Ethereum (ETH) has long been regarded as the backbone of decentralized finance (DeFi) and smart contract applications. However, following a 23.6% crash that sent Ethereum price plunging below $2,400, investors are left questioning whether it can regain its former glory and reach $4,000 or beyond.

According to media reports, the global trade war, triggered by U.S. President Donald Trump’s new tariffs on China, Canada, and Mexico, has led to a widespread crypto market sell-off, sending Ethereum price tumbling to its lowest level in nearly five months. But despite this turbulence, whales and long-term investors are accumulating ETH, hinting at a potential rebound.

So, will Ethereum price recover, surpass $4,000, and even hit new all-time highs? Let’s analyze Ethereum’s latest market performance, expert opinions, price predictions for 2025-2030, and key catalysts driving its future.

Ethereum’s Market Overview (February 2025 Update)

📉 Current Price: $2,610.23

📊 24-Hour Low/High: $2,331.05 / $3,118.17

⚠️ Market Sentiment: Bearish (following Trump’s trade tariffs)

🔄 24-Hour Trading Volume: Over $45 billion

Why is Ethereum’s Price Dropping?

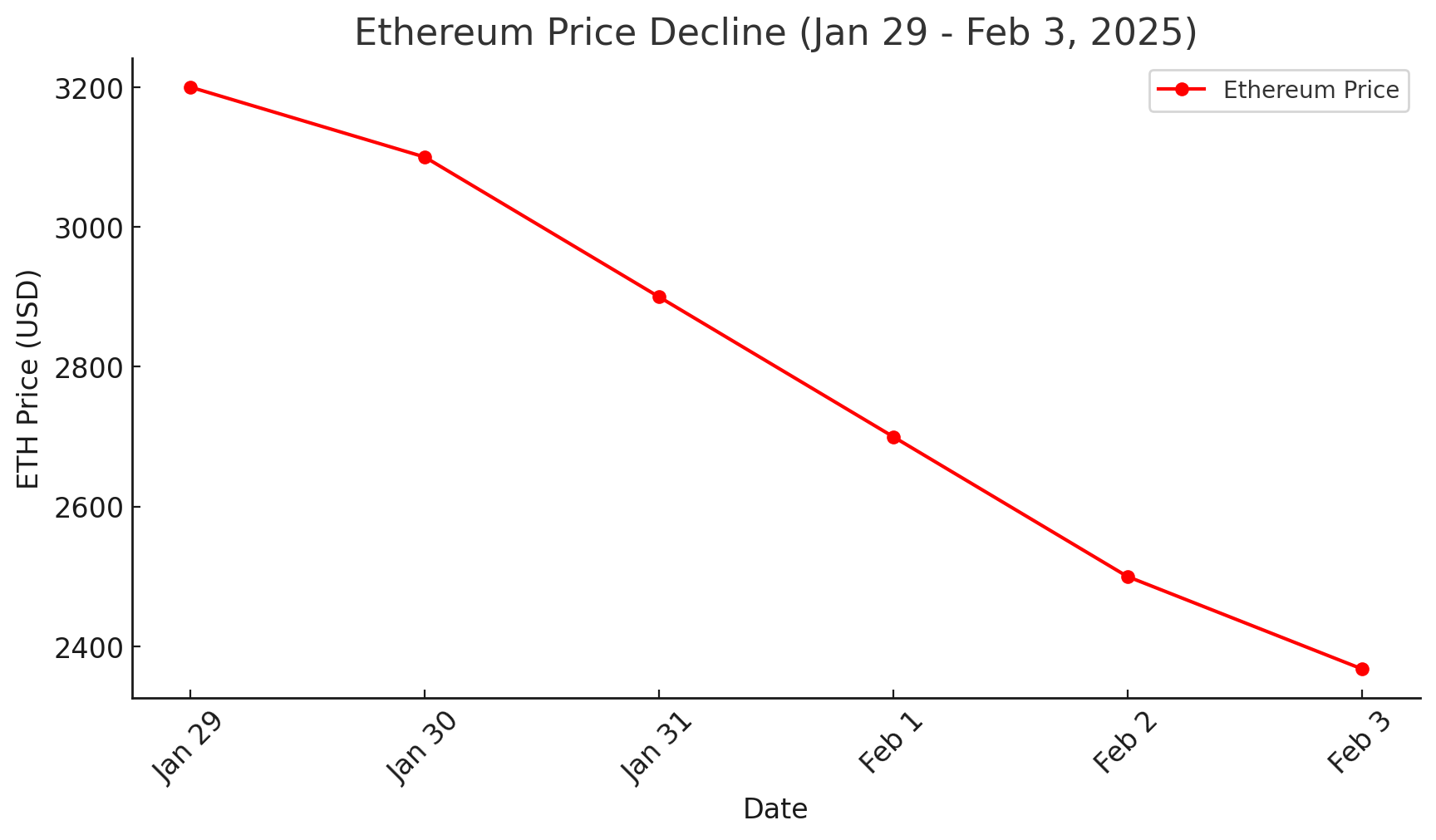

Ethereum price recently suffered a steep 23.6% drop, hitting $2,368 on February 3, 2025, marking its biggest liquidation event in two years:

✅ $475.72M in ETH long positions liquidated

✅ $127.78M in ETH short positions liquidated

✅ Ethereum’s open interest fell by 27% to $23.36B

According to crypto analyst MaxBecauseBTC, this is the largest liquidation event since the March 2020 COVID crash, indicating that ETH could be oversold and ready for a recovery.

Ethereum’s Technical Analysis: Are We at the Bottom?

Ethereum is now trading below both the 50-day and 200-day moving averages, signaling strong bearish momentum. However, key indicators suggest that a reversal could be near.

📌 Key Technical Indicators:

- Aroon Indicator: Aroon Down at 100%, Aroon Up at 0% → Suggests further downside risk.

- Relative Strength Index (RSI): Currently oversold, meaning a potential bullish reversal could be imminent.

- Support Levels: $2,200, $2,000

- Resistance Levels: $2,750, $3,150, and $4,000

Crypto analyst Ali Martinez noted that Ethereum must hold the $2,750 support level to sustain its upward trajectory. If this support fails, ETH could dip further, but if it holds, a strong rebound toward $4,000 and beyond is possible.

Ethereum Price Predictions for 2025: Can ETH Reclaim $4,000?

Ethereum price’s short-term outlook remains uncertain, but analysts have projected various scenarios for 2025:

📈 Changelly Analysts: ETH price between $3,082 – $4,184, with a 73.5% return on investment.

📉 InvestingHaven: ETH could rise from $2,670 to $5,990, with an average of $4,330 in 2025.

🚀 Bitnation Forecast: ETH’s average price could reach $8,683.94 if institutional adoption increases.

💡 Key Takeaway: If ETH can recover above $3,000, $4,000 becomes a realistic target in 2025.

