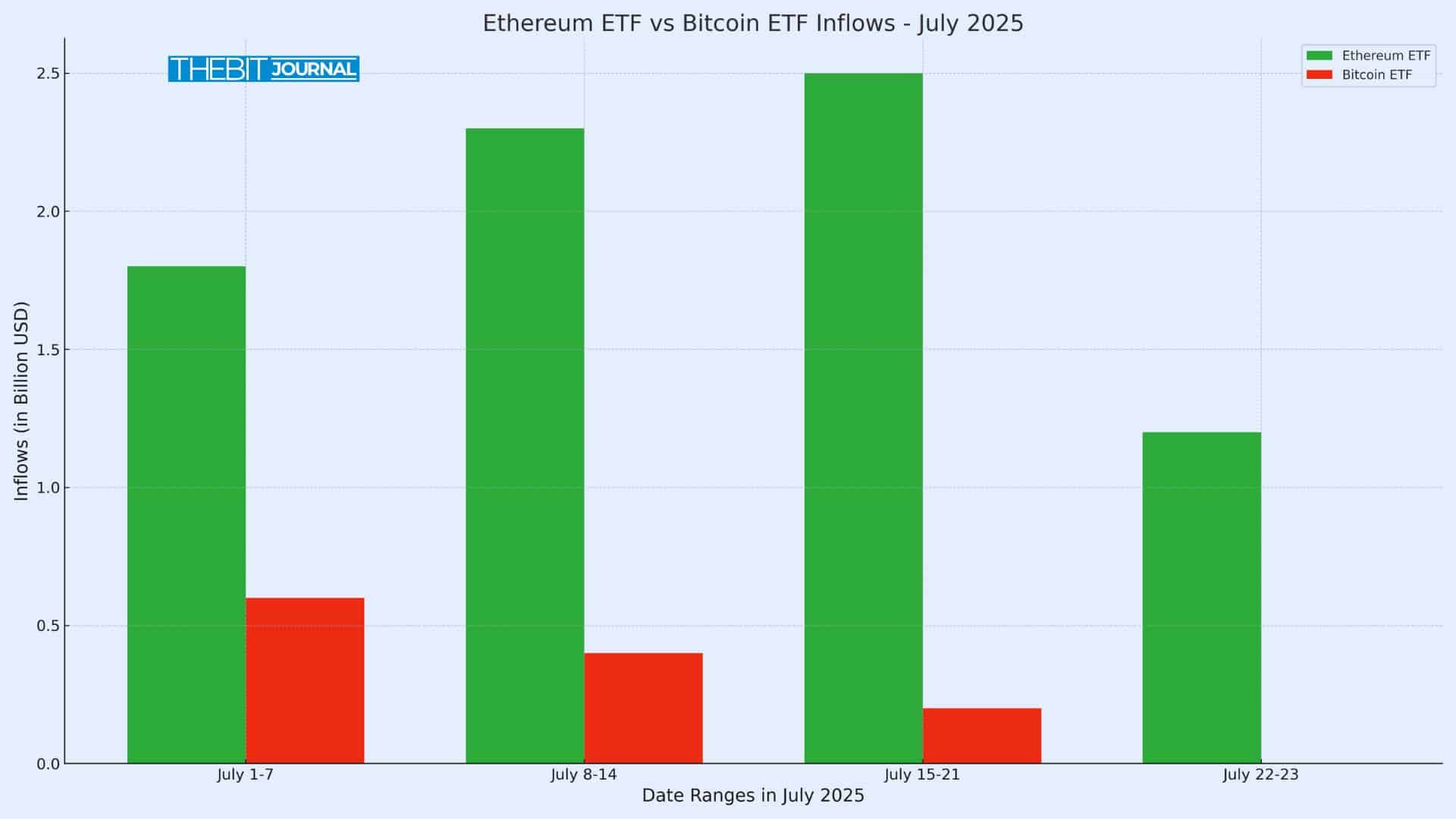

According to recent data, the Ethereum ETF recorded a daily inflow of $602 million on July 17, surpassing the daily inflow of the Bitcoin ETF for the first time. This sharp uptick signals a changing tide in institutional crypto interest.

Staking Prospects Spark Attention

One major driver behind this momentum is growing optimism around staking. While current U.S.-listed funds don’t offer staking yields, discussions are underway. Cboe and NYSE have proposed allowing ETFs to stake their holdings, pending regulatory approval.

Analysts at QCP Capital highlighted the trend, saying,

“We expect Ether to continue outperforming Bitcoin over the medium term as the narrative rotates to potential ETH Spot ETF approvals.”

If approved, staking would enable investors to earn passive income without directly handling the technical aspects of Ethereum. In Europe and Canada, staking-ready ETFs already offer this benefit, giving U.S. investors a glimpse of what could be next.

