Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continues to attract investors with its strong use cases in decentralised applications (dApps), non-fungible tokens (NFTs), and smart contracts. As the market evolves, the question on everyone’s mind is: what will Ethereum’s price look like in the years 2025, 2027, and 2030? Here’s an in-depth analysis supported by Ethereum price prediction tables and charts as per crypto sources and data available.

Ethereum Price Prediction 2025

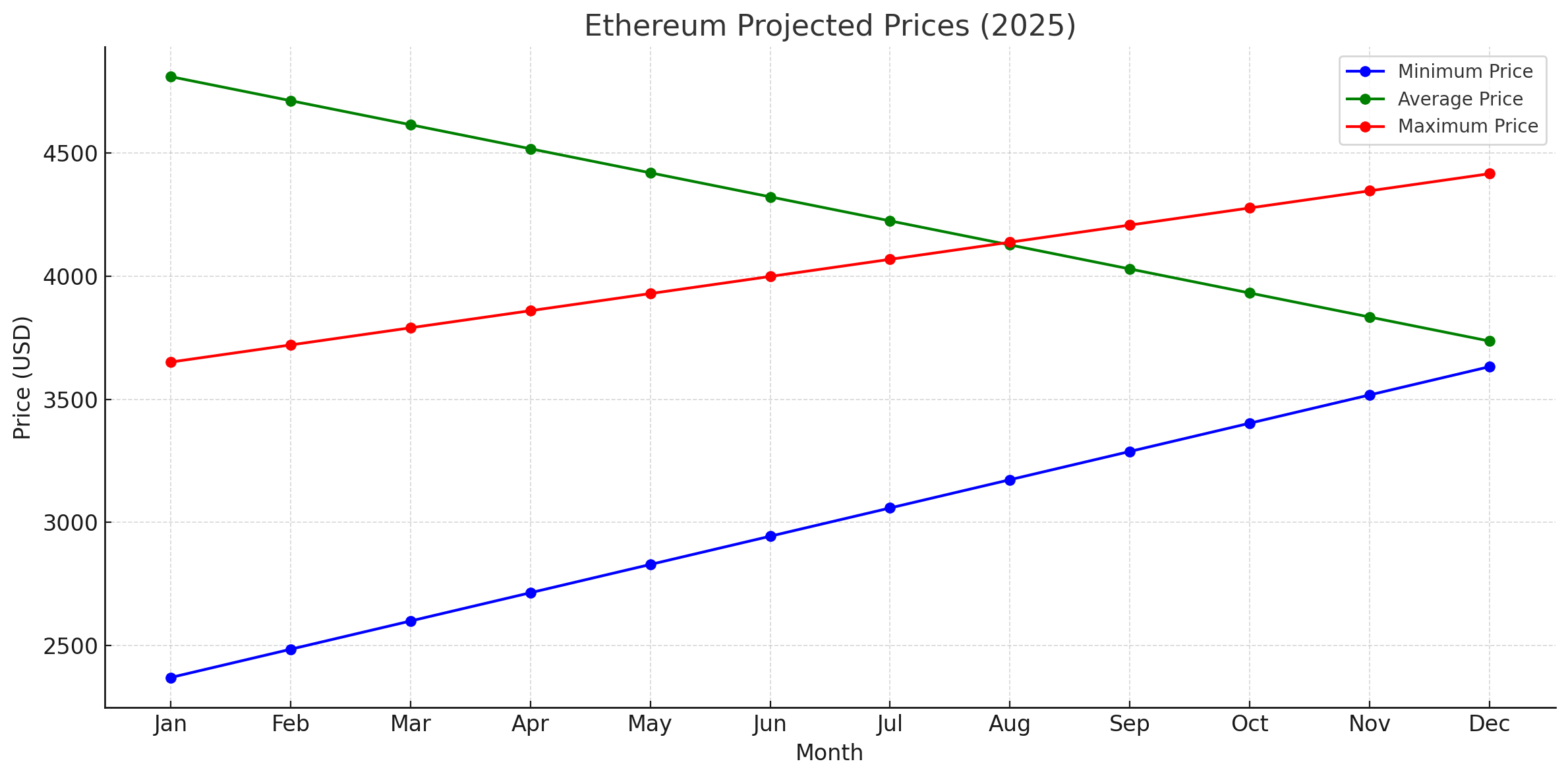

Ethereum price is expected to rise significantly by 2025, driven by widespread adoption of its smart contract and dApp ecosystem. Analysts predict the following price ranges for ETH in 2025:

| Month | Minimum Price | Average Price | Maximum Price |

| January | $2,370.14 | $4,811.39 | $3,651.77 |

| February | $2,484.94 | $4,713.72 | $3,721.33 |

| March | $2,599.75 | $4,616.05 | $3,790.90 |

| April | $2,714.55 | $4,518.37 | $3,860.47 |

| December | $3,633.00 | $3,737.00 | $4,417.00 |

Key Drivers in 2025:

- Increased dApp Adoption: The rise in decentralised finance (DeFi) applications and NFT marketplaces will boost ETH demand.

- Proof-of-Stake (PoS) Enhancements: Ethereum’s shift to PoS increases network scalability, efficiency, and security, encouraging more users and developers to join the network.

Price Chart for 2025:

(Graph displaying the projected minimum, average, and maximum ETH prices across 2025 months.)

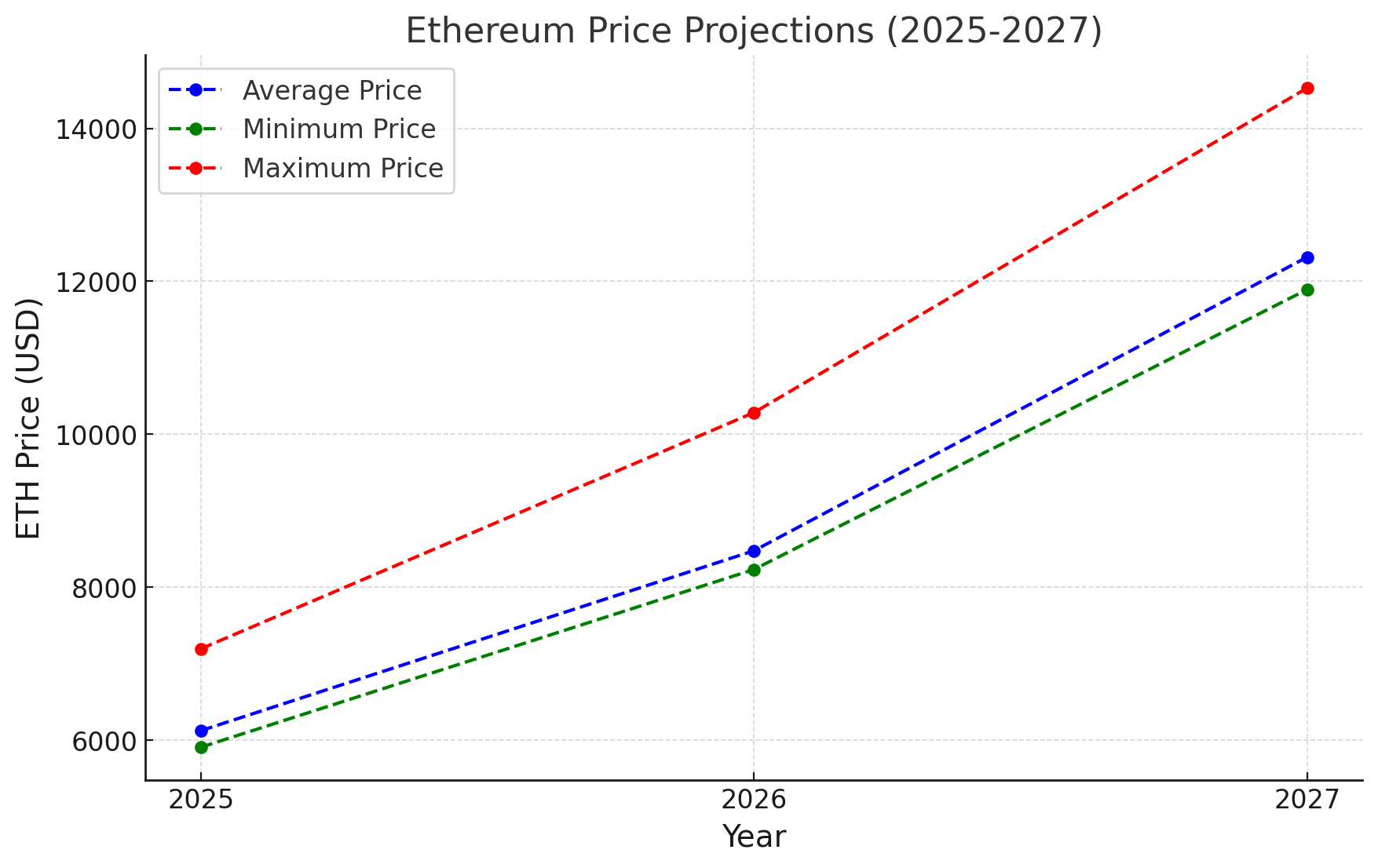

Ethereum Price Prediction 2027

By 2027, Ethereum price is expected to strengthen its position as the backbone of Web3 innovations. The price predictions for ETH in 2027 are as follows:

| Month | Minimum Price | Average Price | Maximum Price |

| January | $5,417.25 | $5,571.75 | $6,513.75 |

| June | $6,373.50 | $6,555.50 | $7,707.50 |

| December | $7,521.00 | $7,736.00 | $9,140.00 |

Key Drivers in 2027:

- Institutional Investments: Major corporations and institutions adopting Ethereum for smart contracts and blockchain solutions could drive higher trading volumes.

- Layer-2 Solutions: Technologies like Arbitrum and Optimism will make Ethereum transactions faster and more affordable, further increasing adoption.

Projected Growth (2025-2027):

Between 2025 and 2027, Ethereum’s price could experience over 100% growth as adoption scales.

Ethereum Price Prediction 2030

As blockchain technology becomes mainstream, Ethereum price is projected to surge to unprecedented levels by 2030. Here’s what analysts predict for ETH:

| Month | Minimum Price | Average Price | Maximum Price |

| January | $16,092.58 | $16,559.25 | $19,264.08 |

| June | $19,415.50 | $20,030.50 | $22,569.50 |

| December | $23,403.00 | $24,196.00 | $26,536.00 |