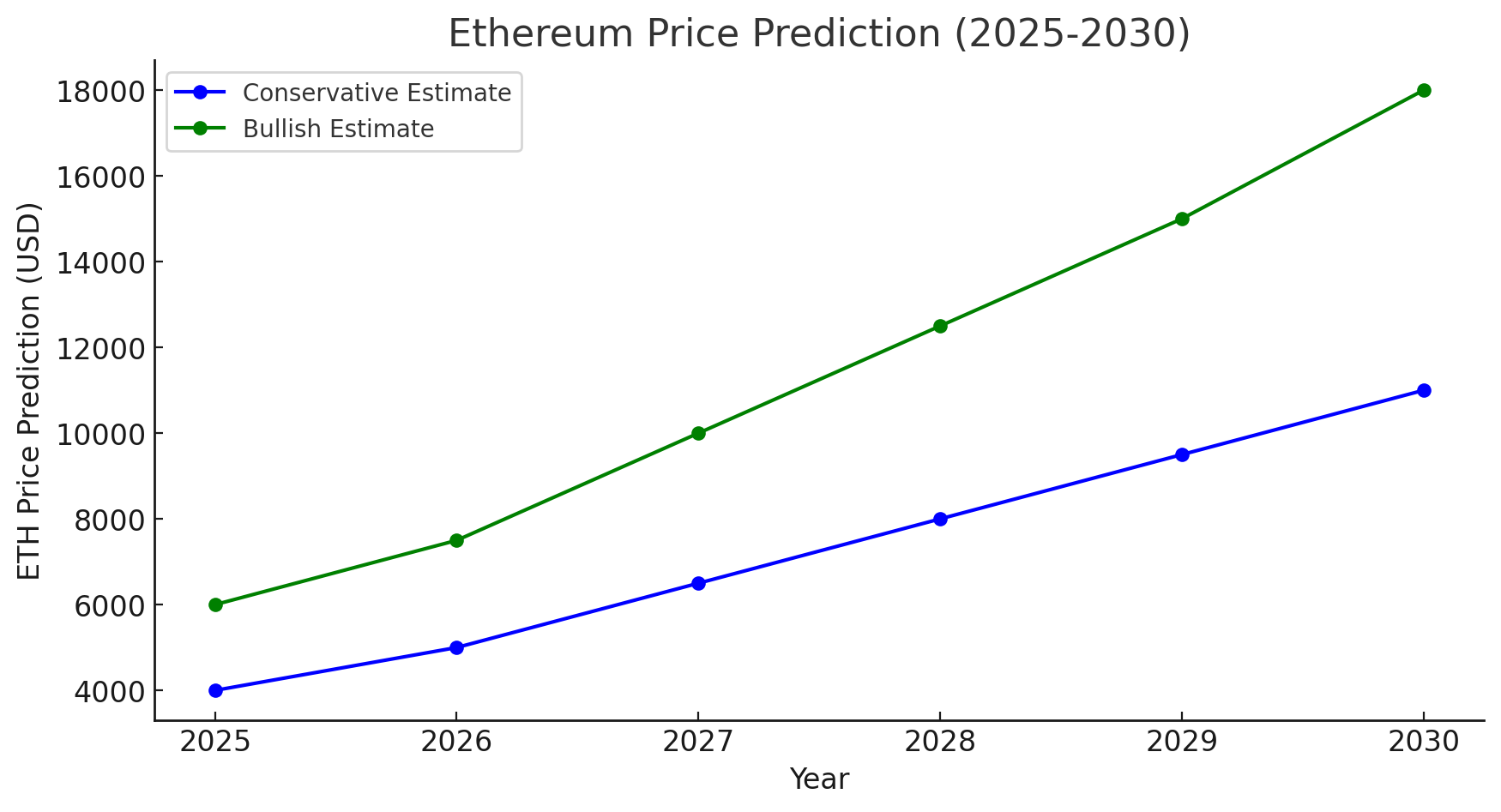

Ethereum Price Forecast 2026-2030: Could ETH Hit $10,000?

📊 Ethereum 2026 Price Prediction

- Conservative Estimate: $5,000 – $7,000

- Bullish Case: $10,000+

📊 Ethereum 2030 Price Prediction

- VanEck Prediction: If Ethereum dominates 70% of smart contract platforms, ETH could reach $11,800 by 2030.

- Goldman Sachs Forecast: Ethereum may outperform Bitcoin, given its vast utility and institutional adoption.

- Cointree Analysis: ETH could hit AU$67,565 (~$45,000 USD) by 2030.

🚀 Could ETH Surpass $10,000?

Yes—if Ethereum continues leading DeFi, NFTs, and Layer 2 scaling solutions. Its ability to process transactions efficiently and offer institutional staking rewards will be key factors in long-term growth.

Ethereum’s Key Catalysts: What Will Drive ETH’s Recovery?

Ethereum price’s ability to reclaim $4,000 and reach new all-time highs will largely depend on a series of key catalysts that shape its adoption, scalability, and investment appeal. The recent market downturn following global economic uncertainty has led to a sharp drop in Ethereum’s price, but the fundamentals behind Ethereum’s future remain strong.

Let’s dive into the major drivers that could propel Ethereum price back into bullish territory in the coming years.

