Despite recent price declines, Ethereum (ETH) bulls seem to be gearing up for a potential price recovery. On-chain data reveals that ETH is currently trading around $3,130, down from its recent high of $3,434 on November 12. However, many investors believe this pullback is only temporary. Here’s an analysis of what could be next for Ethereum.

Investors Are Holding, Not Selling

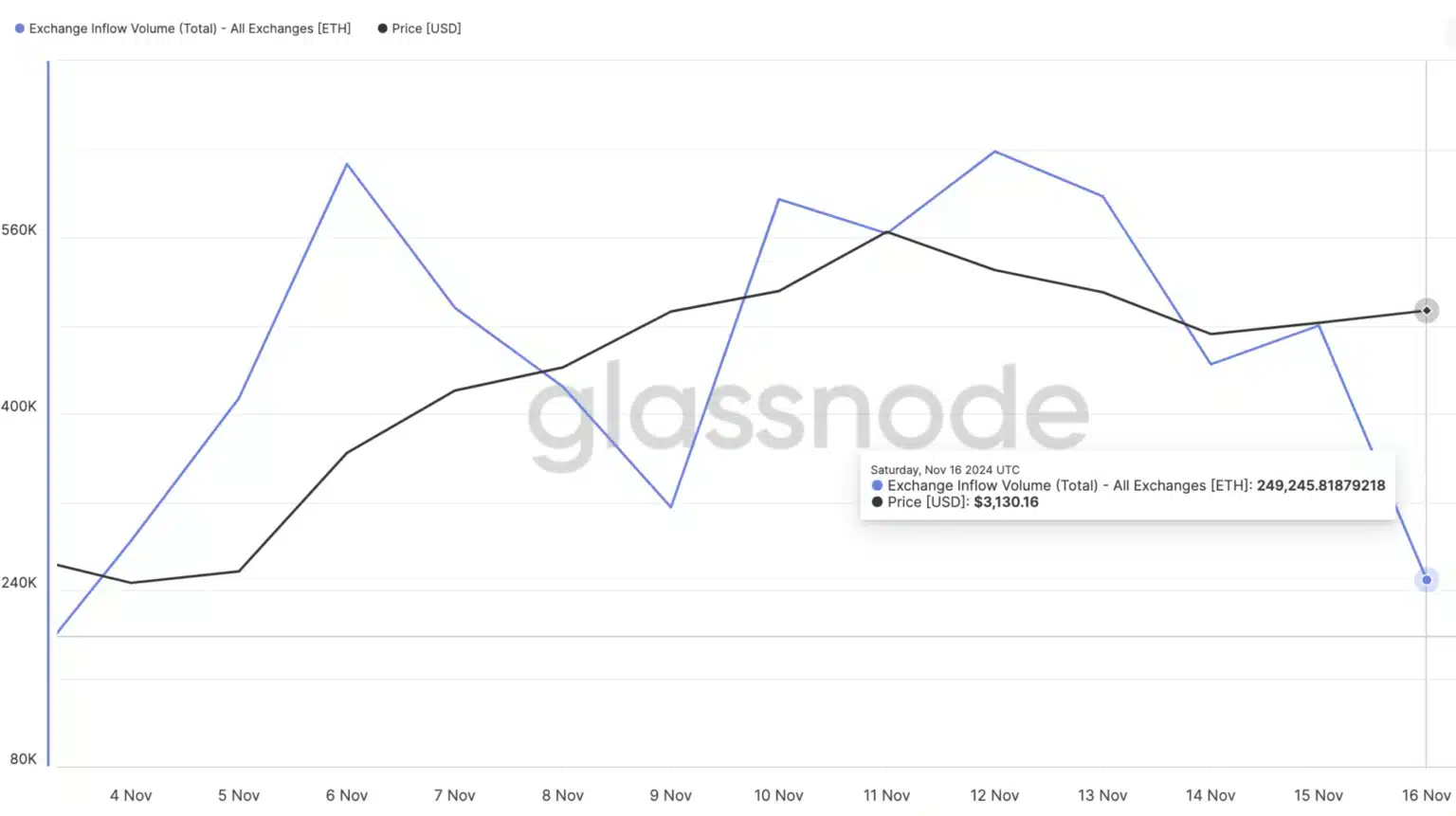

Data from Glassnode indicates that total Ethereum exchange inflow has decreased significantly, standing at 249,245 ETH as of today. Exchange inflow measures the number of coins sent to exchanges over a specific period. When this metric rises, it signals increased selling pressure, creating a bearish environment for the asset. Conversely, a decline suggests that investors are withdrawing their assets, a bullish signal.

