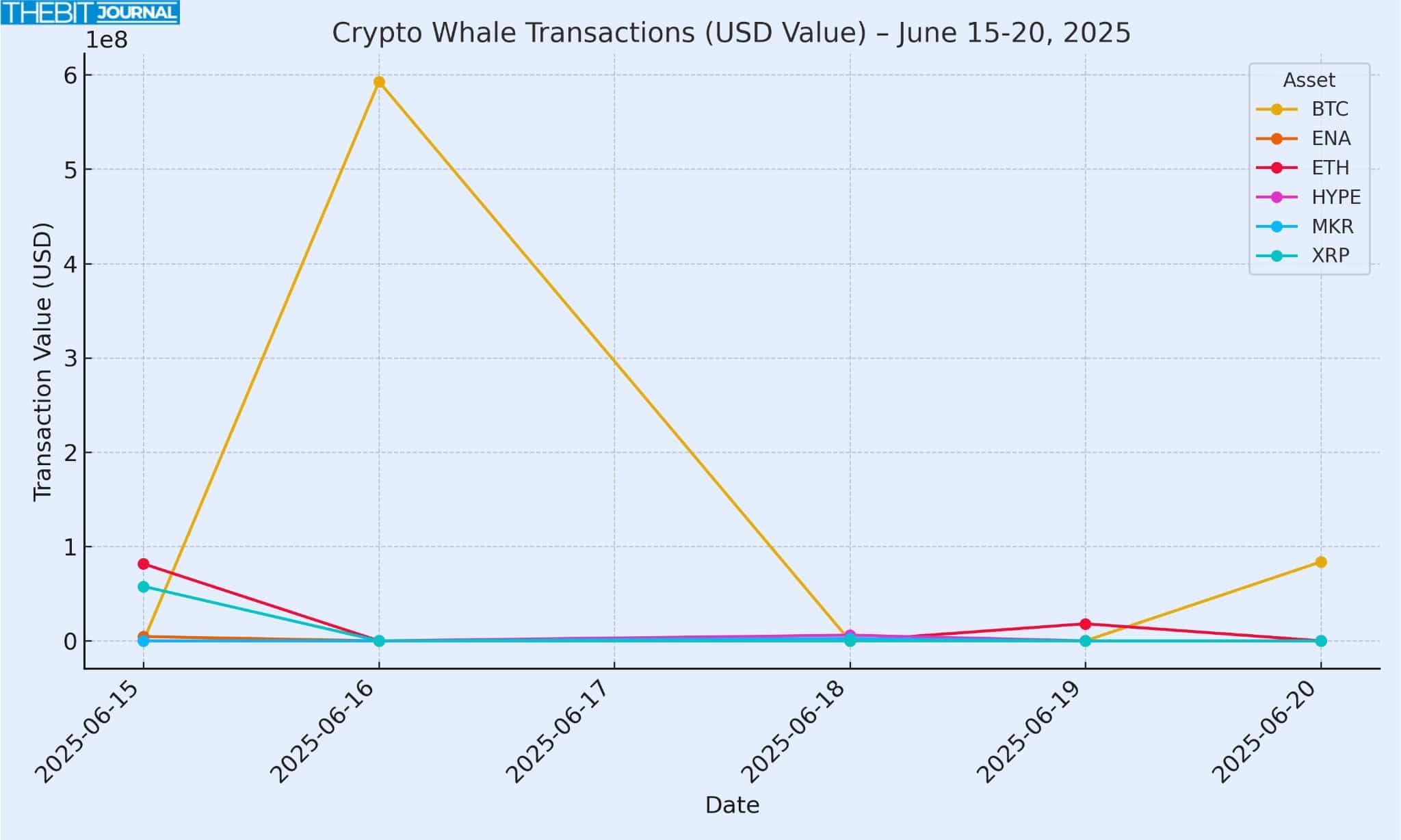

Whale activity this week has been wild, with several big transfers and buys/sells shaking the markets. Large holders (“whales”) moved huge amounts of Bitcoin, Ethereum, XRP, and various altcoins.

Notable examples include a 1,111 BTC ($117.8M) transfer between wallets; multiple XRP transfers totaling $58M to Coinbase; and crypto whales buying and selling millions of dollars of ETH and altcoins. These whale moves can be precursors to price swings or changes in sentiment.

Bitcoin Whale Transfers

Bitcoin had several big whale transactions. On June 16, Whale Alert saw a transfer of 1,111 BTC ($117.8 million) between anonymous wallets. This on-chain move coincided with Bitcoin going above $106,600.