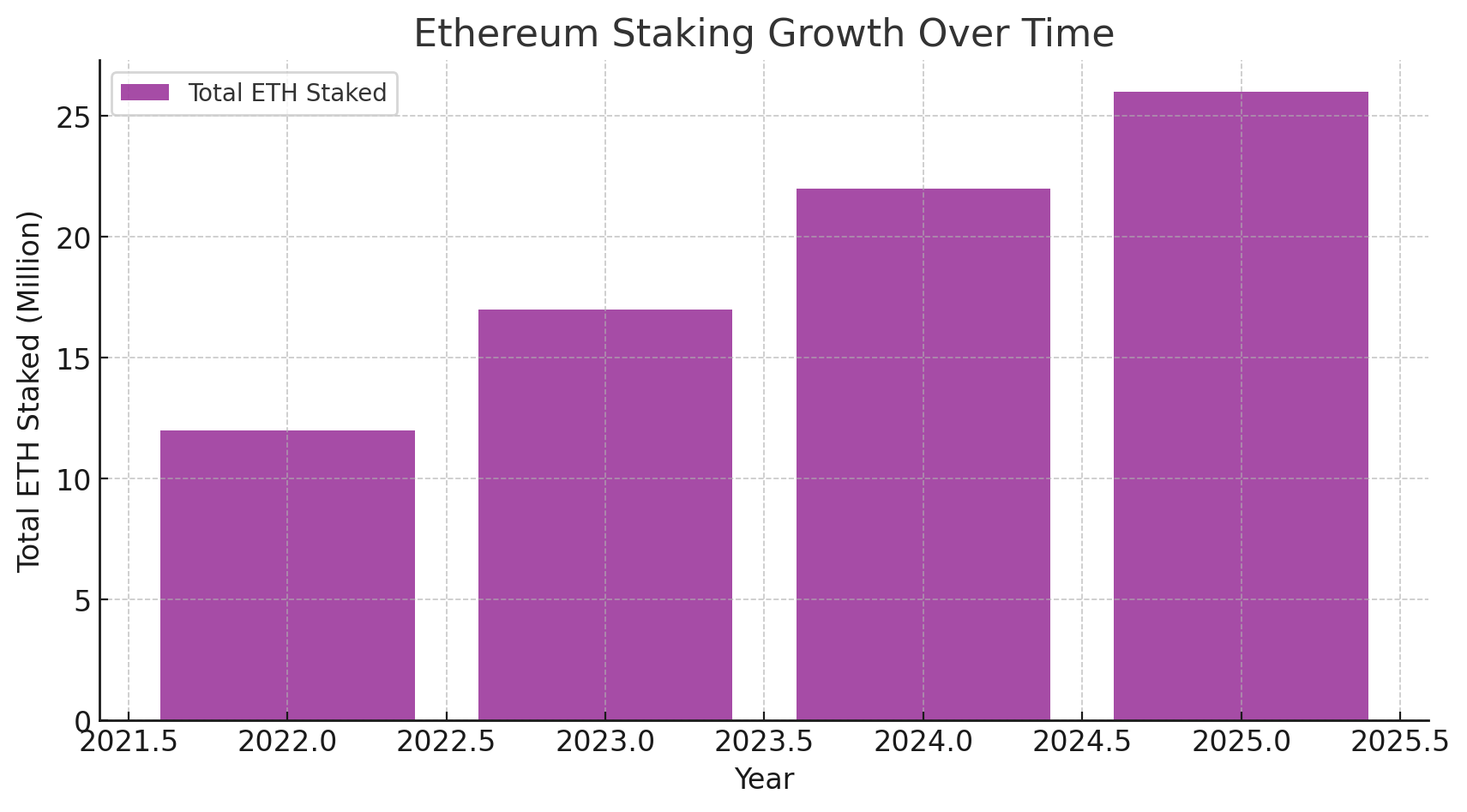

1️⃣ Ethereum’s Transition to Proof-of-Stake (PoS): A Game Changer for Efficiency & Adoption

Ethereum’s transition to Proof-of-Stake (PoS) from its original Proof-of-Work (PoW) consensus mechanism is one of the most significant upgrades in blockchain history. The shift, completed in September 2022 with “The Merge,” has transformed Ethereum into a more energy-efficient, scalable, and environmentally friendly blockchain.

Why Is PoS Important for Ethereum Price Recovery?

🔹 Massive Energy Reduction

- Ethereum’s energy consumption dropped by 99.9% post-merge, making it one of the most eco-friendly major blockchains.

- This change eliminates regulatory concerns over Ethereum’s environmental impact, making it more attractive for institutions and governments.

🔹 Stronger Security & Decentralization

- PoS improves network security by requiring validators to stake ETH rather than using energy-intensive mining.

- Ethereum now has over 26 million ETH staked, proving that investors believe in its long-term future.

🔹 Institutional Confidence & Staking Rewards

- Institutional investors prefer PoS chains because they provide consistent staking yields, offering a passive income stream.

