As per the source, venture capitalist David Sacks recently held high-level discussions with UAE officials to explore new investment opportunities across emerging technologies. The meeting, which took place in Abu Dhabi, centered around establishing strategic partnerships focused on artificial intelligence (AI), crypto infrastructure, and defense-related innovations.

David Sacks, co-founder of Craft Ventures and a prominent figure in Silicon Valley, has long been a proponent of decentralization, free enterprise, and innovation. His talks with top Emirati policymakers mark a deepening of ties between the Gulf region’s sovereign wealth interests and U.S. venture capital.

“The UAE has a strong vision for technology-driven growth, and they’re looking to partner with people who understand how to build the future,” Sacks reportedly said during the meeting.

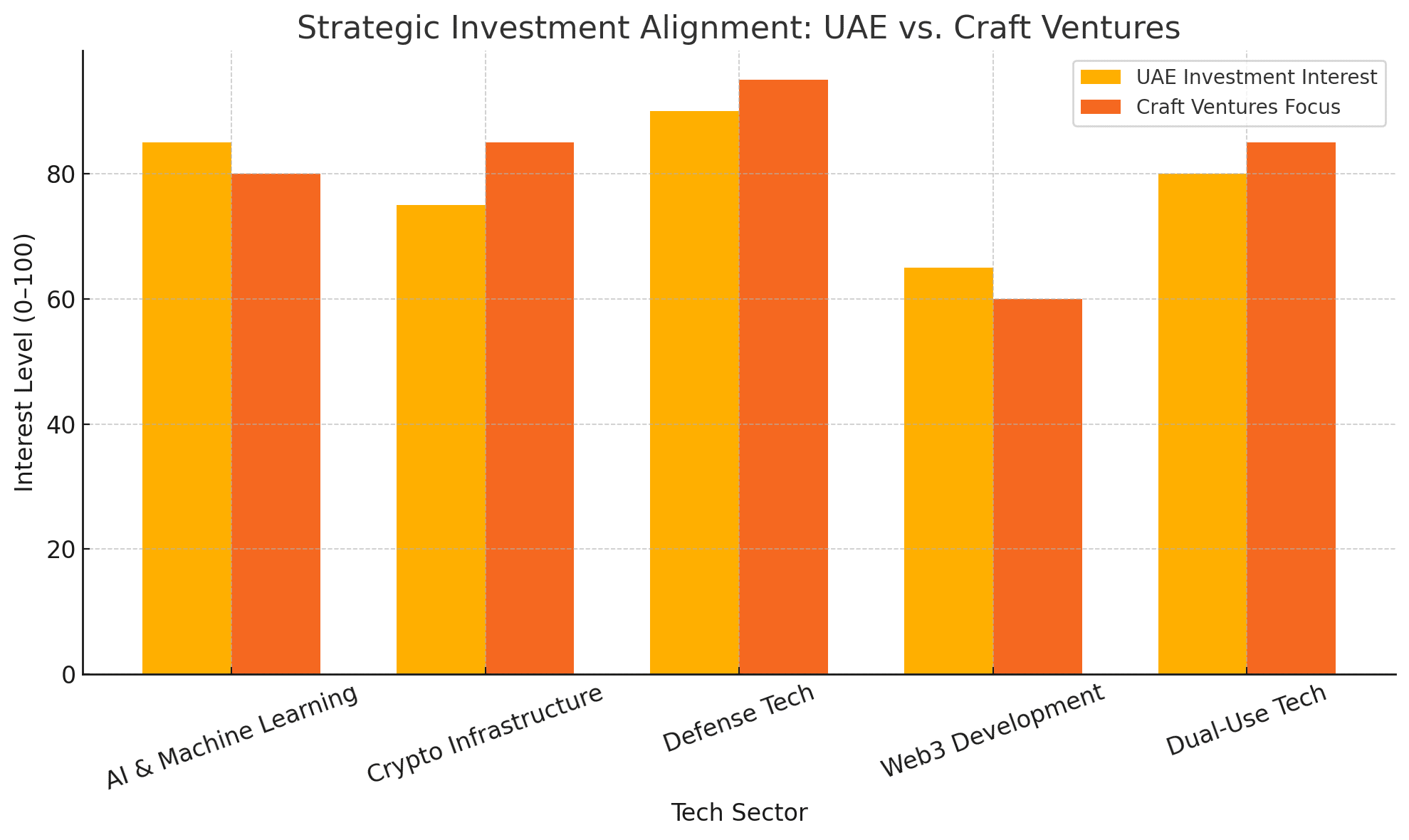

UAE’s Vision Aligns with David Sacks’ Investment Strategy

The UAE, particularly through entities like Mubadala and the Abu Dhabi Investment Authority (ADIA), has accelerated its push into global tech markets. Its focus on digital transformation and economic diversification aligns well with David Sacks’ portfolio, which includes investments in startups like OpenStore, Ramp, and Anduril.

