According to market analysis, Ethereum price prediction 2025 shows steady growth as ETH holds above $3,000. This rise could be an early sign of improving sentiment in the overall crypto market.

According to TradingView, Ethereum’s first breakout since February follows a sharp rebound from April’s $1,800 low, backed by a confirmed bull flag pattern pointing to a potential move toward $3,800 and beyond.

Ethereum’s recent rise isn’t just based on hype or guesses. It’s supported by growing trust from large investors and strong inflows into ETH ETFs. Many experts and traders are watching closely to see if this could be the beginning of a bigger rally.

How Are Analysts Interpreting the Ethereum Price Trends?

Ethereum has crossed the important $3,000 price level, which attracts more investor attention. According to Pintu News, ETH was recently priced around $3,005, showing a 2.07%, in just one day.

CoinMarketCap also listed ETH at $3,035.73. These similar price levels support the positive Ethereum price prediction 2025, showing strong market confidence and growing buying interest.

Similar reports from several trusted sources make the ongoing rally seem more reliable, giving traders confidence that it’s not just a quick jump in price. Instead, it looks like a steady rise supported by real investor interest and strong market signals.

How Are Institutional Investors Influencing Ethereum’s Price?

Institutional buying has been an important reason behind Ethereum’s price changes. One big update was when SharpLink Gaming, a company listed on Nasdaq, made a private deal with the Ethereum Foundation.

In this over-the-counter deal, SharpLink bought 10,000 ETH at an average price of $2,572, spending a total of $25.72 million. CEO Joseph Lubin said this wasn’t just a short-term trade, but a long-term plan to support Ethereum’s future.

SharpLink has built a strong Ethereum position, now holding more than 215,957 ETH, valued at over $600 million. This large investment shows that big institutions have strong confidence in Ethereum’s future, particularly in areas like Web3, DeFi, and tokenization.

This support is important in shaping positive Ethereum price prediction 2025 as long-term investors are putting serious capital into the asset.

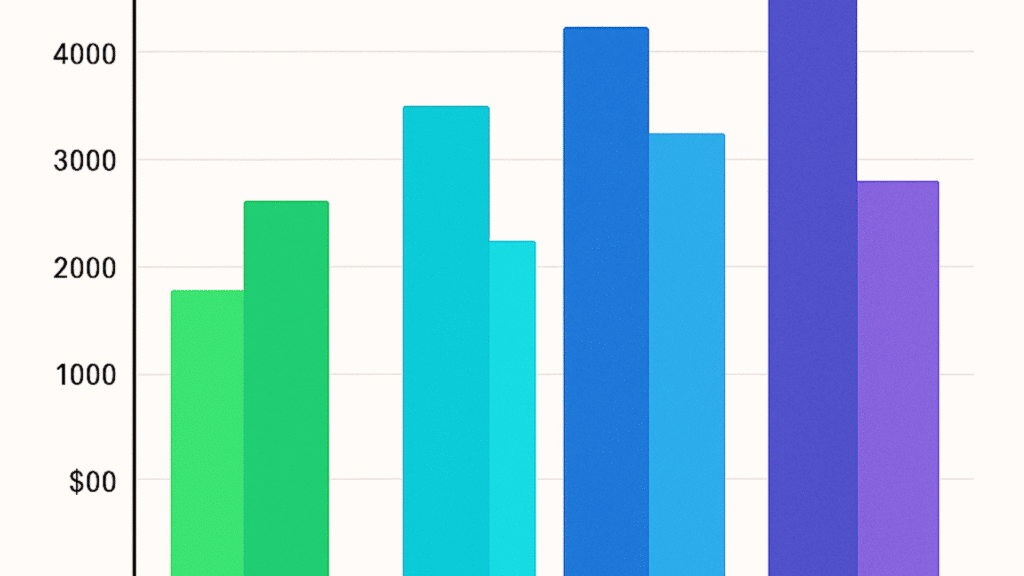

| Analysts | Bearish 2025 Forecast | Average 2025 Forecast | Bullish 2025 Forecast |

| Changelly | $5,907.41 | $6,124.39 | $7,194.28 |

| Coincodex | $ 3,118.45 | $ 4,608.93 | $ 5,513.12 |

| CoinDCX | $2,300 | $2,800 | $3,200 |

What Do Technical Indicators Suggest About ETH’s Short-Term Trend?

