Matt Hougan, the Chief Investment Officer at Bitwise, has made an eye-catching forecast about Ethereum’s (ETH) price following the much-anticipated launch of a spot Ethereum exchange-traded fund (ETF). According to Hougan, the Ethereum ETF launch is poised to send ETH prices soaring to unprecedented heights.

Anticipated Capital Inflow and Market Impact

Hougan’s projection is grounded in the expectation of a significant capital inflow into Ethereum, fuelled by the launch of these ETFs. He predicts that the initial weeks after the Ethereum ETF launch might experience some volatility, but the overall trend points towards a strong bullish momentum by year-end. His analysis hinges on the fundamental economic principle of supply and demand.

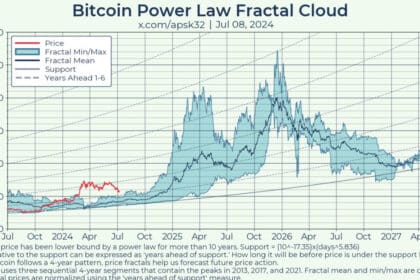

“BTC has risen ~25% since the launch of Bitcoin [exchange-traded products] ETPs on January 11, and more than 110% since the market started pricing in a launch in October 2023. Will we see the same sort of impact with ETH? Actually, I think it might be bigger,” Hougan said.

The Mechanics Behind the Ethereum ETF Launch

Hougan explains that while ETFs do not alter the fundamental nature of the underlying asset, they introduce new sources of demand. He draws a parallel with the launch of spot Bitcoin (BTC) ETFs, which saw demand significantly outpace the new supply generated by miners, thereby driving up Bitcoin’s price. This same dynamic, he argues, will be at play with the Ethereum ETF launch.

The Ethereum ETF launch is projected to attract upwards of $15 billion in new assets within the first 18 months. Given Ethereum’s current trading price of around $3,400, Hougan believes it is plausible for ETH to challenge its previous all-time high and potentially exceed $5,000.

Key Factors Driving Ethereum’s Potential

Several key factors contribute to Hougan’s optimistic outlook for the Ethereum ETF launch. These include Ethereum’s lower short-term inflation rate, the non-compulsory selling behaviour of ETH stakers, and the substantial portion of ETH being staked or locked in smart contracts. These elements combine to create a favourable environment for the Ethereum ETF launch to positively impact ETH prices.

Bitwise’s report echoes earlier projections by VanEck, another asset management giant. In their base case, VanEck predicted that ETH would reach $22,000 by 2030. This confidence is also driven by the anticipated approval of spot Ethereum ETFs, among other factors.

Broader Market Sentiment and Predictions

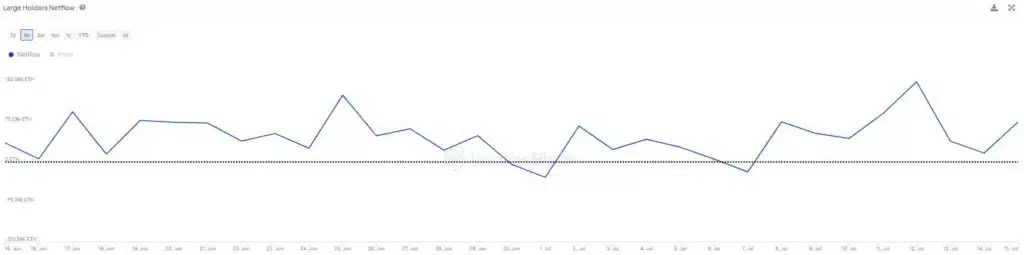

Adding weight to these bullish predictions are insights from Juan Pellicer, Senior Researcher at IntoTheBlock. He noted that after the spot Bitcoin ETF’s introduction, accumulation by large holders skyrocketed, driving BTC prices up. While he anticipates a similar impact with the Ethereum ETF launch, Pellicer expects lower institutional demand for ETH. However, on-chain data shows that large holders have been accumulating.

“Over the past month, net outflows from the largest wallets occurred in only two days, with over 1.4 million ETH accumulated during this period,” he elaborated.

Regulatory Approval on the Horizon

The Ethereum ETF launch has generated significant buzz within the crypto community, with experts predicting that the US Securities and Exchange Commission (SEC) could approve these ETFs sometime this week. Bloomberg’s ETF analyst Eric Balchunas has indicated that the SEC might greenlight the ETFs by July 23. Despite any potential delays, the crypto community remains optimistic about the approval of the Ethereum ETF launch.

If the final offering documents meet the required conditions, major potential issuers can launch their ETFs simultaneously, marking a significant milestone for the Ethereum market. This synchronized launch could further amplify the positive impact on ETH prices, reinforcing the bullish sentiment around the Ethereum ETF launch.

Ethereum ETF Launch: A Bullish Future Ahead?

In summary, the Ethereum ETF launch is expected to be a pivotal event for the market, potentially driving ETH prices to new heights. With anticipated capital inflows, favourable supply-demand dynamics, and a strong regulatory outlook, the Ethereum ETF launch could herald a new era of growth for Ethereum. As the crypto community eagerly awaits regulatory approval, the bullish predictions by experts like Matt Hougan and Juan Pellicer underscore the transformative potential of the Ethereum ETF launch.