Both Ethereum and Dogecoin have seen significant price increases recently, fueled by major whale purchases. Despite recent market dips, these large-scale investors remain undeterred, continuing to accumulate assets. Technical analysis suggests that this buying spree is propelling Ethereum towards the $4,000 mark and Dogecoin to a potential $1 milestone.

Ethereum’s Momentum Supported by Whale Accumulation

Ethereum has been steadily moving towards the $4,000 level, with key indicators pointing to bullish potential. The RSI indicator, currently at 63.6, recently displayed a “golden cross,” a sign of upward momentum. This technical signal, combined with increased whale activity, reinforces Ethereum’s bullish outlook.

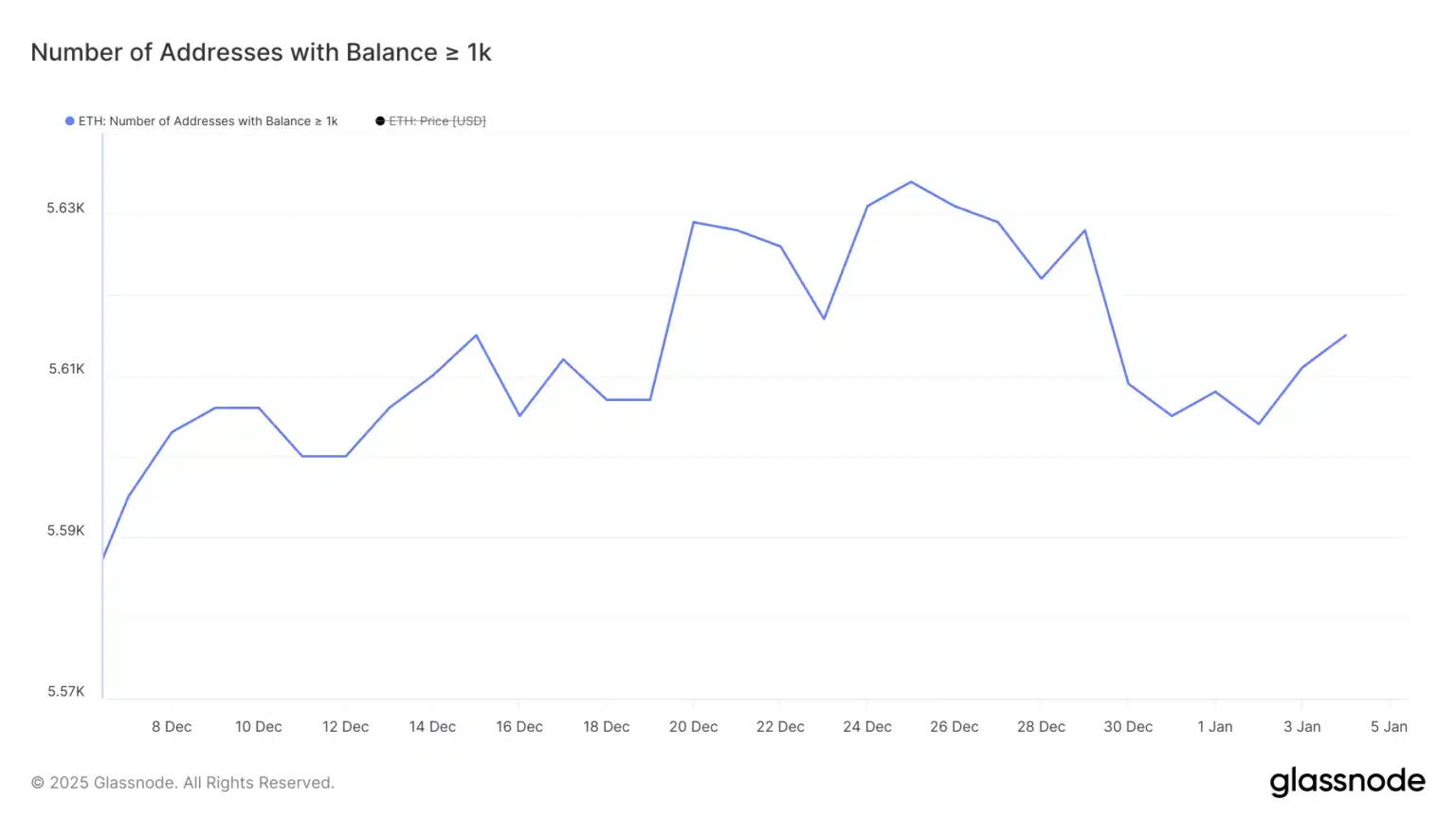

On-chain data reveals that the number of wallets holding at least 1,000 ETH is on the rise again. After dipping earlier this year, these addresses have increased to 5,615, signaling renewed interest from major investors. Analysts note that such accumulation often serves as a confidence booster for the broader market.

However, critical support levels remain in focus. If Ethereum breaks below the $3,543 support, it could trigger a pullback to $3,300 or even $3,096. Conversely, a break above $3,827 resistance could set the stage for a move towards $3,987 and beyond.

Dogecoin Targets $1 Amid Strong Whale Purchases

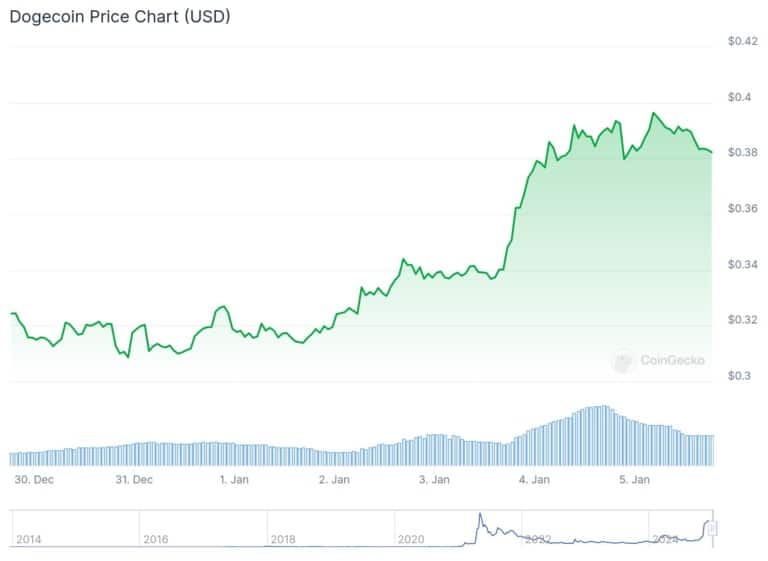

Dogecoin has also gained traction, trading at $0.38 after significant whale purchases. Notably, on January 3, a massive 1.08 billion DOGE was acquired by whales, representing approximately $413 million in value. This surge in activity underscores growing investor confidence in the meme-based cryptocurrency.

Further on-chain analysis shows a transfer of 399.9 million DOGE (valued at $144.9 million) from Binance to an unknown wallet, a move often interpreted as a reduction in selling pressure. Historical data from CryptoRank highlights January as a standout month for Dogecoin, with gains of 711% in 2021 and 269% in 2014.

Market analysts, including Thorn, predict that Dogecoin could climb to $1, marking a 170% increase and potentially reaching a $100 billion market cap. Open interest for DOGE has surged 50% in the past week, growing from $2 billion to $3 billion, according to CoinGlass. This increase reflects heightened investor participation.

Institutional Interest in Dogecoin

Adding to the bullish outlook, Spirit Blockchain Capital recently announced plans to leverage Dogecoin reserves for decentralized finance (DeFi) protocols. The initiative aims to offer yield-focused products to institutional and retail investors alike, further legitimizing Dogecoin’s role in the financial ecosystem.

Conclusion: Optimism for Ethereum and Dogecoin

Both Ethereum and Dogecoin are benefiting from renewed whale interest and favorable technical setups. While risks remain, such as critical support levels for Ethereum and potential profit-taking for Dogecoin, the market’s current trajectory points to continued growth. The Bit Journal will monitor these developments closely, keeping readers updated on key price movements and trends.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!