Currently, the withdrawn ETH, valued at approximately $780 million, reflects a decrease compared to the levels observed on November 15. This shows that most ETH holders are refraining from selling. If this trend continues, the chances of Ethereum dropping below $3,000 in the short term diminish.

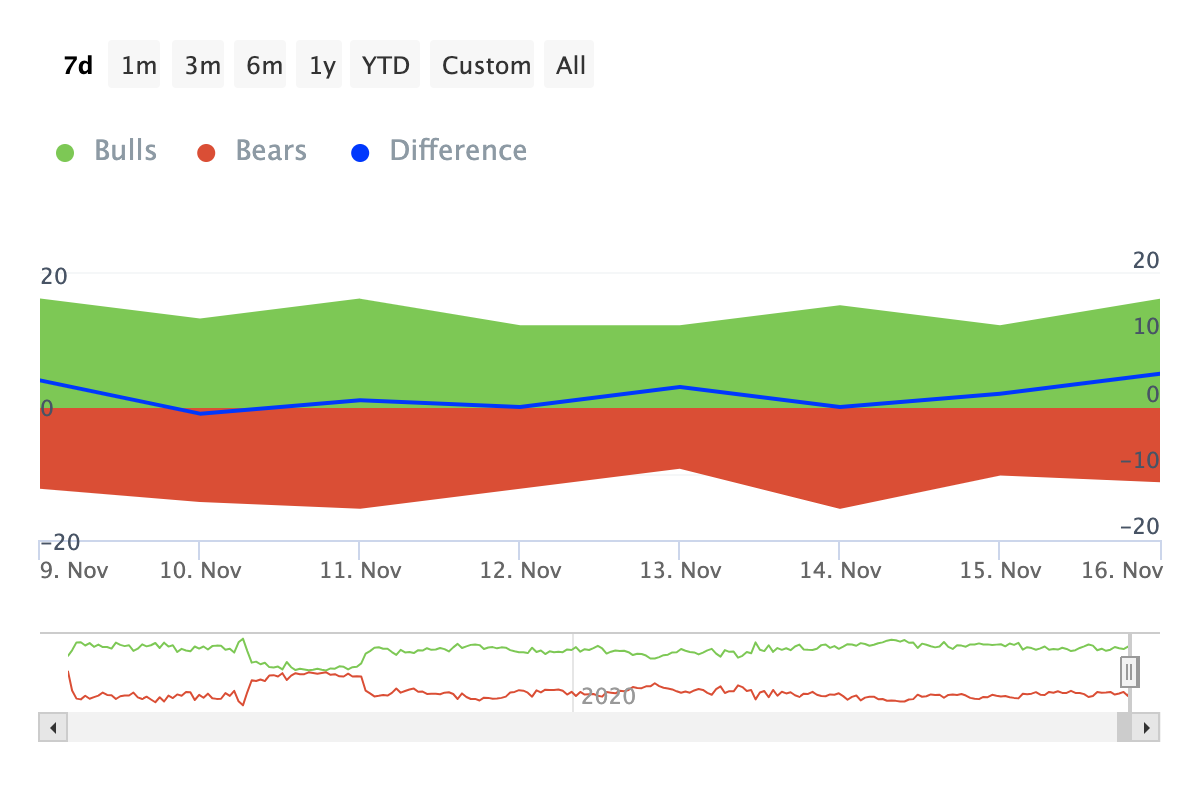

IntoTheBlock’s data further underscores this sentiment. According to the Bulls vs. Bears indicator, Ethereum bulls are actively working to support the price. This metric tracks whether the addresses responsible for at least 1% of trading volume are engaging in buying or selling activities. Over the past 24 hours, Ethereum bulls have outnumbered bears, suggesting potential price stability or an upward move.

Price Projections for ETH

Analyst Victor Olanrewaju highlights the In/Out of the Money Around Price (IOMAP) indicator, which suggests ETH could trade at higher levels. The IOMAP metric identifies key support and resistance zones based on user positions and profitability. Larger volume clusters usually signify stronger levels of support or resistance.

Recent data shows that approximately 3 million addresses purchased 3.56 million ETH at around $3,075, making this a critical support level. These investors are currently in profit, and the data indicates they are unlikely to sell until prices approach the $3,251–$3,591 range.

Given this backdrop, Ethereum’s price may climb toward $3,600. However, Olanrewaju warns that if selling pressure increases, this scenario might not materialize, and ETH could fall below $3,000.

Conclusion

The current on-chain metrics point to a strong support level for Ethereum and reduced selling pressure from investors. If the bullish momentum persists, ETH could see significant upward movement. However, as with all cryptocurrencies, the market’s volatility means investors should approach cautiously.

Stay updated with the latest crypto market insights on The Bit Journal for accurate and timely analysis.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!