According to Galaxy Digital CEO Mike Novogratz, the Ethereum price prediction for 2025 indicates significant upside. With rising demand, a tightening supply, and increasing real-world use, ETH could outpace Bitcoin in the coming months.

Institutional Investors Fuel ETH Growth

Large investors continue to accumulate Ethereum. According to the source, firms such as BitMine Immersion Technologies and Sharplink Gaming now hold over $3 billion in ETH. This signals confidence in Ethereum’s long-term value.

Mike Novogratz recently said:

“There’s a good chance Ethereum outperforms Bitcoin over the next six months. It’s already starting to.”

He explained that Ethereum’s limited supply, driven by staking and burning, could drive prices upward especially if it breaks the $4,000 resistance level.

Ethereum Price Prediction 2025: What Experts Say

Forecast Table – ETH Price Predictions for 2025

| Source | ETH Target Price (2025) | Notes |

|---|---|---|

| Galaxy Research | $5,500 | Based on staking, institutional demand, and Layer-2 expansion |

| Finder Expert Panel | $4,308 | July 2025 average from 35 analysts |

| Standard Chartered Bank | $4,000 | Revised 2025 target from $10,000 due to market headwinds |

| CoinEfficiency Analysts | $5,000–$7,500 | Based on supply data, staking, and macro market performance |

Sources: Finder.com, CryptoSlate, QZ – Galaxy Research

Most experts agree that the Ethereum price prediction favors a rise between $4,000 and $7,500 by the end of 2025.

