Ethereum price is still one of the most innovative and valuable assets in the cryptocurrency market. Ethereum is the spine of decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts, and its future goes hand in hand with the wider development of blockchain technology.

As of May 2025, around $2,342.29, Ethereum is pricing in a volatile market and continued technical improvements, as well as increasing institutional involvement. In this article, we can find a detailed Ethereum price analysis, with information regarding its current trends, its May 2025 forecasts, and end of the year predictions, supported by data from Binance, Changelly and Forbes.

Current Market Snapshot (as of May 2025)

| Metric | Value |

| Current ETH Price | $2,342.29 |

| Market Capitalization | $281 Billion |

| 24-Hour Trading Volume | $10.6 Billion |

| Circulating Supply | 120.2 Million ETH |

| All-Time High | $4,891.70 (Nov 2021) |

Ethereum price has corrected off its all-time high quite considerably. Nevertheless, most analysts see this as consolidation before breakout in the latter part of 2025.

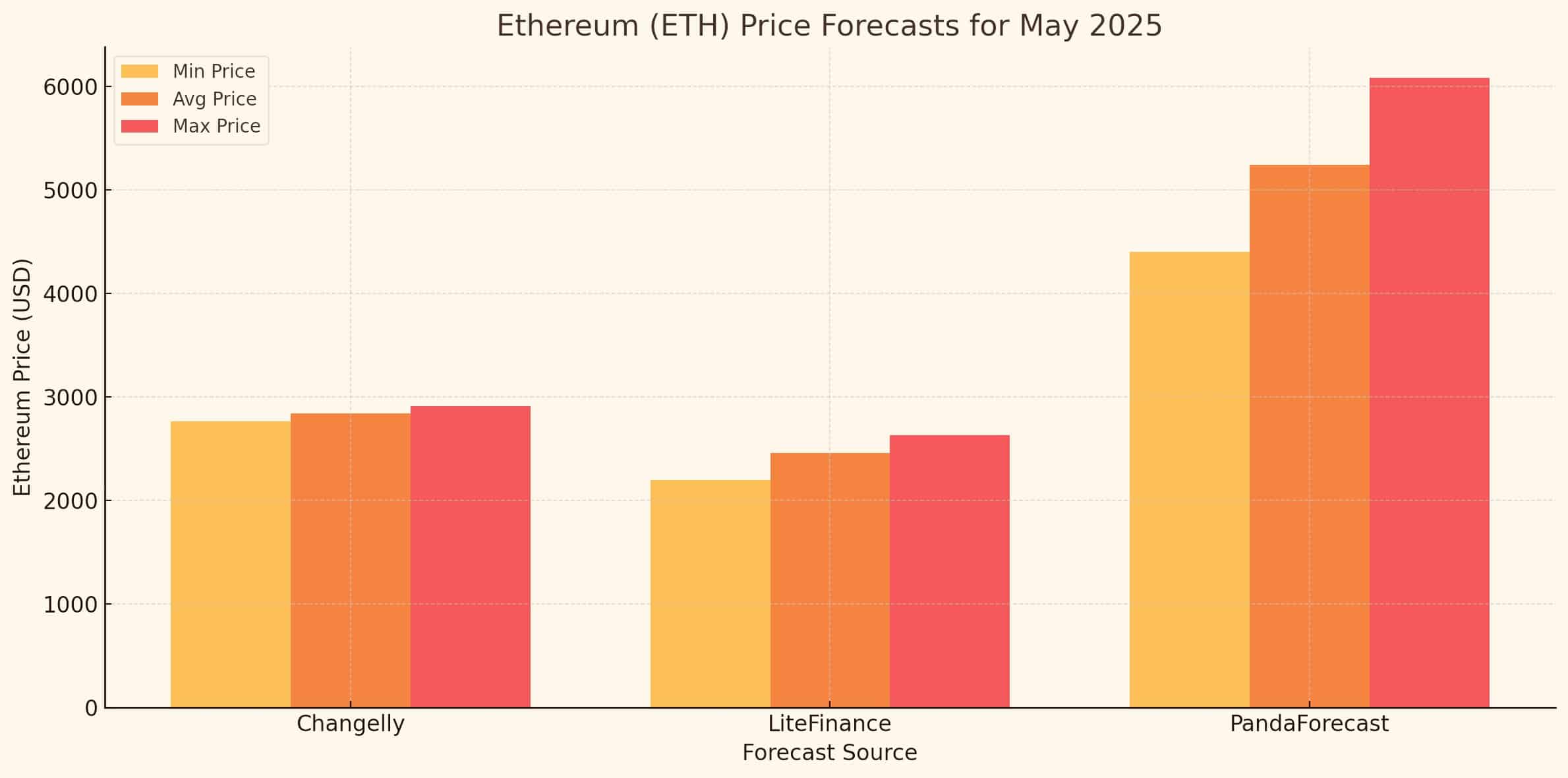

May 2025 Ethereum Price Forecast

ETH prices in May 2025 present a different view in varied forecasting platforms as regards to technical indicators and macroeconomic factors.

