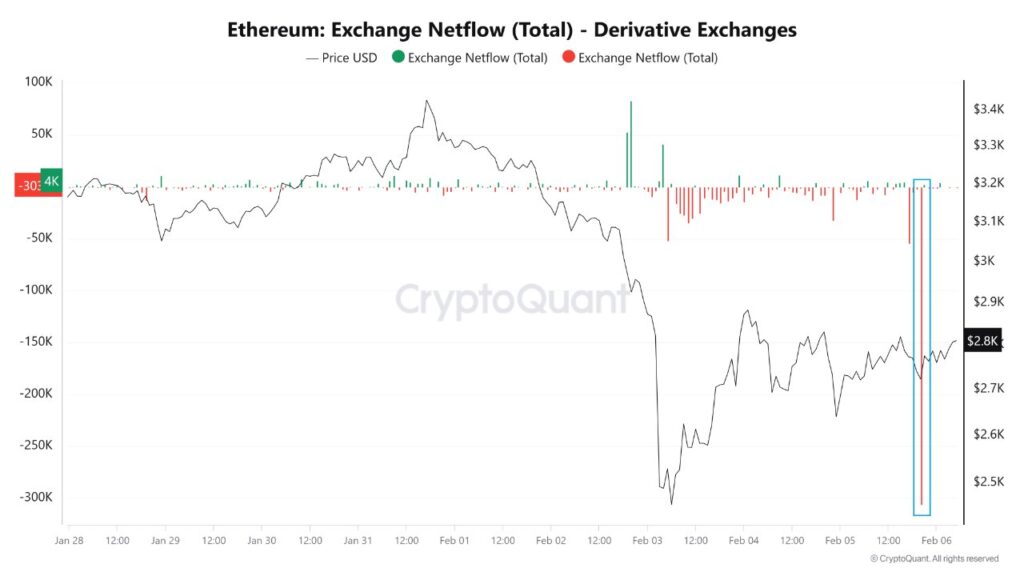

Ethereum (ETH) has registered the highest outflow of tokens from crypto derivatives platforms since August 2023. Analysts see this as positive news for the Ether price outlook, based on the lower sell pressure implied in the market, which can positively affect the Ether price to rally.

Key Developments in Ethereum’s Market

In specific detail, outflow in crypto derivatives exchange stands at negative 300,000 ETH, equivalent to $ 817.2 million as of February 6th. According to CryptoQuant analyst Amr Taha, this situation can be regarded as bullish. As ETH is withdrawn from the exchanges, the overall flow of Ethereum to be sold shrinks, which can only drive the price up or, at least, remain stable if demand is high enough.

Why Ethereum Withdrawals Matter

Such actions as the withdrawal of ETH from the derivatives exchanges may indicate that traders are positioning themselves and might be bullish on Ethereum. It takes out the selling pressure in the near term in the market, which means that ETH cannot fall further easily at the moment. However, should demand be maintained at these levels or is even boosted in the future, then the erosion in supply can compel prices to go up.

Ethereum’s Price Action in Recent Days

This is illustrated by the fact that ETH has shown a wild swing in the recent past. The price of ETH has decreased by 19.42% within the last 30 days, it tumbled below the $3,000 mark for the first time since February 3. However, such lowering may have a friendly environment for price increases; the outflow from the derivatives exchange can, in theory, contribute sufficiently to it. If the market conditions change, ETH can regain upward movement because of low selling pressure and increased institutional demand.

