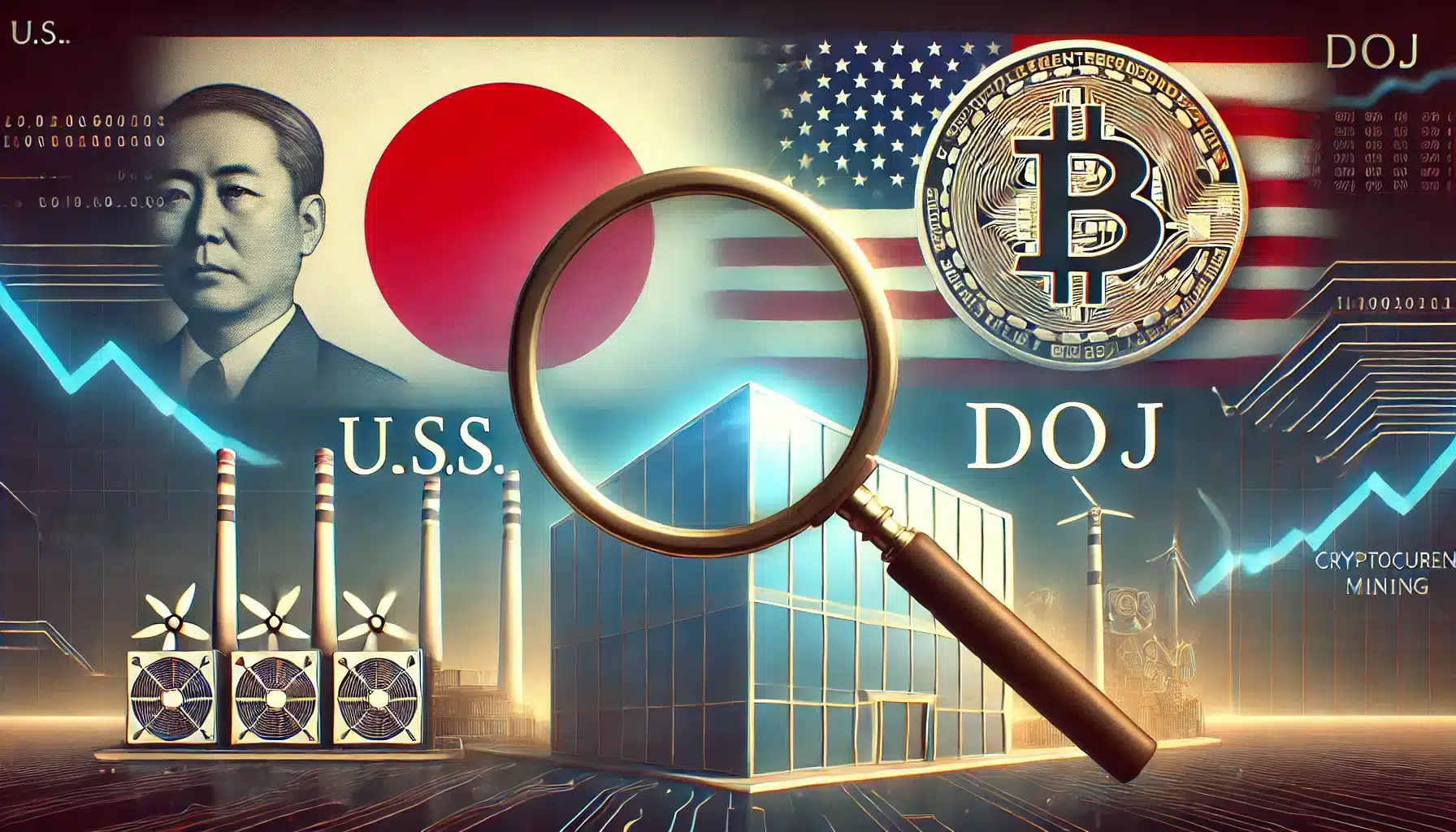

A cryptocurrency mining firm, Bit Mining Ltd., has taken a $14 million hit after admitting to a two-and-half million euro ($2.5 m) bribery scam in which it tried to steal a casino contract in Japan. The enforcement actions come as the Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ) continue another crackdown in the crypto sector on corporate misconduct.

In recent years, Bit mining (previously named 500.com) has switched from operating as a Chinese online sports lottery provider to the blockchain and cryptocurrency mining industry. Focusing on Bitcoin mining and mining pools, as well as data center operations, the firm is now. But its history has been besmirched by allegations it has taken bribes and is corrupt.

The U.S. Department of Justice (DOJ) Investigates $2.5 Million Bribery Scheme by Bit Mining

The company routed out $2.5 million to Japanese officials from 2017 through 2019, cloaking payments as consulting fees, as entertainment, or as various travel expenses. So he could gain a lucrative casino and resort development contract. However, Bit Mining didn’t clinch the deal, getting stuck in legal crosshairs.

Zhengming Pan, the ex-CEO charged for the s out campaigning plan, has charges of conspiracy and falsifying records to conceal bribes through other fake agreements. U.S. Attorney Philip R. Sellinger stated:

“The illegal scheme started at the top, with the company’s CEO allegedly fully involved in directing the illicit payments and the subsequent efforts to conceal them.”

The DOJ says that Bit Mining has agreed to enter into a deferred prosecution agreement (DPA) with a $10 million criminal penalty for the violation of The Foreign Corrupt Practices Act (FCPA). This was also found to violate related securities regulation, for which the SEC assessed a $4 million civil penalty.

Under U.S. Sentencing Guidelines, the firm should have been hit with a $54 million criminal fine. However, since Bit Mining was dangerously financially weak and unable to pay the full amount, the penalty was reduced.

The DPA lays out enhanced compliance requirements for Bit Mining, requires full cooperation with authorities, and sets forth substantial anti-corruption training. The FBI’s Assistant Director Chad Yarbrough emphasized the impact of such cases, stating:

“This type of criminal activity undermines the integrity of business practices.”

Japan Authorities Collaborate in Bit Mining Corruption Investigation

International attention has been drawn toward it as Japan authorities helped investigate the case, which has also helped illustrate global efforts to scrub corporate corruption. The DOJ announced in its announcement that this case ‘clearly sends a strong message to companies, both crypto and tech, that are not exempt from the law.’

The move follows mounting pressure on cryptocurrency firms, as regulators the world over try to bring the sector into line on transparency and accountability. A large market reaction resulted from the announcement of the penalties. According to Google Finance data, Bit Mining’s shares fell by 6.3 percent in after hours trading. The company is of concern for investors because of its uncertain financial health and the regulatory actions that will affect its operations.

Histories of the troubled firm continue to weigh on its performance. Being rebranded as Bit Mining in March 2021 after redirecting its attention to Bitcoin mining in December 2020, the company has failed to retreat on a very competitive and volatile market.

The cryptocurrency industry’s commodity is compliance and ethics, demonstrated by Bit Mining’s bribery scandal. Even in nascent sectors, regulators extol zero toleration for misconduct. Its commitment to reform will be closely watched as the firm will depend on building trust and observing strict anti corruption norms in a regulated space.

Conclusion

The $14 million penalty imposed on Bit Mining emphasizes the significant punishment that corporate misbehavior stands to suffer and that applies even more to the nascent world of cryptocurrencies. The current case is a reminder of the global fight against corruption. Going forward, we will have to focus on compliance and ethical practice to rebuild trust and we need to be sustainable.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!