Dogecoin price is currently experiencing significant bearish pressure. As of Monday, DOGE is trading below its key support level of $0.18, signaling waning bullish momentum. Rising selling activity, combined with dormant wallets moving, suggests further downside potential for the meme coin. On-chain data indicates that holders are engaging in profit-taking, which further exacerbates the downward pressure.

Rising Selling Pressure

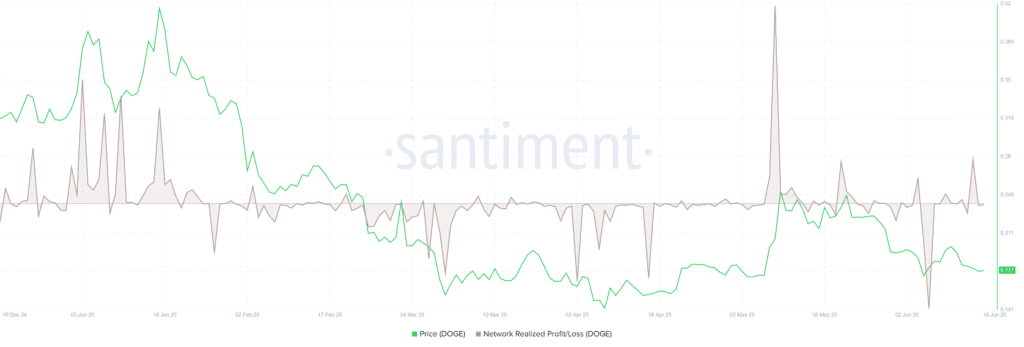

Dogecoin broke below the $0.1720 level, reaching a low of $0.1695. This indicates a shift in market sentiment, with bears taking control. On-chain data further supports this bearish trend. Santiment’s Network Realized Profit/Loss (NPL) metric shows a spike in profit-taking activity, the highest seen in a month.

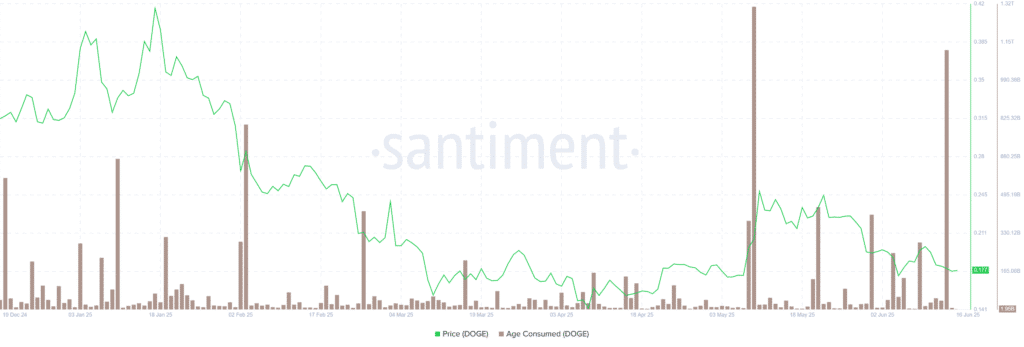

This suggests that many investors are selling their holdings at a profit, increasing selling pressure on DOGE. Additionally, the Age Consumed index, which tracks dormant tokens moving, shows an uptick, indicating that long-held tokens are being moved to exchanges, fueling the downtrend.

Overview of Dogecoin Price Action

At the time of writing, Dogecoin price is trading at $0.1772 and remains below the 100-hour simple moving average. A bearish trend line has formed with resistance at $0.1760, further adding to the pressure.

If DOGE fails to break above this level, the price may continue to decline. The first level of support lies near $0.1720, with the next major support around $0.1700. However, the key support to watch is at $0.1680. If DOGE breaks below this, further declines could follow.

Resistance and Support Levels: Key Price Points to Watch

The immediate resistance for Dogecoin is at $0.1760, followed by a stronger resistance at $0.1785. A significant move above $0.180 could push DOGE toward $0.1880 and the 50-day Exponential Moving Average (EMA) at $0.195.

However, for a more substantial recovery, Dogecoin price needs strong buying pressure to break through these resistance levels. On the downside, $0.1680 remains the key support level. A break below this level could lead Dogecoin price toward further declines, potentially reaching $0.1550 or even $0.1525.

On-Chain Data: Profit-Taking and Dormant Wallet Movement

Santiment’s data reveals a spike in profit-taking among Dogecoin holders. This surge in selling pressure is contributing to the downtrend. Additionally, the Age Consumed index is showing increased movement of dormant tokens.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $0.169 | $0.181 | $0.193 | 57.4% |

| July | $0.207 | $0.217 | $0.226 | 84.3% |

| August | $0.204 | $0.209 | $0.214 | 74.6% |

| September | $0.202 | $0.209 | $0.215 | 75.4% |

| October | $0.197 | $0.205 | $0.213 | 73.7% |

| November | $0.206 | $0.211 | $0.216 | 76.2% |

| December | $0.190 | $0.201 | $0.212 | 72.9% |

This is a key indicator that these long-held tokens are being moved to exchanges, likely to be sold. Historically, such movements have often preceded further price declines, adding to the bearish outlook for Dogecoin price.

Several technical indicators point to continued bearish momentum for Dogecoin. The Relative Strength Index (RSI) stands at 38, indicating that the Dogecoin price is still in a bearish phase. The Moving Average Convergence Divergence (MACD) also shows a bearish crossover, signaling that the downtrend is likely to persist unless there is a strong shift in market sentiment.

Can Dogecoin Price Recover?

Despite the bearish signals, there is still a chance for recovery. If Dogecoin manages to break above the $0.180 resistance, it could rally toward $0.1880 and potentially reach $0.195. However, this would require strong buying momentum and a change in market sentiment. Until such a shift occurs, the bearish trend remains intact, and DOGE faces further risks to the downside.

Conclusion

Dogecoin price remains under significant pressure, with multiple indicators signaling further declines. The increase in profit-taking and the movement of dormant tokens suggest that DOGE could face continued selling pressure.

Key support levels at $0.1720, $0.1700, and $0.1680 are critical to watch. If DOGE breaks below these levels, the price could fall toward $0.1550. However, a recovery above $0.180 would be a positive sign, offering the possibility of a rally toward higher resistance levels.

Frequently Asked Questions (FAQ)

1. What is the current Dogecoin price?

Dogecoin is trading around $0.1767 as of Monday.

2. What resistance levels should DOGE traders watch?

The immediate resistance is at $0.1760, followed by $0.1785 and $0.180.

3. What are the support levels for Dogecoin?

Key support levels are at $0.1720, $0.1700, and $0.1680.

4. Can Dogecoin recover from its current decline?

A break above $0.180 could trigger a recovery toward $0.1880 and $0.195.

Appendix Glossary of Key Terms

Dogecoin (DOGE): A cryptocurrency initially created as a joke, featuring a Shiba Inu dog from the popular meme as its logo.

Support Level: A price point where an asset tends to find buying interest, preventing further price declines.

Resistance Level: A price point where an asset encounters selling pressure, preventing further price increases.

Fibonacci Retracement: A tool used to identify potential support and resistance levels based on key numbers in a sequence.

Exponential Moving Average (EMA): A type of moving average that places more weight on recent price data, making it more responsive to price changes.

Profit-Taking: The act of selling an asset to realize gains after a price increase.

Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements, indicating overbought or oversold conditions.

References

NewsBTC – newsbtc.com

FXStreet – fxstreet.com