The meme-coin darling faces its sternest technical test since 2024. A looming bear-flag continuation pattern, $225 million in one-day realized losses and sharply lower whale activity have analysts debating whether Dogecoin price prediction calls for a plunge toward $0.10, or a surprise rebound if support at $0.15 holds.

Dogecoin Price Prediction: Bear-Flag Anatomy and Short-Term Risk

Dogecoin slipped to the $0.159–$0.161 band on July 1, carving out a compact flag after a 15 % monthly drop. Classical technicians view the flag-pole’s measured move as pointing to the $0.10 area, matching the pole’s height subtracted from the $0.16 breakout line. Pintu analysts estimate a potential 31 % drawdown unless bulls invalidate the setup with a daily close above $0.165.

Key takeaway: Under current structure, the dominant Dogecoin price prediction remains bearish until the flag’s upper trend-line, now near $0.165, gives way on volume.

DOGE Whale Silence and Realized Losses Deepen Anxiety

Data from AInvest show $225 million in net realized losses on June 30 versus just $5.4 million in profits, while whale transfers above $100 K have dwindled to monthly lows. TheCoinRepublic’s chain-analysis desk reports daily active addresses collapsing from 700 K peaks to roughly 120 K, underscoring liquidity fatigue.

Lower whale flows reduce bid-side cushioning, leaving spot markets vulnerable if risk-off macro headlines accelerate. That dynamic supports a cautious Dogecoin price prediction horizon for the week ahead.

Counter-Narrative: Historical Snap-Backs on Volume

Yet not all indicators flash red. CoinDesk notes every probe below $0.145 in late June drew five-times-average spot volume and sparked rebounds to $0.153, hinting at accumulation by longer-horizon traders. Similar squeezes occurred after a 155 million-DOGE dump to Robinhood on June 25, when price slipped only briefly before stabilising.

If another liquidity event triggers forced selling, contrarian desks suggest a quick short-covering rally could violate the flag on the upside, flipping the Dogecoin price prediction script toward $0.20.