Reports speculate that this might be related to the crypto firm Metaplanet, which announced buying 1,112 BTC that day, hitting a 10,000-BTC target. Large corporate treasuries buying big can be a vote of confidence and support for Bitcoin’s rally.

Around the same time, data showed whales withdrawing almost 4,500 BTC from Binance on June 16. Big withdrawals like this often mean a supply squeeze on exchanges, which can precede price rallies as there’s less coin available to sell.

CryptoQuant noted this outflow and a simultaneous influx of stablecoins into exchanges, a classic “supply-demand imbalance” that can drive prices up. In short, on June 16 Bitcoin whales were taking BTC off-exchange, betting on higher prices.

However, on June 20 a whale deposited 800 BTC ($83.7M) into Binance and Cobo custody. Large deposits to exchanges are often seen as sell orders, which can cool a rally. This 3NVex crypto whale move came as Bitcoin was around $104,000, and traders noted it preceded a risk-off day in global markets.

Overall, Bitcoin whales were very active: some building (Metaplanet), some selling (exchange deposit), and many moving coins to cold wallets in between. These patterns kept Bitcoin in a tight range near all-time highs, with bulls waiting to see if this crypto whale activity sparks a breakout or sell-off.

Ethereum Whale Moves

Ethereum whales were active too. On June 15, blockchain data showed an ICO-era Ethereum whale (an early adopter) moved 15,790.6 ETH ($40.8M) to OKX. In the previous 24 hours, this whale sold about $5.03M worth of ETH. Big sales after long periods of dormancy can add selling pressure and short-term volatility to ETH prices. ETH has been around $2,500 lately.

On June 19, a different whale staked 7,182 ETH ($18.1M) via Lido’s liquid staking protocol. This whale had reportedly been dormant for 1.2 years before depositing these coins from Binance and staking them for yield. The staked ETH were valued at $22.96M on withdrawal and about $18.08M after staking, reflecting market dips.

By staking ETH as stETH, the whale effectively removed those coins from circulation, which reduces sell-side supply. Both moves, one shifting ETH to sell, one stashing ETH for yield, show how crypto whales can simultaneously push and pull on supply.

Another giant transfer came on June 15. 32,042 ETH ($81.6M) was withdrawn from Binance to an unknown wallet. Pulling ETH off-exchange suggests whales are moving funds to private holdings or self-custody, rather than selling. Taken together, Ethereum whales were diversifying strategies this week: selling some coins, staking others, and moving large sums to private addresses.

Traders watching on-chain data see this as mixed signals; some bearish (sales), some bullish (staking, withdrawals), contributing to Ethereum’s relatively stable price action around $2,500.

XRP Whale Transfers

Ripple’s XRP also saw giant crypto whale transfers. CryptoAlert services flagged that on June 15, a single wallet sent 26.9 million XRP ($58 million) to Coinbase. This $58M transfer (in one block) grabbed headlines because large XRP transfers to exchanges often presage sell-offs. On June 20, similar reports emerged of $58M in XRP moving to Coinbase.

Analysts note that XRP whales tend to time such moves around regulatory news or market events. Indeed, this period coincided with renewed SEC litigation news involving Ripple, raising speculation. XRP’s price has been range-bound near $2.10-$2.20. These whale flows added uncertainty: some investors fear crypto whales are offloading into Coinbase to sell, while others point out that moving coins onto a regulated exchange could be compliance-driven (Coinbase is US-licensed).

In any case, traders on both sides are watching: if whales do liquidate, prices could dip, but if they continue to hold or use the coins (e.g. for RippleNet), XRP could hold firm. For now, whale-driven volatility is adding caution to XRP’s rally.

Altcoin Whale Activity

Beyond the majors, crypto whales were active in various altcoins. Large crypto addresses have been accumulating certain tokens this month. Certain crypto whales have increased Shiba Inu holdings by 1.94 billion SHIB (about $3.4 billion at current prices). The number of SHIB tokens held by these big players hit a record, indicating bullish bets by large investors.

Similarly, Cardano whales (holding 10-100M ADA each) bought 190 million ADA ($128M) over the week. These accumulation trends suggest that even as BTC and ETH grab headlines, smart money is also positioning in promising altcoins.

$6 million buy of HYPE tokens on June 18. OnchainLens data shows multiple whales (0x55, 0xe6, 0x26) buying tens of thousands of HYPE each (e.g. 59,719 HYPE for $2.31M). That same whale (0x26) also opened leveraged long positions on BTC. These coordinated buys at $38-40 each are bullish for HYPE.