Table: Ethereum May 2025 Forecasts

| Source | Minimum Price | Average Price | Maximum Price | Methodology |

| Changelly | $2,767.75 | $2,839.48 | $2,911.20 | Technical analysis and AI models |

| LiteFinance | $2,198.00 | $2,460.00 | $2,632.00 | Trend and support level analysis |

| PandaForecast | $4,404.00 | $5,243.00 | $6,081.00 | Long-term momentum projections |

Changelly and LiteFinance are fairly bullish, while PandaForecast forecasts an aggressive rally, which is expected to take place halfway through 2025.

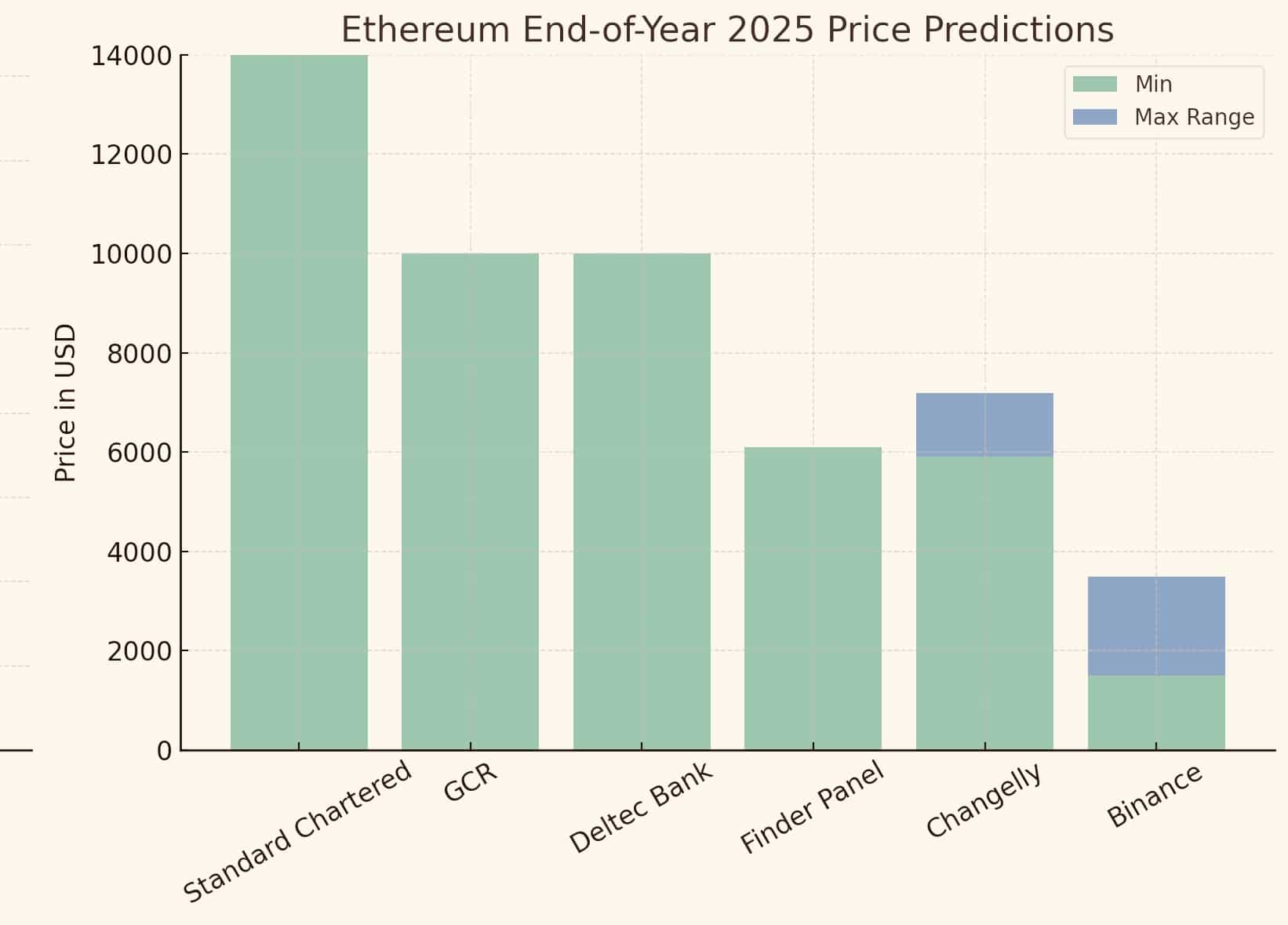

Future Ethereum Price Projections for End 2025

Ethereum’s long-term horizon is partly optimistic, but very guarded, thanks to anticipated institutional take-up, that of Layer 2 scaling solutions, and possible ETFs integration.

