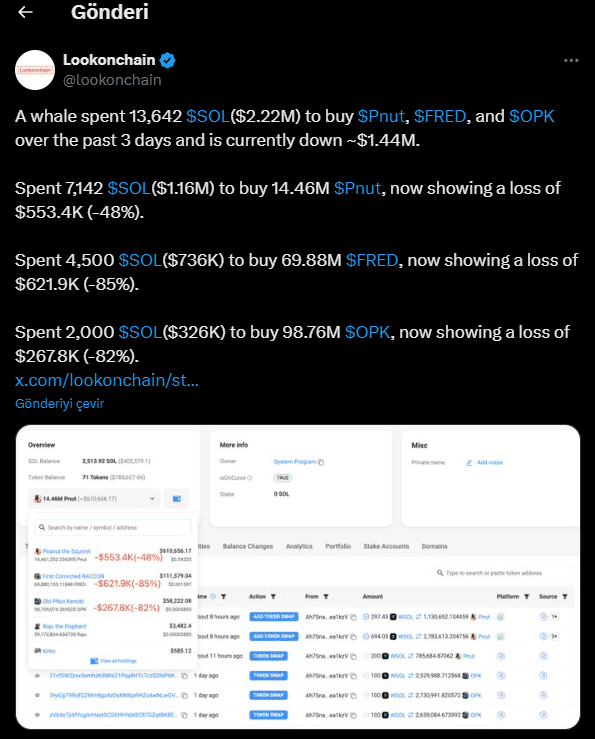

The crypto market has once again highlighted the high risks associated with speculative investments. This time, a prominent whale investor suffered significant losses over the past three days after investing heavily in meme coins. According to data from Lookonchain, the whale allocated approximately $2.22 million in Solana (SOL) to meme coins Pnut, FRED, and OPK, but is now facing losses totaling $1.44 million as the investments have sharply declined in value.

Whale Investor’s Big Meme Coin Bets

The investor poured substantial funds into Pnut, acquiring 14.46 million Pnut tokens for 7,142 SOL (around $1.16 million). However, this high-stakes move led to a 48% decline in value, resulting in a $553,400 loss. Known for its extreme volatility, Pnut quickly became a costly bet rather than a profitable one.

The whale also invested heavily in FRED, buying 69.88 million FRED tokens for 4,500 SOL (roughly $736,000). This position has since suffered an 85% value drop, costing the investor $621,900. The market plunge in FRED’s value illustrates the high risks associated with meme coins. Lastly, the whale purchased 98.76 million OPK tokens for 2,000 SOL (about $326,000), only to see it lose 82% in value, resulting in a $267,800 loss. Although OPK has gained popularity in the meme coin community, its recent volatility has hit the investor hard.

Importance of Investment Strategy

These significant losses underscore the high-risk nature of the crypto market, particularly in meme coins, which are typically driven by social media and community hype. While meme coins can offer high returns, their extreme volatility often results in substantial risks. This whale’s risky investments across three meme coins and the resulting heavy losses emphasize the speculative nature of these assets.

Meme coin investments can bring considerable returns, but they come with serious risks. For investors, it’s crucial not to make decisions based solely on hype or insufficient knowledge. Whale movements, such as this one, are closely watched by the crypto community due to their potential impact on the market. However, as this case demonstrates, even whales are not immune to substantial losses.

For more updates on whale activity and market insights, follow The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!