The price of Dogecoin has been struggling to maintain upward momentum recently, facing multiple barriers that continue to prevent gains. Despite attempts to recover from recent declines, Dogecoin price remains trapped below critical resistance levels. Dogecoin price has been in consolidation mode, with both bulls and bears vying for control.

The recent failure of the price to break above the $0.1820 zone against the US Dollar has left the token trading below the critical $0.1780 level, suggesting the presence of a strong bearish market structure. However, there is still potential for Dogecoin price recovery if certain resistance levels are broken.

DOGE Price Struggles Amid Bearish Market Structure

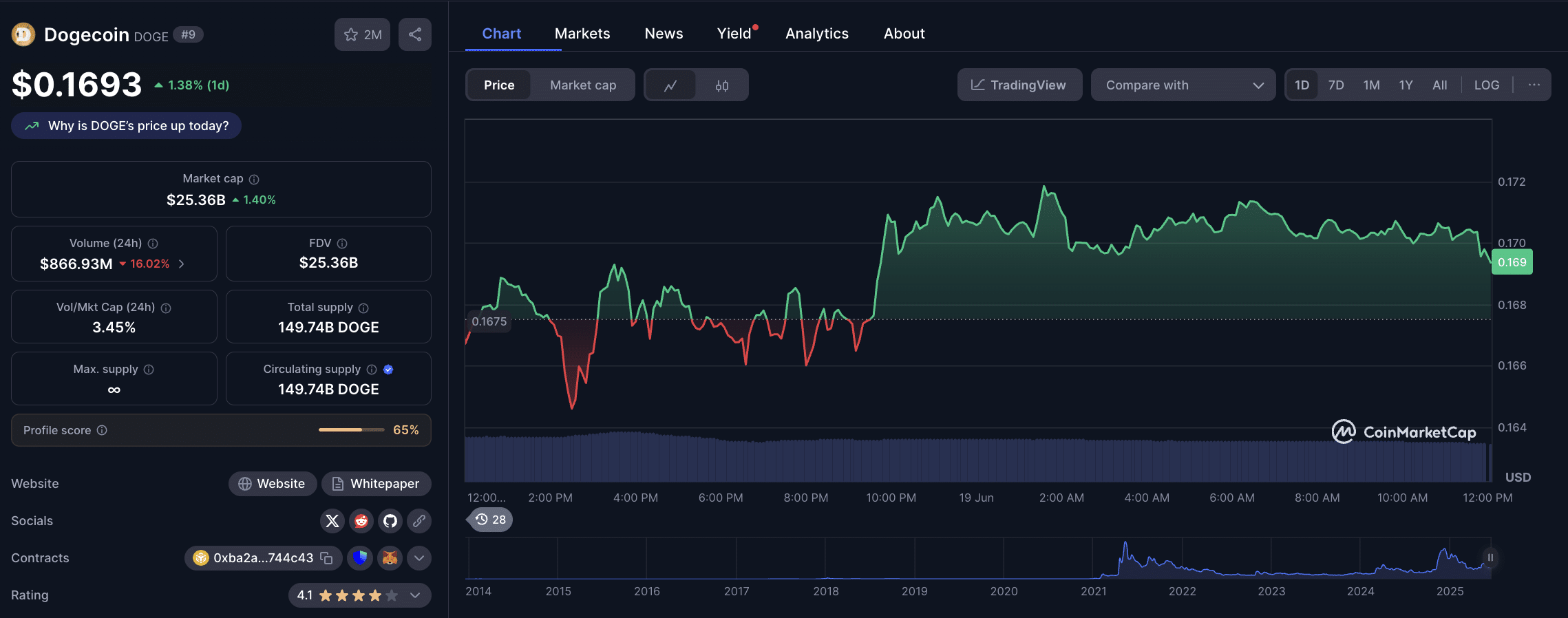

Dogecoin price started to experience a fresh decline after failing to clear the $0.1820 level, and it is now struggling to break the $0.1780 resistance. The price of Dogecoin has been trading below key technical indicators, such as the 100-hourly simple moving average, indicating continued selling pressure. The downward movement has pushed Dogecoin price to the $0.169 low, but the cryptocurrency is currently attempting to recover.

