The cryptocurrency industry is currently navigating a complex regulatory landscape, particularly concerning stablecoin—digital assets pegged to traditional currencies like the U.S. dollar. Recent legislative proposals in the United States have ignited intense debate among policymakers and industry leaders, with significant implications for the future of digital finance.

Legislative Proposals Stirring Debate

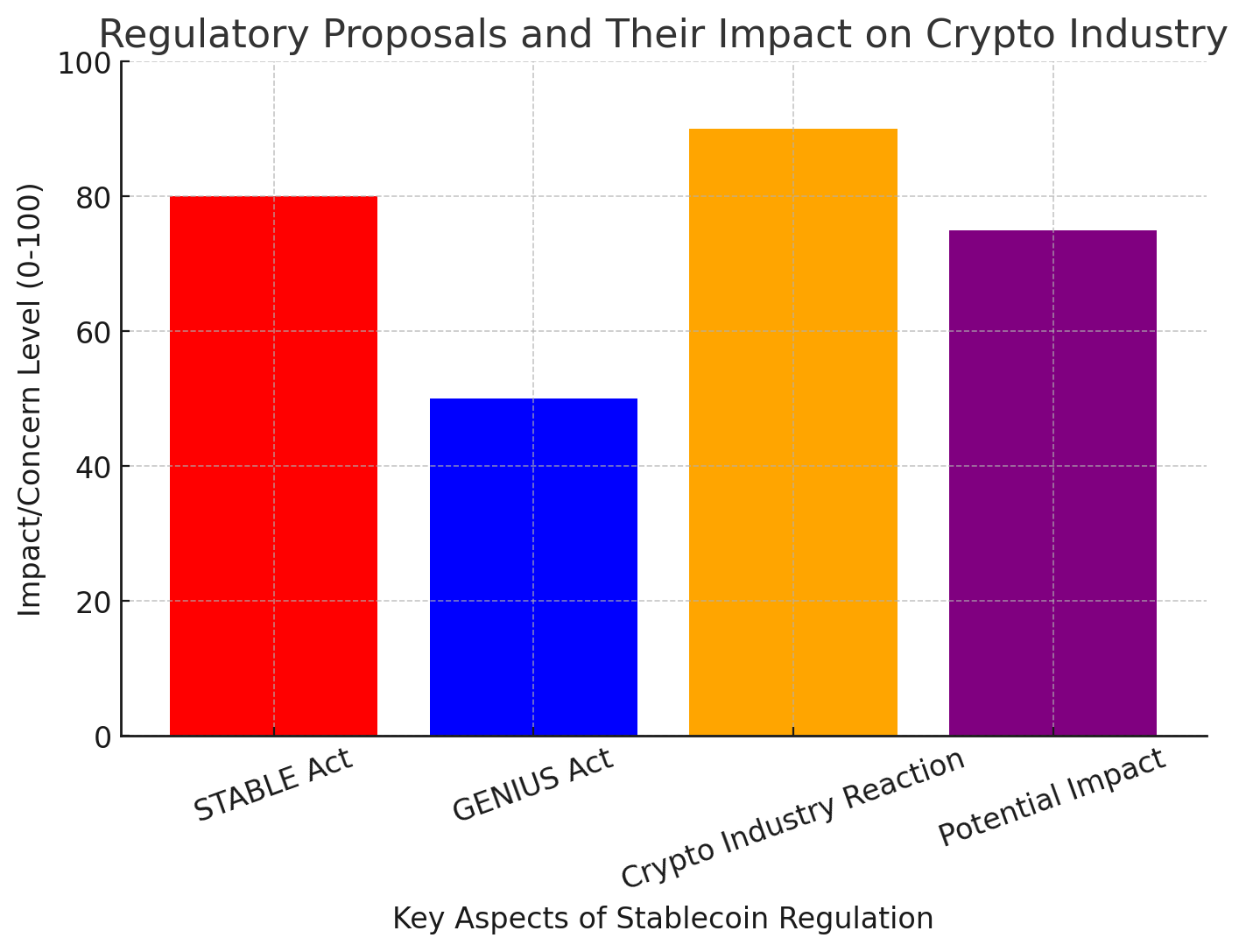

Two prominent bills have emerged at the forefront of this discussion: the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act and the Guiding and Ensuring National Innovation and Uniformity in Stablecoins (GENIUS) Act. Both aim to establish a regulatory framework for stablecoin issuers but differ in their approaches and potential impact on the industry.

