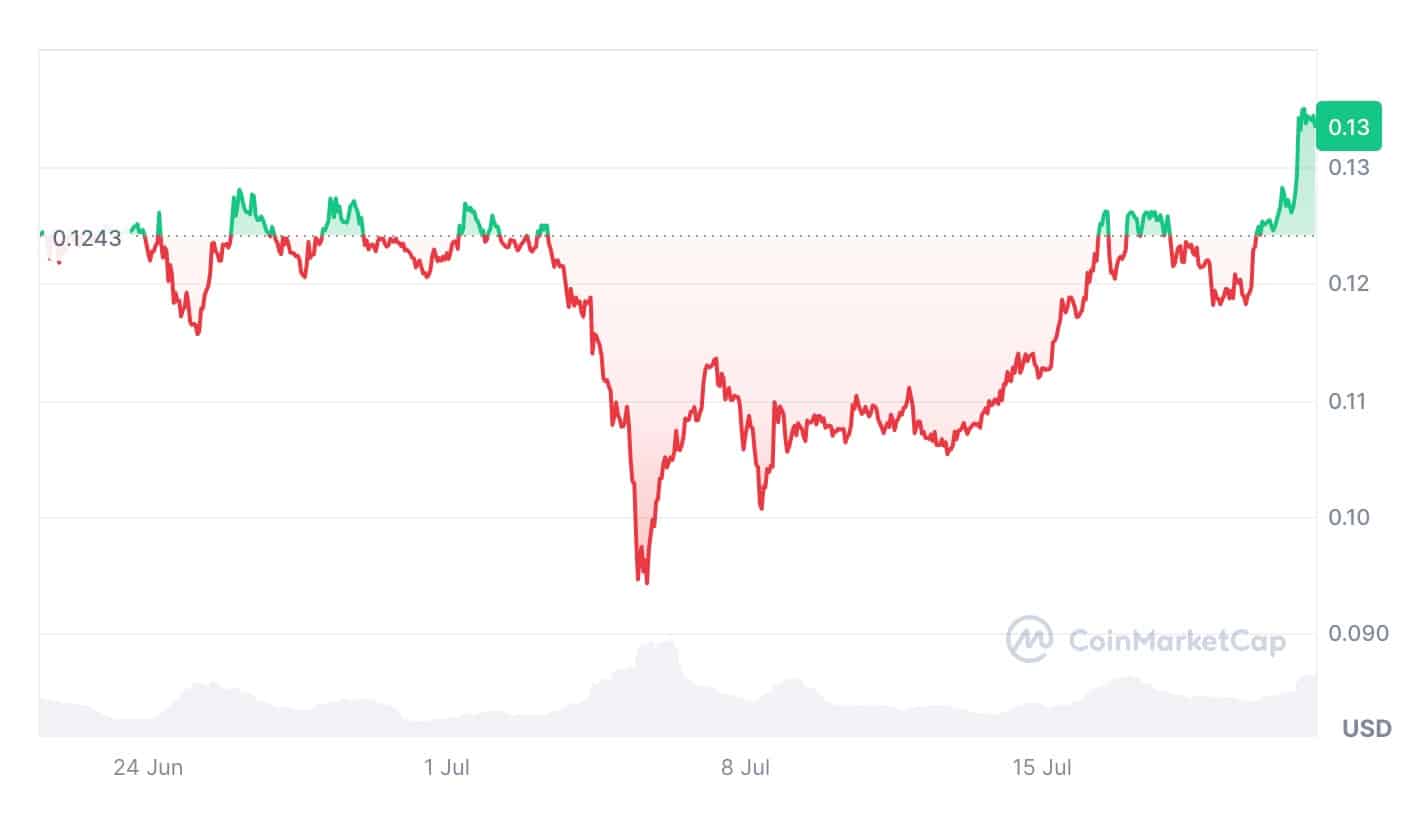

Dogecoin (DOGE) has gained renewed momentum among traders, pushing the coin to its highest monthly level on July 20. This surge has spiked Doge open interest by 19%, an indicator of increased participation and speculation on the cryptocurrency’s future.

According to reports, Dogecoin is currently trading at $0.1336, seeing an 18.82% increase over the past seven days. The sudden price spike has sparked widespread discussion among traders and analysts, who are divided over whether this bullish trend is sustainable.

“DOGE is breaking out and looks primed for an aggressive up move,” stated Shelby, a pseudonymous crypto trader, in a post on social media platform X on July 20. Shelby noted that Dogecoin’s “breakout” has historically served as a catalyst for other altcoins, including Floki (FLOKI) and Shiba Inu (SHIB), which have also seen significant gains, increasing by 37% and 3.89%, respectively.

Crypto trading experts such as Cheds and CryptoBoss have also weighed in, identifying a “nice base break” on Dogecoin’s price and affirming that it is “breaking out.” Meanwhile, other voices in the trading community urge caution. Pseudonymous trader Magnate advised followers to “not FOMO here,” predicting a pullback that could offer a lower entry price. He noted that a 10.6% decline to $0.1194, a price level seen just a week prior, would result in approximately $47.23 million in long positions being liquidated.

From a market perspective, Dogecoin has reached its highest Doge open interest for July, escalating by 19% to $647.19 million in just four days, as per CoinGlass data. Doge open interest, the total value of all outstanding futures contracts, serves as a measure of confidence and participation in the cryptocurrency’s market.

Doge Open Interest Spiking Amid Rising Market Sentiment

One of the key indicators of Dogecoin’s recent price movement has been the overall market sentiment. The Crypto Fear & Greed Index, which assesses the sentiment toward Bitcoin and other cryptocurrencies, has risen notably. Currently, the index stands at a “Greed” score of 74, a dramatic increase from last week’s “extreme fear” score of 33.

This shift in sentiment highlights a broader positive outlook among investors and traders, which is contributing to the spike in Doge open interest. The anticipation surrounding Dogecoin has been further fueled by comparisons to its 2020 performance, which saw an astronomical 15,800% rally following a breakout pattern.

Historical Patterns and Future Speculations

Recent speculation around Dogecoin’s price trajectory suggests that it could potentially mimic its historic patterns. In May 2021, Dogecoin reached an all-time high of $0.73, one year after the previous Bitcoin halving event. If this pattern were to repeat, technical analysts speculate that Dogecoin could achieve a new all-time high by April 2025, a year post the next Bitcoin halving.

However, applying traditional technical analysis to memecoins like Dogecoin can be challenging due to their speculative nature. Observers and seasoned traders alike emphasize that while past performance can offer insights, it is not an absolute predictor of future outcomes.

Despite the impressive gains and increased Doge open interest, traders should remain vigilant and attuned to market movements. The volatile nature of cryptocurrencies, particularly memecoins like Dogecoin, necessitates a measured approach to avoid potential losses from sudden pullbacks.

The Bigger Picture: Market Indicators and Doge’s Popularity

Beyond the immediate market movements and price predictions, Dogecoin’s popularity continues to significantly influence its market behavior. The cryptocurrency’s vibrant community and support from high-profile figures, including Elon Musk, contribute to its enduring appeal.

On July 21, another spike in Doge open interest suggested that traders are betting on sustained momentum. However, as always, the highly speculative nature of cryptocurrency trading means that both profits and losses can be equally dramatic.

In conclusion, while DOGE’s recent breakout has generated significant interest and optimism within the trading community, the underlying volatility of the market suggests that caution is advisable. With Doge open interest at a monthly high, the coming weeks will be critical in determining whether this breakout marks the beginning of a longer-term uptrend or merely a temporary surge fueled by market sentiment. Stay updated on the latest developments with The BIT Journal.