Crypto Whales made big moves this week. From dormant Bitcoin wallets waking up to massive altcoin and meme token accumulation, it seems whales are reorganizing their portfolios. Bitcoin saw big transfers out of exchanges and even a long-dormant Satoshi-era wallet moved 80,000 BTC. Ethereum whales bought heavily while old ETH wallets reactivated after years of dormancy.

Other coins like SHIB, DOGE, PEPE and XRP also caught whale interest. Overall, these moves helped lift the crypto market as total capitalization briefly hit $3.47 trillion.

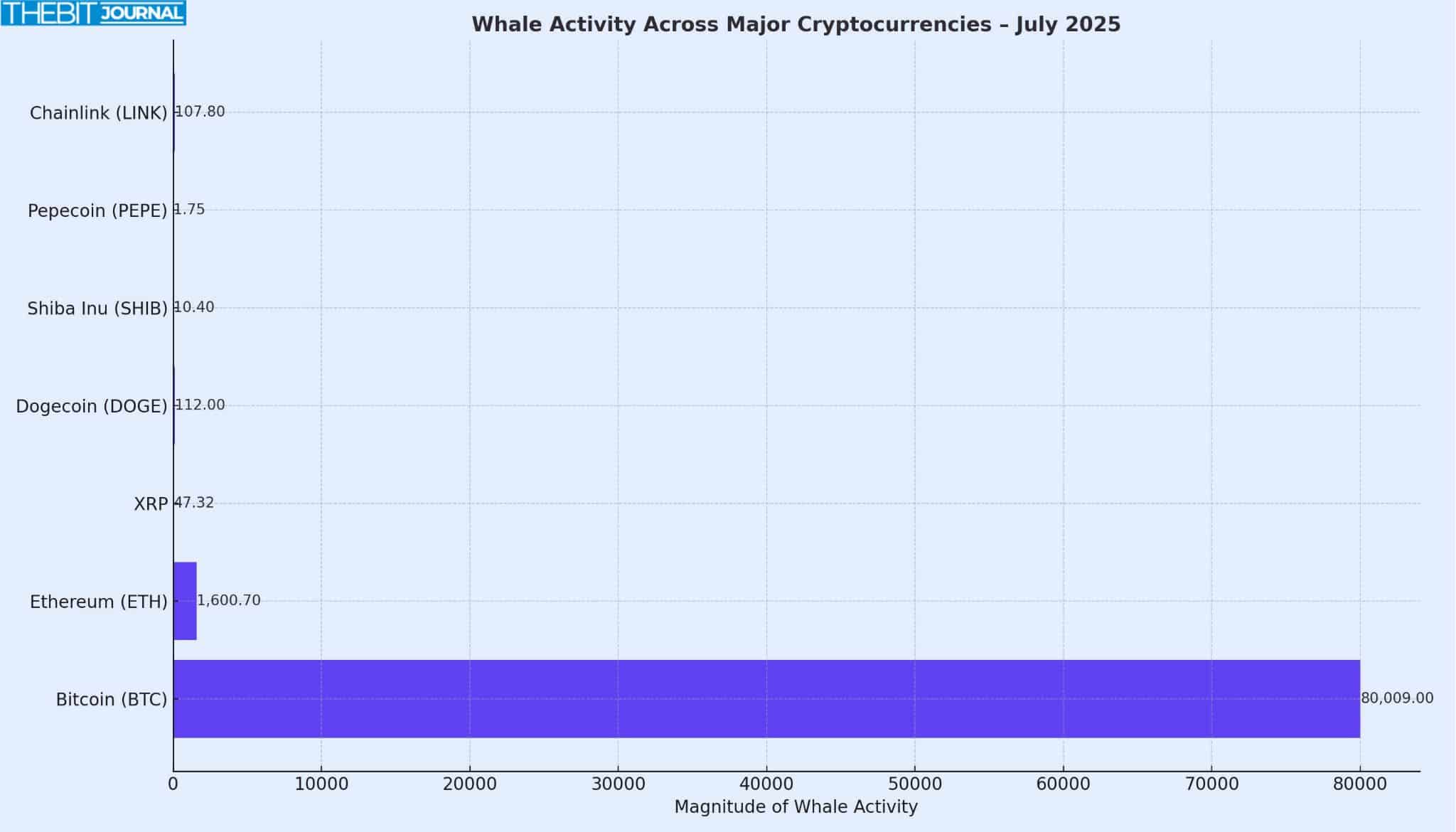

Whale Moves by Token

Bitcoin (BTC)

Early in the week, eight dormant “Satoshi-era” wallets each reportedly moved 10,000 BTC ($8.6 billion). Despite the massive $8.6B outflow, Bitcoin’s price held steady around $110K, so these were likely internal transfers or technical upgrades, not immediate sell-offs. After that, another 10,000 BTC left exchanges, indicating whales are long-term HODLing.

