The Ethereum (ETH) price underwent a major dip by transitioning from its peak at $2,550 until reaching $2,000 support levels. The decision points influencing Ethereum’s future movements are demanding that the cryptocurrency passes multiple thresholds to recover from the price drop or sustain its declining trend. We will study significant price levels in this analysis to predict Ethereum’s future movement during the next few days.

Ethereum Price Prediction: Will It Find Support at $2,000?

Ethereum faced a major price decline that overshot the critical $2,350 support area which several analysts had been monitoring closely. ETH tested the previously important $2,000 price point after its price decline. The current recovery attempt of Ethereum’s price follows its drop to $2,003 while traders wonder if ETH will sustain this support level or face additional depreciation.

Ethereum Price at Key Support Levels

| Support Level | Ethereum Price |

| Recent Low | $2,003 |

| Key Support Zone | $2,000 |

| Critical Support | $1,880 |

Ethereum continues to examine its vital support area at the $2,000 level. A rebound failure at $2,000 would signal more price decreases down to $1,880. A strong defense from Ethereum at this support will establish conditions for potential market growth.

The successful holding of Ethereum’s current price depends on wider markets alongside technical indicator conditions for the platform. Traders along with long-term holders consider $2,000 to be a fundamental psychological threshold which Ethereum has shown historical strength at this level.

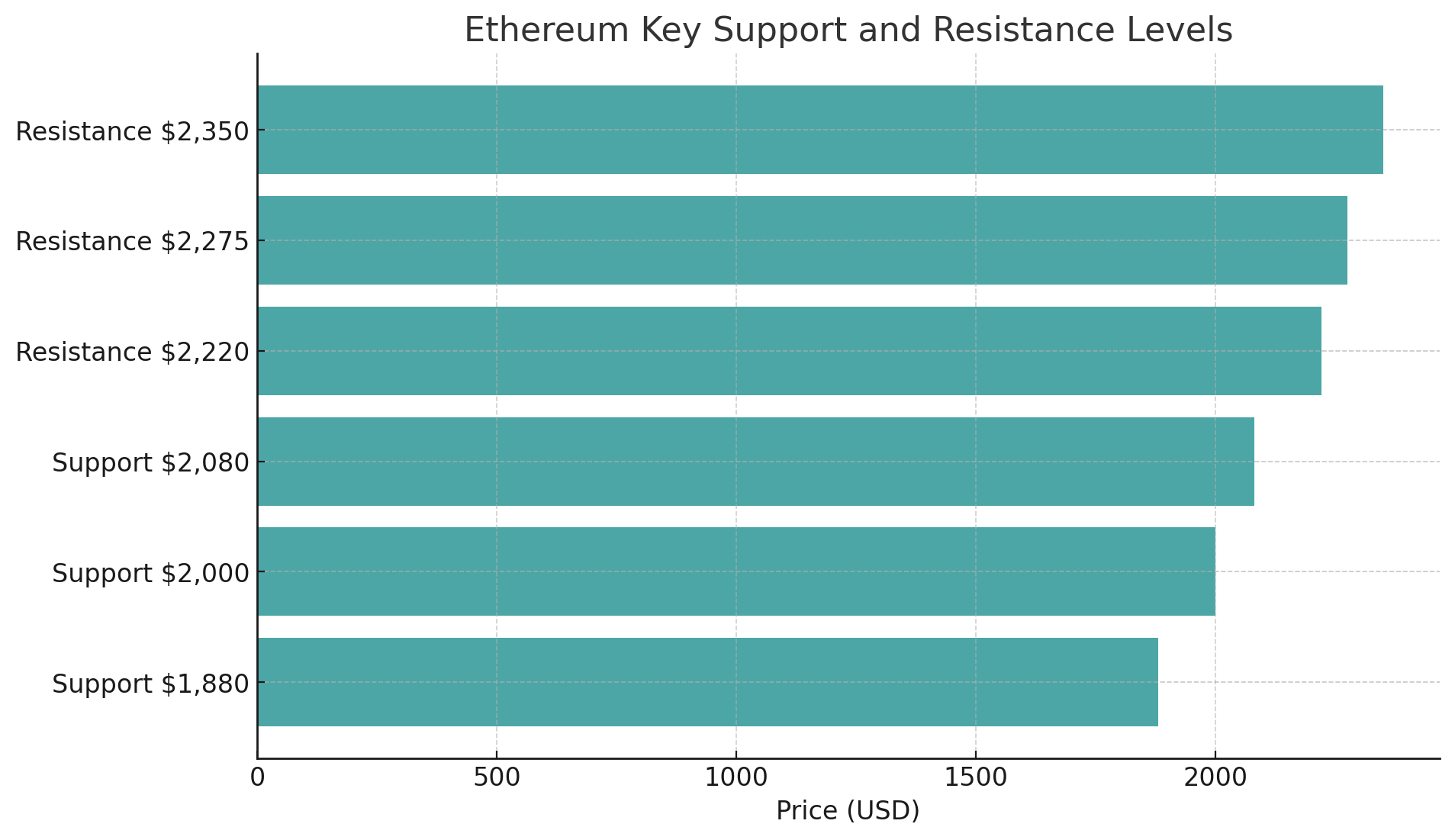

Key Resistance Levels: Can Ethereum Break $2,275 and $2,350?