Key Drivers in 2030:

- Global Blockchain Integration: By 2030, blockchain is likely to power industries like healthcare, banking, retail, and agriculture, with Ethereum leading the charge.

- Scarcity and Staking: Increased ETH staking and decreased issuance post-PoS transition will reduce supply, driving up prices.

Key Trends and Factors Influencing Ethereum’s Price

- Smart Contract Usage: Ethereum’s dominance in smart contracts solidifies its role as the preferred blockchain for decentralized systems.

- Decentralized Applications (dApps): Ethereum’s support for gaming, finance, and entertainment applications will continue attracting developers.

- Environmental Sustainability: Transitioning to PoS has significantly lowered Ethereum’s energy consumption, making it more appealing to ESG-conscious investors.

Conclusion

Ethereum price outlook for 2025, 2027, and 2030 shows a strong upward trajectory driven by technological innovations, increasing adoption, and strategic updates. With predicted prices reaching as high as $26,536 in 2030, Ethereum continues to be a strong contender for long-term investment. Keep following The Bit Journal and keep an eye on Ethereum price prediction.

FAQs

- Is Ethereum price a good investment for 2025-2030?

Yes, Ethereum’s consistent updates, scalability, and wide adoption make it a promising investment, but market volatility should be considered. - What are Ethereum’s long-term price drivers?

Adoption of NFTs, DeFi platforms, and institutional interest in blockchain technology are key drivers. - How does staking impact Ethereum’s price?

Staking reduces circulating supply while offering rewards to holders, creating a supply-demand imbalance that can drive prices up. - Will Ethereum face competition from other blockchains?

While rivals like Solana and Cardano offer similar functionalities, Ethereum’s first-mover advantage and robust ecosystem ensure its competitiveness.

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!