Table: Ethereum Price 2025 End-of-Year Predictions

| Analyst/Institution | Predicted Price (End of 2025) | Notable Assumptions |

| Standard Chartered | $14,000 | ETH ETFs approved and high DeFi usage |

| GCR (crypto investor) | $10,000 | High Ethereum adoption across finance |

| Deltec Bank | $10,000 | Proof-of-stake transition boosts valuation |

| Finder Panel | $6,105 | Average of 50 crypto experts |

| Changelly | $5,907.41 – $7,194.28 | Bullish scenario with positive momentum |

| Binance | $1,500 – $3,500 | Regulatory headwinds and slow growth |

Factors Driving Ethereum Price in 2025

Factors Driving Ethereum Price in 2025

Proof-of-Stake (PoS) and Energy Efficiency

Owing to the switch to PoS, Ethereum’s energy consumption has been slashed by well over 99%, and it has drawn in ESG-conscious investors while elevating ETH’s stature as a sustainable asset.

Ethereum Layer 2 Upgrades

Alternatives such as Arbitrum, Optimism, and zkSync are becoming increasingly popular and easing the queues on the mainnet and saving the gas—crucial for DeFi and NFTs.

Institutional Investment and ETF Approval

The recent authorization of Ethereum spot ETFS in several countries, including Canada, rumours of U.S approval, may floodgates for institutional capital.

Smart Contract Use Cases

The extensive use of Ethereum for the real-world tokenizing (e.g., real estate, bonds) might actually add a lot of demand for ETH – the native asset that would be needed for transaction fees and staking.

Regulatory Landscape

By the year 2025, we should be seeing a more mature and more globalized regulatory environment. The stance that the SEC of the U.S. takes over the staking services in ETFs is confusing, but some changes can be detected.

Risks to Consider

Although, indicators point towards bullish potential, potential risks are as follows: <

- Scalability challenges: Even though it has experienced Layer 2 growth, Ethereum remains competing with faster blockchains such as Solana or Avalanche.

- Regulatory crackdowns: The hostility from government to DeFi protocols can limit ETH’s utility.

- Market volatility: ETH can be impacted predictably by general crypto volatility caused by macroeconomic-states and Bitcoin’s price trends.

Analyst Insights and Community Sentiment

Trained trader Michael Van de Poppe feels “Ethereum price can reach $7,000+ at the end of the year if it succeeded in breaking the $3,500 resistance by Q3 2025.”

Former Goldman Sachs executive, Raoul Pal is long on Ethereum and is of the opinion that institutional adoption will be the “rocket fuel” ETH needs.

In social media, Ethereum price keeps getting positive sentiment from DeFi builders and NFT creators that depend on Ethereum functionality.

Conclusion: What Lies Ahead for Ethereum in 2025?

Ethereum price is on the intersection of innovation and maturity. Its move to proof-of-stake, adoption of Layer 2 scaling solutions, development of institutional capital through ETFs stand as the foundations of a bullish 2025 case. Despite existing risks—especially regulatory clarity and scalability bottlenecks—it is Ethereum’s strong developer ecosystem and practical usage that provide contentegenous value in the long term.

Ethereum is one of the most priced crypto assets under the microscope, with predictions of price ranging from conservative valuations of $3000 to aggressive goals nearing $14,000. Even if you are a long-term holder or a trader, tracking of Ethereum’s technological and regulatory changes will be important during the entire year of 2025.

FAQs: Ethereum in 2025

Q1: What is Ethereum used for?

Ethereum is a decentralized place for smart contracts, DeFi protocols, NFT marketplaces, and dApps. It acts as the structure for a lot of the blockchain world.

Q2: Would Ethereum be a good investment for 2025?

Although not financial advice, there are a lot of analysts who believe the ETH has good long term perspective because it is widely used and has ongoing upgrades. However risks such as regulation and volatility persist.

Q3: Can Ethereum overtake Bitcoin in 2025?

Although Ethereum has more use cases, the latter remains as the dominant store of value. A “flippening” is a possible scenario but unlikely by 2025 on the current trends.

Q4: How will the ETFs fit into Ethereum’s growth?

Spot ETFs could greatly expand institutional investments, resulting in new price catalysts, particularly if the U.S. becomes a signatory to countries, such as Canada, in its approval.

Q5: Will Ethereum gas rates ever decrease?

Yes. With the help of Layer 2 answers and protocol reforms such as Danksharding and Proto-Danksharding, gas fees should be reduced in time.

Glossary of Key Terms

Ethereum (ETH): A decentralized blockchain platform that supports smart contracts and dApps.

Proof-of-Stake (PoS): A consensus mechanism where validators stake ETH to confirm transactions.

Smart Contracts: Contract types where the terms of contracts are written in code itself, i.e, self-executing contracts.

Layer 2: Ethereum-based solutions to enhance the scalability and lower the cost.

DeFi: Decentralized finance applications that do not use traditional intermediaries.

NFT: Non-fungible tokens that represent unique digital or physical properties and assets.

Gas Fees: Eth transaction fees on Ethereum paid in ETH.

ETF (Exchange-Traded Fund): A tradable investment fund that owns assets like ETH.

References

Ethereum (ETH) Price Prediction 2025 | Binance

Ethereum Price Prediction 2025–2040 | Changelly

Ethereum Price Prediction by Analysts | Forbes

Ethereum Price Forecast 2025 | LiteFinance

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!’