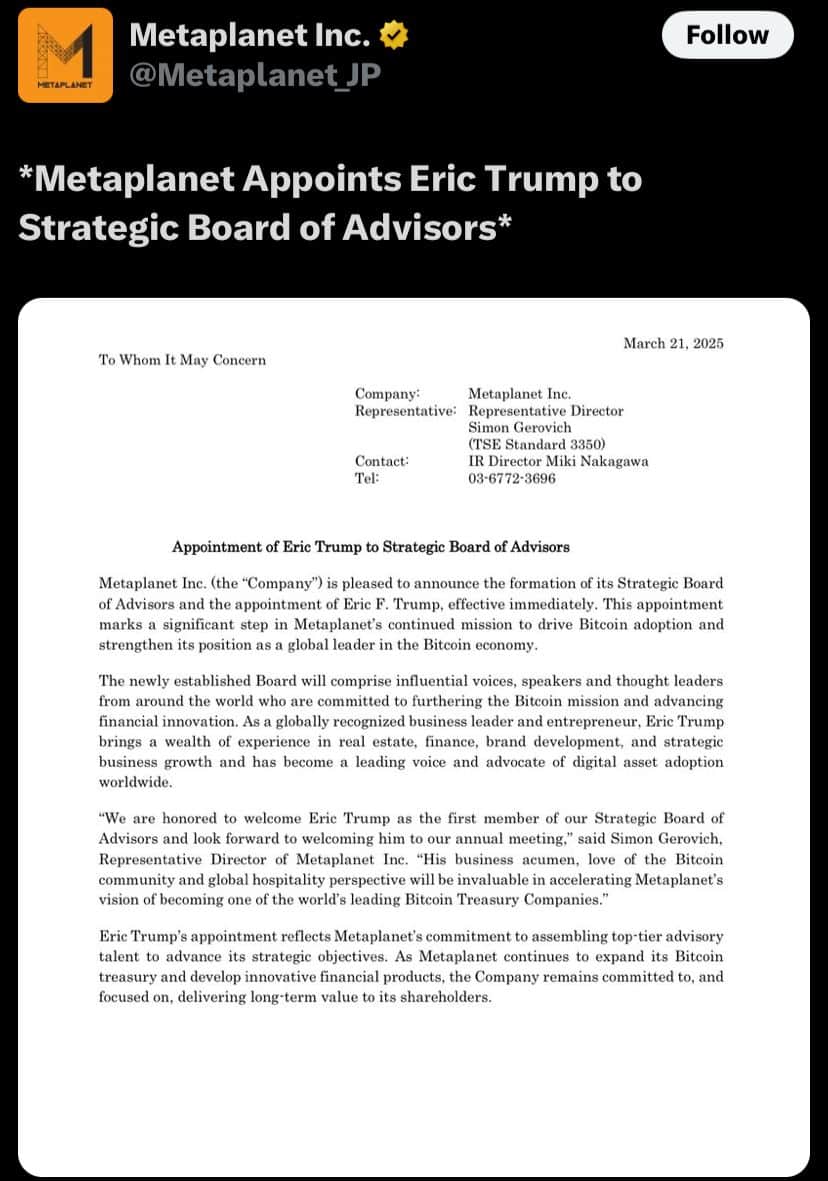

Based on latest reports, Eric Trump has officially joined the Strategic Board of Advisors at Metaplanet, a Tokyo-based investment firm that’s known for its aggressive Bitcoin buying. The addition is a big deal for the company and its Bitcoin treasury movement. With his finance, real estate and brand development background, it is believed that Eric Trump’s addition to the firm would be advantageous to the firm and the Bitcoin economy.

A Big Addition to Metaplanet’s Team

Experts say, Metaplanet is bringing in influential voices into its Bitcoin focused strategy. The company has been buying Bitcoin for its treasury reserves and leadership believes Eric’s business expertise will be instrumental in the next phase of growth.

Simon Gerovich, CEO of Metaplanet, announced the addition on March 21, saying Trump has a deep interest in Bitcoin and financial strategy. In the statement, he said:

“His business acumen, love of the Bitcoin community and global hospitality perspective will be huge in accelerating Metaplanet’s vision of becoming one of the world’s leading Bitcoin Treasury Companies.”

