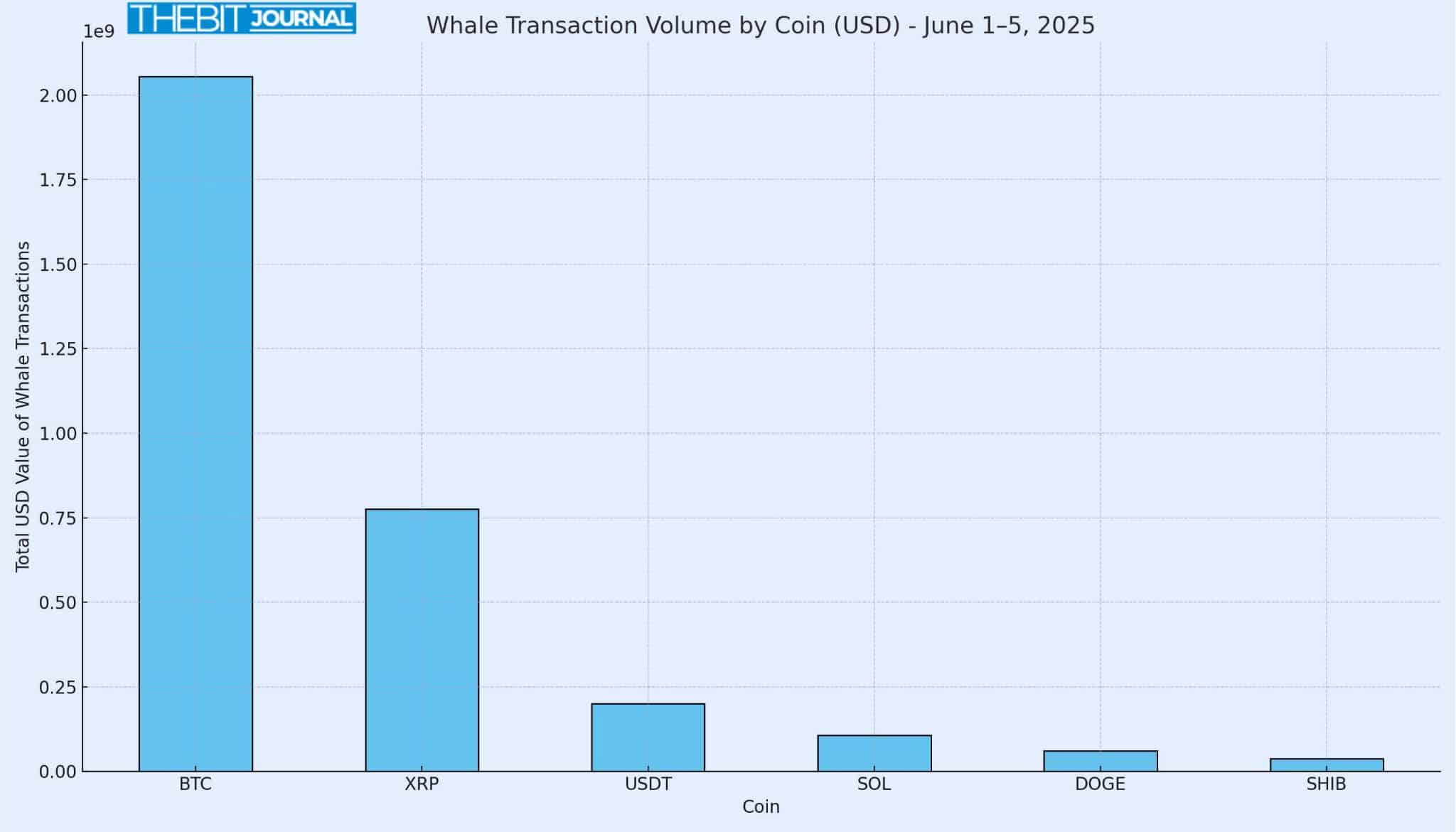

The first week of June 2025 has been eventful for the crypto market, with big crypto whale activities happening on Bitcoin, Ethereum and altcoins like Solana, XRP, Dogecoin and Shiba Inu.

Billions of dollars of crypto moved across wallets, exchanges, and staking platforms, with several high-profile transactions catching the attention of analysts and investors. These large transactions in or out of exchanges, to staking or institutional wallets have been big signals for market sentiment.

From a 10,500 BTC withdrawal from Bitfinex worth over $1.1 billion, to massive ETH staking by ConsenSys, and a $60 million DOGE deposit to Coinbase by a dormant wallet, crypto whales really made big moves this week. Moves that impacted short term price action and volatility across the board.

