Recent Ether price prediction insights from Finder’s latest survey reveal a bullish outlook for Ethereum (ETH) over the coming years. According to 32 crypto experts surveyed, Ether is expected to reach $5,368 by the end of 2024, $7,359 by 2025, and potentially soar to $23,549 by 2030. These projections underscore growing confidence in Ethereum’s future, reflecting the significant impact of institutional involvement and emerging financial products like Ethereum ETFs.

With the majority of experts advising a “buy” signal at current prices, the survey suggests a promising trajectory for ETH. Key factors driving this optimistic outlook include the anticipated launch of Ethereum ETFs and an expected increase in institutional adoption, both of which could attract a wave of new investors into the cryptocurrency space.

Survey Predicts a Strong Future for Ether Prices Driven by Institutional Factors

In July, Finder conducted a comprehensive survey with 32 crypto experts to gauge Ethereum’s potential value through 2030. While the Ether price predictions varied, a consensus emerged that Ethereum’s value is likely to rise significantly in the upcoming years. Finder’s report highlights that “on average, our panel believes Ether will reach $5,368 by the end of 2024, increase to $7,359 by the end of 2025, and could hit $23,549 by 2030.”

Interestingly, the estimates in this survey are slightly more conservative compared to the ether price predictions made in April, suggesting a tempered yet hopeful outlook among experts. For instance, Origin Protocol co-founder estimates Ethereum could reach $13,500 by year-end, attributing this potential spike to the forthcoming ETH ETF. Similarly, Cake Group CEO Julian Hosp anticipates that the ETF launch could drive ETH’s price to $10,000.

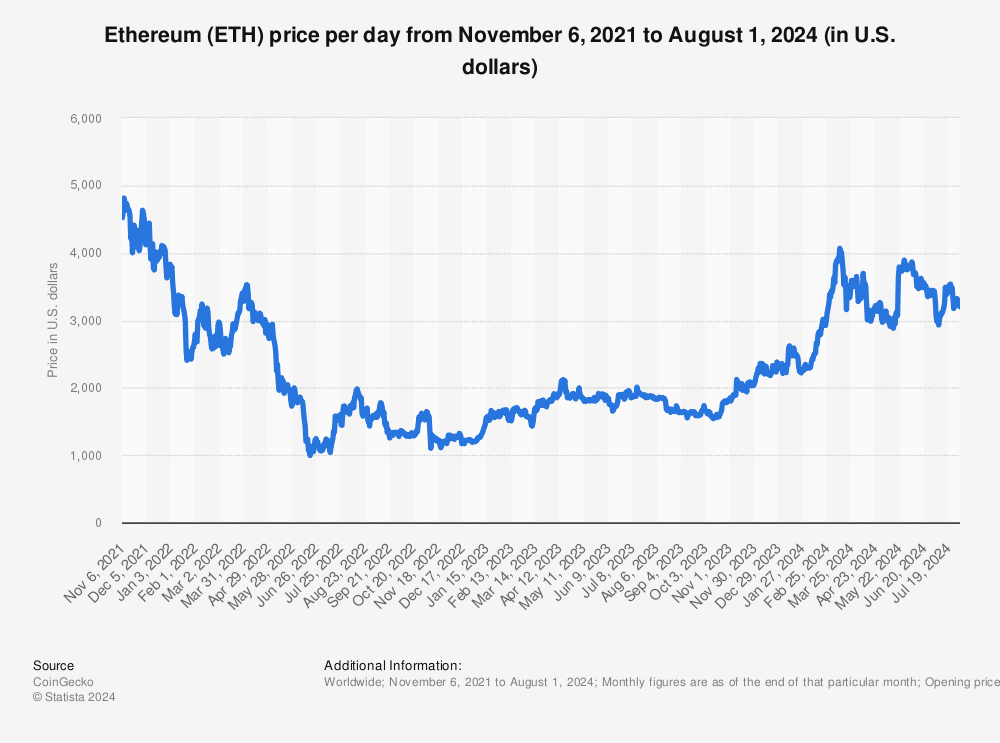

On the other hand, some experts are more conservative. Pedro Febrero from Realfevr is particularly bullish, predicting that ETH could surpass $20,000 soon due to expected heavy institutional investment and growing network popularity. Conversely, University of Canberra professor John Hawkins holds a more skeptical view, forecasting that ETH could fall below $2,700. Hawkins’s cautious stance reflects broader concerns about the speculative nature of cryptocurrencies.

The survey also explored potential ether price prediction ranges for Ethereum in 2024. Finder’s panel projected an average peak price of $6,050, with some estimates reaching as high as $20,000. Conversely, the average lowest price forecast for 2024 is $2,669, with predictions as low as $1,500.

Majority of Experts Recommend Buying Ether at Current Prices

According to Finder, the overwhelming majority of experts, 64%, recommend buying Ethereum now, while 29% suggest holding, and only 7% advise selling. This strong buy recommendation indicates a high level of confidence in Ethereum’s future performance and suggests that current prices present an attractive entry point for investors.

