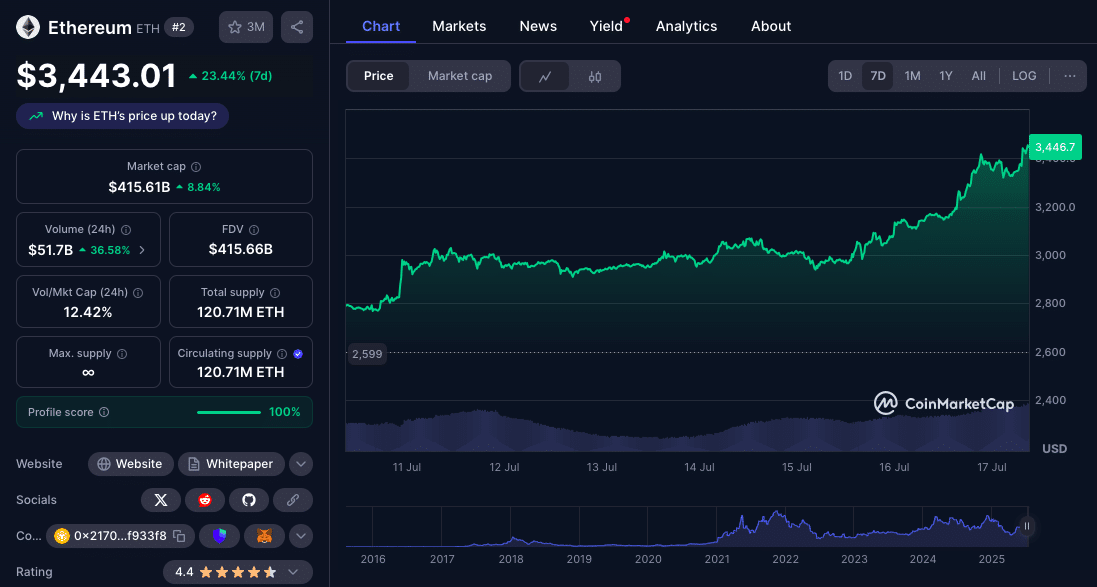

Ether surged 8% in 24 hours, above $3,443 as traders position for a potential all-time high. The rally comes as digital asset markets are optimistic, with cooling US inflation, steady spot Bitcoin ETF flows and a weakening US dollar. Bitcoin is flat at $118,253, up 6.25% for the week, while other top assets like XRP, Solana and Dogecoin are taking profits after recent highs.

The ether price rally is not just short-term sentiment. According to Bitget Research chief analyst Ryan Lee, the macro environment is now more favorable for Ethereum and other altcoins.

“The road to $150,000 for Bitcoin by Q3 looks increasingly likely, driven by ETF flows, supply constraints and macro tailwinds like a weakening dollar and potential Fed cuts,” Lee said in a note to CoinDesk, also implying a spillover effect that could accelerate Ether’s momentum.

ETH Up 8% While Bitcoin Faces Resistance at $120K

CoinMarketCap data shows Ether is up 23.44% in the past 7 days, outperforming Bitcoin and most other top assets. As ETH hit $3,443, talk of a push to all time high of $4,870 resumed. Meanwhile, Bitcoin, despite ETF flows, can’t break above $120,000 yet. Analysts at QCP Capital said in a note that a resistance zone has formed between $118,000 and $120,000, with seasonal slowdowns and equity fatigue contributing to the hesitation.

BNB, XRP and SOL were up 6-29% for the week, with XRP at $3.17 and SOL at $173. Dogecoin crossed to $0.21 for the first time in weeks, while BNB hit $720. Volumes are volatile as investors take profits short term and position long term.

BlackRock’s Bitcoin ETF Sees Record Inflows

US spot Bitcoin ETFs saw their 10th day of consecutive inflows with $799 million added on Wednesday. BlackRock’s IBIT led the inflows with $763 million, according to Bloomberg ETF data. The flows suggest institutional investors are still confident despite the Bitcoin consolidation. This could be a liquidity bridge to altcoins, especially Ether, as institutions diversify their portfolios.

The crypto market is risk on with all top assets moving up. This is backed by macro data showing a cooler US CPI for June, calming rate hike fears and increasing the chances of a Fed cut in the next few months. As rates stabilize and the dollar weakens, the appeal of digital assets is growing.

Top Crypto Performance Over the Past 7 Days

| Cryptocurrency | Current Price | 7-Day % Change |

| Ether (ETH) | $3,443+ | +23.44% |

| Bitcoin (BTC) | $118,353 | +6.25% |

| XRP | $3.17 | +29.78% |

| Solana (SOL) | $173 | +9.29% |

| Dogecoin (DOGE) | $0.2126 | +16.75% |

| BNB | $720 | +7.06% |

| TRX | $0.3110 | +7% |

Macroeconomic Factors Boost Crypto Recovery

Markets are responding to the broader macro environment. Asian equities dipped slightly as global investors re-priced central bank rate decisions, but crypto assets outperformed, helped by a softer US dollar. The dollar index (DXY) is down around 10% YTD, which is good for dollar-denominated crypto assets like Bitcoin and Ether.

US equities were weak, mainly due to renewed trade tariff concerns. But the overall macro narrative is still supportive of digital assets. Lower inflation, stagnant interest rates and a weaker dollar is creating the perfect conditions for capital to rotate back into crypto.

Conclusion

Based on the latest research, ether price rally is gaining steam as multiple factors converge. From ETF driven Bitcoin inflows to a weaker dollar and dovish macro data, Ethereum’s trajectory is pointing to all time highs.

Traders are watching closely as ETH approaches key levels, with a market that is getting more risk on.

Summary

Ether has surged 8% as traders wait for a breakout to new highs. With ETF optimism, cooling US inflation and a weaker dollar, ETH is up 23.44% in a week, outperforming Bitcoin. US spot Bitcoin ETFs have seen 10 days of net inflows of $799m led by BlackRock. Ethereum may benefit from capital spillover as Bitcoin stalls at $120,000. The stage is set for an ether price rally into Q3.

FAQs

What’s driving the Ether price up?

ETF inflows, cooling inflation data and a weakening US dollar are all driving investor appetite for crypto.

How’s Bitcoin performing vs Ether?

Bitcoin is steady at $118,000 but struggling to break $120,000, while Ether is up 23% in a week and has more momentum.

What’s the role of macroeconomic factors?

Cooling US inflation; stable interest rates and a falling dollar index are all good for crypto growth; especially for dollar denominated assets like ETH.

Is Ethereum benefiting from Bitcoin ETF inflows?

Yes; with sustained Bitcoin ETF inflows, capital is rotating into altcoins like Ether as investors diversify across major digital assets.

Glossary

Spot ETF: ETF that holds the actual asset (like Bitcoin) rather than futures contracts.

Inflation (CPI): measure of the increase in prices over time, tracked monthly in the US.

DXY (Dollar Index): measure of the US dollar’s strength against a basket of global currencies.

Altcoin: any cryptocurrency that is not Bitcoin, including Ether, Solana and XRP.

Institutional Inflows: Capital from large financial firms into crypto via funds or ETFs.