Ethereum is showing a strong upward trend. According to TradingView charts, ETH has crossed a rising pattern that started in March 2025.

The RSI, or Relative Strength Index, is at 72, which shows strong buying interest. But at the same time, some signals suggest the price might take a short break or drop a little before it goes up again.

Experts see $2,864 as an important level where buyers might step in if Ethereum’s price drops. Experts believe resistance might appear near $3,126, and if the upward trend stays strong, ETH might even reach $3,432.

These levels are closely watched and included in every Ethereum price prediction 2025, giving traders both caution and hope

How High Could Ethereum Go by the End of 2025?

Different forecasting sources give different views, but most Ethereum price prediction 2025models still point to more growth ahead.

According to Changelly, ETH is expected to trade between $2,942 and $3,527 in July. By December, they see average prices around $2,915, with possible highs up to $3,353. These predictions are based on stable demand and favourable technical signals.

ZebPay gives a broader Ethereum price prediction 2025, expecting the price to range between $2,500 and $5,500, due to Ethereum’s history of big price swings.

On the other hand, the Finder expert panel predicts ETH could end the year near $4,308, supported by ongoing network upgrades and growing use in DeFi and smart contracts.

InvestingHaven shares both positive and negative Ethereum price prediction possibilities, suggesting ETH could end up anywhere between $1,669 and $4,205, depending on outside market conditions.

On the other hand, Flitpay, which looks at predictions from many big investors, gives a more hopeful Ethereum price prediction 2025 between $6,200 and $9,345.

Even though there are different predictions, most of the experts agree that Ethereum will grow throughout 2025, and the Ethereum price prediction for 2025 will remain positive.

Conclusion

Ethereum’s move above $3,000 has brought fresh hope to the crypto market. Big investors are showing interest, and technical charts also point to a strong outlook. Ethereum price prediction 2025 differs a lot, some expect around $2,900, while others think it could go as high as $9,345.

Still, most experts believe ETH will keep rising. With network upgrades, growing ETF investments, and more use in DeFi and Web3, Ethereum could reach a new all-time high by the end of the year.

Summary

Ethereum’s price has stayed above $3,000, strengthening the Ethereum price prediction 2025for further growth. Institutional investors like SharpLink are backing the upward trend with large purchases. But there could be small drops along the way.

The Ethereum price prediction 2025 is different for each expert. Some think it might go over $6,000 by the end of the year. Even though views are mixed, many believe Ethereum will keep growing because of more ETF investments, new upgrades.

FAQs

1. What is Ethereum’s price in mid-2025?

It is trading above $3,000. Right now, it’s around $3,035.

2. Why is Ethereum’s price rising?

As more people are buying it, especially through ETFs and big companies.

3. What do experts think about Ethereum’s price in 2025?

They believe it could reach $6,000 if this trend keeps going.

4. How are big investors helping Ethereum grow?

Companies like SharpLink Gaming are buying and holding a lot of ETH for the long term.

5. Can Ethereum reach a new all-time high in 2025?

Yes, many experts say ETH could hit a new record near $6,000 if the rally continues.

Glossary

OTC– A private trade between two people or companies, done outside of regular crypto exchanges.

Web3 – The next version of the internet, built on blockchain, where users have more control over their data and digital assets.

DeFi – A new way to use financial services like lending or trading, without banks, powered by blockchain.

Tokenization – Turning real-world things like property or gold into digital tokens that can be traded on the blockchain.

Technical Indicators – Tools on price charts that help traders guess where the price might go next.