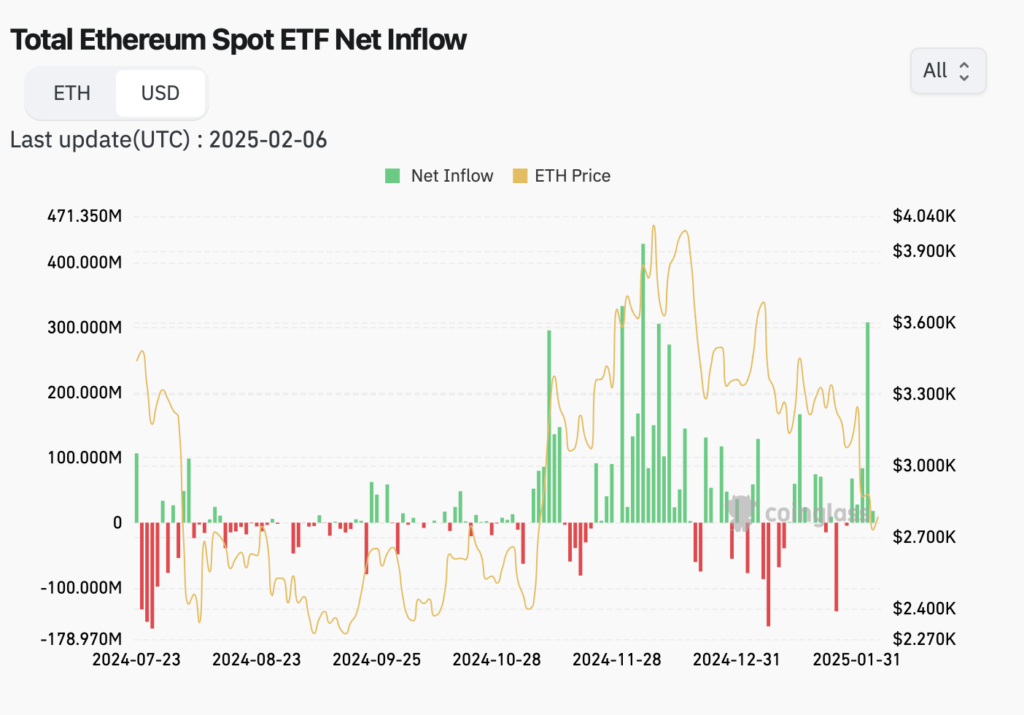

Positive Signals from Ethereum ETFs

Popular ETFs for Ethereum have even seen a good rise in trading activity. Thus, in the last week alone, more than $500m, a significant increase of funds went into Ethereum exchange-traded funds, pointing towards increasing institutional appreciation of ETH. This is considered to be a favorable sign for ETH’s future price outlook since it demonstrates the interest that institutional investors have in the asset.

The Role of Institutional Investors

Institutional investors are gradually entering the Ethereum market as an important segment of the market players. The largest Ethereum ETFs from multiple firms include iShares Ethereum Trust (ETHA), which has a net AUM of $3.75 billion, and Grayscale Ethereum Trust (ETHE), which holds $3.67 billion. Among all established funds invested in ETH, Fidelity’s Ethereum Fund (FETH) is at first place with $1.34 billion. These figures indicate that these Ethereum ETFs are currently banking on ETH’s continued growth, and the overall market’s optimism is reflected in this extension.

Ethereum’s Market Recovery

The ETH price bounced back from $2,150 on the 3rd of February to $2,920 on the 4th of February, which is about a 36% increase. This recovery occurred amidst a general market recovery due to the announcement by the President of the United States of America, Donald Trump, of modifications to tariffs on imports and exports between the United States and Canada, Mexico, and China. Thus this significant price fluctuation shows that ETH is able to sustain itself no matter what the circumstances are in the market.

Market Sentiment and Future Outlook

As of the 7th of February, ETH managed to stand around $2,701. However, it is about 27.97% below its high of $3,750 in 2025, which some of the signals showing bullishness are still present. Crypto trader and investor Ted Pillow observed that the price of ETH fluctuated significantly in Q1 2024 and Q3 2024. The continued reversal would indicate that ETH is still in a position to go up in the next few months.

Bullish Trends in Ethereum’s Ecosystem

Several factors that point to the upside are existing to support Ethereum’s market. The flow of ETF plus the outflow observed in Ether from the exchange through derivatives indicates that investors believed in a further highing of the price of ETH. Moreover, the community has increasing hope for any staked Ethereum ETF, and it may bring more confidence and more investors to the markets.

Conclusion

The current movements have been registered for ETH which has raised anticipation of a possible upswing in the market. Significantly increasing Ether outflow from derivatives exchanges and an increasing interest of institutions in Ethereum ETFs suggest that largeholders are taking their positions for longer-term price appreciation. But even with these issues such as the market fluctuations and legal concerns for ETH, the general outlook is rather positive. If bearish pressure persists and demand for ETH remains high, ETH’s price may experience large gains in the next months.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

What does Ethereum’s recent outflow from exchanges indicate?

It suggests less selling pressure, which could increase ETH’s price if demand stays strong.

How do Ethereum ETFs affect the price?

Increased investments in Ethereum ETFs show growing institutional confidence, potentially driving up ETH’s price.

Why is institutional interest in ETH important?

Institutional investments bring large capital and signal strong confidence in ETH’s future, boosting its market position.

How do withdrawals from ETH exchanges impact the market?

Withdrawals reduce supply, which can make it harder for prices to fall and may help spark a price rally.

Appendix: Glossary of Key Terms

Ethereum (ETH) – A blockchain platform with ETH as its native cryptocurrency.

Derivatives Exchange – A platform for trading contracts based on asset values like Ether.

Exchange-Traded Fund (ETF) – A fund tracking ETH’s price, traded on stock exchanges.

Cold Storage – Offline storage of cryptocurrency for enhanced security.

Institutional Investors – Large financial entities investing in assets like ETH.

Staked Ethereum – ETH is locked in the network for validation, earning rewards.

References

Cointelegraph – cointelegrapgh.com

CryptoQuant – cryptoquant.com

CoinMarketCap – coinmarketcap

CoinGlass – coinglass.com

Blockworks – blockworks.co