Institutional Moves Fuel Price Climb

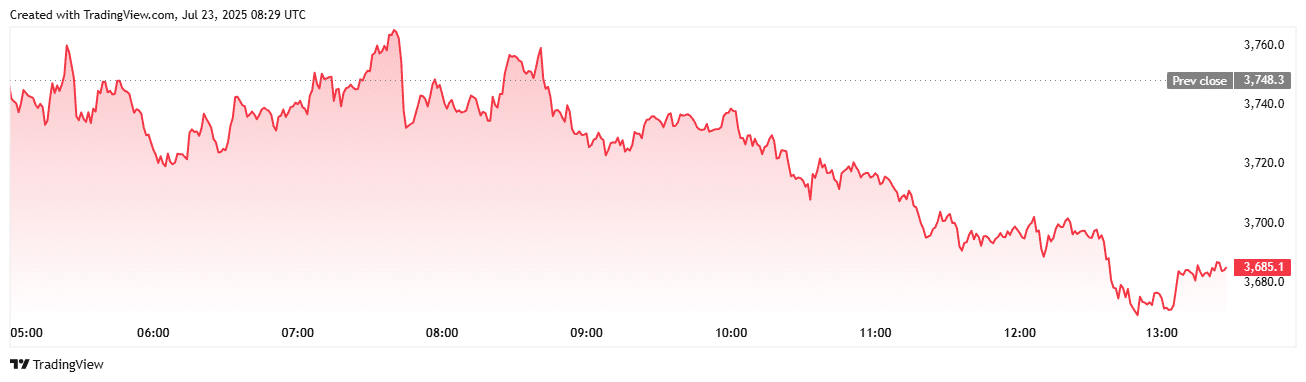

Reports indicate that Ether reached a six-month high of $3,676 in July, with Ethereum-linked stocks rallying in tandem. BitMine Immersion Technologies saw a 14% jump, reflecting investor confidence tied to ETF activity.

James Butterfill, head of research at CoinShare, noted:

“People are preferring Ethereum over Bitcoin… proportionally, it’s much more significant.”

That quote underscores a shift in allocation among professional investors, many of whom previously focused solely on Bitcoin.

How the Funds Are Performing

Ethereum ETFs in the U.S. have seen a significant surge in activity. According to Farside Investors, spot Ethereum ETFs recorded a total of over $7.8 billion in inflows for July 2025 alone, reflecting intense institutional interest. This far exceeds earlier estimates of $2.6 billion.

The standout performer, iShares ETHA, now manages more than $3.7 billion in assets, up from $2.8 billion in early June. BlackRock’s growing influence is evident as it leads other issuers, such as Fidelity and Grayscale, in both daily volume and total capital raised.

Notably, on July 17, ETH ETFs brought in $602 million—one of the most significant single-day inflow spikes—while Bitcoin ETFs lagged on the same day, with no recorded inflow across major issuers.

Here’s a quick breakdown:

| Date | Ethereum ETF Inflow | Bitcoin ETF Inflow |

|---|---|---|

| July 17 | $602M | $0M (net neutral) |

| July Total | $7.8B+ | ~$1.2B |

| Sources: Farside Investors, CoinShares |

This surge highlights a key narrative shift. Institutions appear to be rotating capital toward Ethereum-based products, possibly in anticipation of regulatory clarity around staking. Analysts suggest that this trend could persist if approval for yield-generating ETFs is granted later this year.

Why This Matters for Investors

The case for including Ether in a diversified crypto strategy is growing stronger. With DeFi usage on the rise, regulatory discussions progressing, and staking on the horizon, many view Ethereum as more than just a digital asset—it’s becoming an investment platform in its own right.

Julio Moreno from CryptoQuant emphasized,

“Purchases from U.S.-based Ethereum ETFs have outperformed Bitcoin’s, showing strong market conviction.”

Final Thoughts

Based on the latest research, Ethereum ETF continues to attract strong investor interest, driven by record inflows, potential staking benefits, and increasing institutional adoption. As regulatory clarity improves and product offerings expand, this fund is positioning itself as a credible, long-term option for those seeking structured exposure to Ethereum without direct asset management.

Summary

The Ethereum ETF is gaining momentum as investor inflows surpass those of Bitcoin for the first time. Backed by growing interest in staking and strong institutional support, it’s becoming a preferred option for those seeking simpler exposure to Ethereum. While U.S. ETFs don’t yet offer staking, global models show what’s possible. With rising demand and regulatory discussions underway, ETH ETF is shaping up to be a long-term investment contender.

Explore more: For deeper insights into future trends, don’t miss detailed analysis on Ethereum price prediction.

Frequently Asked Questions

Q: What is an Ethereum ETF?

An exchange-traded fund that tracks the price of Ether, offering a way to invest in Ethereum through traditional markets.

Q: Is staking included in the ETF?

Not in the U.S. yet. However, proposals are under review, and overseas versions already offer this feature.

Q: Why are institutions buying in now?

They’re responding to firm performance, potential yields from staking, and Ether’s growing role in DeFi.

Q: Is ETH ETF better than holding ETH directly?

It depends. ETFs simplify investing and avoid wallet management, while direct holding allows complete control and staking flexibility.

Glossary

ETF (Exchange-Traded Fund): A fund traded on stock markets that holds assets like stocks or cryptocurrencies.

Staking: Locking ETH to support the network and earn rewards.

Inflows: The amount of money entering a financial fund.

DeFi (Decentralized Finance): Financial tools built on blockchain networks like Ethereum.

AUM (Assets Under Management): The total value of assets controlled by a fund.