The Dubai Financial Services Authority (DFSA) has launched an ambitious Tokenization Regulatory Sandbox, signaling Dubai’s continued push towards becoming a global leader in digital finance. This initiative provides a controlled regulatory environment for firms to experiment with tokenized investment products, reinforcing Dubai’s commitment to fostering financial innovation while ensuring robust compliance.

DFSA’s Tokenization Initiative: Key Details and Objectives

A New Frontier for Tokenized Investments

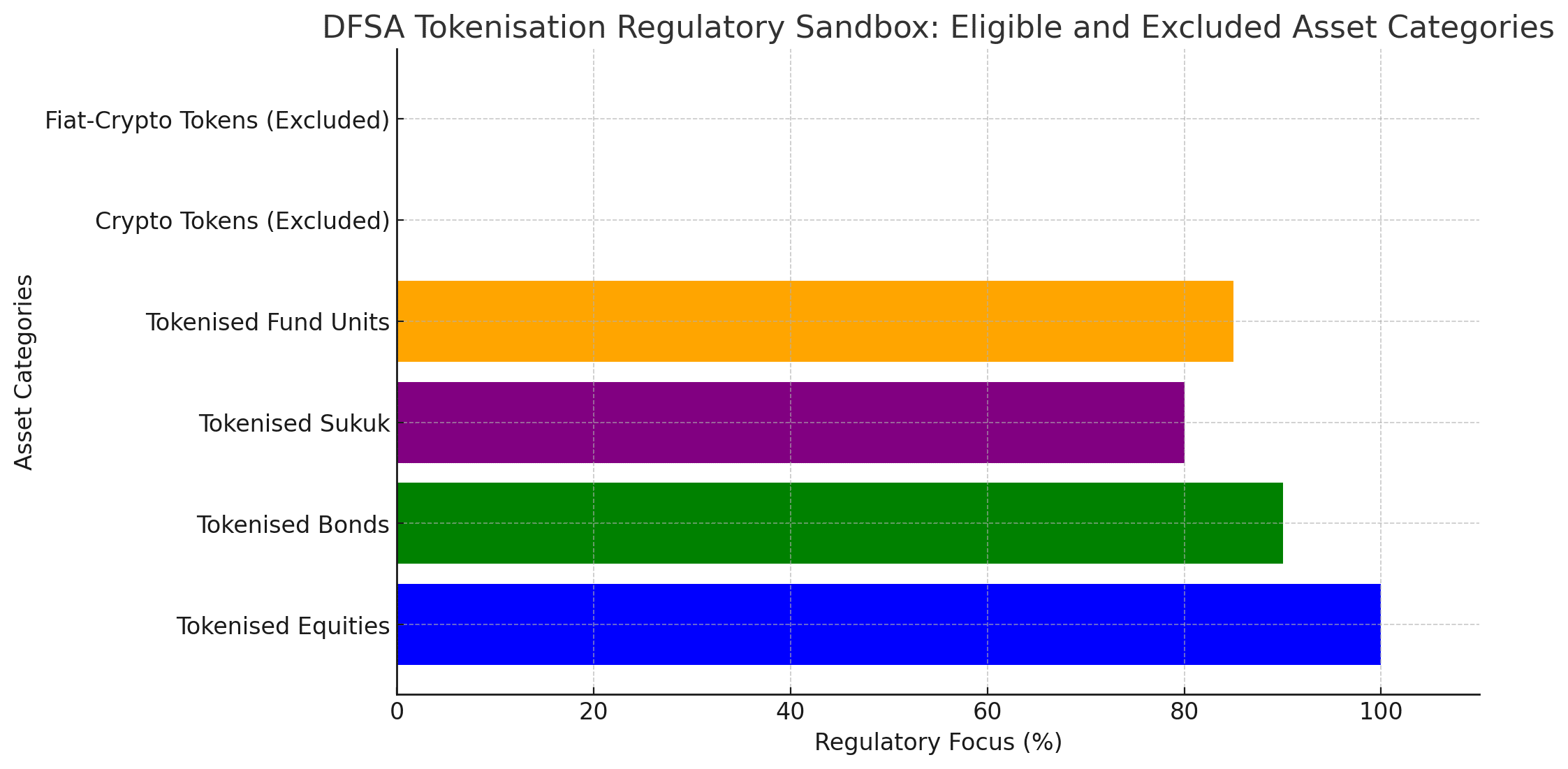

The DFSA’s Tokenization Regulatory Sandbox will allow financial firms to issue, trade, hold, and settle tokenized securities, including equities, bonds, sukuk, and units of collective investment funds. Notably, crypto tokens and fiat-crypto tokens are not included in this sandbox, as it strictly focuses on regulated securities and investment assets.