The technical structure of Dogecoin price reveals a series of lower highs and lower lows, signifying that the bears are in control for now. For the bulls to regain dominance and push Doge price higher, they must clear significant resistance levels, especially near $0.1750 and $0.1800. These resistance levels have been acting as strong barriers, limiting any upward momentum for Dogecoin price.

Resistance and Support Levels for Dogecoin Price

The key resistance level for Dogecoin price is located at $0.1750. This level corresponds to the 50% Fibonacci retracement level of the recent downward move. If Doge price manages to break above this level, it could pave the way for a move toward $0.1820, followed by the $0.1880 level. This would mark a critical point for the bulls to regain control and push the price toward the $0.200 zone.

On the downside, there is significant support at $0.1640. If Dogecoin price fails to hold above this support, it could lead to further declines, with the next support zone at $0.1620. A failure to hold these levels would likely trigger a deeper retracement, potentially sending Dogecoin price down toward $0.150 in the short term.

Market Sentiment and Dogecoin Price Recovery

Despite the bearish market structure, there is still hope for a recovery in Doge price, particularly if the market sentiment turns positive. A potential shift in sentiment could be triggered by a break above the $0.1750 resistance, opening the door for a potential rally toward $0.1880 and $0.200. Given Dogecoin’s historical volatility and strong community support, a resurgence in buying interest could propel the price higher, but this will depend on broader market conditions.

In addition to technical factors, external events such as market sentiment surrounding Bitcoin (BTC) and other major cryptocurrencies can also impact Dogecoin price. If Bitcoin price sees upward momentum, it could benefit altcoins like Dogecoin, as investors rotate into the altcoin market, looking for higher returns.

As of now, the overall market sentiment remains cautious, but any signs of bullish behavior could spark renewed interest in Dogecoin.

What’s Next for Dogecoin?

Looking ahead, Dogecoin price is at a critical juncture. If the price fails to break above the $0.1750 and $0.1800 resistance levels, it could continue to struggle within its current range. The next downside target for DOGE price is at $0.1640, with potential for further declines if the market sentiment remains bearish. On the other hand, a breakout above the $0.1750 resistance could pave the way for a rally, potentially bringing the price back toward the $0.200 mark.

Given Dogecoin’s status and the influence of social sentiment, market-moving announcements, influencer activity, or any major technical updates related to the Dogecoin network could spark sudden price movements, creating new opportunities for traders.

Conclusion: Dogecoin Price Outlook

In conclusion, Dogecoin price continues to face strong resistance at key levels, particularly around $0.1750 and $0.1800. The recent downward movement and failure to break these resistance zones have left the market in a cautious state. However, there is still potential for a bullish reversal if these resistance levels are overcome. Traders are advised to remain vigilant and watch for signs of a breakout, as the potential for an upward move toward $0.200 is still intact.

For now, Dogecoin price is in a consolidation phase, but any breakthrough above resistance levels could signal a fresh leg higher. As always, broader market sentiment, especially Bitcoin’s performance, will play a crucial role in determining Doge price’s next move.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What are the Main Resistance Levels for Dogecoin?

The main resistance levels for Dogecoin price are at $0.1750 and $0.1800. If these levels are broken, Dogecoin price could rise to $0.1880 and beyond.

What is the Current Support for Dogecoin?

The current support for Dogecoin price is at $0.1693. A failure to hold this level could lead to further declines.

Can Dogecoin Recover Despite Its Recent Decline?

Yes, Dogecoin could recover if it manages to break above key resistance levels. A shift in market sentiment could trigger a price rally.

What could happen if Dogecoin price breaks below its current price?

If Dogecoin price breaks below the current price, it could fall to the next support at $0.1620 and potentially lower to $0.150.

Glossary

Resistance Levels: Price points where selling pressure outweighs buying pressure, preventing the price from rising further.

Support Levels: Price points where buying pressure outweighs selling pressure, preventing the price from falling further.

Fibonacci Retracement: A tool used to identify potential support and resistance levels based on the Fibonacci sequence.

Market Sentiment: The overall attitude of traders and investors toward a particular asset or market, which influences price movements.

Bullish Reversal: A situation where a downtrend is reversed, leading to an upward price movement.