Another whale moved 1,271 Maker (MKR) tokens ($2.45M) to Kraken on June 18. Onchain data (via Lookonchain) shows this whale bought MKR at $895 (Feb-Mar 2022) and could realize 116% profit at today’s $1,927 price. Moving MKR to Kraken means a planned sale. Large trades like this in DeFi tokens can move those markets: other traders follow or front-run whale actions, amplifying the price effect.

Crypto whales are also buying stablecoins and small caps. A new whale withdrew 15.14 million ENA tokens ($4.48M) from Bybit on June 15 and became a top ENA holder. On-chain signals like this often spark speculative interest.

In summary, whales are buying altcoins they expect to go up, selling or stashing others. This rotation explains part of the crypto rally as capital flows into favorite projects (TON, SHIB, ADA, HYPE, etc.) and out of the sidelines.

| Date (2025) | Asset | Amount (USD) | Activity |

| June 15 | ETH | 32,042 ETH ($81.6M) | Withdrawn from Binance to unknown wallet |

| June 15 | XRP | 26,896,993 XRP ($57.7M) | Sent to Coinbase |

| June 15 | ENA | 15,140,000 ENA ($4.48M) | Withdrawn from Bybit (new whale) |

| June 16 | BTC | 1,111 BTC ($117.8M) | Transferred wallet-to-wallet |

| June 16 | BTC | 4,500 BTC ($475M) | Withdrawn from Binance (whales) |

| June 18 | MKR | 1,271 MKR ($2.45M) | Deposited to Kraken (likely for sale) |

| June 18 | HYPE | ~150,000 HYPE ($6M) | Accumulated by multiple whales |

| June 19 | ETH | 7,182 ETH ($18.1M) | Staked on Lido (dormant whale) |

| June 20 | BTC | 800 BTC ($83.7M) | Deposited to Binance & Cobo (whale “3NVex”) |

Market Impact of Whale Moves

These crypto whale transactions have rippled through the market and affected sentiment. The stablecoin inflows on Binance are often linked to whales preparing to buy more BTC, which is bullish. Indeed, at times this week, Bitcoin held above $104K even after dips, as whales were ready to absorb selling.

Conversely, large deposits to exchanges (like 800 BTC to Binance) trigger caution. Traders on Binance and other exchanges reportedly tightened their stop-losses, thinking those coins would be sold. Around the June 20 deposit, Bitcoin oscillated between $103K and $106K, as the bulls and bears fought.

Ethereum’s market has felt these crypto whale flows too. The 15,790 ETH moved to OKX coincided with a small increase in ETH trading volume and a minor dip as the additional supply on exchanges created temporary selling pressure. But the big Lido stake removed supply and ETH stayed range-bound around $2,500. Overall, it’s been moderate volatility not a crash.

In altcoins, crypto whale moves are bigger drivers of volatility. The big Shiba Inu buy and token burns in mid-June lifted SHIB prices briefly, the MKR deposit on Kraken pulled back MKR’s price that day. HYPE saw 60% monthly gain in early June partly due to whales accumulating and staking the token.

Conclusion

Crypto whales have been rotating funds across coins this week. Some whales are cashing out (big XRP and ETH moves to exchanges), while others are doubling down (altcoin accumulation and staking). These are important signals: outflows from exchanges are bullish, inflows are bearish. Watching on-chain whale behavior would help traders figure out where the market is headed.

In this week’s case, the data is cautiously optimistic as crypto whales are willing to put capital to work, but moving funds quickly. As the crypto market continues to rally, traders and investors are advised to keep an eye on whale transactions.

FAQ

What is a crypto “whale”?

A crypto whale is an individual or entity that holds a lot of a cryptocurrency. By definition, whales have enough to move the market with large trades or transfers.

Why do whale transactions matter?

Whale moves affect supply and demand. If a whale withdraws coins from an exchange, it reduces sell-side supply (bullish). If they deposit large amounts to an exchange, it can signal selling (bearish). Watching whales helps traders anticipate big price moves or trends.

Should one follow whales in trading?

Whale activity is one of many signals. It can be helpful, but not foolproof. Whales sometimes move coins without selling, or use multiple wallets to hide their moves. Retail traders should use whale data along with technicals and news. Always use risk management when trading on any signal.

Glossary

Whale: An investor with very large cryptocurrency holdings (often millions of dollars’ worth).

Exchange: A platform (like Binance or Coinbase) where cryptocurrencies are traded.

Staking: Locking up cryptocurrency (like ETH in Lido) to earn rewards. Staked coins are taken out of circulation.

On-chain: Refers to transactions on the blockchain. On-chain data includes transfers, wallet balances and staking.

Lido: A staking service for Ethereum. Stake ETH and get a token (stETH) for it.