Analysts say sustained BTC outflows often precede bull runs as it tightens supply available to trade. With continued institutional demand (e.g. Bitcoin ETFs), these crypto whale moves haven’t killed the rally; instead, Bitcoin dominance remains high (63.9%) and stability metrics like RSI/MACD still point to bull momentum.

Ethereum (ETH)

Crypto whales are also buying ETH. One whale address recently bought 1,600.7 ETH ($4.39M at $2,744 each). On-chain data shows Ethereum’s large-holder net inflows rose 95% last week. Reports also divulge that ETH large-holder netflow jumped in early July, indicating heavy accumulation. Even old ETH wallets are waking up as a “genesis” address that received 900 ETH in 2015 moved its entire balance worth $2.27M today; after 9.9 years of dormancy.

Institutional investors are backing this trend. Bit Digital reportedly moved most of its treasury from BTC into 100,603 ETH (over $172M) in early July, betting on ETH’s long-term yield and utility. This heavy accumulation could lead to more upside if technical resistance above $2,800 breaks with momentum.

XRP

Ripple’s token has seen significant whale accumulation, fueling a rally. Santiment analytics report 2,742 wallets now hold at least 1,000,000 XRP each, controlling 47.32 billion XRP (over 3% of the circulating supply). As a result, XRP hit $2.39 as big holders bought in. The clustering of supply in crypto whale wallets often precedes sustained price moves. Technical indicators also turned bullish: RSI is firm, MACD expanding positively, and XRP recently broke above key resistances on high volume.

The whale accumulation suggests renewed market confidence, possibly tied to the upcoming FedWire upgrade to ISO 20022 on Jul 14, which could boost XRP’s institutional use.

Dogecoin (DOGE)

Doge whales are quietly buying. A Coin World report says whale DOGE holdings went up 112% in the last week. Additionally, Dogecoin’s netflow (whale buys minus sells on-chain) is up 111.97% in the same period. These are signs of accumulation levels seen before the last bull run. But DOGE price only went up 5% in 24 hours to $0.172.

Metrics like on-balance volume and positive funding rates in futures suggest building a bullish bias, but a clear breakout above ~$0.18 is needed to confirm a sustained uptrend. In sum, whales are reloading on Dogecoin even as the market remains range-bound.

Shiba Inu (SHIB)

Leading up to this week, SHIB whales quietly scooped up tokens. Reports confirm that large holders acquired 10.4 trillion SHIB ($110 million) in early July. This surge in accumulation (600% jump in on-chain activity) followed SHIB’s mid-2025 lows. The effect was a pop in price and optimistic technical patterns (a bullish “golden cross” MA crossover).

In other words, savvy investors see SHIB’s low point as a buying opportunity. Though SHIB’s price has not exploded yet, reduced exchange reserves (less supply on exchanges) and whale buying suggest that any broader crypto rally, especially if Bitcoin’s rally continues, could give SHIB a lift.

Meme/Alt Tokens

Other lesser-known tokens saw notable whale flows. PEPE whale holdings climbed 1.75% to 303 trillion tokens over 30 days. Concurrently, PEPE’s exchange supply dropped 2.9%, hinting whales are holding rather than dumping. This accumulation reportedly helped PEPE rally 3%.

Meanwhile, on-chain alerts showed large transfers of altcoins into exchanges: five crypto whales reportedly sent $13.4M of OKB to exchanges, and other moves included $2.9M of PEPE and $1.2M of FDUSD into Binance. APEcoin and Mantle each reportedly saw $1M moved to trading venues.

These flows, especially stablecoin deposits like PayPal USD ($7.9M) may signal crypto whales preparing for trades or rebalancing portfolios. In contrast to accumulation, such large deposits sometimes foreshadow sell-pressure; however, many observers interpret the overall pattern as bullish for the next altcoin leg.