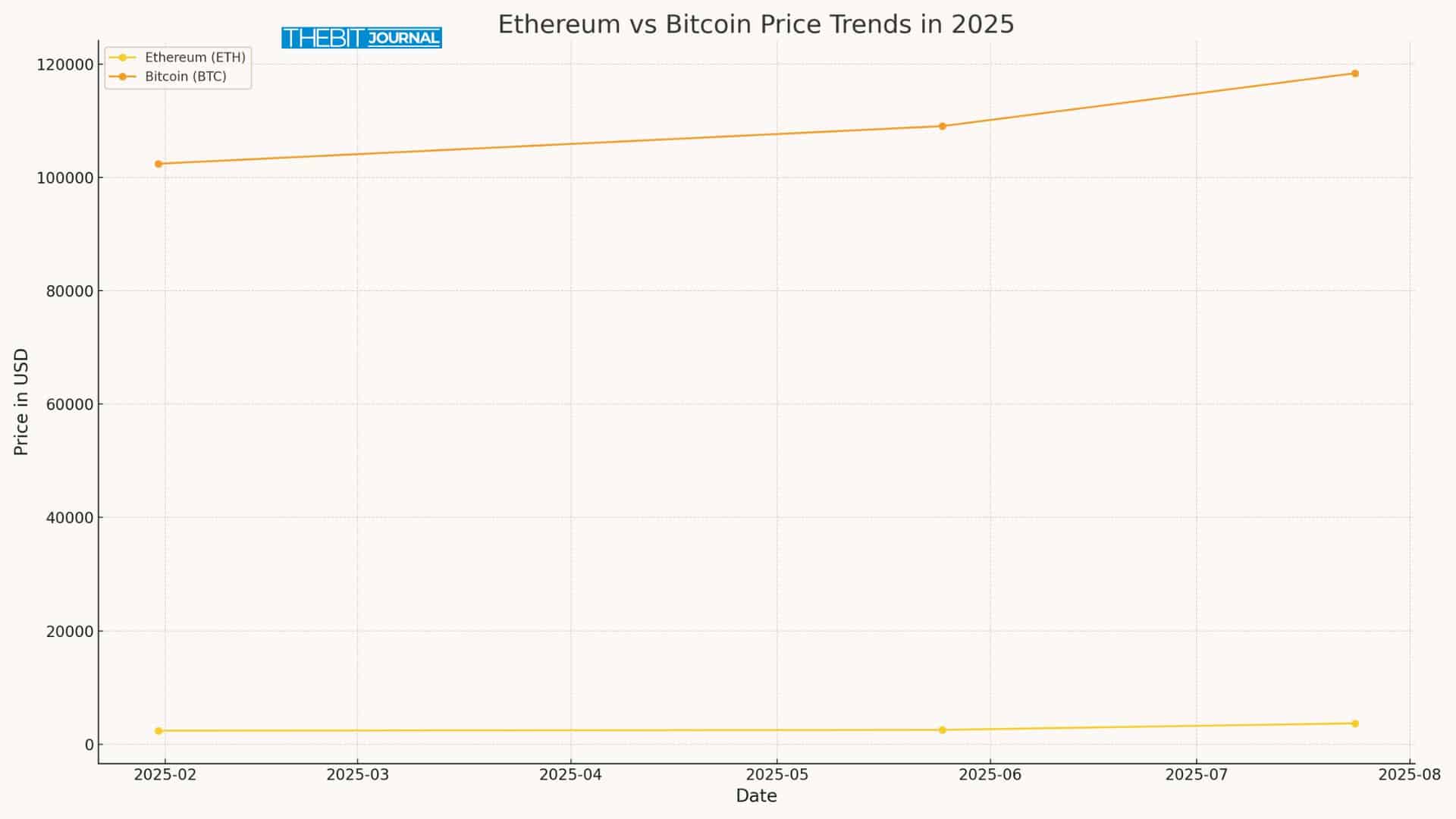

Ethereum and Bitcoin: Price Snapshot in 2025

Updated ETH & BTC Prices

| Date | ETH Price (USD) | BTC Price (USD) |

|---|---|---|

| Jul 24, 2025 | $3,707.94 | $118,368 |

| May 25, 2025 | $2,551.76 | $109,035.39 |

| Jan 31, 2025 | $2,405.79 | $102,405.03 |

Sources: CoinMarketCap, StatMuse, CoinCodex

Ethereum’s price has steadily climbed since early 2025, with analysts now watching whether it can maintain momentum heading into Q4.

Why the Supply Side Strengthens Ethereum

Ethereum became a low-inflation asset after switching to proof-of-stake in 2022. It also deducts a portion of every transaction fee. These features limit the number of tokens in circulation over time.

More than 33 million ETH is now staked, based on Ultrasound.money. This reduces sell pressure and supports the current Ethereum price prediction models.

As availability contracts, demand grows stronger among users, developers, and institutions. Under bullish market conditions, this may help the ETH price burst past $4,500 by year-end.

Ethereum’s Growing Use Case vs. Bitcoin

Ethereum is not merely a token; it operates smart contracts, enables decentralized finance (DeFi), and facilitates the tokenization of real-world assets. Bitcoin is expensive, yet it survives mainly as a store of value.

NewsBTC stated:

“Ethereum is increasingly seen as programmable infrastructure for modern finance.”

This broader use makes ETH attractive to investors seeking real-world blockchain utility. It adds weight to every Ethereum price prediction that expects long-term growth.

Conclusion

Based on the latest research, the Ethereum price prediction suggests a strong potential for growth through the end of 2025. Suppose the current pace of the ETH market’s movement continues with a decreased token supply, increased demand from staking, and institutional interest. In that case, Ethereum may reach its key targets around $4,500 to $5,500, undoubtedly placing itself among the leading movers in the cryptocurrency world this year.

Summary

Ethereum, in 2025, appears to be boosted by growing institutional interest, reduced token supply, and strong real-world use cases. Analysts expect ETH to be anywhere between $4,000 and $5,500 by the end of the year. Some forecasts go even beyond that. Many think that with rising Ethereum staking and mounting demand, Ethereum might outperform Bitcoin in terms of returns. The mutations arising in Ethereum, as its blockchain infrastructure continues to develop, foster long-lasting confidence among investors and analysts alike.

Explore more: Ethereum price prediction for long-term investors

FAQs

Q: What is the Ethereum price prediction for 2025?

A: Analysts forecast ETH may range between $4,000 and $7,500 depending on demand, adoption, and market trends.

Q: Can Ethereum outperform Bitcoin?

A: Many believe so, primarily due to Ethereum’s broader utility and reduced supply.

Q: What could boost ETH prices in 2025?

A: Institutional buying, staking, supply reduction, and new dApps on Ethereum all contribute to potential growth.

Glossary of Key Terms

Ethereum Price Prediction: A forecast of ETH’s price based on market and network factors.

Staking: Locking up ETH to support the network and earn rewards.

Proof-of-Stake: A consensus model that uses validators instead of miners.

EIP-1559: Ethereum’s burn mechanism for reducing token supply.

Layer-2 Solutions: Add-on networks that lower transaction fees and increase speed.