Ethereum (ETH) has recently fueled excitement in the crypto community, bouncing back to the $3,200 level and signaling a potential rally as bulls prepare to take charge. But behind the price movement lies a deeper narrative that’s capturing attention. Here, The Bit Journal delves into the factors driving this potential rise and the price targets that could be within reach.

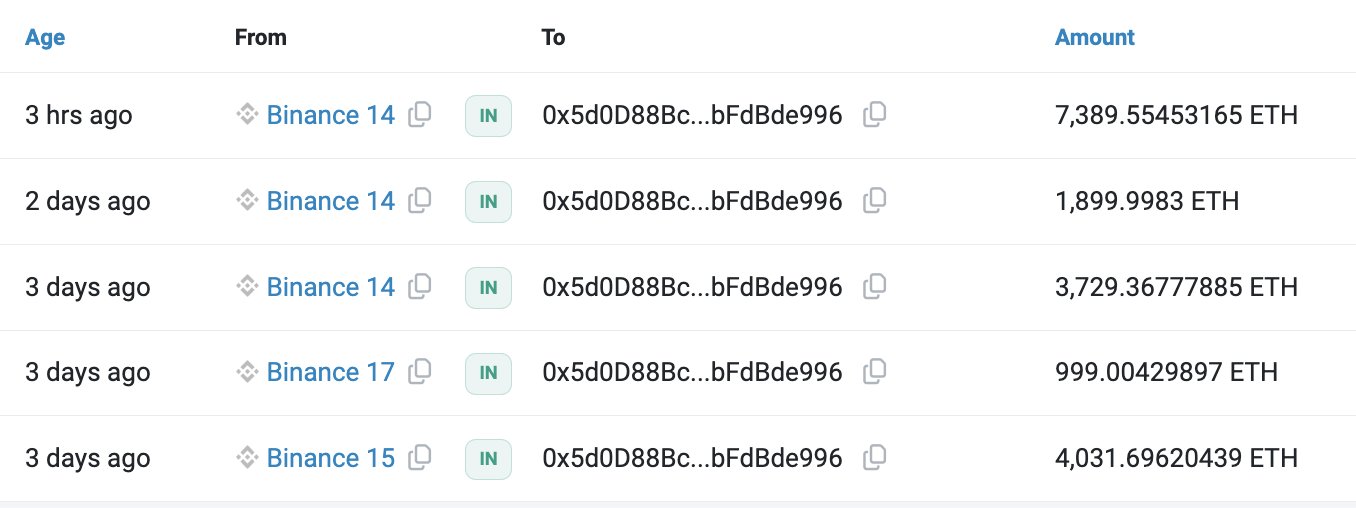

Whale Moves Indicate Renewed Confidence in Ethereum

Large-scale investors, often referred to as whales, are making significant moves that rarely go unnoticed. Recently, a major whale withdrew a whopping 18,000 ETH (valued at around $59 million) from Binance into a private wallet. This substantial withdrawal underscores a broader sentiment: whales are buying at lower levels, which historically hints at an upward trend.

These transactions reflect not only a resurgence of confidence in Ethereum but also a longer-term bullish outlook among large investors who tend to capitalize on strategic opportunities.

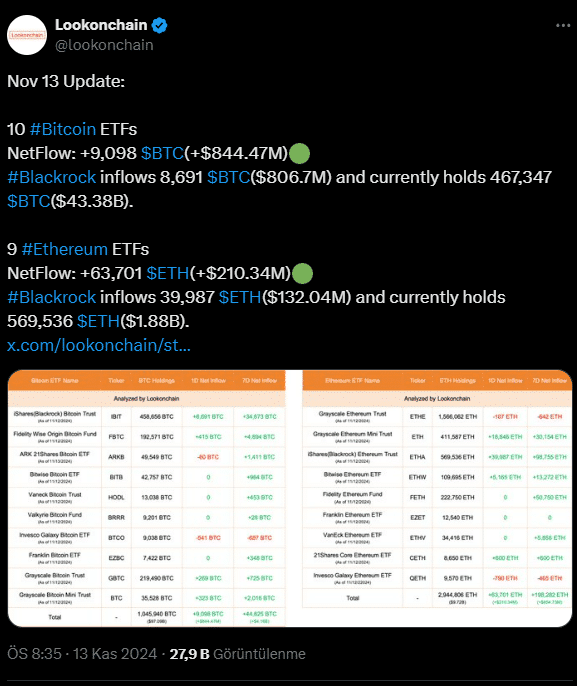

Institutional Investors Show Increased Interest in Ethereum

Institutional interest in Ethereum is also on the rise, with some attributing this uptick to anticipated favorable regulatory changes. Investment giants like BlackRock have made significant ETH purchases, sending a positive signal to the market. Just in the last few days, BlackRock has accumulated approximately $132 million worth of Ethereum, indicating that ETH is increasingly recognized as a reliable asset with growing adoption potential.

