The introduction of Ethereum exchange-traded funds (ETFs) into the cryptocurrency market has been eagerly anticipated, promising to significantly reshape investor participation and market dynamics. According to Tom Dunleavy, managing partner at MV Global, Ethereum ETFs could attract inflows totalling up to $10 billion in the months following their launch, paralleling the profound impact witnessed with Bitcoin ETFs earlier this year.

“We saw $15 billion in flows for Bitcoin. I think we’re probably going to see $5 billion to $10 billion for Ethereum,” Dunleavy projected. “I expect a very positive price impact sending us to new all-time highs by early Q4.”

The Impact of Ethereum ETF Inflows on Institutional Investment

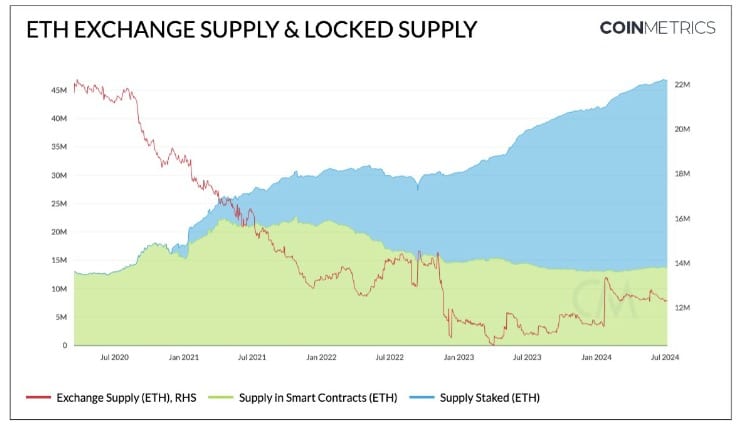

“The BTC ETF led to a price appreciation of 36% from the January 10th launch date to the peak and >50% from the time of initial speculation and rumours,”Dunleavy stated in a Q2 investor memo. Bitcoin’s ETFs led to a notable 36% price increase from launch to peak, showcasing significant market appreciation. Ethereum, renowned for its versatility beyond digital gold, appeals strongly to institutional investors eager for exposure to blockchain’s expansive applications. Tom Dunleavy underscores Ethereum’s scarcity on exchanges and increased staking, enhancing its responsiveness to ETF demand and potentially driving prices to new highs.

According to reports, The imminent launch of eight Ethereum ETFs, pending US regulatory approval, signals a pivotal moment for cryptocurrency adoption in traditional finance. These ETFs are poised to collectively manage a substantial share of Ethereum’s market capitalization, akin to Bitcoin’s $15.9 billion managed by existing ETFs. Dunleavy forecasts an initial monthly inflow of about $1 billion into Ethereum ETFs, setting a sturdy foundation for sustained investment and liquidity enhancement in the ETH market.

As institutional interest converges on Ethereum through these financial products, Dunleavy underscores the asset’s evolving narrative as a tech-driven investment akin to a “tech stock” or “internet bond,” presenting a compelling alternative to Bitcoin’s digital gold narrative. This shift in perception among traditional investors positions Ethereum favourably as a transformative asset class with tangible utility and growth potential.

Market Dynamics and Ethereal Expectations

The dynamics of Ethereum ETFs extend beyond their financial mechanics to encompass broader implications for market sentiment, investor behaviour, and regulatory considerations. Tom Dunleavy’s insights into the potential inflows of $10 billion into Ethereum highlight the financial opportunities and the strategic implications for cryptocurrency market evolution.

Ethereum, known for its decentralized applications (dApps) and smart contract capabilities, presents a distinct value proposition compared to Bitcoin’s store-of-value narrative. The introduction of ETFs tailored to Ethereum reflects a maturing market ecosystem, where institutional investors seek exposure to assets with demonstrable utility and technological innovation. Dunleavy’s comparison of Ethereum’s market liquidity challenges, stemming from reduced availability on exchanges and increased ETH locked in staking contracts, underscores the asset’s potential for price volatility and investor responsiveness.

Market analysts anticipate that Ethereum ETFs could act as a catalyst for renewed interest in blockchain technology, fostering innovation and adoption across industries. The ETFs’ regulatory journey, currently awaiting final approvals, underscores the cryptocurrency market’s ongoing integration into traditional financial frameworks. Regulatory clarity and institutional endorsement through ETF investments are expected to bolster Ethereum’s market credibility and mitigate perceived risks associated with digital assets.

Dunleavy’s projections for Ethereum’s price trajectory post-ETF launch suggest a bullish outlook, driven by institutional capital allocations and a redefined narrative appealing to mainstream financial advisors and investors. The asset’s performance relative to Bitcoin during market downturns highlights Ethereum’s resilience and potential for distinct market positioning, potentially influencing broader market sentiments towards digital assets.

Strategic Implications and Future Outlook

The introduction of Ethereum ETFs marks a strategic milestone with broad implications for blockchain adoption, financial integration, and regulatory oversight. Analyst Tom Dunleavy predicts significant institutional interest, projecting up to $10 billion in ETF inflows to Ethereum. Unlike Bitcoin, Ethereum’s focus on technology applications makes it appealing for institutional adoption through products like ETFs. Pending regulatory approval, the launch of eight Ethereum ETFs is seen as pivotal, offering regulated access to Ethereum’s potential and technology.

Dunleavy also notes Ethereum’s liquidity advantages over Bitcoin, suggesting ETF demand could impact prices and volatility positively. Institutional participation is expected to boost liquidity, stabilize prices, and enhance investor confidence in crypto as a viable asset class. Regulatory scrutiny reflects market maturation, potentially improving investor protections and stability. Overall, Ethereum ETFs are set to reshape digital asset perceptions, affirming Ethereum’s role in diversified portfolios and signaling confidence in its future growth.

Conclusion

Ethereum ETFs represent a paradigm shift in cryptocurrency market dynamics, offering institutional investors regulated access to Ethereum’s technological prowess and market opportunities. The strategic implications of ETF inflows extend beyond financial metrics to encompass broader implications for blockchain adoption, regulatory frameworks, and global financial integration, positioning Ethereum at the forefront of digital innovation and investment. Stay tuned to The BIT Journal for the latest crypto news.