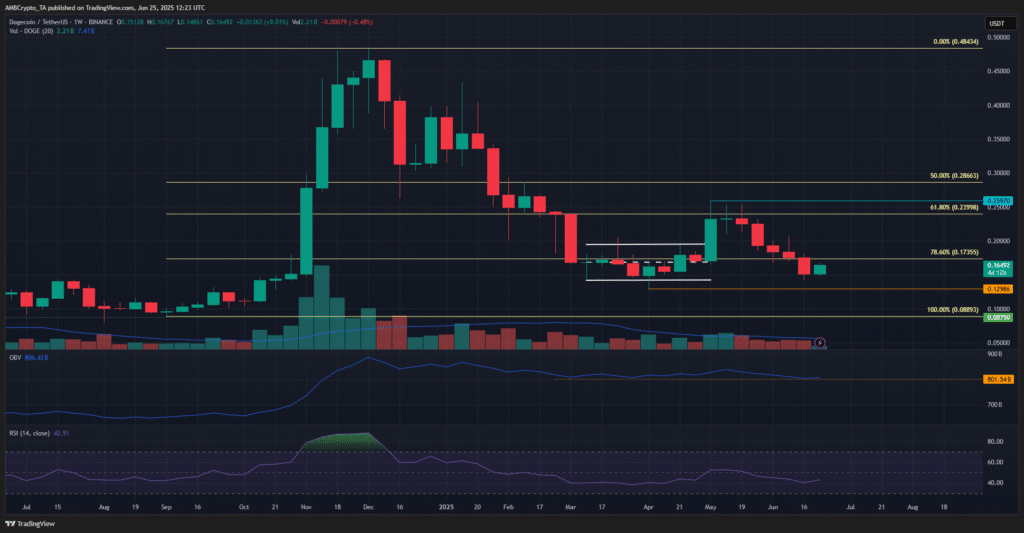

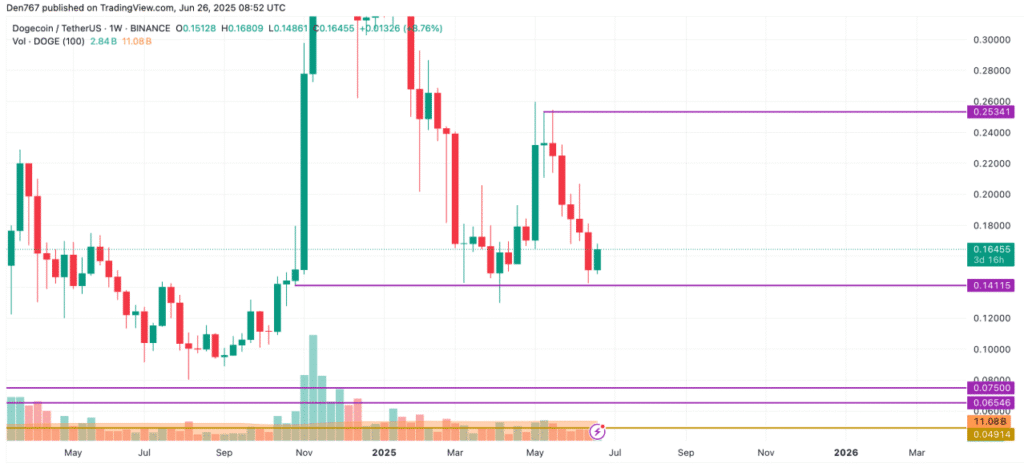

The Dogecoin price recently retested the critical support level of $0.142, which has been pivotal since April. This support was established as a range low during that time, and it continues to be a key level in the current price structure. Despite a bullish rally in May, Dogecoin price prediction 2025 seems to be caught in a consolidation phase, with its price oscillating within a specific range.

Dogecoin Stuck in Range Despite Bearish Signals

Dogecoin price has shown mixed signals in recent weeks. The coin’s price action appears stuck in a range, despite some bullish momentum earlier in May. At the same time, Dogecoin price has failed to fall below the $0.089 swing low, suggesting that there is still some underlying support.

However, the coin’s internal market structure remains bearish, as indicated by technical indicators like the On-Balance Volume (OBV) and the Relative Strength Index (RSI).

The OBV, which tracks the flow of volume, recently retested a low from March. Meanwhile, the RSI suggests that bearish momentum is still prevalent in the market. These indicators imply that Dogecoin could continue to trade sideways or face further downside risks. Despite these bearish signals, the overall sentiment is not entirely negative.

