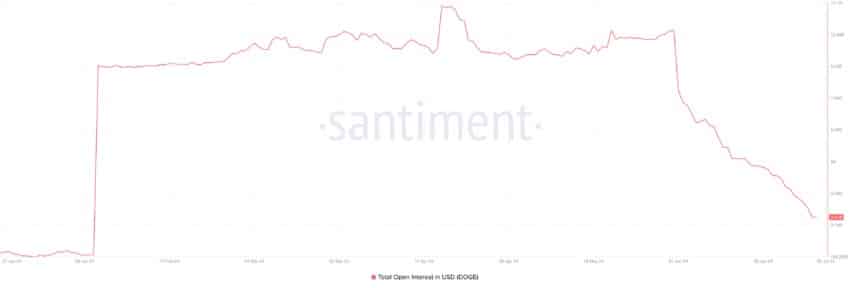

Dogecoin (DOGE) has been facing a steady decline in its price over the past few weeks, significantly impacting its derivatives market. As of the latest data, the Dogecoin (DOGE) Open Interest has plummeted to its lowest level since the beginning of the year, currently standing at $2.51 billion. This starkly contrasts the over $10 billion seen just a month ago.

Dogecoin Derivatives Market Feels the Pinch of Dogecoin (DOGE) Open Interest

Open interest serves as a critical metric in the derivatives market, measuring the total number of outstanding options or futures contracts that have not yet been settled or closed. An increase in open interest typically signals growing market activity or interest, as more contracts are being created. Conversely, a decline in open interest indicates that existing contracts are being closed out without new ones being initiated, reflecting a waning interest in the market.

Dogecoinopen interest began its decline on June 8, dropping by a staggering 80% since then. This significant decrease aligns closely with the coin’s steady depreciation in value, which has fallen by 30% in the past month alone. Presently, Dogecoin, ranked ninth by market capitalization, is trading at $0.10.

The Ripple Effect of Price Decline on Derivatives Trading

The prolonged downturn in DOGE’s value has compelled many futures traders to take short positions. According to reports, on July 6, the coin’s funding rate registered a negative figure of -0.026%. Funding rates are instrumental in perpetual futures contracts, designed to ensure that the contract price closely mirrors the spot price. A negative funding rate indicates a prevalence of short positions, implying that more traders anticipate further declines in DOGE’s price.

DOGE Price Prediction: A Glimmer of Hope?

Despite the overall decline in DOGE’s market value, its Chaikin Money Flow (CMF) has managed to maintain an upward trend. Currently standing above the zero line at 0.03, the CMF continues its ascent. This metric gauges the flow of capital into and out of an asset. A scenario where the asset’s price falls while its CMF rises suggests a bullish divergence, indicating robust buying activity despite the price slump. This divergence suggests buyers increasingly accumulate DOGE at lower price points, potentially alleviating selling pressures.

If this uptick in buying momentum persists, DOGE’s price could potentially rebound to $0.11. Conversely, if the divergence proves to be misleading and selling pressures persist, DOGE may see its price plummet to $0.08.

Navigating Uncertain Waters Amid Dogecoin (DOGE) Open Interest

The current landscape for Dogecoin presents a mosaic of mixed signals. While the sharp declines in price and open interest highlight a dwindling market interest, the positive trajectory of DOGE’s Chaikin Money Flow (CMF) provides a ray of hope for potential recovery. Analysts cautiously point out that sustained buying activity has the potential to stabilize DOGE’s price and possibly spur an upward movement.

Conversely, the prevalence of a negative funding rate and the prevalence of short positions paint a cautious sentiment among market participants. This cautiousness stems from the anticipation of further declines in DOGE’s price, which could exert additional downward pressure in the weeks ahead. Should these bearish sentiments persist, DOGE might encounter challenges in regaining its foothold in the competitive cryptocurrency landscape.

Navigating these uncertain waters requires vigilance and strategic foresight from investors and traders alike. As the market dynamics continue to evolve, stakeholders will closely monitor indicators such as open interest, funding rates, and CMF trends to gauge DOGE’s resilience and potential for recovery.

The Future of Dogecoin (DOGE) Open Interest

Dogecoin’s future journey is intricate and unpredictable, influenced by a delicate balance of market forces and investor sentiment. While the current downturn in price and open interest poses challenges, the underlying resilience reflected in its CMF trend signals a potential turnaround opportunity. Whether DOGE can sustain a price above $0.10 and navigate through the prevailing market uncertainties hinges on how effectively it can harness buying momentum and mitigate bearish pressures.

Stakeholders must adapt to seize opportunities and mitigate risks in the evolving cryptocurrency landscape. Dogecoin’s future hinges on navigating these challenges to establish a sustainable position amid market fluctuations.