Anduril, a defense tech startup co-founded by Palmer Luckey and backed by Sacks, is of particular interest to UAE officials. With regional security high on the agenda, defense innovation is becoming a key pillar in the UAE’s sovereign tech investments. This intersection of capital, geopolitical interest, and next-gen technology underscores the strategic nature of the talks.

According to TechCrunch, insiders close to the discussions said the UAE is especially interested in increasing its stake in U.S.-based startups with dual-use technologies—those with both commercial and military applications.

A Pivot Toward the Middle East?

David Sacks’ visit also signals a broader trend of Western tech investors turning to the Gulf for capital and partnerships. With traditional VC markets tightening and regulatory uncertainty clouding the U.S. tech scene, investors are increasingly seeking stable, forward-looking partners.

With its business-friendly environment and access to global markets, the UAE offers a compelling alternative. Over the past five years, Abu Dhabi and Dubai have launched multiple tech-focused funds and accelerators, including Hub71 and DIFC Innovation Hub, attracting startups from around the world.

Sacks’ alignment with UAE interests could open doors for Craft Ventures to co-invest alongside Emirati funds and tap into the Gulf’s vast capital reserves.

Crypto and AI in the Spotlight

Another key topic of the discussions was the growing synergy between crypto infrastructure and artificial intelligence. The UAE has shown increasing interest in blockchain-based financial systems and decentralized protocols, particularly in light of global de-dollarization trends and the rise of BRICS-led alternatives.

Sacks, an outspoken supporter of crypto’s role in the future of finance, discussed potential collaboration on Web3 infrastructure and policy innovation.

“There’s a clear appetite in the Gulf to support technologies that enable financial sovereignty and programmable economies,” he noted.

UAE policymakers, meanwhile, expressed interest in shaping regulatory frameworks that encourage innovation while protecting national interests—a balance that Western markets have struggled to maintain.

Conclusion: A New Axis of Innovation?

David Sacks’ visit to the UAE may mark more than a diplomatic gesture. It suggests a potential realignment in the flow of venture capital, one that reflects shifting global power dynamics. As East meets West in the investment space, the collaboration between Sacks and Emirati leaders could usher in a new era of cross-border innovation.

With AI, crypto, and defense tech at the center of global economic transformation, partnerships like these will likely define the next decade of investment and entrepreneurship. The world will be watching as these plans take shape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What was the purpose of David Sacks’ visit to the UAE?

David Sacks visited the UAE to discuss potential investment partnerships with Emirati officials, focusing on areas such as AI, crypto, and defense technology.

What technologies are being prioritized in these discussions?

The talks emphasized artificial intelligence, crypto infrastructure, and dual-use defense technologies that have both civilian and military applications.

Who are the key UAE entities involved?

Entities such as the Abu Dhabi Investment Authority (ADIA) and Mubadala are central to the discussions. These sovereign wealth funds are among the world’s largest and most active tech investors.

Why is the UAE an attractive partner for tech investors?

The UAE offers a stable political climate, robust regulatory frameworks, and a proactive vision for digital transformation. Its access to capital and global influence also make it a key hub for innovation.

Glossary of Key Terms

David Sacks – A prominent Silicon Valley venture capitalist, co-founder of Craft Ventures, and former COO of PayPal.

UAE (United Arab Emirates) – A federation of seven emirates in the Gulf region, known for its oil wealth, global investment portfolios, and growing influence in tech and finance.

Mubadala – A state-owned investment company in Abu Dhabi that manages a diversified global portfolio, including tech, energy, and healthcare.

Anduril – A U.S.-based defense tech startup specializing in autonomous systems and AI-driven security solutions.

Dual-Use Technology – Technologies that can be used for both civilian and military purposes.

Web3 – The next generation of the internet based on decentralized technologies such as blockchain, enabling trustless digital ecosystems.

Sovereign Wealth Fund – A state-owned investment fund typically derived from national reserves, used to invest globally across various asset classes.