Bitcoin Whale Transfers

Bitcoin had multiple big flows. On June 3rd, reports showed that a whale withdrew 10,500 BTC ($1.106 B) from Bitfinex to a private wallet. Off-exchange transfers are typically bullish by reducing circulating supply.

Smaller moves included 1,000 BTC ($103.9 M) sent from an unknown wallet to Galaxy Digital on June 2nd and 8,022 BTC ($843.5 M) moved out of a CEX on June 4th. These outflows from exchanges often mean accumulation by whales.

Inflows to exchanges can mean selling. Previously, a Cumberland affiliated deposit of 2,000 BTC to Coinbase in late May drew attention, these were two transactions totalling 1,995 BTC. The recent outflows and flat prices this week have suggested that these whales were accumulating or consolidating rather than selling.

Ethereum Whales and ETF Flows

Ethereum had big off-chain and on-chain whale activity. Arkham Intelligence found a Consensys-linked whale bought $320M of ETH from Galaxy Digital on June 4th and staked $120M via Liquid Collective. This can be projected as bullish. Just few weeks before, an on-chain transaction saw a huge 100,000 ETH ($265M) moved from Arbitrum to Binance, indicating a big portfolio repositioning for Ethereum.

Exchanges saw net outflows as Binance reported approximately 114,000 ETH left exchanges on June 5th as a result of buying pressure.

Institutionally Ethereum funds are also in demand. US spot ETH ETFs saw steady inflows through this early June. CoinStats reported $57.0M net inflow into ETH ETFs on June 4th, as part of a 13 day streak of positive flows. CoinShares also noted $321M flowed into ETH ETPs in the week ending May 30th.

Bitcoin ETFs had minor flows of $86.9M into BTC ETFs on June 4th after a brief outflow. Analysts project that ETF and staking activity is seemingly bullish for ETH.

Solana and Altcoin Whale Moves

Several altcoins also saw appreciable whale activity:

Solana (SOL): On June 3, Whale Alert reported 661,113 SOL ($106M) moved between anonymous wallets. This transfer coincided with a 4.18% SOL price increase that day. The unknown sending address sparked debate speculating whether this large SOL flow means profit taking or strategic repositioning.

XRP (Ripple): Two large XRP flows stood out. First is the 330M XRP ($716M) which was returned to Ripple Labs on June 2. This was tagged as likely an internal treasury transfer. Then on June 3, about 27,028,655 XRP ($60.16M) reportedly landed on Coinbase. Experts claim the Coinbase exchange deposit likely for selling and indeed put pressure on XRP’s price.

Dogecoin (DOGE): A whale dormant since 2021 reportedly moved 312,375,048 DOGE (worth $60M) into Coinbase as DOGE broke back above $0.20. Large exchange deposits historically mean selling pressure. After this move and the whale’s liquidation of its holdings, DOGE’s price dropped. However, sources say some institutional wallets were buying DOGE at lows hence the net effect is mixed.

Shiba Inu (SHIB): On June 4 2.869 trillion SHIB ($36.6M) flowed from an Arkham-tagged market-maker wallet (Wintermute) to Coinbase Institutional. This followed an earlier transfer of ~2.9T SHIB from BitGo to the whale address. The transfer into Coinbase came as SHIB was down 2.3% in 24h and people speculated about selling. But analysts noted Wintermute had aggregated SHIB and deposited it, likely for market-making; the short-term impact was minimal due to prior coordination.

Stablecoin & Exchange Flows

Stablecoins had some whale activity, reflecting liquidity shifts. On June 4, 200,000,000 USDT ($200M) was reportedly transferred from MEXC to an unknown wallet. This could be a whale moving large holdings out of an exchange, into DeFi or another chain.

Big stablecoin flows often precede big trades or yield strategies. No large USDC or USD₁ transfers were reported, but whales move stablecoins for arbitrage or staking.

Institutional Moves (ETFs, Staking, Treasuries)

Beyond on-chain trades, institutions were active. As noted, Consensys’s whale bought $320M ETH and staked $120M, showing confidence in ETH’s staking future. On the ETF front, inflows were strong: CoinStats reports combined $143.9M net inflow into BTC and ETH ETFs on June 4 with $86.9M into BTC ETFs and $57.0M into ETH ETFs.

This is after outflows from Bitcoin ETFs just a few days ago. These flows show traditional investors (via BlackRock, Fidelity, etc.) are getting back into spot crypto funds in early June. Data for late May showed seven consecutive weeks of crypto ETP inflows totaling $10.9B, indicative that institutions are still buying.