- Ethereum’s annual staking rewards range between 4-6%, making it an attractive investment for hedge funds and asset managers.

Key Takeaway: Ethereum’s transition to PoS enhances security, scalability, and environmental sustainability, making it one of the strongest candidates for mainstream institutional adoption.

2️⃣ Layer 2 Scaling (Rollups & Sharding): Making Ethereum Faster & Cheaper

Ethereum’s biggest challenge has always been scalability and high gas fees. However, the network is undergoing a major transformation through Layer 2 scaling solutions and sharding, expected to fully roll out in 2025.

What Is Layer 2 Scaling & Why Is It Crucial?

🔹 Rollups (Optimistic & ZK-Rollups)

- Rollups batch transactions off-chain before settling them on Ethereum, reducing congestion.

- Optimistic Rollups (Arbitrum, Optimism) and ZK-Rollups (StarkNet, zkSync) make transactions cheaper and faster.

🔹 Sharding (Ethereum 2.0 Upgrade, Expected 2025)

- Sharding splits Ethereum into multiple chains, allowing it to process thousands of transactions per second (TPS) instead of just 15 TPS.

- Gas fees will be dramatically reduced, making Ethereum more developer-friendly.

Key Takeaway: If Ethereum successfully implements full sharding, it could rival Solana, Avalanche, and other fast blockchains, cementing its position as the top smart contract platform.