DOGE Technical Levels in Focus

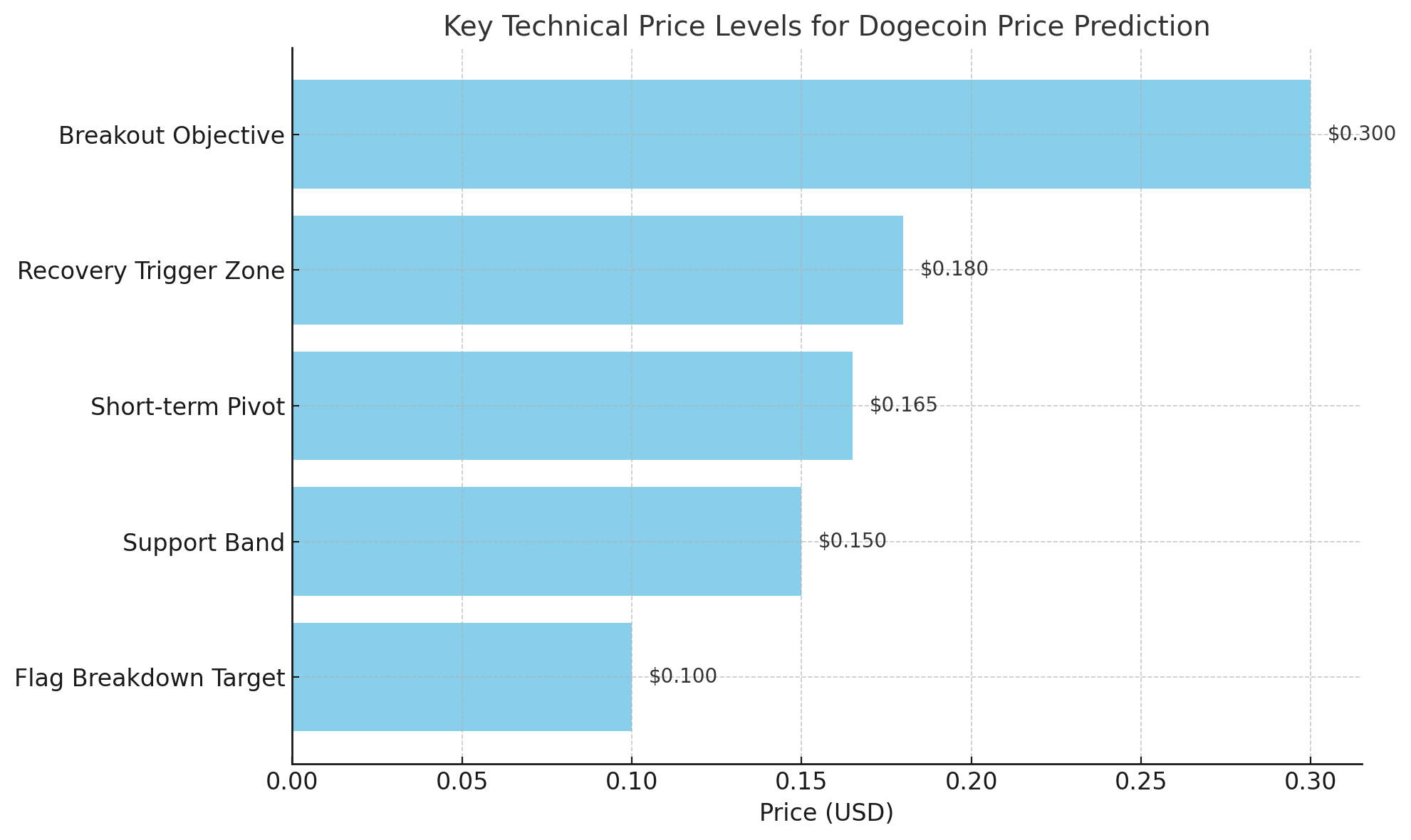

| Zone | Price (USD) | Significance |

|---|---|---|

| Psychological floor | 0.100 | Flag-pole target if the breakdown extends |

| Major support band | 0.150 – 0.157 | Base of the descending triangle |

| Short-term pivot | 0.165 | Flag mid-line; reclaim weakens bear case |

| Recovery trigger | 0.180 – 0.195 | Needs volume to flip trend |

| Bullish objective | 0.30 | Measured wedge breakout |

Fruitful Insights for Readers

Volatility window: Deribit funding at 0.013 % signals traders pay to hold shorts; a flip positive often precedes sharp reversals.

Catalyst calendar: July 4 U.S. holiday thins liquidity, intraday spikes can exaggerate moves.

Risk management: Stops below $0.145 protect against a flag crash, while limit bids near $0.125 capture overshoot bargains if the bearish Dogecoin price prediction plays out.

Taken together, disciplined position sizing and alertness to volume shifts remain essential as sentiment whipsaws around meme-coin headlines.

Conclusion

Momentum, on-chain stress, and a textbook bear-flag layout currently bias the Dogecoin price prediction toward a retest of $0.10. Still, historical snap-backs on volume caution against one-way bets. Until either $0.145 breaks decisively or $0.18 reclaims trend control, traders face a volatile no-man’s-land where sentiment can flip in an instant, a reminder that meme-coin markets reward timing as much as conviction.

Frequently Asked Questions

Q1. Why is the bear flag important to the current Dogecoin price prediction?

The flag’s structure statistically favors continuation in the prior direction—down—implying a likely test of $0.10 if validated.

Q2. What could invalidate the bearish outlook?

A daily close above $0.18 on 2× average volume would break the flag and tilt predictions toward $0.30.

Q3. How significant are whale transfers to price direction?

Large transfers often precede volatility; shrinking whale flows reduce support, reinforcing the bearish Dogecoin price prediction.

Q4. Does realized loss data guarantee further downside?

Not necessarily, but outsized losses signal capitulation phases that can precede either panic selling or contrarian accumulation.

Glossary of Key Terms

Dogecoin price prediction: Forward-looking assessment of DOGE value using technical, on-chain and sentiment data.

Bear flag: Brief consolidation that typically continues the preceding downtrend.

Realized loss: Aggregate loss when coins move at a lower price than acquired.

Whale activity: Transfers by holders controlling ≥100 K DOGE.

Funding rate: Fee paid between longs and shorts to keep perpetual futures near spot.