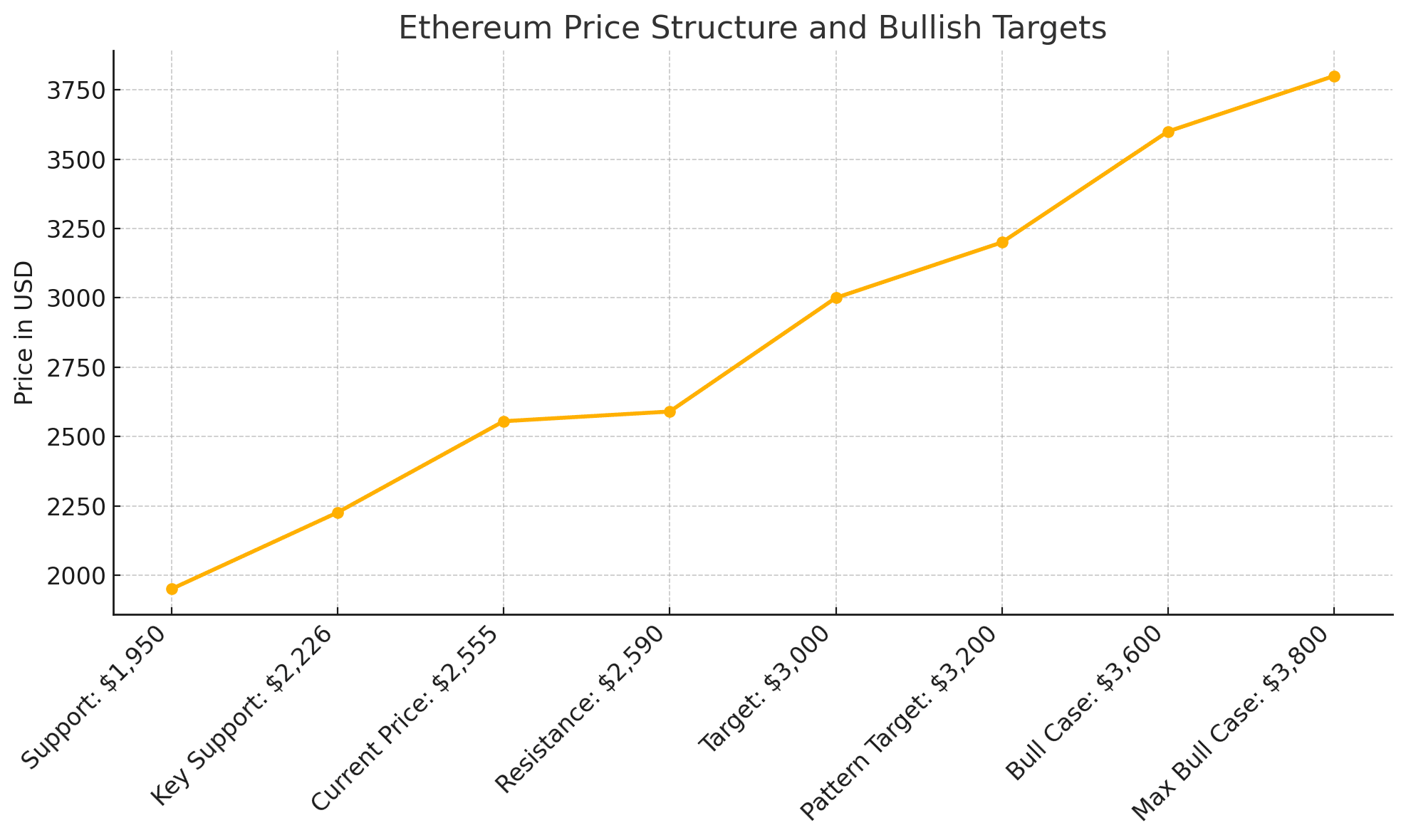

Ethereum (ETH) is consolidating just below major resistance after reclaiming the mid-$2,500s. A developing harmonic “Butterfly” pattern suggests that the market may complete one final corrective leg before launching a new advance toward the $3,200 zone. With spot-ETF inflows hitting fresh records and corporate treasuries rotating into ETH, both technical and fundamental triggers are lining up for the next decisive move

From Post-Merge Slump to Institutional Magnet

After bottoming near $1,500 in late-2024, ETH rallied more than 70 % on the back of deflationary issuance, the Dencun and Pectra upgrade road-map, and the approval of U.S. spot-Ether ETFs. The bid intensified in Q2 2025 as ETFs accumulated over 61,000 ETH in eight straight weeks of net inflows, transforming Ethereum into the year’s top institutional allocation play.