Major Whale Transactions This Week

| Date (UTC) | Coin | Amount | USD Value | From | To |

| 2025-06-02 | BTC | 1,000 BTC | $103,948,843 | Unknown wallet | Galaxy Digital |

| 2025-06-02 | XRP | 330,000,000 XRP | $716,000,000 | Unknown wallet | Ripple (company) |

| 2025-06-03 | BTC | 10,500 BTC | $1,106,836,694 | Bitfinex | Unknown wallet |

| 2025-06-03 | SOL | 661,113 SOL | $106,000,000 | Unknown wallet | Unknown wallet |

| 2025-06-03 | XRP | 27,028,655 XRP | $60,160,000 | Unknown wallet | Coinbase |

| 2025-06-04 | BTC | 8,022 BTC | $843,498,467 | CEX (unspecified) | Unknown wallet |

| 2025-06-04 | DOGE | 312,375,048 DOGE | $60,000,000 | Dormant wallet | Coinbase |

| 2025-06-04 | SHIB | 2,869,483,918,550 SHIB | $36,603,136 | Unknown (Wintermute) | Coinbase Institutional |

| 2025-06-04 | USDT | 200,000,000 USDT | $200,000,000 | MEXC | Unknown wallet |

Top Crypto Whale Activities

Top Crypto Whale Activities

Market Impact

The early June crypto whale moves affected prices and volatility. Large withdrawals to private wallets (e.g. 10,500 BTC and 8,022 BTC outflows) likely supported Bitcoin’s consolidation. In contrast, the massive deposits into exchanges (SHIB, DOGE, XRP, LINK) coincided with short-term pullbacks.

By June 5, major crypto prices were mixed: BTC was trading at $103.7K (-1.55%), ETH at $2,562 (-3.51%), SOL at $149 (-5.36%), XRP at $2.17 (-3.36%), DOGE at $0.1815 (-5.57%) and ADA $0.6621 (-3.63%). These declines followed the above whale activities and broad profit-taking.

The DOGE whale’s $60M Coinbase deposit aligned with DOGE’s 18% slide over two weeks. Analysts note that large transfers from exchanges into private wallets usually indicate long-term holding (bullish signals) while transfers into exchanges suggest selling pressure.

The week’s activity fits this pattern: most bullish-signals (BTC outflows, ETH staking) have supported rallies, whereas the exchange inflows (DOGE, XRP, SHIB) preceded minor corrections.

DeFi and staking also helped the market. Crypto whales moving assets into staking or DeFi can reduce liquidity. The Consensys whale’s staking of $120M ETH removes ETH supply, and whale transfers into protocols may similarly lock assets.

At the same time, low funding rates on futures suggested trader caution. Overall, the interplay of crypto whale flows and market data points to a volatile but data-driven trend: accumulation is at highs as well as short-term profit-taking.

Conclusion

For this week, crypto whales moved billions in crypto and stablecoins, both bullish and bearish. Large BTC outflows to private wallets and ETH staking was long-term bullish, while big inflows to exchanges (SHIB, DOGE, XRP) was short-term profit-taking. Institutional flows reinforced this: strong ETF inflows and multi-million dollar ETH stakes was in demand, but market prices pulled back slightly due to uncertainty.

Crypto market right now is on edge. BTC and ETH have pulled back from their all-time highs, SOL and ADA corrected from recent highs, and meme-coins are volatile due to whale activity.

The first week of June saw intense on-chain activity by crypto whales and may have set the grounds for more volatility and new price levels in the coming days.

FAQ

Do crypto whale transfers always move prices?

Not always, but big moves often influence sentiment. Transfers off exchanges into private wallets like the 10,500 BTC to unknown wallet typically reduce sell-side pressure, whereas large deposits into exchanges like the 312M DOGE to Coinbase can signal selling pressure.

What did June whales do to price?

The early June whale flows were mixed. Bitcoin and Ethereum held steady near all-time highs, partly due to whales accumulating. Meme-coins and some alts dipped after huge exchange inflows. Overall, volatility increased.

How can traders react to whale activity?

If whales are buying into an asset (off-exchange flows, staking, ETF inflows), it’s most likely bullish. Large exchange inflows might be short-term selling pressure. But crypto whales act on advanced analysis, so retail traders should consider whales within the bigger picture.

Glossary

On-chain data: Transaction information on the blockchain. Whale movements are identified by looking at these records.

Inflow: assets moving into a cryptocurrency exchange often to sell.

Outflow: assets moving out of an exchange often to cold storage or private wallets.

Stablecoins: Cryptocurrencies pegged to fiat (like USD).

ETF (Exchange-Traded Fund): Tradable investment funds.

Staking: Locking up coins (e.g. ETH) to secure a proof-of-stake network and earn rewards.

HODL: Slang for holding crypto long-term.