3️⃣ Institutional Adoption: The $10 Trillion Opportunity

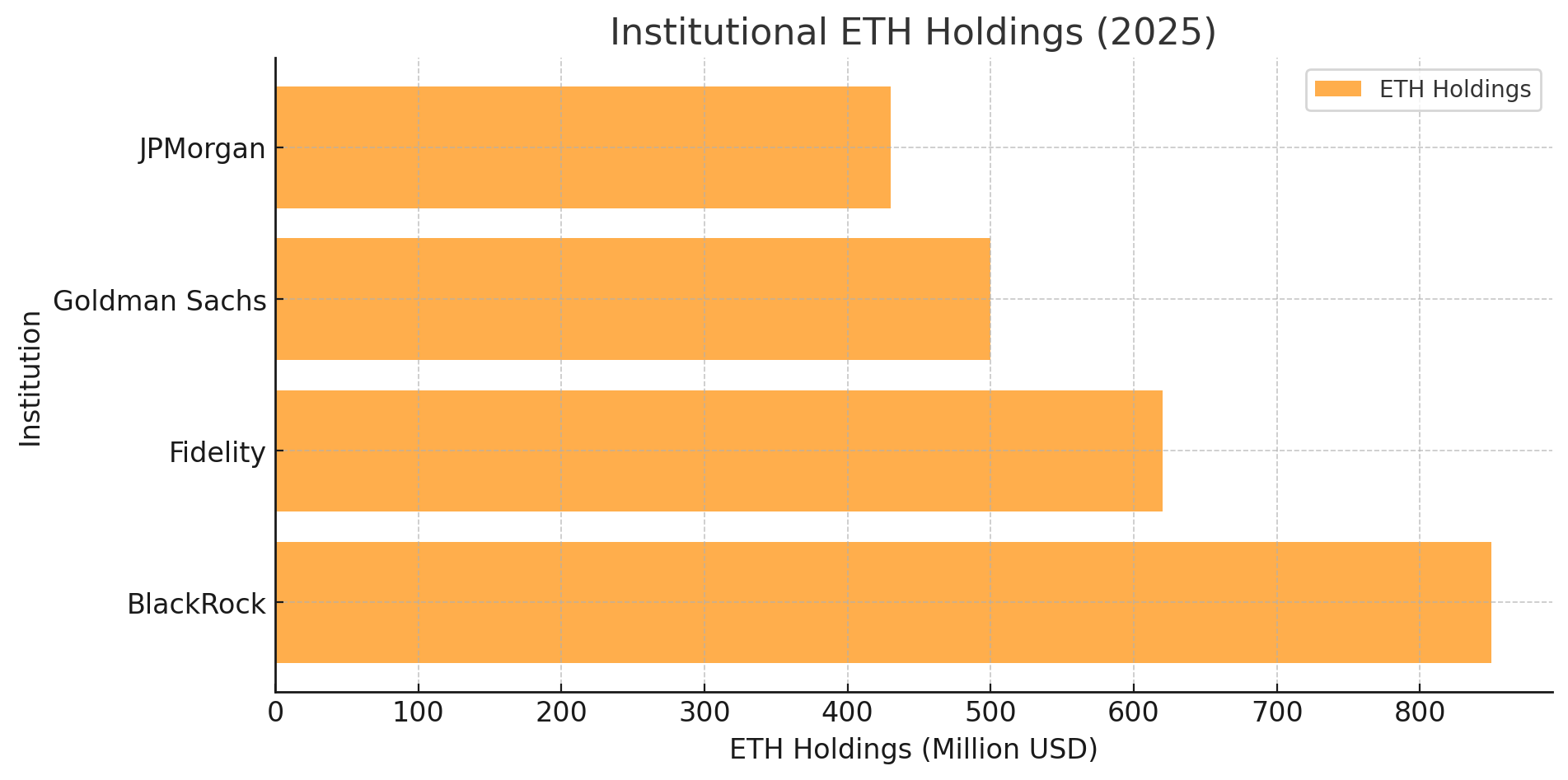

Institutional investment in Ethereum is at an all-time high, with major asset managers like BlackRock, Fidelity, and Goldman Sachs entering the ETH market through ETFs, staking, and tokenization projects.

Why Are Institutions Investing in Ethereum?

🔹 Ethereum Spot ETFs (Pending SEC Approval)

- BlackRock and Fidelity have filed for Ethereum Spot ETFs, similar to Bitcoin ETFs, which could unlock billions in institutional inflows.

🔹 Ethereum as an Asset for Tokenization

- Traditional finance is moving toward tokenized assets (stocks, bonds, real estate) on Ethereum’s blockchain.

- JPMorgan and Goldman Sachs are building tokenization platforms using Ethereum’s infrastructure.

🔹 ETH Staking for Passive Yield

- Institutional investors love yield-generating assets, and Ethereum’s staking yield (4-6%) makes it a valuable investment.

Key Takeaway: If Ethereum Spot ETFs are approved and institutional staking grows, Ethereum price could surge toward $5,000+ in the next two years.

4️⃣ Regulatory Clarity: A Make-or-Break Moment for Ethereum Price

The regulatory landscape for cryptocurrencies is evolving rapidly, and Ethereum’s future price depends heavily on legal clarity.

Why Does Regulation Matter for Ethereum?

🔹 SEC’s View on Ethereum

- The U.S. SEC has not classified Ethereum as a security, unlike XRP and other cryptos.

- Ethereum’s decentralized nature makes it less likely to face regulatory crackdowns.