The upcoming targets for Ethereum include breaking past both $2,275 and $2,350 resistance points to reach new heights. Ethereum needs to surpass multiple intense barriers that stand in the way of beginning its prospective price revival. There are significant obstacles above $2,220 followed by another barrier at $2,275. ETH must break through the $2,350 resistance level for the price to potentially reach this important barrier.

| Resistance Level | Ethereum Price |

| Immediate Resistance | $2,220 |

| Next Resistance | $2,275 |

| Major Resistance | $2,350 |

Most traders expect Ethereum price growth beyond $2,275 to serve as a sign of strengthened upward movement. More opposition points at $2,350 followed by $2,450 will possibly emerge if Ethereum’s price climbs higher. A successful price break through these levels will drive ETH toward $2,500 because traders start showing more trust in the asset.

The ability of Ethereum to surpass these deciding levels determines whether upward advancements can occur. Ethereum might suffer additional downtrends because of its inability to overcome the current levels of resistance.

What Could Cause Ethereum to Drop Further?

Ethereum demonstrates signs of returning to strength yet remains exposed to additional downfall. If it cannot surpass the $2,275 barrier and falls below the $2,080 mark, the cryptocurrency will face another round of testing at the $2,000 support level. The support level of $1,880 will likely become a target if Ethereum breaks beneath it while facing pressure from a tough market condition.

Ethereum Price Faces Critical Support Levels

| Support Level | Ethereum Price |

| First Major Support | $2,080 |

| Next Support | $2,000 |

| Final Support | $1,880 |

Peter Johnson from Bitwise Investments explained that Ethereum needs to overcome the $2,275 resistance threshold to maintain climb. The failure to pass this critical threshold may result in significant market decline which will find its primary support levels at $2,000 and $1,880.

Trader monitoring needs to be sustained for weak indicators around these significant risk areas. Failure to defend its position at critical support ranges will produce a significant price decline for Ethereum within a short timeframe.

Ethereum Price Prediction: Where Is ETH Headed Next?

Market analysts predict the Ethereum price direction through upcoming months. The current position of the Ethereum price near crucial levels determines its upcoming trajectory because its sustained position above $2,000 acts as a significant predictor. Ethereum shows potential to start a price rally according to recent technical indicators provided it manages to pass through the $2,275 resistance point. Ethereum will launch its long-term recovery path by reaching potential price points at $2,350 and $2,500.

A bear market momentum would put Ethereum on track for a decrease between $2,000 and $1,880 unless bears lose their control and Ethereum reaches major resistance zones. Ethereum investors must maintain high alertness during the upcoming few days.

Ethereum Price Prediction 2025 to 2030: What’s Next for ETH?