The STABLE Act, introduced in the House of Representatives, proposes stringent requirements for stablecoin issuers, including mandatory banking charters and adherence to traditional banking regulations. This approach has raised concerns within the crypto community, with critics arguing that it could stifle innovation and impose undue burdens on emerging fintech companies.

In contrast, the GENIUS Act, presented in the Senate, offers a more lenient regulatory pathway. It allows non-bank entities to issue stablecoins under the supervision of state regulators, provided their market capitalization remains below $10 billion. This tiered approach aims to balance consumer protection with the need to foster innovation in the digital asset space.

Industry Response and Concerns

The introduction of these bills has elicited strong reactions from industry leaders. Many view the STABLE Act’s requirements as disproportionately harsh, potentially driving innovation offshore and hindering the United States’ competitiveness in the global digital economy. The GENIUS Act, while more accommodating, still raises questions about federal versus state oversight and the potential for regulatory arbitrage.

Jeremy Allaire, CEO of Circle—a major stablecoin issuer—has been vocal about the need for clear and balanced regulations. He emphasizes that while oversight is essential, it should not come at the cost of innovation and the growth of the digital finance sector.

Political Dynamics

The political landscape significantly influences the trajectory of these legislative efforts. The current administration’s stance on digital assets, coupled with lobbying efforts from both proponents and critics of cryptocurrency, plays a crucial role in shaping policy outcomes. The crypto industry has ramped up its political engagement, aiming to educate lawmakers and advocate for regulations that support growth while ensuring consumer protection.

The Final Verdict on Stablecoin Laws

As these bills progress through legislative processes, cryptocurrency ecosystem stakeholders closely monitor developments. The outcome of this regulatory push will have lasting implications, not only for stablecoin issuers but also for the broader adoption and integration of digital assets into the mainstream financial system.

In conclusion, the ongoing debate over stablecoin regulation in the United States underscores the delicate balance between fostering innovation and ensuring robust oversight. As policymakers deliberate on the STABLE and GENIUS Acts, the decisions made will chart the course for the future of digital finance, influencing the country’s position in the rapidly evolving global financial landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

1. What is the main concern about the proposed U.S. stablecoin regulations?

The crypto industry fears that strict regulations, like those in the STABLE Act, could stifle innovation, drive businesses offshore, and limit financial inclusion.

2. How do the STABLE Act and GENIUS Act differ?

The STABLE Act requires stablecoin issuers to obtain banking charters and follow strict banking rules, while the GENIUS Act allows non-bank issuers to operate under state oversight, provided they stay under a $10 billion cap.

3. Why are crypto leaders opposing these bills?

Many believe these laws are overly restrictive and could hurt the U.S.’s competitiveness in the global crypto market by discouraging investment and innovation.

4. What could happen if these bills pass?

If passed, stricter regulations could reshape the stablecoin market, potentially favoring traditional financial institutions over crypto startups and leading to more industry regulation.

Glossary of Key Terms

Stablecoin – A cryptocurrency pegged to a stable asset, like the U.S. dollar, to minimize price volatility.

STABLE Act – A proposed U.S. bill requiring stablecoin issuers to obtain a banking charter and comply with banking regulations.

GENIUS Act – An alternative bill proposing a regulatory framework for stablecoin issuers with a $10 billion market cap threshold.

Regulatory Arbitrage – The practice of shifting operations to jurisdictions with more favorable regulations to avoid strict compliance requirements.

Crypto Innovation – The continuous development of new financial technologies and digital assets in the blockchain and cryptocurrency industry.

Offshoring – Moving business operations to other countries to escape unfavorable regulations or economic conditions.

Sources