Beginning 2025 strong, Ethereum-the second largest cryptocurrency in terms of market capitalization-is in the firing line for retail and institutional buyers after a blast up to $3,380. Despite bulls making good strides in the entire market, recent whale moves, as well as other indicators, are suggesting short-term volatility. Thus, we shall look further at the price action by Ethereum, whale movement, and network trends to paint a wider picture.

Ethereum Price and Whale Moves

Analysts report that Ethereum’s move to $3,380, up 4.6% in 24 hours, was backed by $26.2 billion in trading volume. At the time of this writing, Ethereum’s market cap stands at $411.09 billion, showing clear investors’ sentiment.

However, recent whale activity has added some complexity to Ethereum’s price picture. A big whale reportedly deposited 20,000 ETH, $67.6 million, into Kraken. This follows a pattern of large transfers from the same whale who has been interacting with Kraken since March 2024.

This type of whale activity has preceded many periods of volatility in the past. Of course, many large deposits introduce sell-side liquidity and can take the price lower, but it’s not a hard and fast rule; a lot depends on the macro environment and sentiment at the time.

ETH’s price has been volatile and resilient so far this year, ranging from $1,500 to $4,500. The recent run tested the $3,400 resistance. If this level breaks, it could set up ETH to test the $3,500-$3,600 range in the short term.

On the flip side, if it can’t continue higher, it could retrace the $3,200-$3,100 area. Of note, Ethereum is above its 50-day and 200-day moving averages, so the trend is up for the cryptocurrency.

Other indicators like Fibonacci retracement levels agree with this and $3,400 is a key level for Ethereum’s next move.

Network and Fundamentals

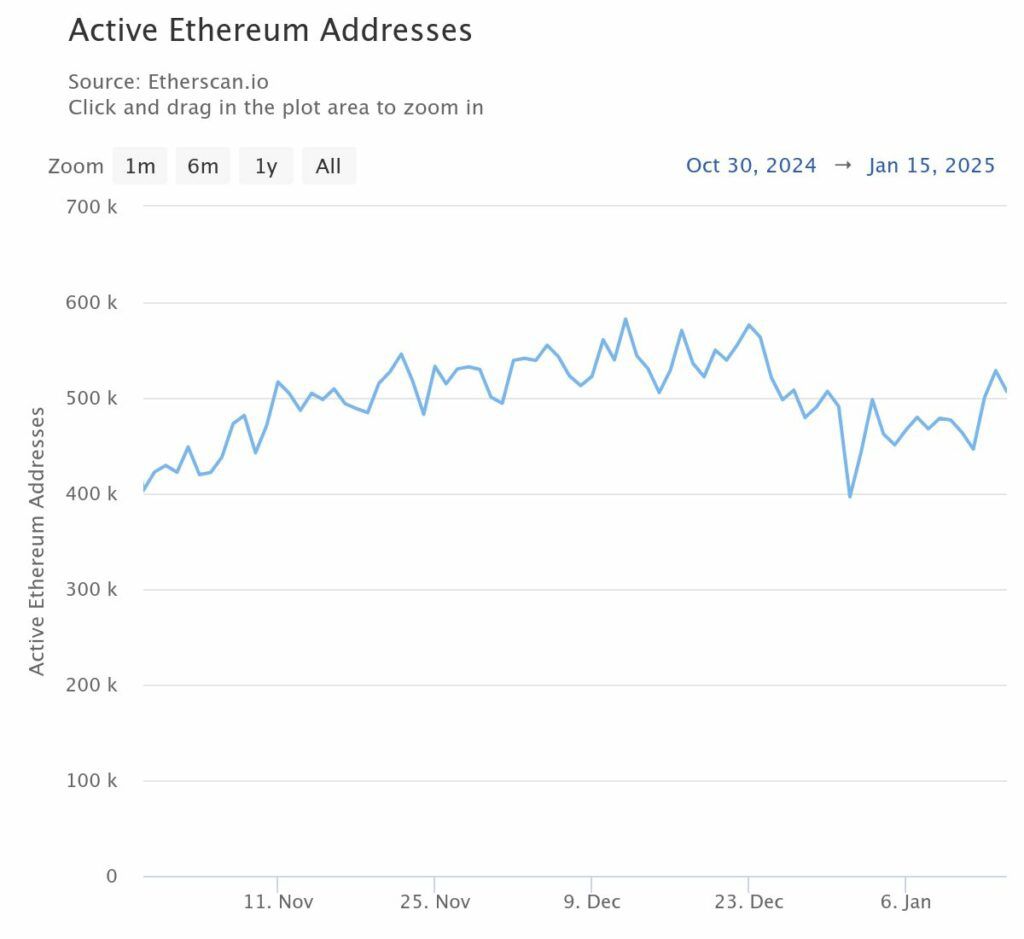

Ethereum’s network health is a key factor in its price. On-chain data shows a steady increase in active addresses which are now around 400,000 daily.

