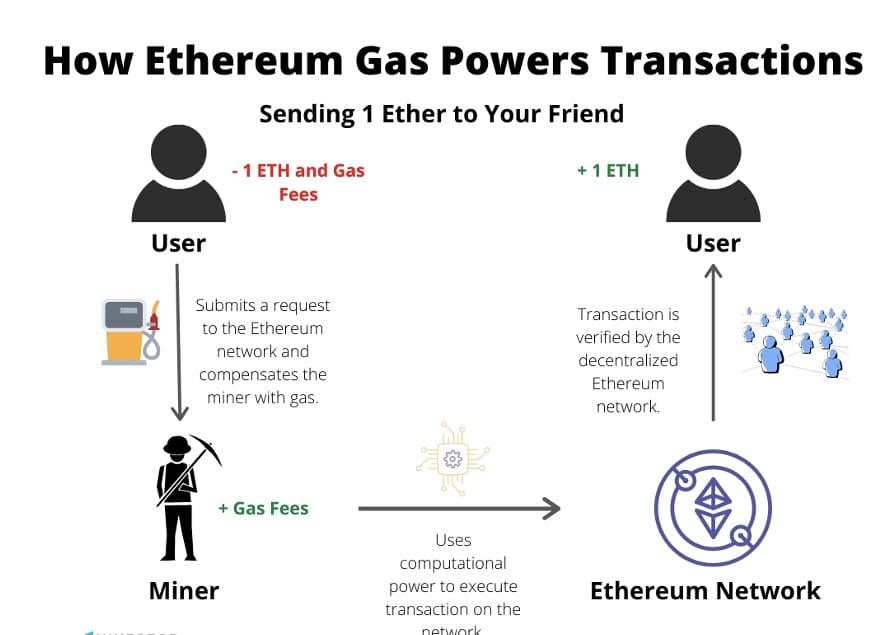

The crypto media outlet reports that the Ethereum gas fees have risen by an incredible 498% over the last two weeks, confirming that there has been strong on-chain traffic on the Ethereum network. Some of the reasons for the increase in Ethereum gas fees include activity in decentralized exchanges, increase in Ether transfers and lending platform rates.

Ethereum Gas Fees Soaring

Compared to the monthly average, between September 16 and 26, Ethereum gas fees approximately doubled, and the median reached $1.69, from $0.09 at the start of the month. This has been directly attributed to the higher uptake of Ethereum gas fee costs, particularly due to the trading volumes across DEXs, lending platforms, and DApps within the network.

Coinbase’s analyst David Duong commented on that and said, “The increase in Ethereum gas fees correlates with growing DEX traffic, especially Ether transfer and lend such platforms as Aave.

In addition, Ethereum gas fees also rose up on 9% of week-on-week growth in decentralized exchange volumes and total Ether transfer volume was up 17% week-on-week exerting further pressure on transactions. Using the data from Gashawk, a blockchain efficiency firm, proved that number of Ethereum gas fees varied between 30 and 40 gwei multiple times during the past week, which is evidence to the volatility of the transactions’ demand.

Aave and USDC Lending See Increased Demand

Higher Ethereum gas fees are also accompanied by rising interest in lending platforms, for example Aave, where deposit rates for USDC (USD Coin) have grown from 3.5% to 4.5% over the past two weeks. This rise in rates has made there to be higher leverage in the network as more and many people rush to the social media platform to invest.

David Han, another Crypto analyst, said: Core product market rates such as lending rates have been higher and have contributed to some of the ethereum gas fees. Leverage also translates to higher transaction costs on the Ethereum network.”

While lending platforms and Ether transfers are responsible for raising Ethereum gas fees even higher, the explosive growth of decentralized applications (DApps) has only worsened the situation. From data obtained from DappRadar, it was noted that dApps saw nearly a $2 billion daily trading surge, creating a trading volume of $3.6 billion within 24 hours; NFTs recorded a 17% volume surge.

Ether Burn Rates Increase as Network Usage Increases

In addition to increasing Ethereum gas fees users are now burning larger quantities of Ether as part of their fee calculations. The total Ether fees burned per day rose by over 900% between September 14 and September 24 to 2,097 ETH. This fee burn, included as part of the Ethereum network’s ‘London’ upgrade, is the process of regularly and automatically destroying Ethereum in the process, which may even have deflationary tendencies inside the network.

Even with these new higher fees and Ether burning, Ethereum is still below key technical levels of resistance. Until September 29, Ether (ETH) had not yet climbed back above its 100-day and 200-day exponential moving averages (EMA) at $2,770 and $2,864, respectively. Getting out of these levels is imperative for a sustainable recovery of Ether’s price.

However, on the bright side, the Ethereum gas fees have not retreated investors’ interest away from Ethereum. Investment products linked to Ethereum have emerged more attractive after five straigh that saw Ethereum recording a negative outflow in terms of investment products. According to crypto sources, Ethereum funds received a net of $87 million in by September 27. This was mainly led by spot Ethereum exchange-traded funds (ETFs), and the asset category raked in $58.7 million on the same day.

Conclusion: The Path Forward for Ethereum

Ethereum network has witnessed significant growth recently, and the increase in Ethereum gas fees is the demand for the decentralized financial services and applications. Although the increased onchain activity results in higher transaction fees it also indicates a healthy ecosystem with increasing usage.

Now and in the future, market analysts encourage that Ethereum’s price swings and network activity rely on the ability to address scaling and congestion concerns. Thus, they are going to experience an increase in the Ethereum gas fees still required in the periodically developing network of the project.

Ethereum gas fees may continue to be used to forecast the state of the Ethereum network and the levels of activity in the upcoming weeks thanks to the increasing interest in decentralized finances (DeFi), as well as other decentralised applications (DApps). Keep following TheBITJournal and keep an eye on the changing cryptocurrency market and trends.

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!