It’s a trend of high-profile people aligning with Bitcoin-focused companies. Eric’s real estate and finance background and his family’s increasing involvement in digital assets match Metaplanet’s goal of making Bitcoin a corporate asset.

Metaplanet’s Bitcoin Strategy: 10,000 BTC by 2025

As of March 2025, reports have it that Metaplanet holds 3,050 BTC worth around $4.1 billion making it one of the biggest corporate Bitcoin holders in the world. The company is targeting to hold at least 10,000 BTC by the end of 2025 which requires a big acceleration in buying.

Metaplanet reportedly bought 1,288 BTC in Q1 2025, more than its 2024 buying pace. Following the announcement, the company’s stock price surged 17.8% on the Tokyo Stock Exchange within the first 80 minutes of trading on March 21, according to Google Finance.

The company’s Bitcoin first approach is similar to the strategy of companies like MicroStrategy which has one of the largest Bitcoin treasuries in the world. Industry experts believe Metaplanet’s growing BTC reserves will be a model for other corporate treasuries to follow Bitcoin as a long term store of value.

Eric Trump’s Growing Influence in Crypto

Besides his new role at Metaplanet, Eric Trump has been active in the digital asset space. He has played a key role in the Trump family’s World Liberty Financial crypto platform, a blockchain-based financial services and digital assets platform.

World Liberty Financial recently completed its second major token sale in March 2025 and raised $550 million in total funding. According to Arkham Intelligence, the platform currently holds $80.8 million in crypto assets, a strong vote of confidence from investors.

Trump has also publicly disclosed his personal cryptocurrency portfolio, claiming it includes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Sui (SUI)

His involvement in Metaplanet and World Liberty Financial means an expanding role in crypto, further stressing the Trump family’s pro-crypto stance.

The Bigger Picture: Bitcoin Institutional Adoption is Rising

Eric Trump’s appointment at Metaplanet and Metaplanet’s focus on BTC accumulation is following a broader trend of institutional adoption as companies worldwide start to integrate Bitcoin into their financial planning.

The company’s move comes when: Institutional investors are buying more Bitcoin, due to fiat currency inflation; The SEC has relaxed its stance on Bitcoin ETFs, bringing in new capital; Regulatory clarity is providing more guidance for corporate Bitcoin adoption, reducing uncertainty.

Metaplanet’s expansion plan could be a template for other publicly traded companies to consider Bitcoin as a treasury asset. With Eric Trump on board, the company will grow its global presence and root its position in the Bitcoin economy.

The BIT Journal is available around the ‘clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is Metaplanet and what does it do?

Metaplanet is a ‘Japan-based investment firm that accumulates Bitcoin as a strategic treasury asset. The company aims to become a global Bitcoin treasury manager.

Why did Metaplanet hire Eric Trump?

Eric Trump brings finance, real estate and brand development expertise. His role will help Metaplanet expand its global Bitcoin strategy.

How much Bitcoin does Metaplanet own?

As of March 2025, ‘Metaplanet holds 3,050 BTC, worth $4.1 billion. The company targets 10,000 BTC by end of 2025.

How did Metaplanet’s stock react to Eric Trump’s appointment?

After the announcement, Metaplanet’s stock surged 17.8% on Tokyo Stock Exchange, a strong vote of confidence.

What is Eric Trump’s involvement in crypto?

Eric Trump is a key player in the Trump family’s World Liberty Financial platform, which raised $550 million. He also owns Bitcoin, Ethereum, Solana and Sui.

Glossary

Bitcoin Treasury – A strategy where companies hold Bitcoin as a corporate reserve asset, like cash or gold.

Institutional Adoption – Large firms, financial institutions and corporations **integrating cryptocurrency into their financial planning.

Blockchain Analysis – The study of blockchain transactions to monitor asset flow and market movements.

Token Sale – A fundraising event where investors buy digital tokens to back a blockchain project.

Stock Jump – A rapid rise in a company’s stock price due to good news or investor sentiment.