🔹 Potential Ethereum ETF Approval

- If the SEC approves Ethereum Spot ETFs, billions in institutional capital will flow into ETH.

- Bitcoin ETFs set a precedent, increasing the chances of Ethereum getting similar treatment.

🔹 Clearer Tax & Compliance Rules

- Regulatory clarity will attract hedge funds, pension funds, and major investors.

- Countries like Singapore, UAE, and Switzerland have already established Ethereum-friendly regulations, leading to higher adoption.

Key Takeaway: If Ethereum gets favorable regulatory treatment, it will gain massive institutional backing, fueling long-term price appreciation.

5️⃣ Massive Whales Buying the Dip: A Bullish Signal for Ethereum Price

Despite the recent crash, whales are accumulating Ethereum—a strong indicator that big players are betting on Ethereum’s long-term recovery.

Who’s Buying Ethereum Right Now?

🔹 Whale 1: Purchased 35,494 ETH ($88M) after the price drop.

🔹 Whale 2: Acquired $1M worth of ETH following the market dip.

Why Are Whales Accumulating ETH?

✅ Long-Term Faith in Ethereum’s Fundamentals

- Ethereum’s dominance in DeFi, NFTs, and smart contracts makes it a top long-term hold.

✅ Anticipation of ETH ETF Approval

- Institutional whales expect ETH Spot ETFs to drive massive price appreciation.

✅ Ethereum’s Staking Yields

- Whales earn passive income from ETH staking, making it an attractive long-term investment.

Key Takeaway: Whale accumulation suggests Ethereum is undervalued, and big investors expect a major price recovery.

