According to Cryptonews, Ethereum price faced a big drop following U.S. military strikes on an Iranian nuclear site. Iran responded swiftly with missile attacks, escalating geopolitical tensions and rattling global markets.

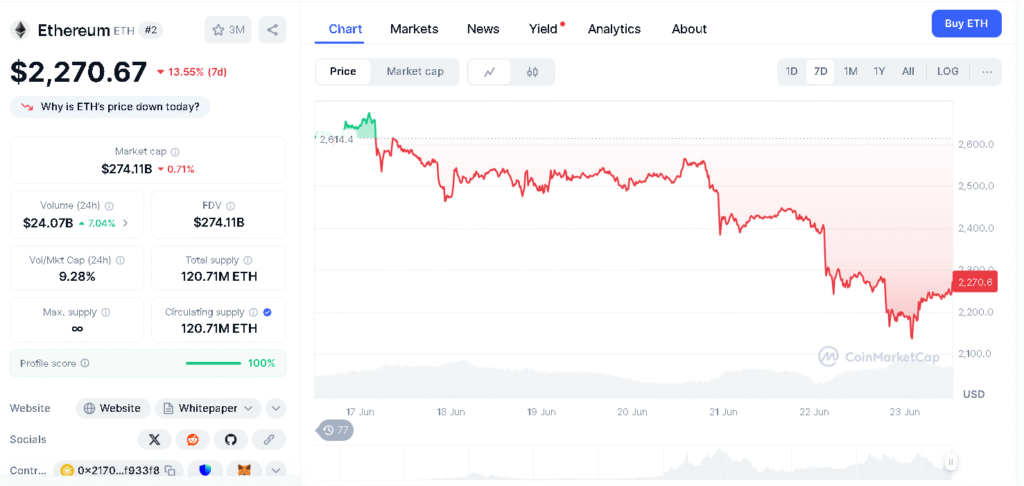

The sudden rise in global tensions shook markets and caused panic among crypto traders. As investors pulled back from risky assets, Ether’s value fell to $2,270.86 within a few hours, which showed a 6.4% loss in just one day.

Within just 24 hours, more than 172,000 crypto traders were forced to close their positions. The total loss cost reached $681.8 million, with about 87% of these losses coming from traders who expected prices to rise.

Ether traders were hit the hardest; they faced $282 million in liquidations, making Ethereum the most affected asset during this sudden market drop.

Traders Dump Risk as Middle East Escalation Fuels Volatility

The events in the Middle East have caused investors to lose confidence. Missiles were launched, and tensions between countries grew.

Many investors pulled their money out of risky assets like Cryptocurrencies. The Ethereum price dropped quickly as traders rushed to sell, which caused a loss of billions in value.

Crypto analyst Manish Rao said that now, global tension does not just affect oil and gold, but now they also impacts digital assets like Ethereum, particularly when the market is already weak.

This shows how global events are now closely connected to the ups and downs of Cryptocurrencies.

Ethereum Price Faces Heavy Technical Pressure

The Ethereum price is also facing pressure from technical patterns. For weeks, ETH has been making lower highs, and now it has dropped below the important horizontal support level of $2,378.

It had stayed above this level throughout most of May and early June. This breakout has turned that support into resistance and added more selling pressure on the price to fall further.

Ethereum is still stuck below a downward trendline from its earlier high of $2,900, which is stopping any strong upward move. It is also trading under the 50-day moving average. Currently, it is trading around $2,262.61.

Technical expert Arjun Mahadev said the Ethereum price is in a difficult position, and it will be hard for buyers to push the price up unless it moves above both levels.

| Metrics | Value | Sources |

| Current Price | $2,243.71 | CoinMarketCap |

| 24 Hour Trading Volume | $25.22B | CoinMarketCap |

| 24 Hour Low | $2,116.68 | CoinMarketCap |

| Resistance Level | $2,340–$2,380 | Trading View |

| Support Level | $2,150–$2,220 | Trading View |

| Liquidation | $282M | CoinDesk |

| All Time High (Nov 2021) | $4,891.70 | CoinMarketCap |

$282 Million ETH Liquidations Signal Weak Bull Hand

One of the most clear indicators of market fragility came from liquidation data. In just 24 hours, more than $282 million worth of Ether positions were wiped out.

This sudden liquidation shows how quickly confidence in the Ethereum price turned into heavy selling and big losses

A total of 172,853 traders were liquidated across the crypto market, which shows that the ETH drop was part of a much larger sell-off.

However, the fact that Ether had the biggest share of those losses signals that many traders had placed big bets on the Ethereum price surge, even though the global risk was rising.

Key Levels and What to Watch Next

Traders are closely watching the new $2,378 resistance level to see if ETH can reclaim this zone. If it fails to do that, particularly with patterns like bearish engulfing candles, it might lead to more price drops, possibly towards $2,114 or even $2,036 if the selling continues.

Indicators like MACD are showing that the market is still moving downward, and there’s a growing gap between the MACD and signal lines.

The histogram, which tracks momentum, is also trading downward. For the Ethereum price to find a stable bottom in the short term, there must be a clear sign of reversal, like strong trading volume in support.

Conclusion

Ethereum’s big price drop shows how global conflict can now affect digital assets. With $282 million lost and the price falling below important levels, investors are feeling nervous.

If the tension between countries does not calm down, and Ethereum price doesn’t rise above $2,378 with strong volume, the prices might fall even more to $2,036.

FAQs

1. Why did the Ethereum price drop suddenly?

Due to U.S. airstrikes on Iranian nuclear sites and Iran’s missile retaliation.

2. How much did Ethereum fall in price?

Ethereum dropped by 10%, falling to around $2,262.

3. How much ETH liquidation happened?

About $282 million worth of Ethereum positions were liquidated.

4. How many traders were affected in 24 hours?

Over 172,000 crypto traders closed positions.

5. Can Ethereum recover above $2,200 soon?

Analysts say recovery is tough unless ETH breaks key resistance levels.

Glossary

Ethereum- A leading crypto asset powering smart contracts and Web3 apps.

Liquidation- Auto-exit of a trader’s position when losses cross safety limits.

Short Position- A trade placed expecting the price to fall.

Trendline- A line drawn on a chart to show the general direction of price movement over time

50-Day Moving Average- ETH’s rolling average price over the past 50 days, used to spot trends.