In a series of recent developments, Ripple Labs finds itself at the intersection of legal battles and high-level discussions that could reshape the future of cryptocurrency in the United States. The ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC) has taken unexpected turns, while conversations between Ripple’s leadership and President Donald Trump hint at a potential national digital asset reserve.

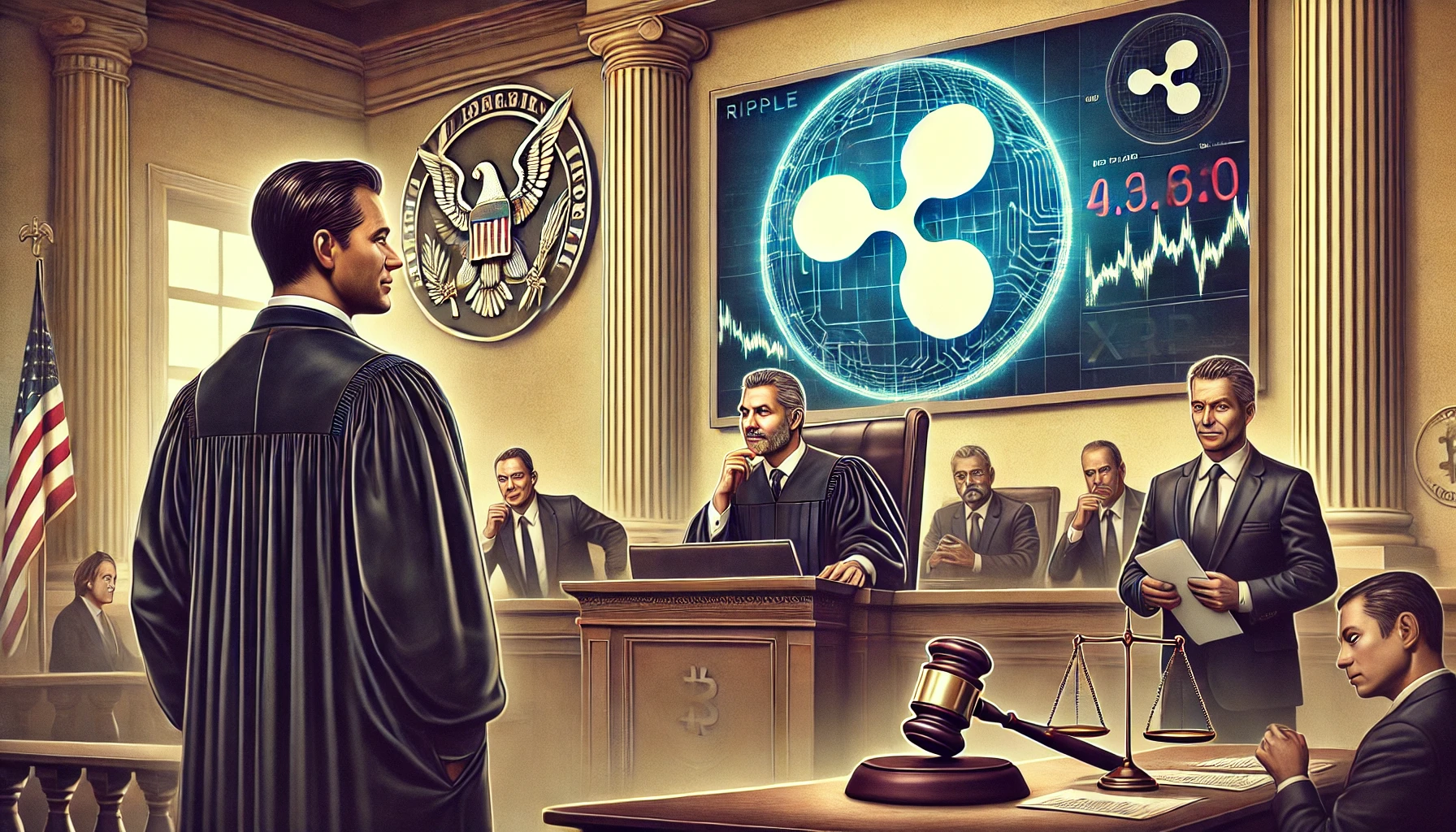

Ripple’s Legal Battle with the SEC: A Turning Point?