Dogecoin Price Prediction 2025: Resistance Levels to Watch

For Dogecoin to shift its current market structure, it must surpass the $0.259 resistance. This price level has been a key barrier for the coin, capping its upward movement. Fibonacci retracement levels suggest that $0.259 is a crucial resistance point. Breaking above this level could signal a shift toward more bullish conditions.

However, moving averages also present dynamic resistances. Despite these resistances, the potential for an upward move remains. Recent price action has shown that if Dogecoin price prediction 2025 manages to break above $0.259, it could target the $0.2 supply zone.

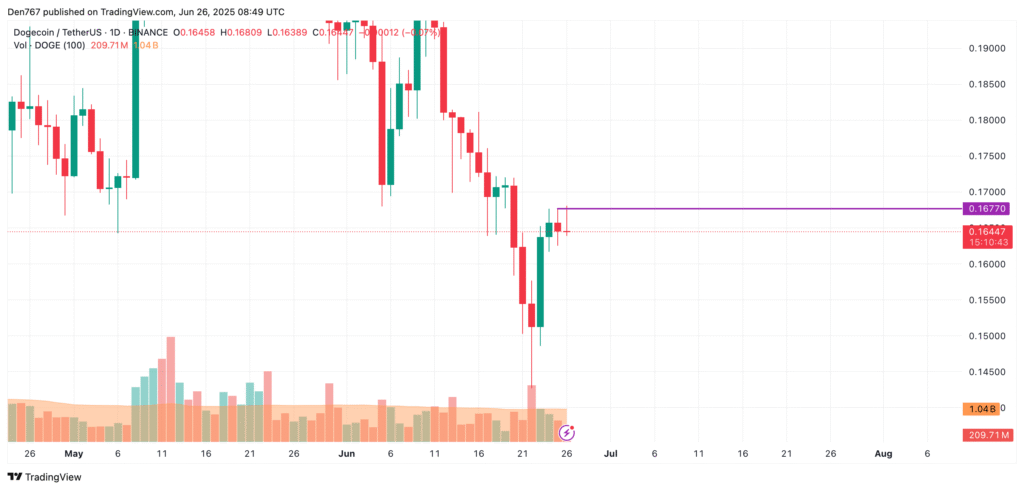

Traders should monitor these levels closely, as they will play a critical role in the coin’s near-term direction. As of press time, DOGE is trading at $0.1627, down by 1.84% over the past day.

Analyzing the Dogecoin Chart: Key Price Zones

The current Dogecoin chart presents a picture of consolidation. The mid-range level, which was formed during March and April, continues to play an essential role in both support and resistance. This level was initially thought to be the top of the range. However, following the May breakout, it has become a critical point for determining whether Dogecoin can continue its upward trajectory.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $0.160 | $0.163 | $0.165 | 34.6% |