Conclusion: Ethereum’s Future Depends on Adoption & Market Sentiment

Despite recent volatility, Ethereum remains one of the most valuable assets in the crypto space. If Ethereum retains its dominance in Web3, DeFi, and NFTs, it will likely regain $4,000 and surge toward new all-time highs.

🚀 Bullish Indicators for Ethereum price Recovery:

✅ PoS transition enhances security, sustainability, and staking rewards.

✅ Layer 2 scaling solutions increase transaction speeds & lower gas fees.

✅ Institutional adoption is at an all-time high, with ETH ETFs pending approval.

✅ Regulatory clarity could bring billions in institutional capital into Ethereum.

✅ Whale accumulation suggests Ethereum is undervalued and poised for a rebound.

🔹 Final Prediction: Ethereum could surpass $4,000 in 2025 and potentially hit $10,000+ by 2030 if adoption trends continue.

Are you bullish on Ethereum price future? Share your thoughts in the comments below! Looking to invest in Ethereum? Now might be the perfect time to buy the dip!

FAQs About Ethereum Price Prediction

1. What caused Ethereum’s recent price drop?

Ethereum crashed 23.6% due to Trump’s trade tariffs, mass liquidations, and risk-off sentiment in global markets.

2. Can the Ethereum price reach $4,000 in 2025?

Yes! Analysts predict Ethereum could trade between $3,082 – $8,683 in 2025, making $4,000 a strong possibility.

3. What is Ethereum’s 2030 price prediction?

Ethereum could reach $11,800+ if adoption continues to grow, with some projections pointing toward $45,000.

4. Is Ethereum a better investment than Bitcoin?

Ethereum’s smart contract dominance makes it a better long-term bet in Web3 applications.

5. Will the Ethereum price crash below $2,000?

If ETH loses $2,200 support, another drop could occur—but whale accumulation suggests strong buying interest.

Glossary of Key Terms for Ethereum Price Prediction (2025-2030)

A

🔹 Aroon Indicator – A technical analysis tool used to identify trends and potential reversals in the market by measuring the time elapsed since the highest and lowest prices.

🔹 Altcoin – Any cryptocurrency other than Bitcoin. Ethereum (ETH) is the most well-known altcoin.

🔹 Arbitrum – A Layer 2 scaling solution for Ethereum that improves transaction speed and reduces gas fees by processing transactions off-chain before finalizing them on the main Ethereum blockchain.

B

🔹 Bearish Market – A market condition where prices are declining, and investor sentiment is negative.

🔹 Bitcoin ETF – An exchange-traded fund that tracks Bitcoin’s price, allowing investors to gain exposure to Bitcoin without directly owning it.

🔹 Blockchain – A decentralized, distributed ledger technology that records transactions across multiple computers to ensure transparency and security.

🔹 Bullish Market – A market condition where prices are rising, and investor sentiment is optimistic.

C

🔹 Consensus Mechanism – The method by which a blockchain network agrees on the validity of transactions. Ethereum transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in 2022.

🔹 Cryptocurrency Liquidation – The forced closing of leveraged positions in crypto markets when a trader’s collateral is insufficient to maintain the position.

D

🔹 Decentralized Finance (DeFi) – A blockchain-based financial system that eliminates the need for intermediaries such as banks by enabling direct peer-to-peer transactions.

🔹 Decentralized Applications (dApps) – Applications built on a blockchain network that run autonomously without centralized control.

🔹 Decentralized Autonomous Organization (DAO) – A blockchain-based organization governed by smart contracts and token holders rather than a centralized entity.

E

🔹 Ethereum 2.0 (Eth2) – The major upgrade to Ethereum’s blockchain that introduced Proof-of-Stake (PoS) and scaling solutions such as sharding to improve efficiency.

🔹 Ethereum Spot ETF – A proposed exchange-traded fund that would track Ethereum’s price by directly holding ETH, making it easier for institutional investors to gain exposure to Ethereum.

🔹 Ethereum Virtual Machine (EVM) – The software platform that allows developers to create and execute smart contracts on the Ethereum blockchain.

🔹 Exchange-Traded Fund (ETF) – A financial product that tracks the price of an asset and allows investors to trade it on stock exchanges.

F

🔹 Fibonacci Retracement – A technical analysis tool used to identify potential support and resistance levels based on previous price movements.

🔹 Funding Rate – A fee paid between traders in a perpetual futures contract to ensure the contract price stays close to the spot price of the asset.

