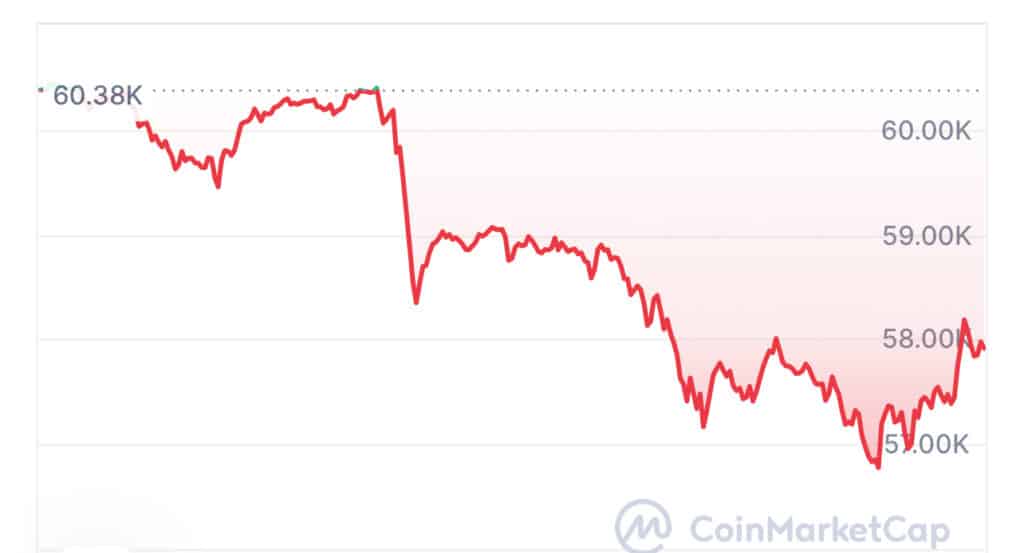

The world of cryptocurrency is once again in the spotlight as Bitcoin struggles to stay above the $60,000 mark. According to CoinMarketCap, Bitcoin’s drop to $57,744.54, down by 3.5% in a single day has sent shockwaves across the altcoin market. Notably, Ethereum (ETH), BNB, Solana (SOL), XRP, and Dogecoin (DOGE) have all dropped by 9%.

Cryptocurrency Price Analysis: Unpredictable Shifts and Resilience in the Market

This recent fall underscores just how quickly fortunes can change in the crypto world. As Bitcoin wavers, the impact spreads swiftly to other cryptocurrencies, reflecting the tightly-knit nature of this market. Investors are keeping a wary eye on these developments, knowing well that Bitcoin’s performance often sets the tone for the broader market.

Several complex factors drive the downturn in the cryptocurrency market. The impending $9 billion repayment obligation from the defunct Mt. Gox exchange stands out, injecting considerable anxiety into the market atmosphere. This situation is further compounded by significant Bitcoin sell-offs conducted by various global governments, coupled with a mysterious entity offloading $810 million worth of BTC, amplifying the selling pressure.

Despite these challenging conditions, stablecoins like Tether and USDC have demonstrated resilience. Their ability to maintain stability amid the chaos underscores a selective impact on the cryptocurrency market, affecting some digital assets more than others.

This divergence highlights the nuanced nature of the current crypto environment. It suggests that while certain segments of the market are facing downward pressure, others continue to exhibit strength, providing a mixed but insightful picture of the overall landscape.

Cryptocurrency Price Analysis: Bitcoin’s Influence and Altcoin Responses

The ripple effects of Bitcoin’s price movements significantly impact the broader crypto market. Currently, Bitcoin fluctuates around crucial support levels, causing other cryptocurrencies to experience volatility. Shivam Thakral from BuyUcoin notes that this instability is partly due to the expected Mt. Gox repayments, along with other market pressures.

Vikram Subburaj of Giottus Crypto Platform also weighs in on the situation, emphasizing the importance for Bitcoin to remain above the 200-day Exponential Moving Average (EMA), which is currently at $58,300. Holding this line is vital to prevent further market downturns, according to Subburaj.

News reports have it that certain altcoins have showcased resilience, underscoring a complex dynamic at play. XRP’s stability amidst the chaos has been buoyed by positive legal progressions, illustrating how regulatory advancements can bolster specific cryptocurrencies against broader market volatility.

This intricate web of influences—ranging from macroeconomic shifts to heavyweight transactions—illustrates the multifaceted nature of cryptocurrency investments and their susceptibility to a variety of global events.

Avinash Shekhar of Pi42 captures the mood by describing the market’s volatility as a “classic weekend pump turned Tuesday dump,” portraying the unpredictable decline and flow that investors must navigate.

The market’s adaptability will also be tested by the anticipation surrounding potential ETH and Solana ETFs. These ETFs hint at a future where traditional and crypto-specific financial instruments may intertwine, potentially offering new stability zones within this volatile landscape.

Cryptocurrency Price Analysis: Staying Informed and Adaptable

For individuals navigating the crypto market, the frequent fluctuations in cryptocurrency price analysis emphasize the importance of vigilance and adaptability. Amid rapid changes and potentially significant impacts from various global factors, it is crucial to remain informed and strategic in one’s approach.

As the crypto landscape continues to evolve, balancing the excitement of new innovations with the prudence required in risk management becomes increasingly important. Adapting to the ever-changing environment is essential for anyone engaged in this dynamic market.

Looking ahead, while Bitcoin’s current predicament may pose concerns, the persistent intrigue surrounding altcoins and the prospect of new market-stabilizing financial products provide a beacon of hope for what lies ahead in the crypto realm.

For investors seeking cutting-edge analysis, cryptocurrency price analysis and the latest crypto updates, The BIT Journal serves as an essential resource. It offers guidance to help navigate through the complexities and unpredictabilities of the cryptocurrency markets, providing insights that are vital for making informed decisions.