IntoTheBlock show a 107.8% increase in large-holder outflows of Chainlink last week as whales removed a lot of LINK from exchanges. Less supply on exchanges tightens liquidity and usually precedes price breakouts.

Beyond that, data from analytics firms shows quiet whale activity in small caps. Alphractal reports whales are buying long in four under-the-radar altcoins which include Alien Worlds (TLM), MOBOX (MBOX), FIO Protocol (FIO) and Tutorial (TUT); all in a “depression” zone after a long decline. This stealth buying is often a precursor to early rally moves once retail latches on.

Summary of Major Whale Transactions

| Asset | Whale Activity |

| Bitcoin (BTC) | 80,009 BTC moved from 14-year dormant wallets; 10,000 BTC withdrawn from exchanges |

| Ethereum (ETH) | Whale purchase of 1,600.7 ETH ($4.39M); multiple old ETH wallets reactivated |

| XRP | 2,742 wallets holding more than 1 M XRP (47.32 B XRP total) |

| Dogecoin (DOGE) | Whale holdings +112% |

| Shiba Inu (SHIB) | 10.4 trillion SHIB acquired ($110M) |

| Pepecoin (PEPE) | Whale holdings +1.75% (to 303T); large transfers to Binance |

| Chainlink (LINK) | Large-holder outflows +107.8% |

| Others (OKB, APE, MNT, etc.) | Multimillion-dollar deposits to exchanges |

Whale Flows & Market Context

Overall, the large-scale flows this week fit a rotating bull market narrative. Many of the crypto whale moves were out of exchanges or into promising altcoins. The total crypto market cap hit around $3.47 trillion, and the Crypto Fear & Greed Index also got to 71, showing extreme greed.

Several analysts call this a “calm before the storm,” where strong hands are accumulating while weak hands are on the sidelines. Previous patterns show large dormant wallet activations rarely lead to immediate crashes; instead, they often mean internal moving or OTC deals. In fact, institutions are buying up supply. Entities like Ark Invest and Bit Digital support long-term bullish optimism.

Meanwhile, stablecoin inflows to alt-heavy exchanges as per Santiment data is fueling altcoin trading. In short, the crypto whale dynamics is supporting the current crypto rally by locking up a lot of liquid coins and redirecting capital into higher-risk, higher-reward tokens.

Conclusion

Crypto whales were quite busy this week, reactivating dormant wallets, pulling out billions of Bitcoin and altcoins from exchanges, and buying into promising assets. Highlights include an $8.6 billion BTC transfer from 14-year-old wallets, big Ethereum buys and accumulation on XRP, DOGE, SHIB, PEPE, and more.

This has supported the current rally by reducing supply and showing big holders are confident. While the market is always dynamic, whale activity is backing this phase of the growth; often a sign of a bull run.

Summary

This week, dormant Bitcoin wallets released 80,000 BTC, and 10,000 BTC was pulled off exchanges, showing long-term holding. Ethereum whales bought big as institutions flipped to ETH. Meme coins and altcoins rallied on whale buying: 10.4 trillion SHIB and 303 trillion PEPE was loaded into whales’ wallets. XRP whales accumulated 47.3 B XRP across 2,742 wallets and XRP rallied 20%.

FAQs

What big crypto whale transactions happened this week?

80K BTC ($8.6B) from 14-year dormant wallets, 10K BTC leaving exchanges; 1,600 ETH ($4.4M) bought. Other large flows: $13.4M OKB and multi-million PEPE deposits to exchanges. SHIB, DOGE, PEPE, XRP heavy accumulation.

How did whale moves affect the market?

Market cap hit $3.47T. BTC held near all-time highs despite massive transfers, XRP and DOGE surged on whale accumulation.

Are these whale transactions unusual?

Some were never seen before (14-year dormant Bitcoin activation). But big moves are common at cycle peaks. Analysts say these transfers look like accumulation not panic sell.

Glossary

Whale – an entity holding very large amounts of crypto.

On-chain data – blockchain transaction information analyzed for trends.

Netflow – difference between coins moving into vs out of exchanges or holder addresses.

Accumulation – buying and holding more of an asset.

Altcoin – any cryptocurrency other than Bitcoin.

Exchange supply – amount of a coin held on exchanges, available for trading.

Bullish signal – indicators suggesting prices may rise.