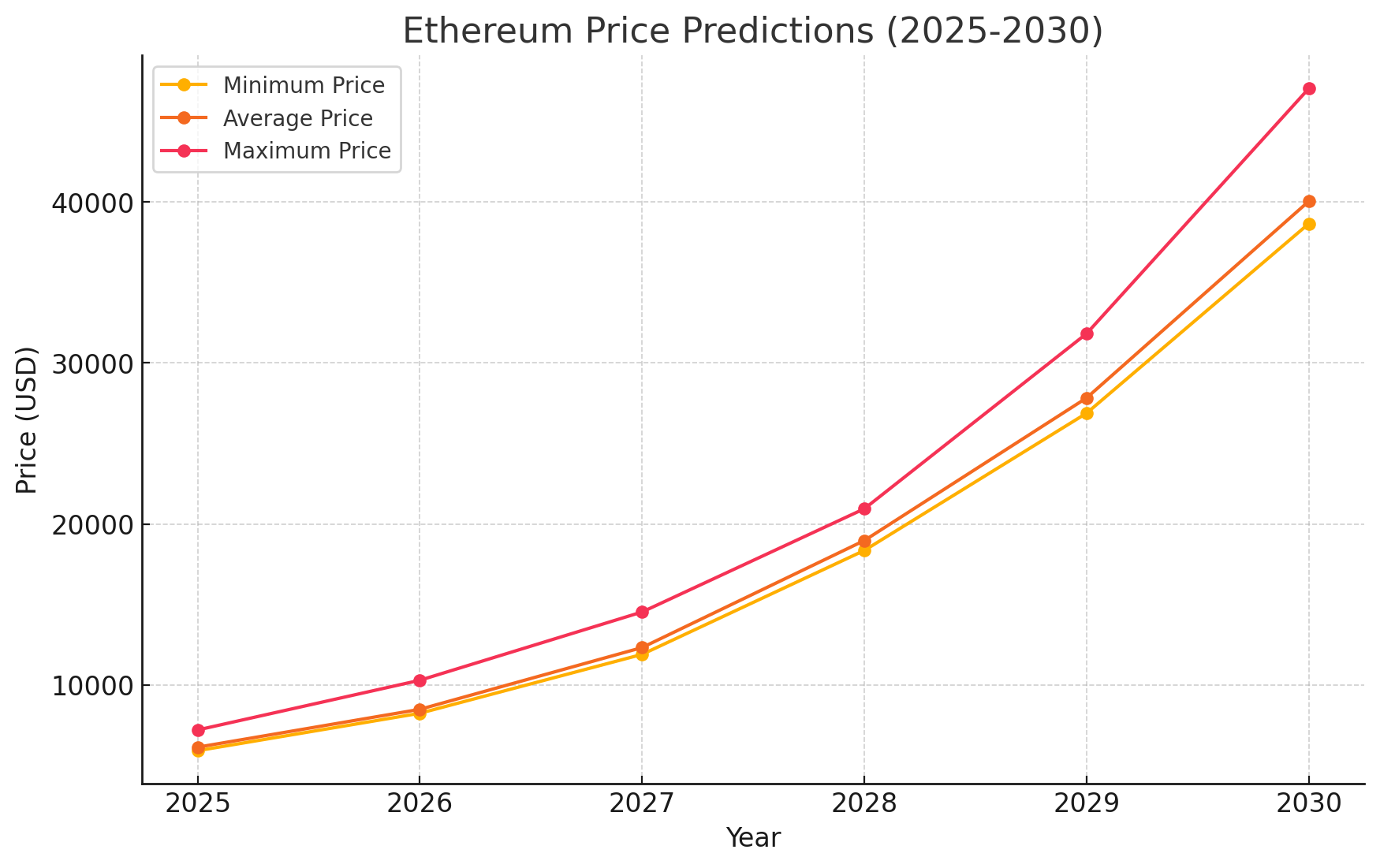

Ethereum experts predict its value movements from 2025 through 2030. Ethereum shows strong potential to advance its market value across multiple years of the upcoming decade. The network advancement through Ethereum 2.0 combined with increased DeFi and other sector adoption will drive up the value of Ethereum significantly.

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $5,907.41 | $6,124.39 | $7,194.28 |

| 2026 | $8,232.18 | $8,477.15 | $10,283.97 |

| 2027 | $11,892.81 | $12,316.77 | $14,527.55 |

| 2028 | $18,352.16 | $18,968.10 | $20,942.91 |

| 2029 | $26,883.31 | $27,831.22 | $31,829.82 |

| 2030 | $38,664.13 | $40,055.99 | $47,066.29 |

Since Ethereum gains maturity its smart contract system grows in popularity which makes its price projection attain massive growth. The analysts predict ETH will reach $7,194 by 2025 while maintaining a bottom limit of $5,907 throughout the year. According to market conditions and Ethereum-based technology adoption rates an increase of $40,000 beyond its current value seems possible during the upcoming decade.

Conclusion: Is Ethereum Ready for a Bounce or Further Decline?

Current market conditions have made Ethereum’s value position extremely vulnerable. The cryptocurrency maintains support near $2,000 but its future price movement requires successful resistance breaking at $2,220 and $2,275. A remarkable breakout might trigger additional price growth which could push the value beyond $2,500 and potentially surpass it. Ethereum’s descent will continue if it prevents surpassing momentum above $2,220 and $2,275.

The short to medium direction of ETH’s price movement depends on how Ethereum performs in the next period since market participants need to watch its actions carefully. Keep following The Bit Journal and keep an eye on Ethereum price prediction.

FAQs

What is Ethereum’s current price for the short term?

The experts project Ethereum to trade at which levels throughout the upcoming short-term period. A price increase for Ethereum will be possible after it surpasses the $2,275 resistance threshold. A successful breakout above $2,275 would open the way for ETH to reach $2,350 followed by $2,500 respectively.

What are the key support levels for Ethereum?

The essential support zones for Ethereum remain at $2,000 and $1,880. Two essential support zones exist at $2,000 and $1,880 for Ethereum. Lower prices below $2000 would trigger additional market downfall.

What is Ethereum’s resistance level?

Ethereum encounters strong opposition to price increases around $2,220 and $2,275. Once it breaks through strategic price resistance barriers at these levels, Ethereum may initiate an upward movement to achieve higher targets.

Do Ethereum investors need to be concerned about the current price fluctuations in the market?

The present support at $2,000 for Ethereum creates a potential opportunity for price recovery after its major price drop. The market continues to show potential price drops even after reaching specific support points remains intact.

Glossary of Key Terms

- Support: An asset finds support at the specific price which stops additional selling to avoid price drops.

- Resistance: An asset regards resistance as the selling pressure point above which it cannot climb any higher.

- The Fibonacci Retracement: represents a technical analysis instrument which detects supporting price levels and resistance points resulting from historic market movements.

- RSI: measures the speed and change of price movements to identify whether prices have reached an overbought or oversold state.

References

- “Ethereum Price Analysis – Key Levels to Watch,” Kraken, March 5, 2025.

- “Ethereum’s Price Struggles to Hold $2,000 Support,” Bitwise Investments, March 5, 2025.

- Newsbtc.com

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!