According to the DFSA, this initiative aims to enhance the efficiency, transparency, and accessibility of financial markets, encouraging institutions to explore the potential of blockchain-powered investments under regulatory oversight.

Who Can Apply for the Sandbox?

DFSA has outlined specific eligibility criteria for participation:

- Existing DFSA-authorized firms looking to expand into tokenization.

- New applicants with solid regulatory and legal compliance knowledge are interested in offering tokenized financial instruments.

- Companies involved in blockchain-based financial infrastructure supporting tokenized assets.

Firms interested in joining must submit an Expression of Interest (EOI) before April 24, 2025. Successful applicants will enter the Innovation Testing License (ITL) program, allowing them to test their solutions under DFSA’s regulatory supervision.

What Does This Mean for Dubai’s Crypto and Blockchain Sector?

Dubai has consistently positioned itself as a pioneering hub for blockchain and fintech advancements. The Tokenization Regulatory Sandbox is a continuation of Dubai’s broader regulatory strategy, aligning with global trends in decentralized finance (DeFi) and tokenized assets.

By establishing clear regulatory guidelines, DFSA aims to attract institutional players and innovative startups, fostering a robust and compliant tokenization ecosystem within the Dubai International Financial Centre (DIFC).

Industry Insights

Industry experts have lauded DFSA’s proactive stance, seeing it as a catalyst for wider adoption of tokenized securities in traditional finance.

James Peterson, a blockchain analyst, commented:

“This sandbox is a game-changer. It provides a regulated environment for institutions to safely experiment with tokenized assets, paving the way for institutional adoption of blockchain technology.”

In contrast, some critics argue that excluding crypto tokens from the initiative might limit its broader impact. However, DFSA maintains that the sandbox is designed for investment securities rather than cryptocurrencies, aligning with global regulatory trends favoring institutional blockchain adoption.

The Future of Tokenized Securities in Dubai

Tokenization is gaining momentum globally, with markets like the U.S., Europe, and Asia actively exploring blockchain-based securities. DFSA’s initiative adds credibility and structure to the sector, potentially attracting major financial institutions to pilot digital securities in the DIFC.

If successful, this regulatory sandbox could set a blueprint for other jurisdictions, making Dubai a leading example of blockchain integration into traditional finance.

Final Thoughts

The DFSA’s Tokenization Regulatory Sandbox is a significant step forward in bridging traditional finance and blockchain innovation. By providing a regulated environment for experimentation, Dubai continues to solidify its reputation as a global fintech hub, offering a blueprint for institutional adoption of tokenized securities. With a structured approach to blockchain finance, this initiative could be a key driver for the next wave of financial innovation.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is the DFSA’s Tokenization Regulatory Sandbox?

The DFSA’s Tokenization Regulatory Sandbox is a controlled testing environment that allows firms to explore tokenized investment products under regulatory supervision.

2. Which assets are eligible for tokenization under this initiative?

The sandbox supports tokenized equities, bonds, sukuk, and collective investment fund units, but excludes crypto tokens and fiat-crypto tokens.

3. Who can apply to participate?

Existing DFSA-authorized firms and new applicants with a strong understanding of financial regulations and blockchain-based securities can apply.

4. How can companies apply for the sandbox?

Interested firms must submit an Expression of Interest (EOI) before April 24, 2025, to be considered for the Innovation Testing License (ITL) program.

5. How does this initiative benefit Dubai’s financial sector?

It enhances market transparency, efficiency, and accessibility, positioning Dubai as a global leader in regulated blockchain finance.

Glossary of Key Terms

Tokenization – The process of converting real-world assets (e.g., stocks, bonds) into blockchain-based digital tokens.

Sandbox – A controlled regulatory environment where businesses can test new technologies under regulatory supervision.

DFSA (Dubai Financial Services Authority) – The financial regulatory agency overseeing Dubai’s International Financial Centre (DIFC).

Sukuk – Islamic financial certificates similar to bonds but structured to comply with Shariah law.

Innovation Testing License (ITL) – A DFSA program that allows firms to trial new financial technologies within a regulated framework.

Fiat-Crypto Token – A digital asset pegged to a traditional currency (e.g., USDT, USDC), often used in cryptocurrency markets.