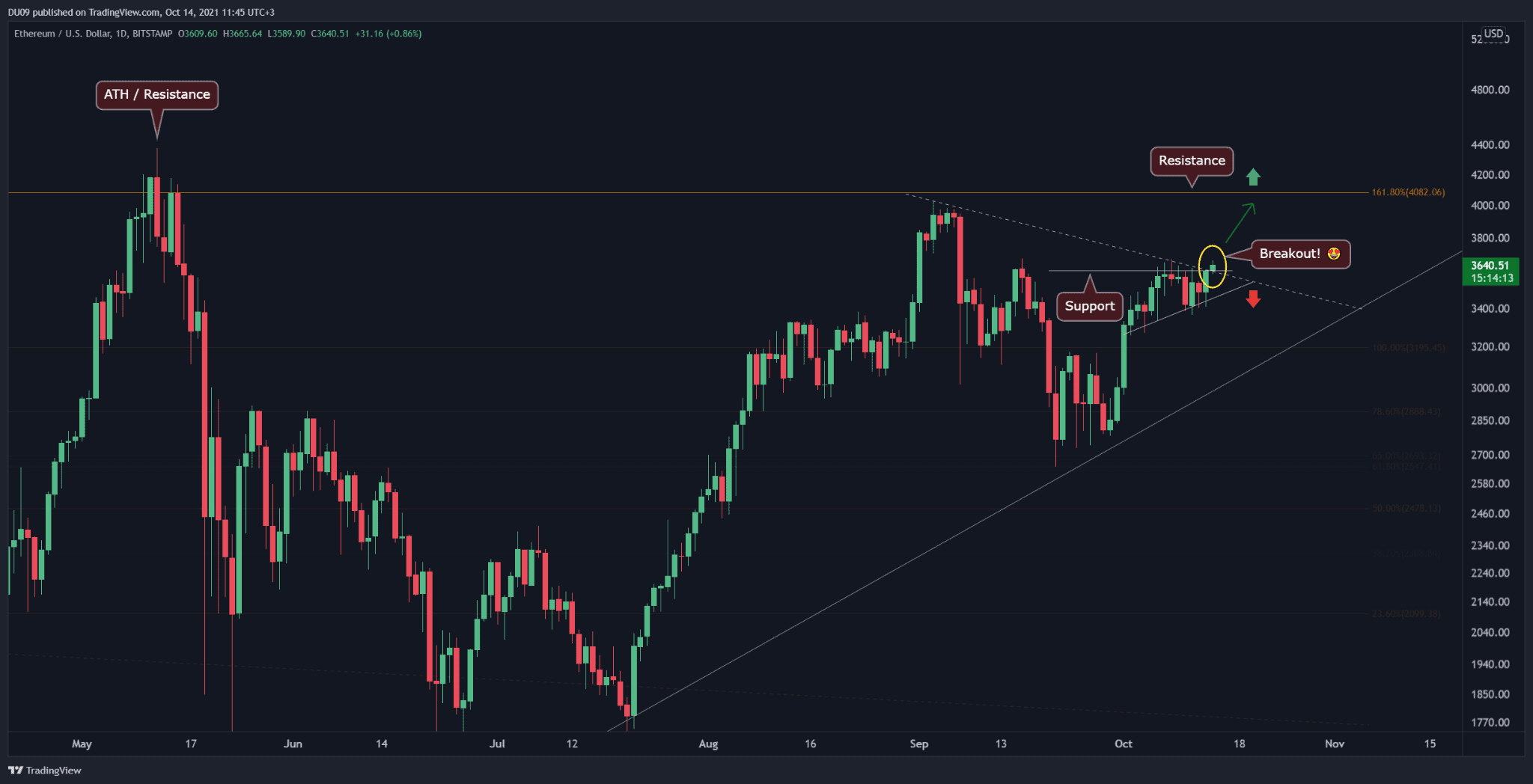

Several factors contribute to this positive outlook. Continuous improvements to Ethereum’s network, increased adoption of decentralized finance (DeFi) applications built on the Ethereum blockchain, and the potential introduction of Ethereum ETFs are seen as significant drivers behind the bullish Ether price predictions.

Ethereum’s Evolving Ecosystem and Its Impact on Ether Price Predictions

While the Finder survey primarily focused on price predictions, it’s essential to consider how Ethereum’s evolving ecosystem could influence future values. Ethereum remains a leading platform for decentralized applications (dApps) and smart contracts, with more developers and businesses choosing to build on its blockchain.

The ongoing upgrade to Ethereum 2.0 is another crucial factor. This upgrade aims to enhance the network’s scalability, security, and sustainability. If Ethereum 2.0 successfully attracts more users and developers while managing transaction volumes more efficiently, it could drive increased demand for ETH.

Additionally, the rising interest in non-fungible tokens (NFTs) and the expanding DeFi sector are significant factors that could further boost ETH’s value. Both of these areas are heavily reliant on Ethereum’s infrastructure, reinforcing its central role in the cryptocurrency ecosystem.

Conclusion: A Bright Future for Ethereum

In summary, Finder’s survey paints a positive picture for Ethereum’s price trajectory, with Ether price predictions indicating a substantial increase in value over the next several years. The anticipated introduction of Ethereum ETFs, coupled with growing institutional interest and ongoing network upgrades, supports the bullish outlook.

Despite some varying Ether price predictions among experts, the overall sentiment suggests that Ethereum is well-positioned for significant growth. Investors should remain attentive to market developments, leverage insights from expert predictions, and consider diversifying their portfolios to navigate the dynamic cryptocurrency landscape effectively.

TheBITJournal will continue to provide updates and analyses on Ethereum and other cryptocurrencies, keeping you informed about the latest trends and opportunities in the digital asset world.