Peter Brandt is a veteran trader with more than 40 years of trading experience and recently made an outstanding analysis that concerns the relationship of Bitcoin relative to gold. According to the trader, the emerging evidence suggests that the price structure may form an inverted head-and-shoulders pattern, which signals a market trend reversal.

The prediction includes one of the main aspects of the patterns under analysis: the neckline at 32.5, the left shoulder low at 14.2, and the right shoulder in a bull flag. This is because the current standing of BTC to gold, which is 23.85, may come down to the high teens before the breakout.

When I look at chart of Bitcoin/Gold ratio, here is how I view it: $GC_G $BTC $BTCXAU

1. Continuation inverted H&S pattern, neckline at 32.5 to 1

2. Left shoulder low at 14.2 to 1

3. Right shoulder forming flag

4. Could decline into high teens to 1

5. Target 123 to 1 pic.twitter.com/VKvsDqwkuU

— Peter Brandt (@PeterLBrandt) September 21, 2024

How Bitcoin Could Outperform Gold by Over 500%

If Brandt’s explanation continues to be correct and the ratio increases further to 123.75, as illustrated in the chart he provided, then the price of BTC in terms of gold would appreciate by 518%, assuming other factors remain constant.

Although traders have been comparing Bitcoin’s performance to gold for some time now, the situation is likely to change enormously, according to the analysis of experts in Brandt’s likeness. There is an indication of a substantial change in the ratio dynamics in favor of BTC.

If this situation occurs, it would not only mark a significant premium in Bitcoin’s value compared to gold but also indicate that almost all market players believe that BTC is becoming a preferred means of wealth storage.

Optimistic Q4 Outlook for Bitcoin

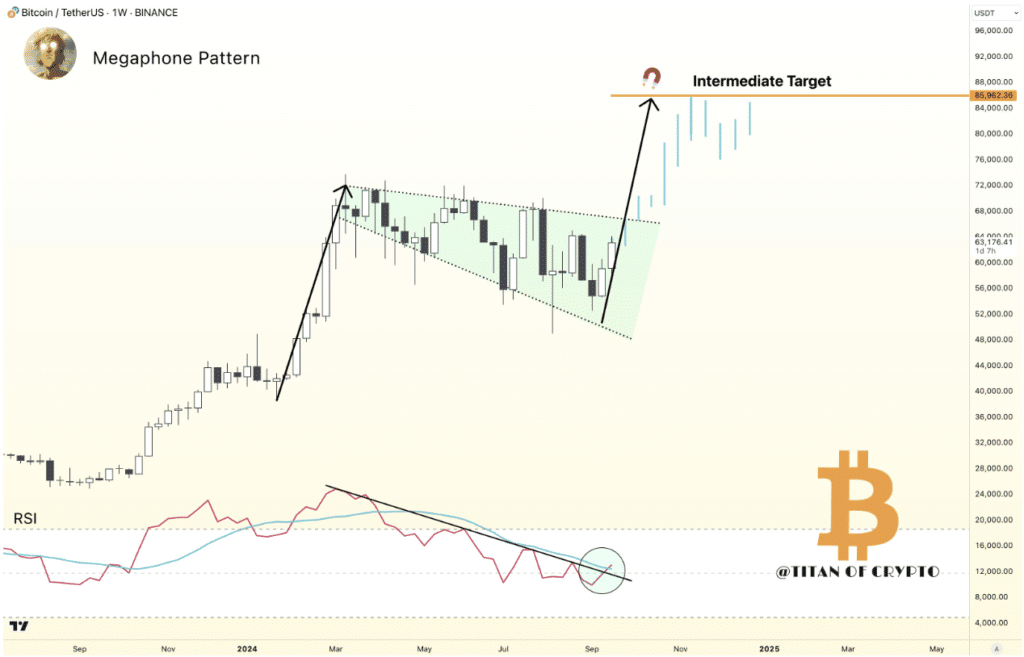

On September 21, in an update on social media, “Titan of Crypto,” a known crypto trader investor and analyst, expected the BTC/USD pair to trade significantly 35% higher in the medium, eyeing the longer time frame. In the wake of Bitcoin’s weekly close of $62,000, its market capability recovered from the $52,000 low price at its support level earlier in September.

Forecasts suggest further gains, so the outlook for Bitcoin enthusiasts is positive. Titan of Crypto estimates a target of $85000 will likely follow this price.

Still, to corroborate his optimistic view, Titan of Crypto uploaded a chart showing the relative strength of Bitcoin over a week, stating that active buying is building up, which may propel the market to its all-time highs.

RSI is a popular indicator among traders. It helps identify probable local tops and bottoms in pricing and determines the trend’s strength or no trend movement at a certain price level. At the moment, the weekly RSI is sitting at a value higher than the 50/100 level, which might indicate the end of this prevailing down movement that has been in existence since the last high recorded in March.

To support his prediction further, Titan of Crypto said that if September ends on a better note, the positive trend is likely to continue into the fourth quarter. In this regard, Skew, another famous trader, also described the requirement of proving the strength of the Bitcoin price once again next week.

Kiyosaki and Rickards Discuss Bitcoin’s Potential

The man behind ‘Rich Dad Poor Dad‘, Robert Kiyosaki, has made headlines yet again in the financial space, but this time for very reasons regarding the future of Bitcoin. Kiyosaki also drew attention on social platforms to the excerpts of his colleague’s book MONEY GPT, which is expected to be published soon, in which the author Jim Rickards examines the peculiar influence of AI on capitalism.

Rickards’ book brings the most outrageous prediction regarding the future of Bitcoin, saying that the cryptocurrency might reach $500,000 by 2025 and $1 million by 2030. Such a prediction integrates with Kiyosaki’s omnipresent idea that claims Bitcoin will be helpful in dire times economically as a form of protection and also has other wealth-preserving capabilities when the economy is under worry.

Conclusion

These diverse forecasts come together to a level where it has become an acknowledgement that Bitcoin will alter what we have known as asset valuation, more so than how we used gold. The structures of Bitcoin’s direction, presented by the end of the market’s long-term trend courtesy of Peter Brandt and a new analyst, Titan of Crypto, suggest only a bullish sentiment in the markets.

Such a scenario presents clear perspectives on how likely BTC will become the new primary foundation of wealth creation, especially at this age when technology and other uncertainties are quickly shaping up the financial world.