A recent, widely shared online post claims Elon Musk’s AI firm is preparing to invest $104 billion into XRP, and even suggests a partnership with Ripple to navigate regulatory hurdles. This sensational rumor follows a prior, unsubstantiated claim that Musk would spend $50 billion on XRP, including a prediction of XRP reaching $600.37 per coin. However, none of these claims are confirmed by Musk, his companies, or Ripple, and thus remain speculative.

Viral Headlines and the Quest for “XRP Momentum”

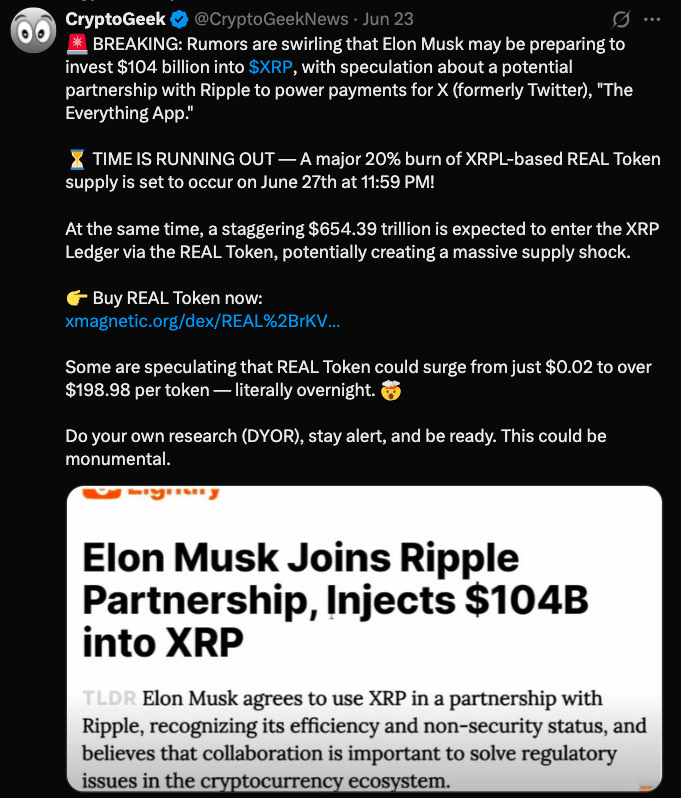

The most recent exaggerated headline reads: “Elon Musk Joins Ripple Partnership, Injects $104 Billion into XRP.” Social media users widely shared it, citing the rapid transfer capabilities and cost advantages of XRP. Some attributed the claim to how Musk admires the token’s efficiency and regulatory positioning.

Despite echoing earlier rumours about a possible $50 billion XRP investment, no credible source or industry insider has validated these claims. The recurring mention of huge sums, first $50 billion, now $104 billion, reveals how baseless hype can inflate rumour, rather than reflecting real investment potential.

To add to confusion, rumors surfaced of a quickly deleted Musk tweet containing “#XRP is looking quite promising.” According to proponents of the claim, this was an indication that Musk was shifting from his known interest in Dogecoin and Bitcoin toward XRP. Yet, no screenshots, archives, or verifiable evidence exist to support this, and the story remains anecdotal.

Searching token trackers, public APIs, and Musk’s social profiles reveals no trace of Musk’s engagement with XRP. Consequently, the supposed tweet is as likely a false memory or manipulated message rather than a genuine Musk signal.

Analyzing the Pattern Behind XRP Rumour Cycles

There is a repetitive pattern of exaggerated posts claiming Elon Musk will invest enormous sums, first $50 billion, now $104 billion, in XRP. These stories lean on Musk’s popularity and his history of moving markets with comments on Bitcoin and Dogecoin. Yet they consistently collapse under scrutiny; each iteration is larger in scale but lacks credible evidence.

Meanwhile, Musk continues to focus publicly on ventures like Tesla, SpaceX, xAI, and ClimateTech, with no recent signals of involvement in Ripple Labs or XRP. This pattern suggests opportunistic rumors seeking attention through Musk’s name, rather than any factual basis.

Technology platforms and the media need strong verification to verify such rumors, yet in this case, no primary source exists. Journalistic standards demand confirmation from Musk, his spokespeople, or Ripple, none of which are present. Until official channels validate the claim, the mass circulation highlights the power of rumor, not reality.

Recognizing the Red Flags of Crypto Hype Through the XRP Rumor

The recent wave of speculation around Elon Musk and XRP offers a textbook example of how crypto hype spreads, and how to spot it before getting caught up. These kinds of rumors often gain traction because they use a powerful name, in this case Elon Musk, to boost credibility without providing any real proof.

The promise of massive investment; first $50 billion, now $104 billion. This sounds exciting, but the absence of direct confirmation from Musk or Ripple should immediately raise red flags.

Another clue lies in how fast the story spread, particularly on platforms that reward engagement over accuracy. Headlines that include eye-popping numbers or suggest insider moves from well-known figures are designed to spark emotion, not clarity. The supposed quote from Musk about XRP being “promising,” posted and then allegedly deleted within seconds, plays right into this formula, even though there’s no screenshot, archive, or credible source to back it up.

Conclusion: No $104 Billion XRP Deal, No Tweet, No Partnership

The claim that Elon Musk is planning a $104 billion investment in XRP is unverified and lacks any official support. No authentic sources confirm Musk’s intent or involvement, no credible tweets exist, and there’s no narrative from Ripple indicating such collaboration. While Elon Musk’s influence in crypto is undeniable, that power is being exploited here through baseless speculation.

Until Musk or affiliated entities issue verified statements, the “Elon Musk XRP” rumor remains fictional. Crypto investors should remain vigilant and rely only on confirmed information.

Summary

A viral rumour falsely claimed that Elon Musk planned to invest $104 billion into XRP, sparking widespread excitement despite zero evidence or official confirmation. The claim followed earlier unfounded speculation and included a likely fabricated deleted tweet. The XRP case highlights the need for critical thinking and verified information in the crypto space, especially when rumours involve influential figures like Musk.

FAQs

Has Elon Musk confirmed any investment in XRP?

No. There is no confirmation from Musk, Ripple, or any credible financial institution regarding a $104 billion XRP investment.

Is a partnership between Musk’s firms and Ripple possible?

While technically possible in the future, no official discussion or negotiation has been confirmed at this time.

Could XRP Realistically Reach $600 per Coin?

A jump to $600 per XRP implies a near $600 billion market cap; highly unlikely without major structural changes.

How Can I Verify Crypto Rumors?

Cross‑check with official statements from the people involved, credible news organizations, and regulatory filings. Unverified social media claims should be treated with skepticism.

Glossary

XRP – A digital asset created by Ripple Labs designed for fast, low-cost cross-border transactions.

Capitulation – In crypto, it denotes mass selling following losses.

Rumour – Information that lacks verifiable evidence, often spread to generate attention rather than inform.

Verification – The journalistic process of corroboration through credible sources before publicizing claims.

Pump and Dump – A scheme that inflates the price of an asset through false or misleading statements to sell at a profit before the value crashes.

Market Manipulation – The act of spreading misleading or false information to influence the price or volume of a financial asset.