G

🔹 Gas Fees – Transaction fees on the Ethereum network that users pay to compensate miners and validators for processing transactions.

H

🔹 Hodl (Hold On for Dear Life) – A crypto investing strategy where investors buy and hold assets for the long term, regardless of market fluctuations.

🔹 Hard Fork – A permanent split in a blockchain network that results in a new, separate chain with different rules. Ethereum’s London Hard Fork introduced EIP-1559, which improved fee structures.

I

🔹 Institutional Adoption – The process of major financial institutions, such as BlackRock and Fidelity, integrating cryptocurrencies into their investment portfolios.

🔹 Inflation Hedge – An asset that retains or increases in value over time despite rising inflation. Ethereum is often considered an inflation hedge due to its deflationary tokenomics after EIP-1559.

L

🔹 Layer 2 Scaling Solutions – Technologies like rollups and sharding that improve Ethereum’s scalability by handling transactions off-chain before settling them on the main blockchain.

🔹 Liquidation Event – A market condition in which traders’ leveraged positions are forcibly closed due to insufficient collateral, often resulting in sharp price declines.

M

🔹 Market Cap (Market Capitalization) – The total value of a cryptocurrency, calculated by multiplying its current price by the total circulating supply.

🔹 Moving Average (50-Day & 200-Day) – A technical indicator that smooths out price data over a specific period to identify trends. A price drop below these levels often signals a bearish market.

N

🔹 Non-Fungible Token (NFT) – A unique digital asset stored on a blockchain that represents ownership of a specific item, such as art, music, or collectibles.

O

🔹 On-Chain Data – Blockchain-based metrics that provide insights into transaction activity, wallet movements, and market trends.

🔹 Open Interest – The total number of outstanding futures contracts in a market, often used to gauge trader sentiment.

🔹 Optimistic Rollups – A Layer 2 scaling solution that processes Ethereum transactions off-chain and submits them in batches to the main Ethereum chain, improving efficiency and reducing fees.

P

🔹 Proof-of-Stake (PoS) – Ethereum’s consensus mechanism, where validators stake ETH to secure the network rather than using energy-intensive mining.

🔹 Proof-of-Work (PoW) – The traditional mining-based consensus mechanism, which Ethereum moved away from in 2022.

R

🔹 Relative Strength Index (RSI) – A momentum indicator used in technical analysis to measure whether an asset is overbought or oversold.

🔹 Regulatory Clarity – Clear legal frameworks for cryptocurrencies, which can impact adoption and institutional investment.

🔹 Resistance Level – A price level at which selling pressure tends to prevent further price increases.

S

🔹 Sharding – A method of splitting Ethereum into multiple parallel chains (shards) to increase transaction speed and reduce congestion.

🔹 Smart Contracts – Self-executing agreements built on blockchain networks that operate without intermediaries.

🔹 Support Level – A price level where buying pressure is strong enough to prevent further price declines.

🔹 Staking – The process of locking up cryptocurrency to support blockchain security in exchange for rewards. Ethereum’s staking rewards range from 4-6% annually.

T

🔹 Tokenization – The process of representing real-world assets (stocks, bonds, real estate) as blockchain-based tokens.

🔹 Total Value Locked (TVL) – The total amount of capital locked in DeFi protocols, measured in ETH or USD.

V

🔹 VanEck Price Prediction – A leading investment firm’s forecast that Ethereum could reach $11,800 by 2030 if it captures a dominant share of the smart contract market.

🔹 Volatility – The degree to which an asset’s price fluctuates over a given period. Cryptocurrency markets, including Ethereum, are known for high volatility.

W

🔹 Whale – A large investor or entity that holds a significant amount of cryptocurrency, capable of influencing market movements.

🔹 Whale Accumulation – The process where large investors buy massive amounts of an asset, often signaling confidence in its long-term value.

🔹 Web3 – The decentralized internet powered by blockchain technology, where Ethereum plays a key role in supporting decentralized applications (dApps).

Z

🔹 Zero-Knowledge Rollups (ZK-Rollups) – A Layer 2 scaling solution that enables fast and secure transactions by bundling multiple transactions and validating them in a single proof.

References

Binance – Binance Website

FX Empire – FXEmpire Website

FX Street – FXStreet Website

Crypto News – Cryptonews Website