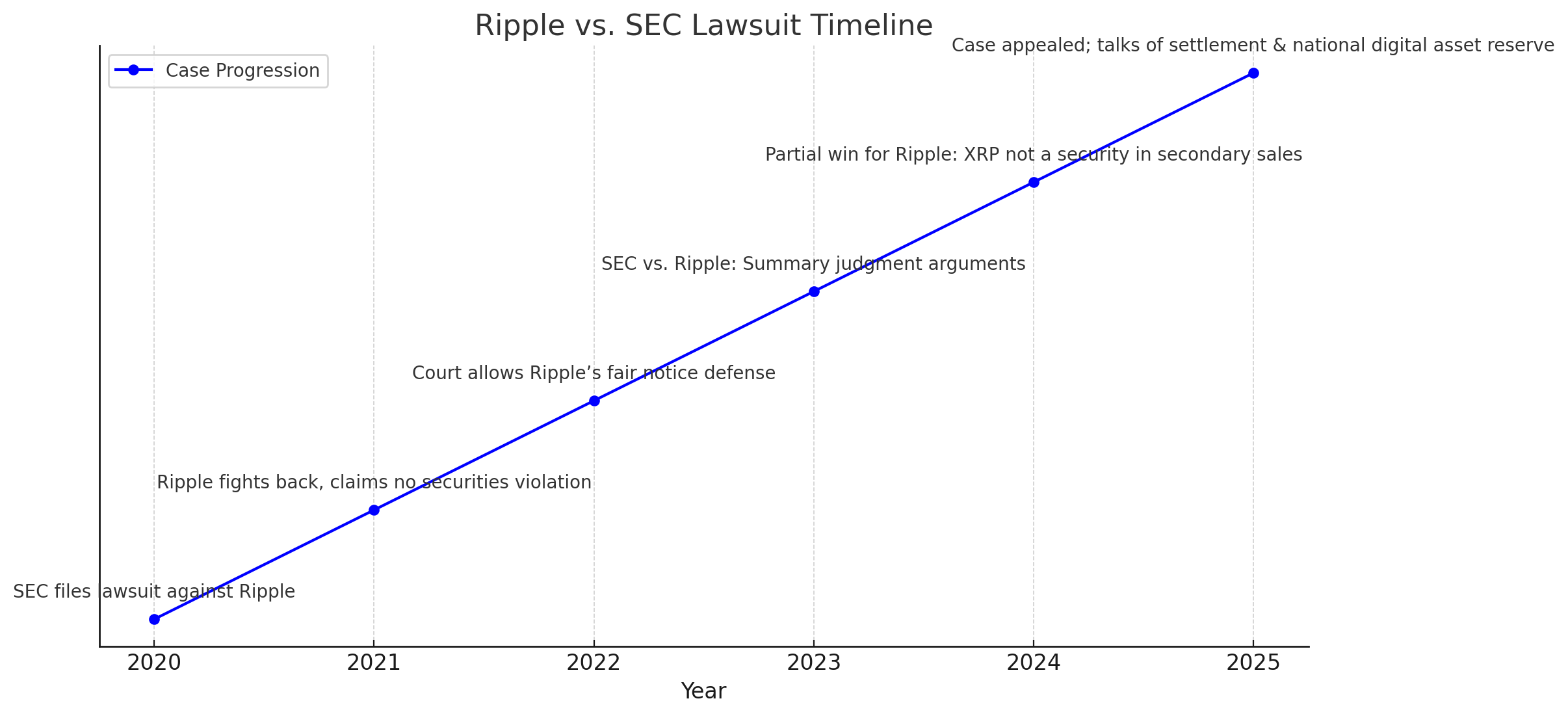

The legal confrontation between Ripple Labs and the SEC, initiated in December 2020, centers on allegations that Ripple conducted unregistered securities offerings through its XRP token. Recently, the SEC’s removal of the Ripple lawsuit from its official website has ignited speculation about the case’s status. Legal experts clarify that the case remains active in the Court of Appeals, with Ripple requesting an extension to file its response brief by April 16, 2025. This move indicates that, despite online appearances, the legal proceedings are far from over.

