Ethereum (ETH) is defying bearish expectations after a notable wave of ETF outflows. On Saturday, the price briefly surged past the $2,000 mark, reigniting investor optimism. What made this move remarkable was that it came despite continuous capital leaving Ethereum-based ETFs—suggesting deeper market dynamics at play.

According to recent data, over $102 million exited Ethereum ETFs in the past week alone. Between March 19 and 21, $42 million in outflows were recorded. Yet ETH remained resilient, sparking speculation about whether the trend will continue and how it might influence future price action.

Whale Accumulation and Shrinking Supply

On-chain signals are painting a bullish picture. Crypto analyst Merlijn The Trader highlighted that whales acquired over $236 million worth of ETH within 72 hours. This surge in accumulation indicates strong underlying demand, which may help push prices higher.

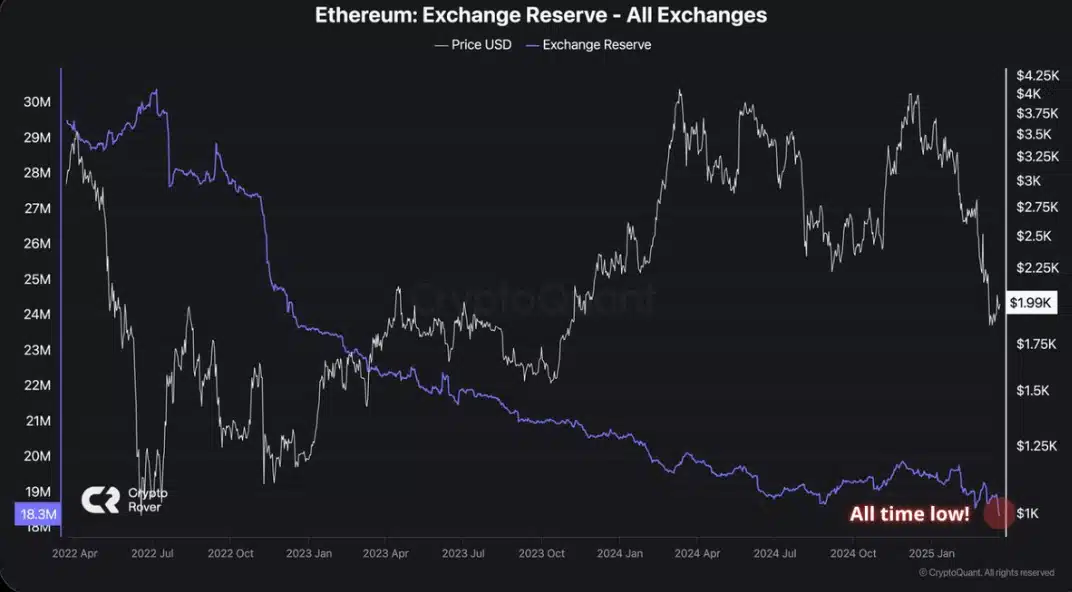

At the same time, data shared by Crypto Rover revealed that ETH reserves on centralized exchanges have hit historical lows. Investors appear to be moving their tokens into cold storage, reducing available supply and hinting at a possible supply shock. For Ethereum, this could mean significant upside pressure if demand continues to build.

Technical Setups Suggest Major Upside Potential

According to analyst Patron, Ethereum has regained a key support level at $1,978. Holding above this zone could unlock bullish targets at $2,296, $2,913, and even $4,000 in the coming weeks.

However, sentiment remains cautious. Ethereum’s Fear & Greed Index currently sits at 37, reflecting a wary market. Still, with strong technical backing and favorable on-chain metrics, many believe Ethereum’s price could be poised for a major move.

Are ETF Outflows Losing Influence?

While recent ETF outflows have dented confidence, the market may be shifting its focus. After a $20 million outflow on March 18, Ethereum’s price actually rose by 5%. This reaction suggests that some investors now view these outflows as buying opportunities rather than warning signs.

If ETH continues to climb, a reversal in ETF trends could follow. Renewed retail interest may drive fresh capital back into these investment products, reinforcing Ethereum’s momentum. According to The Bit Journal, this shift in sentiment could help Ethereum retake center stage in the crypto market narrative.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!