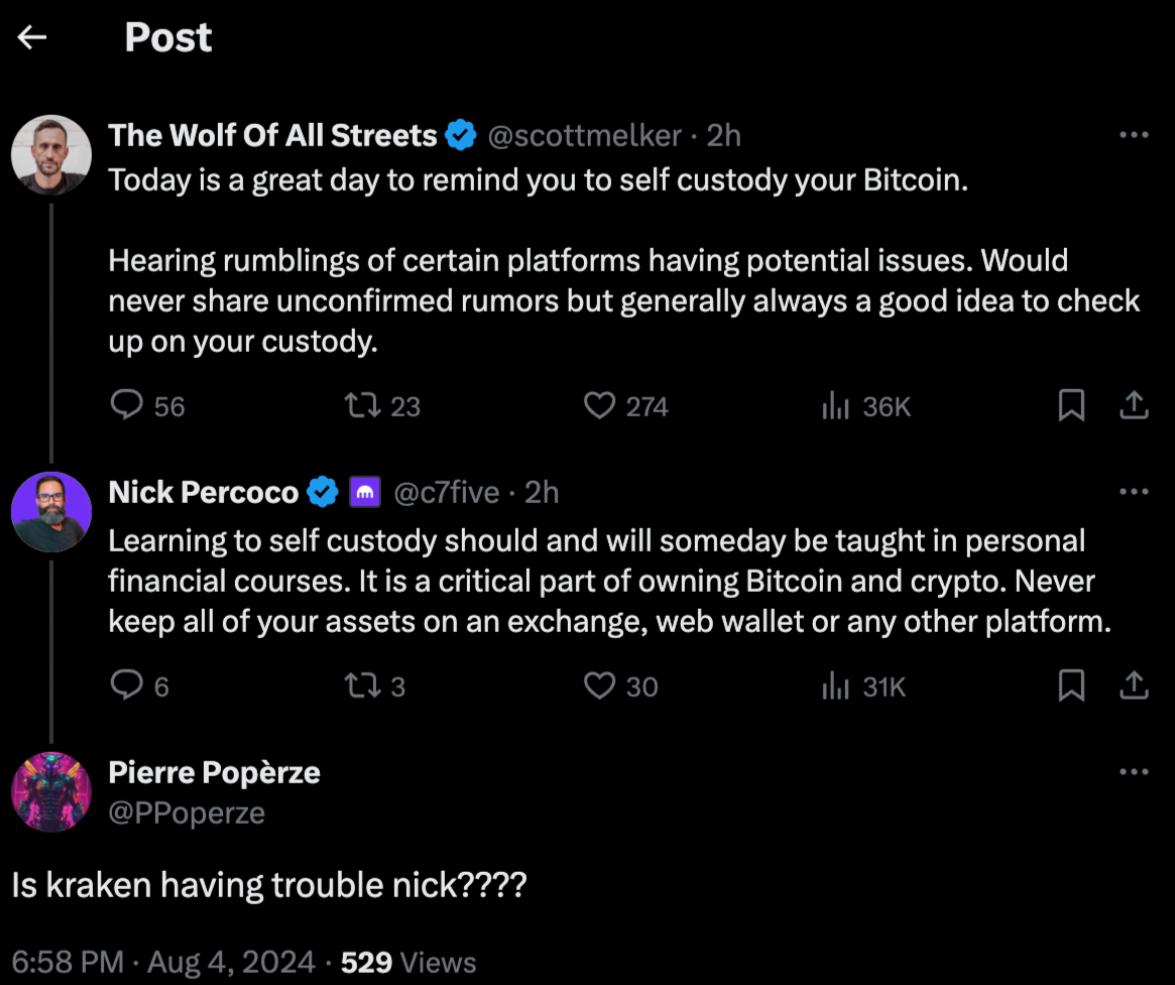

Nick Percoco’s recent emphasis on the importance of crypto self custody has sparked significant discussion in the cryptocurrency community. On August 4, 2024, Percoco took to Twitter to share his thoughts on the matter, stating, “Never keep all of your assets on an exchange or web platform.” This advice, while not new, has reignited conversations about the best practices for safeguarding digital assets.

Cryptogics, a data platform that tracks traffic to cryptocurrency exchanges, ranks Kraken among the top 10 platforms. In July 2024 alone, the platform recorded 6 million visits to Kraken. The prominence of Kraken in the cryptocurrency exchange landscape means that Percoco’s words carry substantial weight and influence.

Crypto Platforms Under Scrutiny After Tweet

The tweet from Kraken’s CSO came in response to crypto analyst Scott Melker’s comments on potential issues with certain platforms. Melker, a well-known Bitcoin and crypto influencer and host of “The Wolf Of All Streets Podcast,” tweeted, “I have heard of certain platforms having potential issues. Always remember the importance of self custody.”

Crypto Self CustodyPercoco’s reply to Melker’s tweet was simple yet impactful, as he reinforced the importance of self custody. This interaction raised immediate concerns among traders, with one user, under the handle @PPoperze, directly asking, “Is Kraken having trouble?” Such questions reflect the growing anxiety within the community about the security of their assets on exchange platforms.

The timing of Percoco’s statement is particularly significant as it comes during a period of market correction among top cryptocurrencies. As traders seek to navigate the volatile landscape, the advice to prioritize self custody over relying solely on exchanges is being taken seriously.

Percoco’s Advice Sparks Market Caution Shift

The concerns raised by Kraken’s CSO have had a noticeable impact on market sentiment. According to data from the Cryptogics platform, Kraken’s high ranking among exchanges makes any security-related comments from its executives particularly influential. The crypto fear and greed index, a metric that reflects the emotions and sentiments of market participants, read 34 on August 4, up from 26 the previous Friday. This shift from fear to greed and back within a two-week timeframe indicates heightened sensitivity among traders to any perceived risks.

“Never keep all of your assets on an exchange or web platform,” Percoco advised, reiterating the principle of diversifying asset storage to mitigate risk. His warning underscores the necessity for traders to take personal responsibility for their crypto holdings, rather than relying entirely on the security measures of exchange platforms.

By spreading assets across multiple platforms and storage solutions, traders can minimize exposure to potential security breaches and protect their investments. This proactive approach empowers traders to safeguard their assets and maintain control, rather than relying solely on third-party security measures.

Major Takeaway on Crypto Self Custody

The discussion around crypto self custody, sparked by Kraken Chief Security Officer Nick Percoco, has highlighted a crucial aspect of digital asset management. As traders express concern over the security of their assets on exchange platforms, the emphasis on self custody serves as a timely reminder of the importance of personal security measures. In an environment where market sentiment can shift rapidly, and the stakes are high, the advice from industry leaders like Percoco is invaluable.

By prioritizing self custody, traders can better protect their investments and navigate the complexities of the cryptocurrency market with greater confidence. As the market continues to evolve, it’s crucial for traders to stay informed and adapt to changing circumstances. By taking a proactive approach to asset management and security, traders can minimize risk and maximize opportunities, ultimately achieving their long-term investment goals in the cryptocurrency space. Keep following TheBITJournal for latest updates and more.