The Trump-backed WLFI project has ignited the cryptocurrency market with its focus on ETH, LINK, and AAVE. Amid this buzz, investors are keen to understand the potential future moves for these tokens. Crypto analyst Yashu Gola breaks down the key predictions for these assets.

Ethereum (ETH) Price Prediction: Awaiting Confirmation of the Breakout

Ethereum has successfully broken out of a long-standing symmetrical triangle formation on its weekly chart, signaling potential momentum toward bullish territory. The breakout occurred near the $3,900 level, which aligns with the critical resistance at the 0.786 Fibonacci retracement level. However, ETH has struggled to maintain significant upward momentum.

Key points include:

- The likelihood of retesting the upper trendline, previously a resistance level, for breakout confirmation.

- Major support levels are around $3,500, while the next resistance is at $4,200.

- The 50-week EMA crossing above the 200-week EMA further supports a bullish outlook, though the RSI remains close to neutral, allowing for potential consolidation or upward movement.

- A breakdown below the upper trendline could see ETH revisiting $3,110 (20-week EMA) or $2,890 (50-week EMA) if bearish pressure persists.

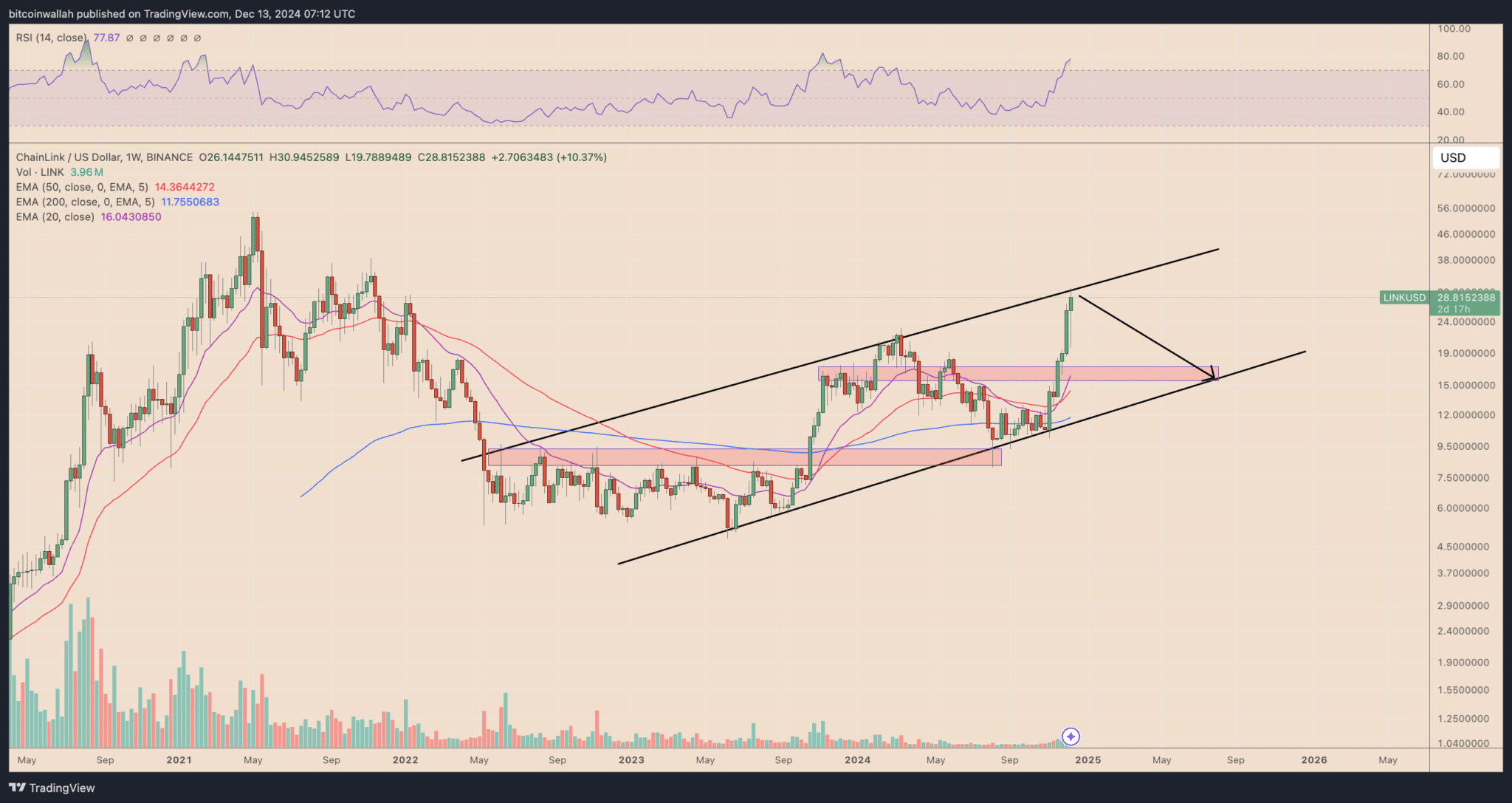

Chainlink (LINK) Price Prediction: A Correction Ahead?

Chainlink (LINK) is showing signs of correction within a long-term rising channel on its weekly chart. Following a robust rally to $29, momentum appears to be waning.

Key observations include:

- The next potential target is the channel’s lower trendline, aligning with the $15-$17 range. This area coincides with major resistance zones from December 2023 and June 2024.

- RSI at 77 indicates overbought conditions, pointing to a possible 40-50% correction by January 2025.

- These levels will be crucial for establishing bullish momentum during a pullback.

AAVE Coin Price Prediction: Overbought Levels Signal Possible Correction

AAVE Coin Price Prediction: Overbought Levels Signal Possible Correction

AAVE is currently trading near $370 on its weekly chart, reaching overbought levels last seen in February 2021. With RSI exceeding 80, the token’s rally appears overextended, raising the likelihood of a retracement.

Key highlights:

- Immediate resistance lies at $457 (0.618 Fibonacci level), while the first support is at $379 (0.5 Fibonacci level).

- A deeper correction could see AAVE revisiting $301 (0.382 Fibonacci level) or testing the $290 level, supported by the 50-week EMA.

Final Thoughts

The cryptocurrency market’s reaction to Trump’s WLFI project underscores the volatility and potential of these assets. While Ethereum, Chainlink, and AAVE show promise, their short-term trajectories could involve significant corrections or consolidations.

Stay tuned to The Bit Journal for more updates on these dynamic markets.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

AAVE Coin Price Prediction: Overbought Levels Signal Possible Correction

AAVE Coin Price Prediction: Overbought Levels Signal Possible Correction