| July | $0.195 | $0.204 | $0.212 | 72.9% |

| August | $0.196 | $0.201 | $0.205 | 67.2% |

| September | $0.201 | $0.206 | $0.210 | 71.3% |

| October | $0.192 | $0.199 | $0.205 | 67.2% |

| November | $0.195 | $0.200 | $0.205 | 67.2% |

| December | $0.184 | $0.194 | $0.204 | 66.4% |

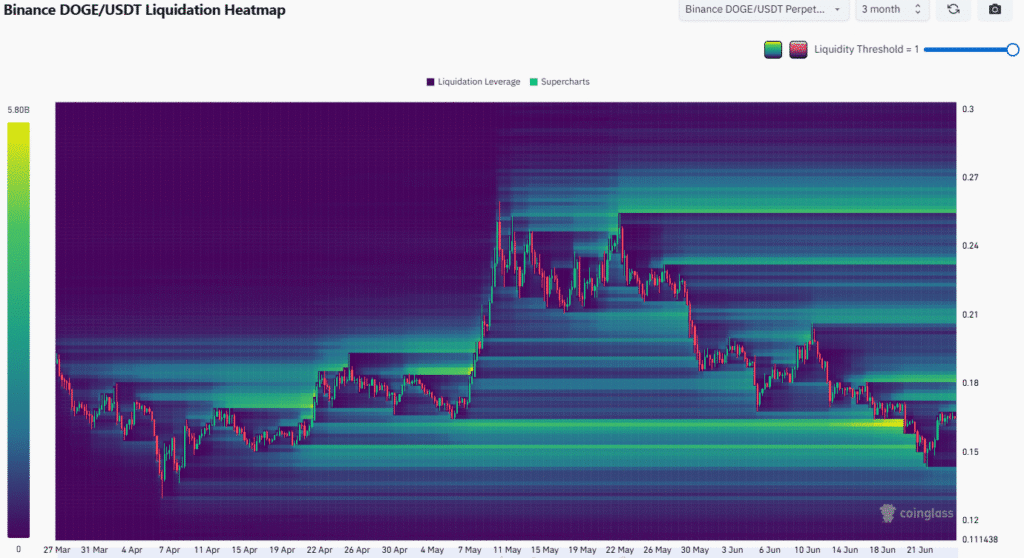

According to the analytical platform Coinglass, liquidity analysis reveals important zones for price action. The liquidity pocket between $0.145-$0.162 has already been swept, but smaller liquidity pockets are forming at higher levels. These include the $0.173 and $0.182 zones, which could act as immediate resistance levels for any further price moves. The next major target for the coin could be $0.21, which aligns with the mid-range resistance.

Short-Term Outlook for Dogecoin Price Prediction 2025

In the short term, Dogecoin’s price is approaching key support levels. If the price holds at $0.142, it could bounce back and attempt to break through resistance at $0.173 or $0.182. However, a failure to hold above $0.142 could lead to a decline toward the $0.16 range.

The 3-month liquidation heatmap shows significant liquidity sweeps at the $0.145-$0.162 range, indicating that these levels may continue to act as support. Traders should watch these levels carefully to identify potential buy signals. On the hourly chart, the price of Dogecoin is approaching local support at $0.1635. If it breaks below this support, the price could fall to the $0.16 range, continuing its short-term downward trend.

Mid-Term Outlook: Consolidation Likely

Looking at the bigger picture, Dogecoin price prediction 2025 has bounced back from the $0.1411 support level, showing some signs of recovery. However, the coin has yet to accumulate enough momentum for a sharp price increase. The most likely scenario for the coming weeks is sideways trading within the range of $0.16-$0.18.

Despite these bearish undertones, Dogecoin price prediction 2025 remains relatively stable within this range, indicating that the market is waiting for a clear catalyst to trigger a breakout. Traders and investors should remain cautious, as the price is likely to continue fluctuating between support and resistance levels.

Conclusion

Dogecoin price prediction 2025 continues to face significant resistance at key levels such as $0.259. Despite some bearish signals from indicators like the OBV and RSI, there remains potential for a price rally if the coin can break through these barriers.

With consolidation expected in the short to mid-term, traders should focus on key price levels such as $0.142 for support and $0.173 and $0.182 for resistance. The next few weeks will be crucial in determining whether Dogecoin can regain bullish momentum or continue trading sideways.

Summary

Dogecoin has recently tested key support at $0.142, with its price fluctuating within a range despite a bullish May rally. The coin’s market structure remains bearish, as indicated by the On-Balance Volume (OBV) and Relative Strength Index (RSI), signaling potential further downside.

However, Dogecoin has failed to drop below its $0.089 swing low, showing underlying support. Traders should focus on key resistance and support levels, with a possible sideways trading scenario in the short to mid-term.

Frequently Asked Questions

1- What is the current support level for Dogecoin price prediction 2025?

Dogecoin price is testing the key support level at $0.142, which has been pivotal in recent trading.

2- Can Dogecoin break through the $0.259 resistance?

For a bullish move, Dogecoin must surpass the $0.259 resistance, which has been a significant barrier in its price action.

3- What are the potential price targets for Dogecoin in the short term?

Dogecoin could target the $0.173 and $0.182 levels, with the next major zone being around $0.21.

4- Is Dogecoin likely to trade sideways in the coming weeks?

Given the current consolidation, Dogecoin is likely to trade within the range of $0.16-$0.18 in the short to mid-term.

Appendix: Glossary of Key Terms

Support Level: A price level where a downward trend is expected to pause due to an increase in demand.

Resistance Level: A price level where an upward trend is expected to face selling pressure, preventing further price increase.

On-Balance Volume (OBV): A technical indicator that uses volume flow to predict changes in stock price.

Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements, helping identify overbought or oversold conditions.

Fibonacci Retracement: A tool used by traders to identify potential support and resistance levels based on the Fibonacci sequence.

Liquidity Pocket: Areas in the market where significant orders are concentrated, acting as potential support or resistance levels.

Consolidation Phase: A market phase where price moves sideways, typically indicating indecision or waiting for a new trend to form.

Reference

AMB Crypto – ambcrypto.com