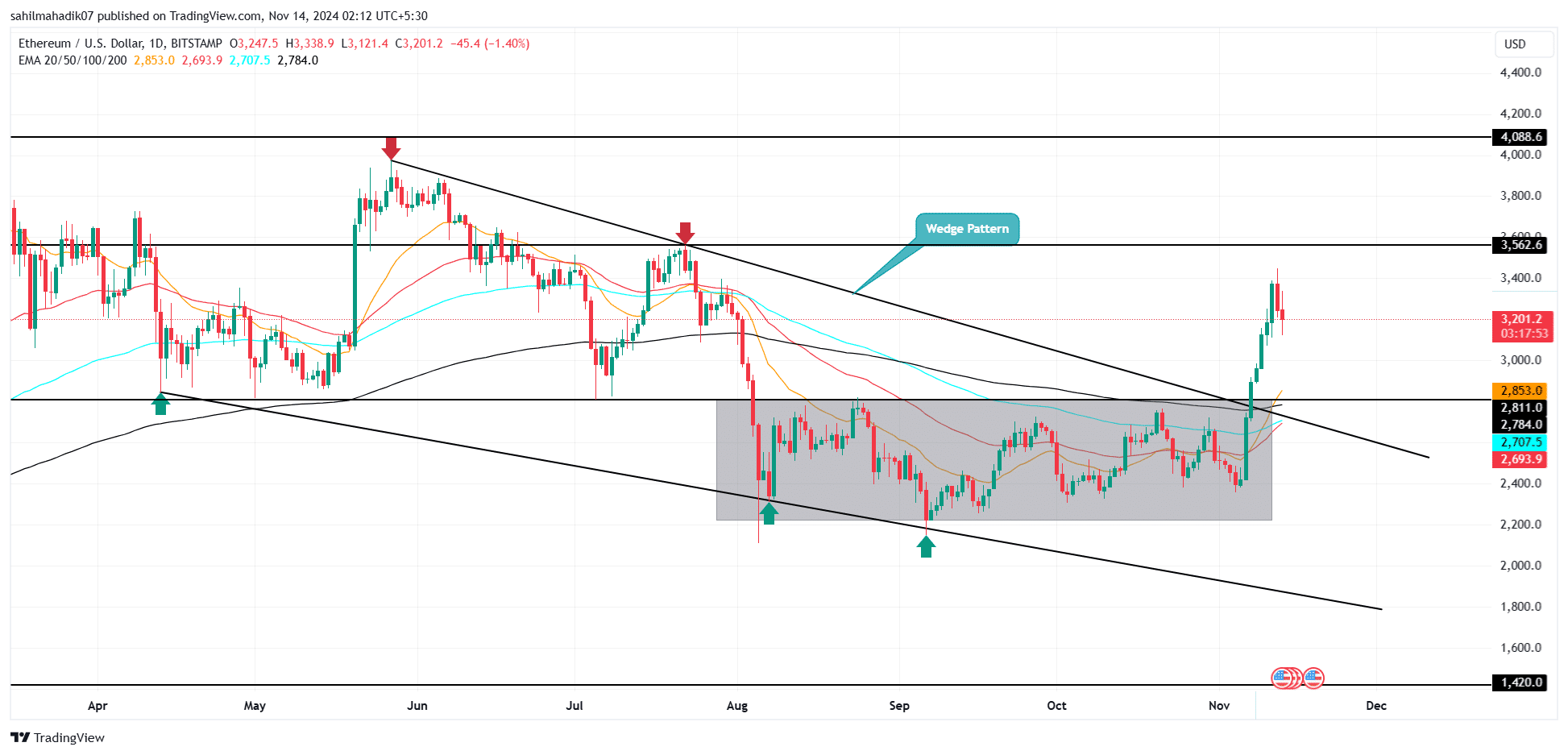

Ethereum Technical Analysis: Pathway to $4,000?

Ethereum Technical Analysis: Pathway to $4,000?

From a technical perspective, Ethereum appears to have broken out of a descending wedge formation, typically a bullish indicator. A recent surge to $3,177 suggests that a path toward $4,000 could be forming. However, every rally requires healthy corrections; this current pullback may simply be part of that necessary adjustment phase. Despite short-term fluctuations, the long-term upward trend for Ethereum remains clear.

The Road Ahead: Will Ethereum Reach $4,000?

Ethereum’s future looks bright, supported by growing confidence among large investors and a positive market sentiment. For those navigating these volatile waters, the key lies in watching for strong support levels. If ETH consolidates at the right levels, $4,000 may no longer be a distant target. As always, investors should perform their own due diligence given the inherent risks of crypto markets.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Ethereum Technical Analysis: Pathway to $4,000?

Ethereum Technical Analysis: Pathway to $4,000?