Brad Garlinghouse Advocates for a Diversified Digital Asset Reserve

Amid the legal turmoil, Ripple’s CEO, Brad Garlinghouse, has discussed establishing a U.S. strategic digital asset reserve with President Donald Trump. Garlinghouse emphasizes the importance of a multichain approach, stating,

“If a government digital asset reserve is created, I believe it should be representative of the industry, not just one token (whether it be BTC, XRP, or anything else).”

He further highlights his personal investments in various cryptocurrencies, including XRP, Bitcoin (BTC), and Ethereum (ETH), underscoring the need for inclusivity in the nation’s digital asset strategy.

Trump’s Executive Order: A New Era for Cryptocurrency?

In a significant policy shift, President Trump signed an executive order to position the United States as the “crypto capital of the planet.” This directive includes the formation of a working group on digital asset markets to explore the creation of a national digital asset stockpile and to develop a comprehensive regulatory framework for cryptocurrencies.

The order also seeks to protect banking services for crypto businesses and explicitly prohibits the creation of a central bank digital currency in the U.S. Industry leaders view this move as a potential catalyst for innovation, reducing regulatory uncertainties that have previously hindered the sector.

Market Reactions: XRP’s Volatility Amid Speculation

The market has responded dynamically to these developments. XRP, the cryptocurrency associated with Ripple, experienced a surge to an all-time high of $3.02 on January 15, 2025, driven by investor optimism surrounding the potential resolution of the SEC lawsuit and the prospect of favorable regulatory changes under the Trump administration. However, prices have since stabilized, reflecting the market’s cautious anticipation of concrete outcomes from ongoing legal and policy shifts.

Looking Ahead: The Future of Ripple and Cryptocurrency Regulation

The broader cryptocurrency industry watches closely as Ripple navigates its legal challenges and engages in high-level policy discussions. The outcome of the SEC lawsuit and the implementation of President Trump’s executive order could have far-reaching implications for digital asset regulation and adoption in the United States. Garlinghouse’s advocacy for a diversified digital asset reserve aligns with a growing sentiment in the industry that a collaborative, inclusive approach is essential for sustainable growth. As he aptly puts it,

“The crypto industry has a real shot, here and now, to achieve the many goals we have in common if we work together instead of tearing each other down.”

The Final Word

In conclusion, Ripple’s journey through legal hurdles and its proactive engagement with policymakers underscore the evolving landscape of cryptocurrency in the U.S. The interplay between regulatory actions and industry initiatives will be pivotal in shaping the future of digital assets, with Ripple positioned as a key player in this transformative era.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Is the Ripple vs. SEC lawsuit over?

No, the case is still active but has been moved to the Court of Appeals. The SEC removed it from their website, sparking speculation, but Ripple is still fighting the legal battle.

2. Did Trump discuss making XRP a national digital reserve?

Yes, Ripple CEO Brad Garlinghouse confirmed discussions with Trump about XRP as a potential U.S. reserve asset, though no official decision has been made.

3. Why hasn’t Acting SEC Chair Mark Uyeda dropped the lawsuit?

Uyeda is only an interim chair, and a full-time SEC Chair typically handles major decisions like dropping a high-profile case. The new chair is expected to be approved by April.

4. How has XRP’s price reacted to these developments?

XRP surged to $3.02 in January 2025 but has since stabilized. The lawsuit outcome and Trump’s pro-crypto policies could drive future price movements.