According to Matthew Sigel, Head of Digital Assets Research at VanEck, Ethereum’s increased dependence on layer-2 networks (L2s) threatens the asset’s long-term price direction. If things continue in the same direction, Ethereum’s current trends could deliver a serious knock to its market cap, Sigel said. Earlier in an analysis, Sigel cautioned that Ethereum’s 2030 valuation estimates are at great risk to be significantly lowered.

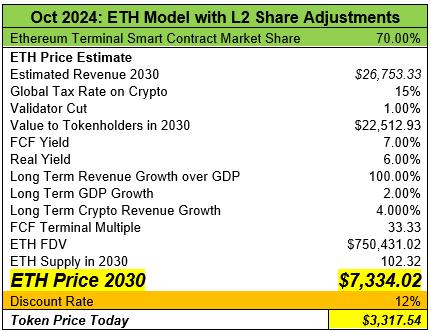

The original model by VanEck that gave an estimate of $22,000 for the price of Ethereum in 2030, might fall to just below 67% at about $7.3k. As Sigel said on X (Twitter), the drastic reduction is due to Ethereum L2s gaining more transaction revenue than they anticipated.

“Our initial assumption was a 90:10 split in favour of Ethereum over L2s. However, the reality is vastly different. Currently, the split is 10:90 in favour of Ethereum L2s,” Sigel said. This shift has strained Ethereum’s capturing value from L1 activity; the bulk of it is leaving for solutions like Optimism and Base.

Ethereum L2s Impact Ethereum’s Market Share

Ethereum Layer 2s are increasingly emerging as the secret sauce to drive down Ethereum transaction fees while scaling up and overloading the network. A more recent advancement, “Dencun”, enabled layer-2 networks to offer blobs as an ancillary storage option, enabling them to pack transactions together more cheaply and effectively.

The result is even more of the capacity balance being moved to Ethereum L2s at the expense of ETH mainnet transaction fees. According to Sigel’s interpretation, Ethereum has spent the months since Dencun, trending inflationary; a dynamic reversal of a trend that saw supply shrinking for most of 2018 as issuance trailed behind token burns on account of transaction fees.

According to ultrasound.money, the supply expanded by 318K ETH since mid-April—a worrying sign for those betting that Ethereum would continue to operate as an outright deflationary asset. Sigel warned that if Ethereum L2s continued to eat up transaction space, the network could find it hard to win back lost market share.

Potential Solutions: Fee Sharing and Radical Community Effort

Sigel, however, sees some hope on the horizon that Ethereum’s development community will react and revise the network’s roadmap accordingly. A suggested topic is a fee-sharing model between Ethereum mainnet and layer 2’s, supported by even Vitalik Buterin.

Buterin, who recently took to his blog to share his plans, stressed the importance of keeping a united ecosystem on Ethereum. “Ethereum should feel like one ecosystem, not 34 different blockchains,” Vitalik penned. Under this plan, trades would no longer move from one L2 directly to another, diminishing the need for monolithic actors or “hub” bridges.

The plan also underscores the importance of Ethereum L2s working with core net to ensure that more transaction revenue is preserved on Ethereum.

Institutional Perception and Price Struggle

It increasingly looks like not only Ethereum L2s are affecting price dynamics but that the underperformance of Ethereum against major tokens is mounting. In the last 12 months, Ethereum has been up a mere 65% compared to Bitcoin’s +135%, and an astounding Solana’s 517%.

A number of analysts suspect Ethereum’s price is reeling due to the weak performance of spot ETH ETFs. Kraken Head of Institution Tim Ogilvie similarly adds that “While Ethereum is a programmable blockchain and deflationary through fee burns, it doesn’t appeal to institutions as clearly as Bitcoin does.”

Even spot Ethereum ETFs have seen $160,000 in outflows since their launch in July, crypto reports show.

According to Ogilvie, institutional investors are still hesitant as there is not a very clear return story for them on staking Ethereum and the complexity of the myriad use-cases within DeFi or Ethereum L2s.

The Road Ahead for Ethereum

Right now, there appears to be a critical time for Ethereum. If the core network of Ethereum is not able to restore dominance in relation to transaction revenues, then this may undermine an element of the value proposition over time. Ethereum will have to scale efficiently and improve fast or be facing competition from the L2s and multiple other blockchains by 2030, with price targets plunging down below $7,300

The ability of the community to roll out innovative solutions like fee-sharing models as well as executing strategic roadmap changes will be key in making sure that Ethereum keeps its dominant position within this dynamic blockchain ecosystem.

The BIT Journal provides updates on how the crypto world is evolving, stay tuned!