Harmonic Butterfly Flags a $3,200 Ethereum Price Objective

Technical analysis of the daily chart shows Ethereum price kissing the 0.618 Fibonacci retracement at $2,590, exactly where the midpoint of a year-long ascending channel resides.

According to crypto.news, the pattern’s leg C could pull back as deep as $2,226, a level that coincides with channel support, before a leg D thrust targets $3,200, the upper boundary of the structure. Volume confirmation remains the missing ingredient, yet pattern symmetry argues that the next impulsive wave will carry further than the last.

Accumulation and Treasury Rotations Underpin the Structure

On-chain data show sustained exchange outflows and large wallet accumulation. Bit Digital, for example, sold 280 BTC to pivot its treasury into 100,000 ETH, highlighting a broader trend of firms diversifying reserves away from Bitcoin and toward yield-bearing staking assets.

Meanwhile, demand from the eight active spot-Ether ETFs continues to absorb supply; Foresight News notes eight consecutive weeks of inflows despite choppy Ethereum price action, fuel the market did not have during the 2022-2023 bear cycle.

Support-and-Resistance

| Metric | Value |

|---|---|

| Spot price (8 Jul 2025 UTC) | $2,555 |

| 24-hour range | $2,521 – $2,598 |

| Immediate support | $2,500 |

| High-time-frame support | $2,226 |

| Key resistance | $2,590 |

| Bullish target | $3,200 |

“Healthy Pullback, Then Ascent”

Forex24 Pro strategists project a short-term dip toward $2,635 before a larger breakout, echoing the Butterfly thesis. Meanwhile, Ainvest research argues that a clean reclaim of $2,700 would trigger algorithmic buys aimed at the $3,000 handle; reclaiming that number historically unlocks 15 %–20 % upside extensions.

Ryan Lee, chief analyst at Bitget Research, adds that

“ETF-driven inventory absorption and corporate treasuries chasing staking yield create a structural bid that could catapult ETH to $3,600 by year-end if macro conditions remain benign.”

Ethereum Price Prediction Scenarios

Base case: A dip toward $2,400–$2,500 completes leg C. A surge in spot volume then drives Ethereum price to the $3,200 objective by late Q3.

Bull case: Immediate breakout above $2,590 nullifies the pullback thesis and accelerates toward $3,600 to $3,800 on ETF inflows.

Bear case: Failure to hold $2,226 exposes $1,950, invalidating the Butterfly and delaying upside until Q4.

Overview

Ethereum price sits at a technical crossroads. The harmonic pattern implies that a controlled retracement could be the launchpad for a fresh advance while macro tailwinds, steady Fed policy, and persistent ETF buying continue to firm the bid. Should the $2,590 ceiling give way on strong volume, traders may witness the long-awaited run toward the $3,200 region, with deeper targets unlocked if institutional demand maintains its current trajectory.

Frequently Asked Questions

What is a harmonic Butterfly pattern?

A Butterfly is a four-leg price structure using Fibonacci ratios to forecast a reversal zone; in this case, the pattern eyes $3,200 as leg D.

Why is $2,590 such an important resistance?

The level matches the 0.618 Fibonacci retracement of the 2025 range and the midpoint of Ethereum’s year-long ascending channel, making it a confluence barrier.

How do ETF inflows affect price?

Spot-ETF issuers must buy physical ETH to back new shares; sustained inflows remove liquid supply, raising the equilibrium Ethereum price over time.

Glossary of Key Terms

Harmonic pattern

A chart pattern based on Fibonacci ratios that helps forecast potential reversal zones in price movements.

Butterfly

A specific type of harmonic pattern that indicates a reversal zone after a corrective wave is often used to identify the end of a trend and the start of a new move.

Fibonacci retracement

A technical analysis tool that uses horizontal lines to indicate areas of support or resistance at key Fibonacci levels before the price continues in its original direction.

Ascending channel

A bullish chart pattern was formed by drawing two upward-sloping trendlines that connect higher highs and higher lows, indicating continued price growth.

Support

A price level where a cryptocurrency tends to find buying interest, preventing it from falling further.

Resistance

A price level where selling pressure tends to emerge, preventing further upward movement in price.

Spot ETF

An exchange-traded fund that holds the actual underlying asset—in this case, ETH—allowing investors to gain exposure without owning crypto directly.