Increasing active addresses have also coincided with price runs and reflect increased demand for and usage of the network. Ethereum’s move to $3,380 was accompanied by a spike in active addresses so the connection between network activity and price is clear.

Additionally, Ethereum’s deflationary tokenomics from the fee-burning mechanism triggered by EIP-1559 and increasing staking further solidifies the long-term value proposition. Together, they make for a strong network that will keep investor confidence high.

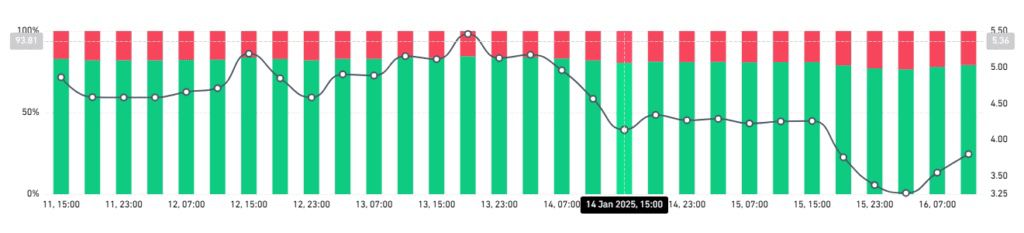

Derivatives and Open Interest

Ethereum’s open interest in the derivatives market has been wild, showing lots of activity and leverage. At the time of writing, Ethereum’s OI across major exchanges was $1.52 million, a big increase from last week. OI spikes usually occur before big price action as it shows increased market participation. New positioning by traders expecting volatility will determine Ethereum’s short-term direction.

If buying pressure holds, then the market may see a short squeeze, and ETH could go up. If it drops unexpectedly then it could be liquidations that will accelerate the drop.

Market Sentiment and MVRV

Market sentiment for Ethereum is also reflected in the Market Value to Realized Value (MVRV) ratio, which shows investor behavior. MVRV for long-term holders shows large unrealized profits, so it’s bullish.

At peaks in the MVRV ratio, local tops in price often occur because long term holders take profit and introduce sell pressure. Short-term holders should look for declining MVRV ratios to buy, as it means potential undervaluation.

Currently, MVRV for Ethereum is at critical levels for long-term holders to make a profit. This may extend the correction in the short term, but overall, it’s positive.

Broader Implications and Future

Ethereum’s 2025 will be determined by the interplay of internal and external factors:

- Macroeconomic Events: Central bank policy changes and inflation trends will continue to impact the broader crypto market. Ethereum’s correlation to these events shows it’s connected to the global economy.

- Bitcoin Correlation: With Bitcoin above $95,000 Ethereum is finally seeing the spillover effect of the bull market in the overall market. Bitcoin sets the tone for Altcoins, Ethereum included.

- Whale and Institutional: Whale behavior is clear from recent whale deposits and will be a key driver of ETH price. Institutional participation in Ethereum staking and DeFi will also add to demand.

In the long term, the future of Ethereum is further solidified by its strong dev ecosystem and innovation. In fact, proof-of-stake transition on the network and scalability solutions like rollups makes the case even stronger for users and devs.

Conclusion: Ethereum’s Future

Ethereum’s bounce to $3,380 showed the market is strong and resilient. However, high whale activity and increasing OI is short-term uncertainties. Overall it’s still bullish. $3,400 is major resistance and will either extend to $3,500-$3,600 or force a drop to $3,200 and $3,100.

With strong network activity, deflationary tokenomics, and growing staking opportunities, Ethereum is set to grow in 2025. However, traders and investors should be aware that market sentiment and external factors will still determine its path.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What caused Ethereum’s recent price surge to $3,380?

The high price of ETH could be explained by weaker-than-expected CPI data, strong trading volumes, and generally high market confidence. Whale dynamics, such as the deposit of 20,000 ETH to Kraken yesterday, have also possibly contributed to the short-term price action.

2. What are the key support and resistance levels for Ethereum?

Ethereum’s immediate resistance is at $3,400, with $3,500-$3,600 range if the momentum continues. Support is at $3,200-$3,100 if there’s a pull back.

3. How do whales affect Ethereum’s price?

Whale deposits bring in sell-side liquidity and often create short-term price corrections. Though not always a tell of the direction of the market, it should be looked at in conjunction with the bigger picture.

4. How does network activity impact Ethereum’s price?

Active addresses with higher demand usually mean more utility and, therefore, price increase in the network; less activity means less participation and possibly lower ETH price.